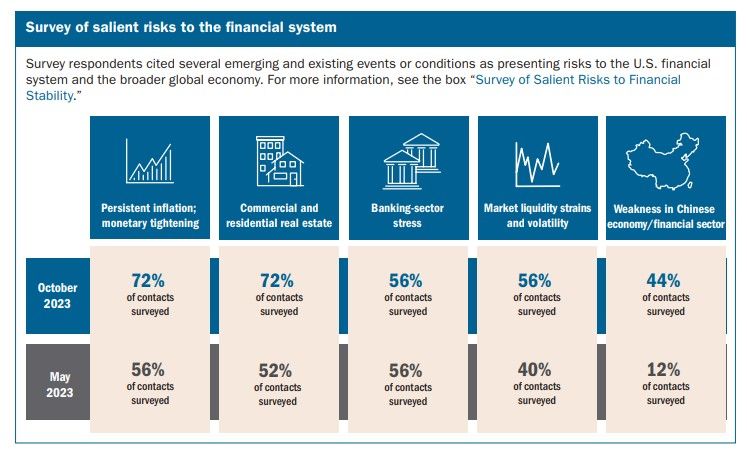

The Fed's October 2023 Financial Stability Report: Three-fourths of survey participants cite persistent inflation and potential residential and commercial real estate losses as top concerns.

Highlights:

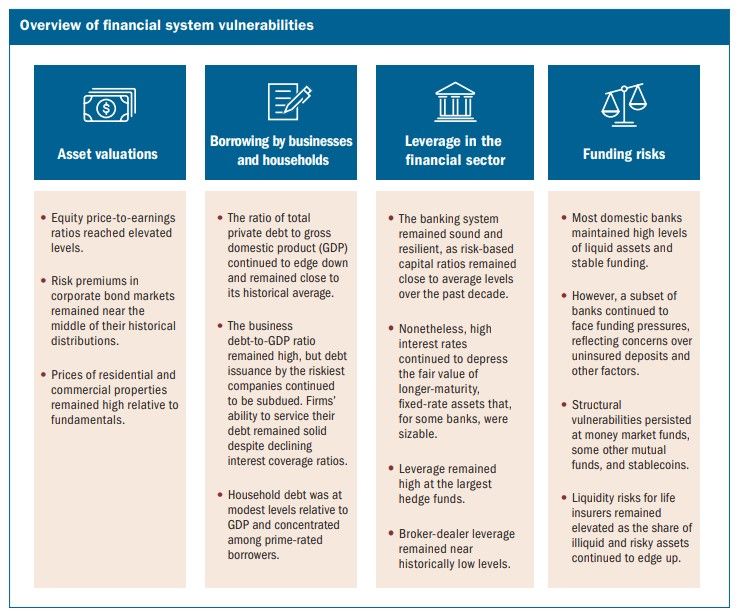

Asset valuations:

