Fed OIG Report on SVB: Officials considered removing SVB’s CEO from FRB San Francisco’s board of directors after discussions to downgrade SVB’s rating but chose not to for fear of spooking markets.

Summary:

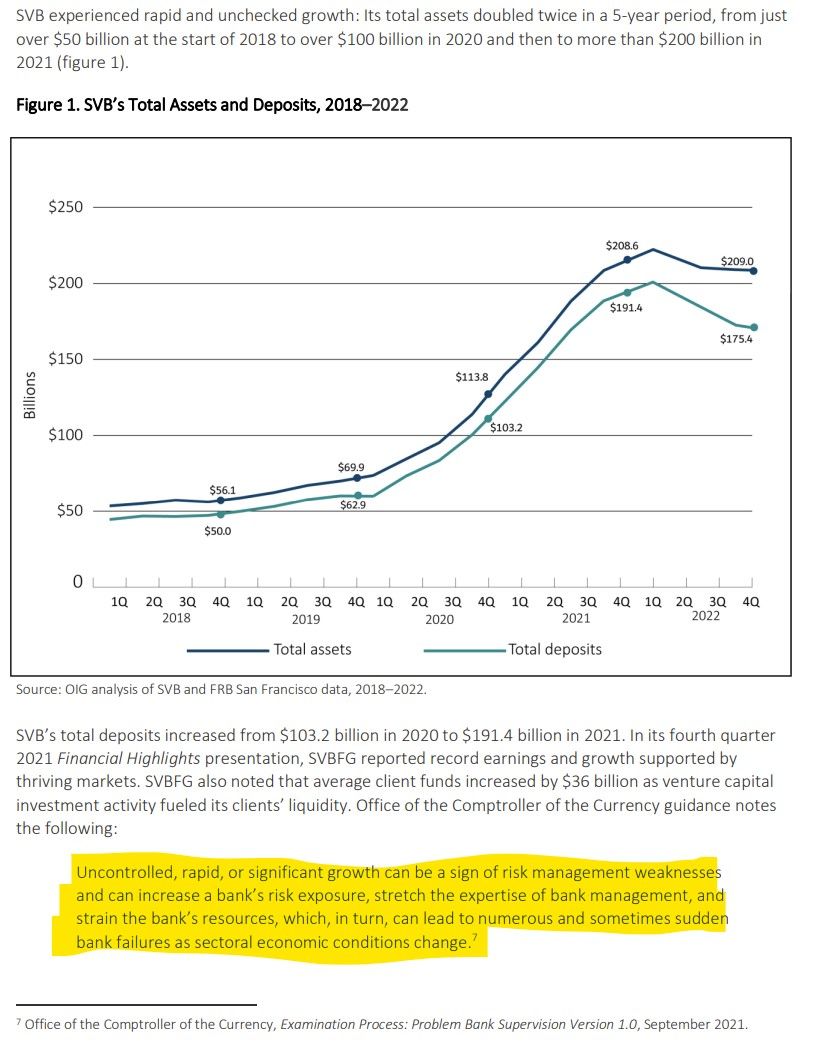

Silicon Valley Bank—which once had over $200 billion in total assets—failed in March 2023. SVB went into receivership and cost the Deposit Insurance Fund an estimated $16.1 billion.

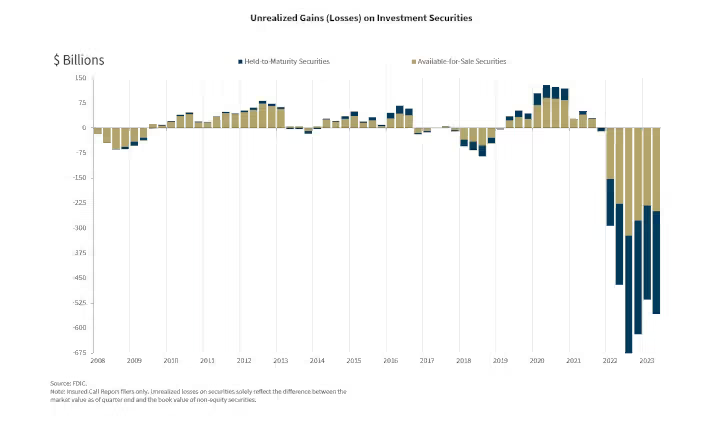

SVB failed for several reasons. It was vulnerable to the business cycles of its customer base—concentrated in science and tech—with a high share of uninsured deposits and large, irregular cash flows. SVB also invested a large portion of deposits in securities with long-term maturities, and experienced significant unrealized losses on those securities as interest rates rose. Further, the bank's management and board of directors failed to manage the risks of its rapid, unchecked growth and concentrations. Finally, management's ineffective communication about the bank's financial moves, coupled with news of Silvergate Bank's liquidation, led to a $40 billion run on deposits with additional withdrawal requests totaling $100 billion that SVB could not meet.