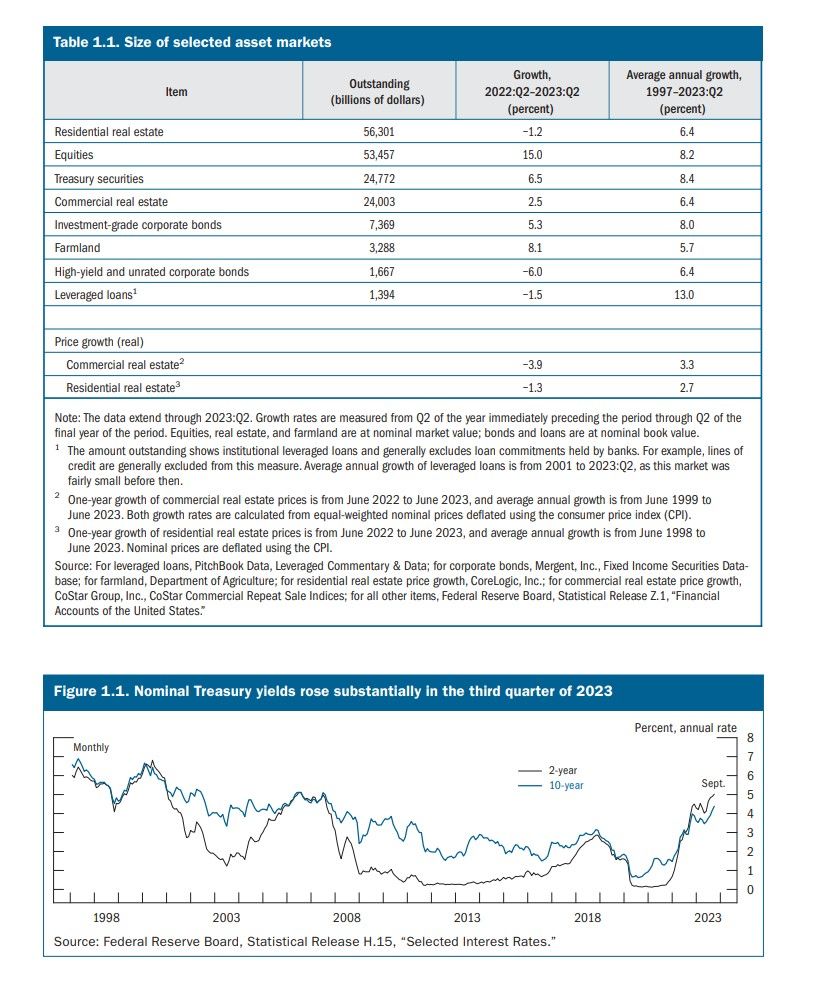

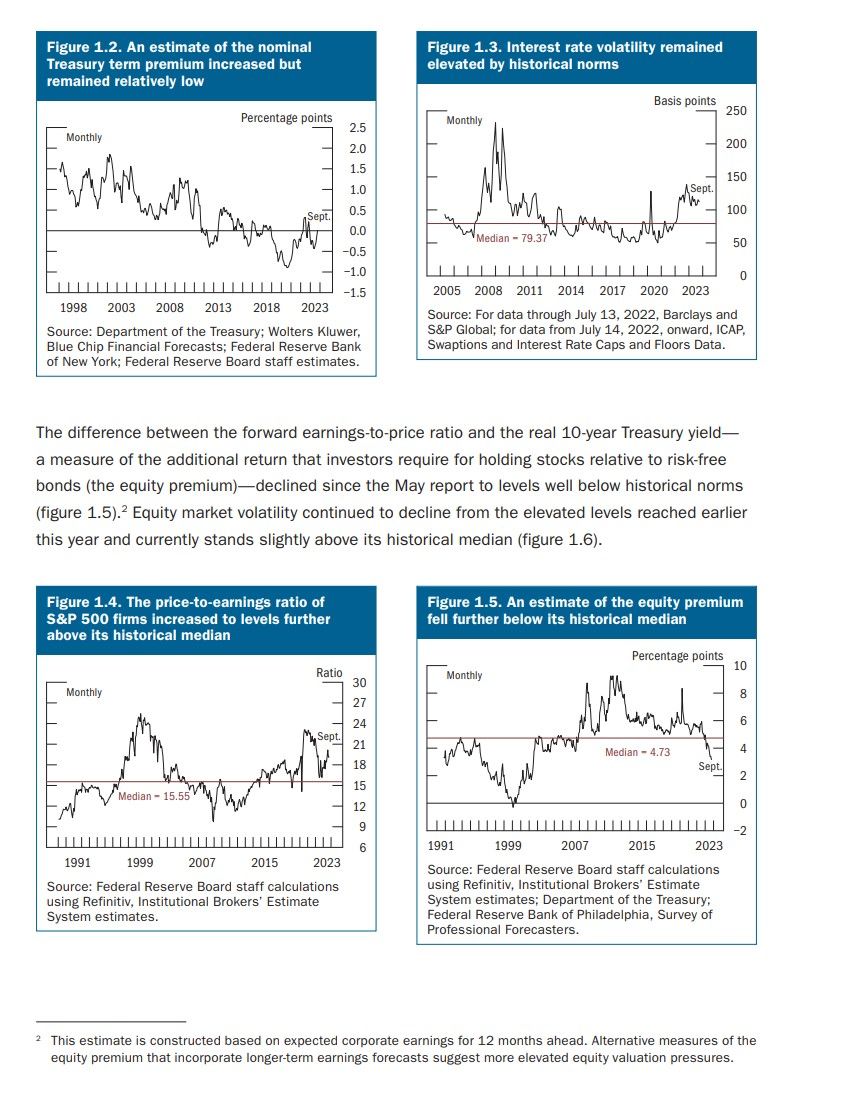

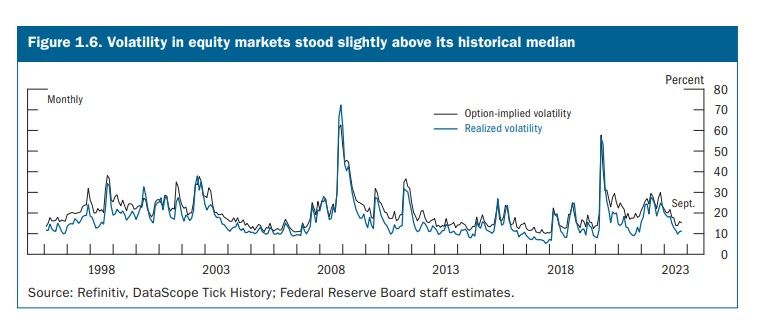

Equity prices grew faster than expected earnings, pushing the forward price-to-earnings ratio into the upper ranges of its historical distribution. Risk premiums in corporate bond markets narrowed somewhat and remained near the middle of their historical distributions. Prices of residential and commercial properties remained high relative to fundamentals.

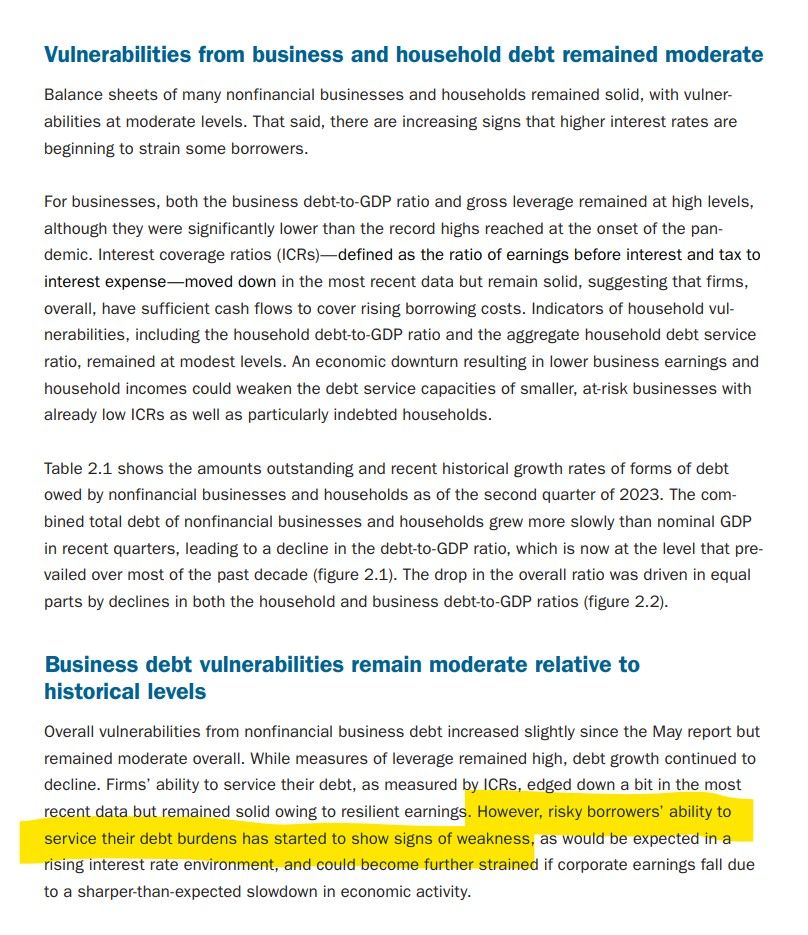

Borrowing by businesses and households:

Balance sheets of many nonfinancial businesses and households remained solid. Growth of business debt continued to decline through the first half of the year, although business debt remained high when measured relative to gross domestic product (GDP) or business assets. Measures of the ability of firms to service their debt remained strong. Household debt remained at modest levels relative to GDP, with most of that debt owed by households with strong credit histories or considerable home equity.

Leverage in the financial sector:

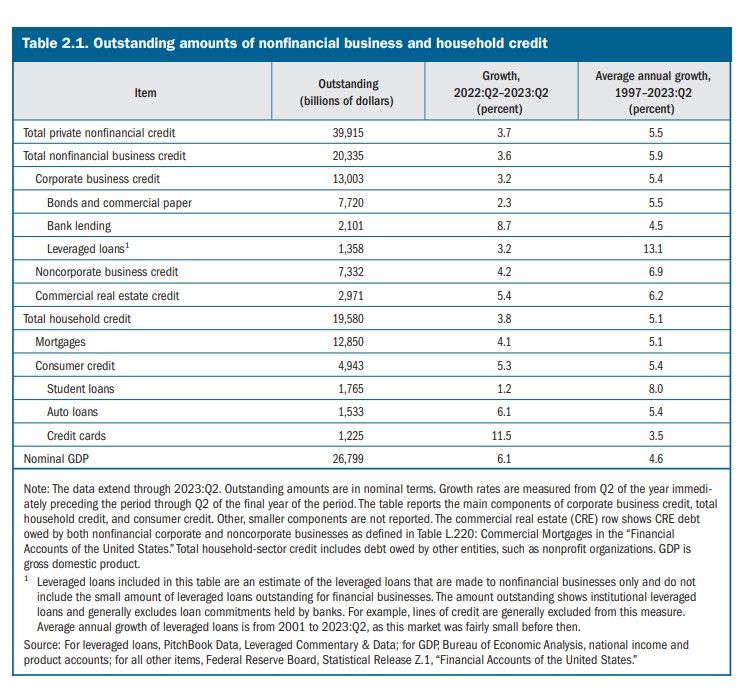

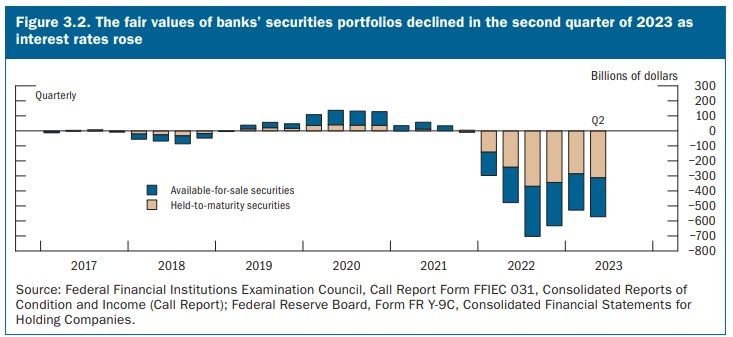

The banking sector remains sound and resilient overall, and most banks continued to report capital levels well above regulatory requirements. That said, the increase in interest rates over the past two years has contributed to declines in the fair value of longer-maturity, fixed-rate assets that, for some banks, were sizable. Outside the banking sector, available data suggest that hedge fund leverage remained somewhat elevated, especially for the largest hedge funds. Leverage at life insurance companies remained near the middle of its historical range, while broker-dealer leverage remained historically low.

Funding risks:

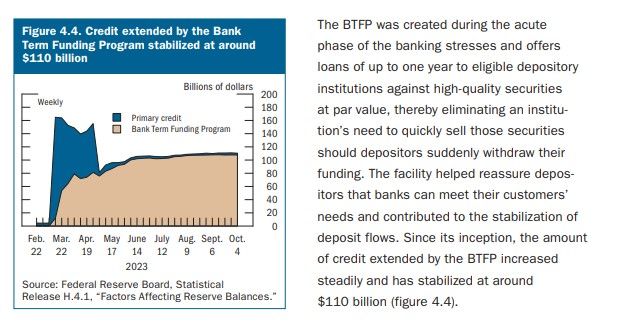

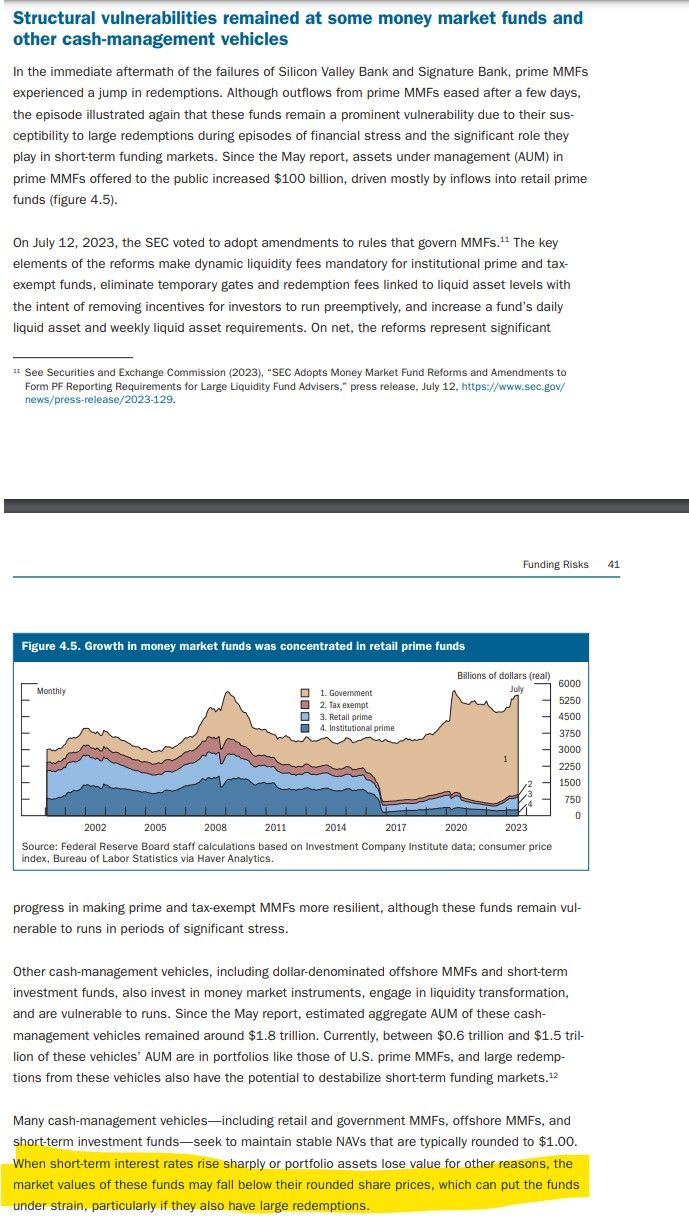

Most domestic banks have ample liquidity and limited reliance on short term wholesale funding; nevertheless, some banks continued to face funding strains, likely owing to vulnerabilities associated with high levels of uninsured deposits and declines in the fair value of assets. The Bank Term Funding Program (BTFP) helped mitigate these strains. Structural vulnerabilities remained in other short-term funding markets. Prime and tax-exempt money market funds (MMFs), as well as other cashinvestment vehicles and stablecoins, remained vulnerable to runs. Bond and loan funds that hold assets that can become illiquid during periods of stress remained susceptible to large redemptions. Life insurers continued to rely on a higher-than-average share of runnable liabilities.

Market liquidity stayed near the lower end of its historical range:

Market liquidity refers to the ease and cost of buying and selling an asset. Low liquidity can amplify the volatility of asset prices and result in larger price moves in response to shocks. In extreme cases, low liquidity can threaten market functioning, leading to a situation in which participants are unable to trade without incurring a significant cost.