The Board and the Federal Reserve Bank of San Francisco were responsible for ensuring that SVB had safe and sound business practices. However, their supervisory approach did not evolve with SVB's growth and increased complexity—for example, there were insufficient examiner resources, and examiners lacked the requisite expertise for supervising a large, complex institution. Further, the Board and FRB San Francisco did not effectively transition SVB between supervisory portfolios. Finally, examiners did not closely scrutinize the risks that rising interest rates posed to SVB's investments.

Matter for Management Consideration:

Paraphrasing the highlighted sections:

- A senior official did note that a Reserve Bank does not want a loser CEO part of the club.

- They thought about removing him but didn't want to spook the markets that him being a loser CEO and SVB was gonna tank as the reason.

- Another official noted it wasn't in the rules they had to, so no sweat not doing the morally right thing!

- The OIG calls all of this out as an "appearance of a conflict of interest for the system"

Findings:

Now where have we seen this before? Oh Yeah:

Banks unrealized losses on held-to-maturity securities totaled $309.6 billion in the 2nd quarter

Rapid Growth:

Concentration of Uninsured Deposits:

There are no loyalties in a bank run!

Conclusion:

Other Notes:

As early as 2018, examiners noted the bank’s rapid growth and the need for the risk management structure to be commensurate with the bank’s growing size, complexity, and risks. Another examination report noted the complexity of the bank’s activities as well as the bank’s concentrated funding structure and weaknesses in the bank’s liquidity risk management. Interviewees noted that SVB was growing rapidly while facing liquidity and risk management issues. Specifically, one interviewee described growth as its own risk because it creates problems that are not foreseeable; the interviewee noted that “everyone underappreciated that rapid growth always exposes cracks.”

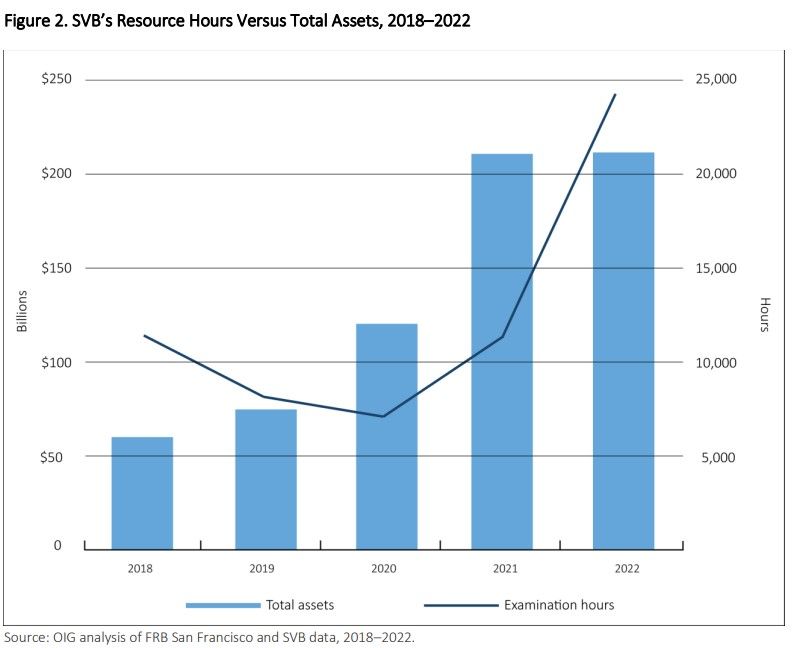

Insufficient Examiner Resources and Hours:

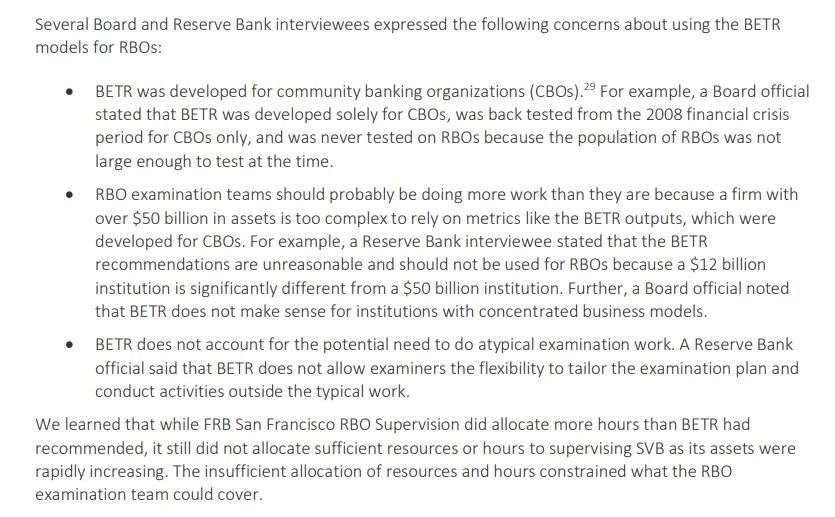

Examiners were using the wrong grading metrics!

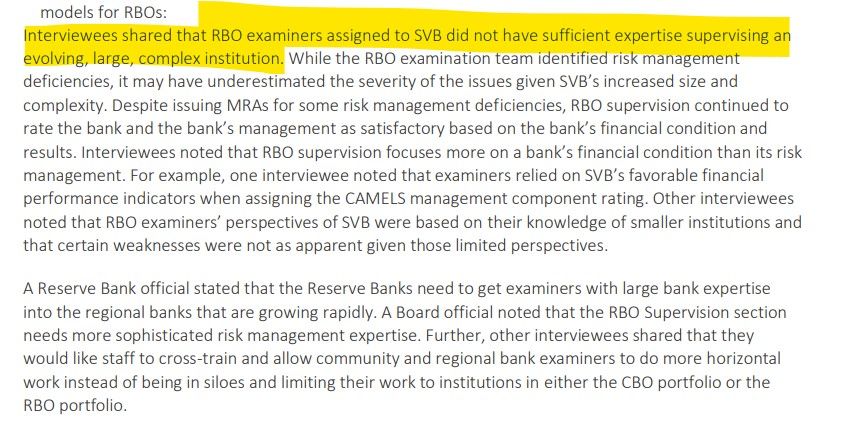

Lack of Large, Complex Banking Experience:

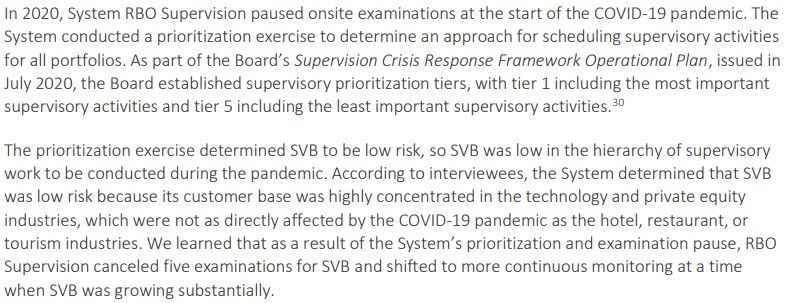

Examination Pause During the COVID-19 Pandemic:

TLDRS:

- Silicon Valley Bank (SVB), once boasting over $200 billion in assets, failed in March 2023, costing the Deposit Insurance Fund an estimated $16.1 billion.

- The supervisory approach of the Board and the Federal Reserve Bank of San Francisco did not adapt to SVB’s growing complexity, with insufficient resources and expertise, contributing to the oversight failure.

- A senior official did note that a Reserve Bank does not want a CEO of a bank whose ratings are falling serving as a board member at that Reserve Bank.

- "We also learned that FRB San Francisco and Board senior officials considered removing SVB’s CEO from FRB San Francisco’s board of directors following the discussions to downgrade SVB’s ratings; they ultimately decided that the CEO should remain on the board of directors to avoid revealing confidential supervisory information and potentially signaling to the market the bank’s declining condition."

- "We believe that the CEO’s service on the FRB San Francisco board of directors created an appearance of a

conflict of interest for the System."