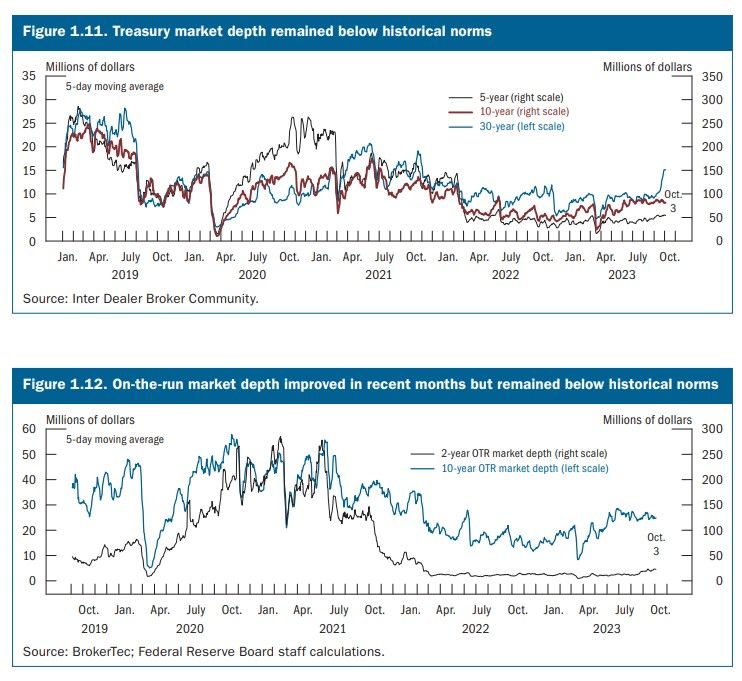

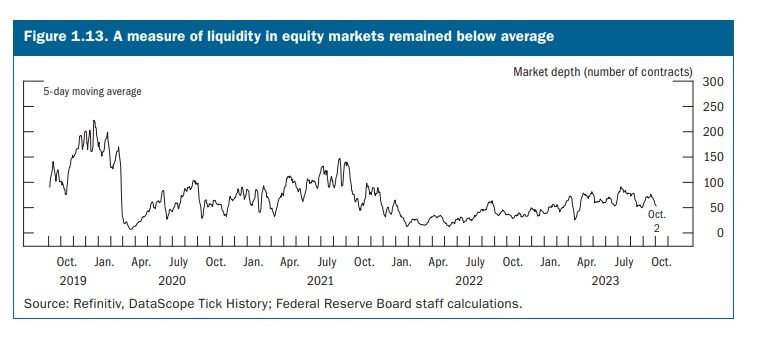

Treasury market liquidity is important because of the key role these securities play in the financial system. Various measures of market liquidity, such as market depth, suggest that while Treasury market liquidity was largely in line with expectations given interest rate volatility, it remained below historical norms (figures 1.11 and 1.12). This low level of market depth could indicate that liquidity providers are being particularly cautious, and liquidity may be less resilient than usual.

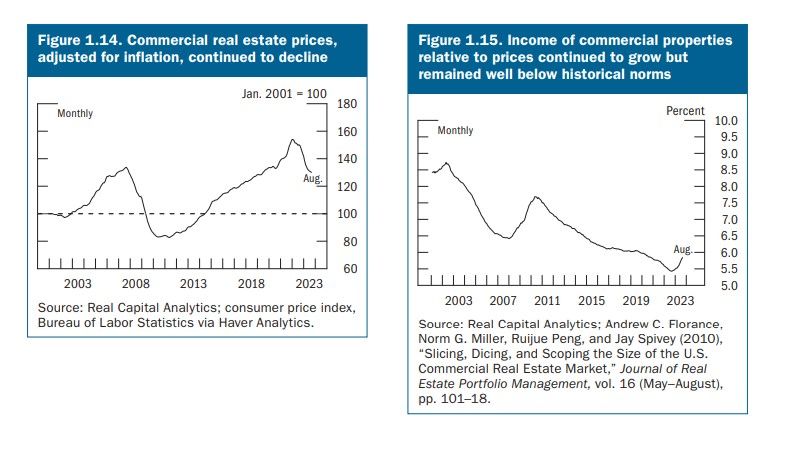

In other markets, liquidity conditions were little changed since the previous report and present a more mixed picture. In corporate bond markets, bid-ask spreads remained well below pandemic levels, suggesting ample liquidity, while in equity markets, depth in the S&P 500 futures markets stayed at below-average levels (figure 1.13).

Commercial real estate valuations remained elevated, even as prices continued to decline:

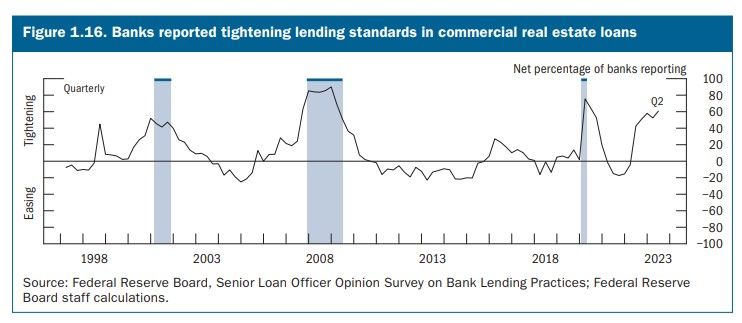

Aggregate CRE prices measured in inflation-adjusted terms continued declining through August (figure 1.14). Capitalization rates at the time of property purchase, which measure the annual income of commercial properties relative to their prices, have increased modestly from recent historically low levels but have not increased as much as real Treasury yields, suggesting that prices remain high relative to rental income (figure 1.15). CRE valuations are particularly elevated for the office sector, where fundamentals are especially weak for offices in central business districts, with vacancy rates increasing further and rent growth declining since the May report. In the April and July 2023 Senior Loan Officer Opinion Survey (SLOOS), banks reported weaker demand and tighter standards for all CRE loan categories over the first half of 2023 (figure 1.16).

While the overall banking system remains sound, declines in the fair value of assets at some banks remained sizable and leverage at some nonbanks continued to be somewhat elevated:

Leverage at hedge funds continued to be somewhat elevated:

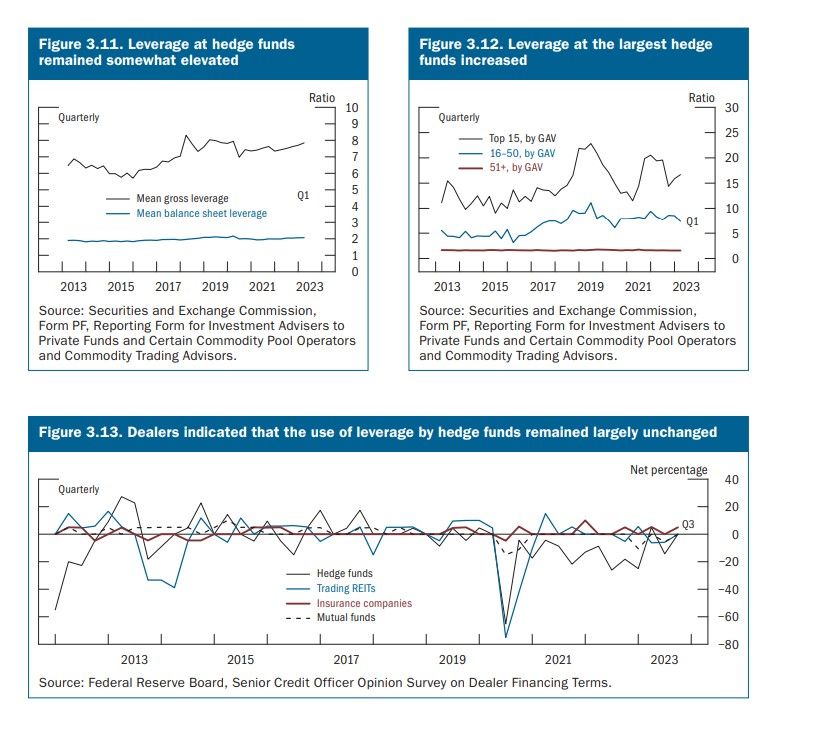

Comprehensive data collected by the Securities and Exchange Commission (SEC) indicate that measures of leverage averaged across all hedge funds remained above their historical norms in the first quarter of 2023. These somewhat elevated levels hold true for both average on-balance-sheet leverage (blue line in figure 3.11)—which captures financial leverage from secured financing transactions, such as repurchase agreements and margin loans, but does not capture leverage embedded through derivatives—as well as for average gross leverage of hedge fund (black line in figure 3.11)—a broader measure that incorporates off-balance-sheet derivatives exposures. Leverage at the largest funds was significantly higher, with the average on-balance-sheet leverage of the top 15 hedge funds by gross asset value rising in the first quarter of 2023 to about 17-to-1 (figure 3.12). These high levels of leverage were facilitated, in part, by low haircuts on Treasury collateral in some markets where many hedge funds obtain short term financing.9 More recent data from the September 2023 SCOOS suggested that the use of financial leverage by hedge funds remained largely unchanged between mid-May 2023 and mid-August 2023 (figure 3.13).

Data from the Commodity Futures Trading Commission (CFTC) Traders in Financial Futures report showed that leveraged funds’ short Treasury futures positions increased notably since the beginning of the year. In the past, high levels of short positions in Treasury futures held by leveraged funds coincided with hedge fund activities in Treasury cash-futures basis trades— trades that involve the sale of a Treasury future and the purchase of a Treasury security, funded by repurchase agreement, deliverable into the futures contract—and several indicators suggest that the trade likely gained in popularity recently as well. The data from the CFTC Traders in Financial Futures report suggest that the recent growth of the trade could be, in part, attributed to increased demand from asset managers—including mutual funds, pension funds, and other investor types—for exposure to interest rates in the futures market. Because the basis trade is often highly leveraged, a funding shock or heightened volatility in Treasury markets could force leveraged funds to abruptly unwind their positions at potentially distressed prices. This deleveraging could amplify initial disruptions in Treasury markets, possibly impairing market liquidity and market functioning. However, recent SCOOS surveys suggest that these risks are likely mitigated by tighter financing terms applied to hedge funds by dealer counterparties over the past several quarters

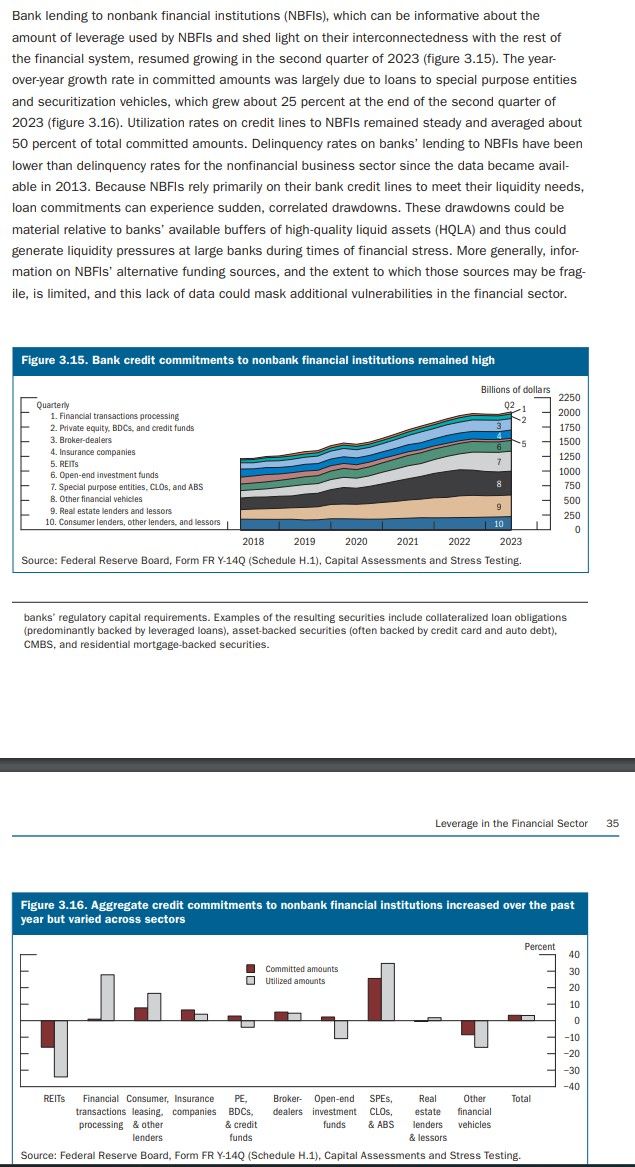

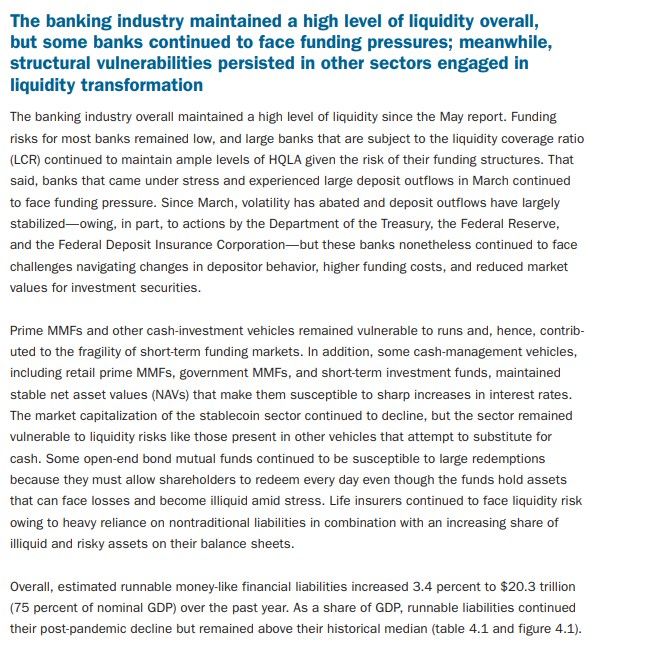

Bank lending to nonbank financial institutions remained high:

Funding Risks:

TLDRS:

- October 2023 Financial Stability Report

- "The two most frequently cited topics in this survey—the risk of persistent inflationary pressures leading to a more restrictive monetary policy stance and the potential for large losses on commercial real estate (CRE) and residential real Overview 3 estate—were mentioned by three-fourths of all survey participants, up from one-half of all participants in the previous survey"

- Hedge funds, especially larger ones, showed elevated leverage.

- Some banks experienced funding pressures due to high uninsured deposits and asset value declines, but the Bank Term Funding Program (BTFP) provided relief.

- Bond and loan funds holding potentially illiquid assets were at risk of substantial redemptions.

- Reminder, while banks have the liquidity fairy, 'we' get the promise of more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.