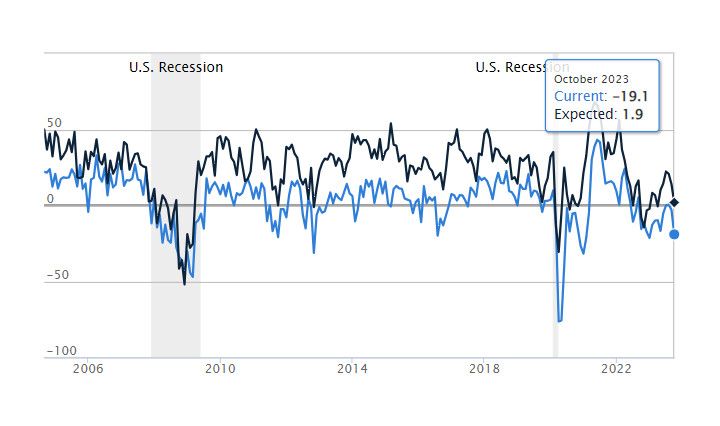

NY Fed October Business Leader Survey: "Activity declined significantly in the region’s service sector." "The headline business activity index dropped sixteen points to -19.1, its lowest level in several months." "while wages grew"...

Highlights

General Business Activity Overview:

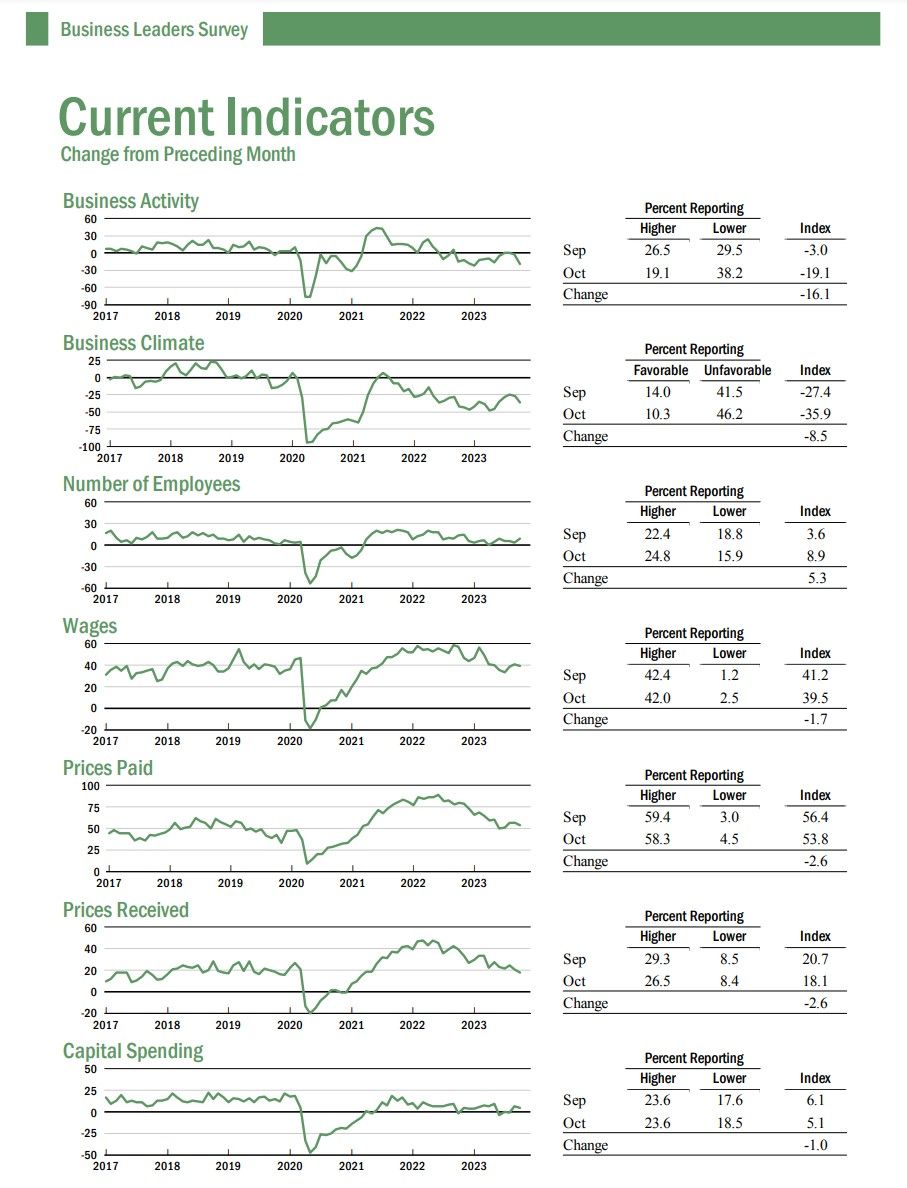

- The service sector in the region experienced a significant decline as per the Federal Reserve Bank of New York’s October 2023 Business Leaders Survey.

- The business activity index saw a considerable drop of sixteen points, reaching -19.1, its lowest in several months.

- The business climate worsened with the index decreasing by nine points to -35.9, indicating a much worse than normal situation.

- Despite the downturn in activity, there was an increase in employment and wages continued to grow at a similar pace to the previous month.

- Both input and selling prices saw a slight moderation.

- The survey indicated that 19% of firms saw improved conditions, whereas 38% felt the conditions deteriorated.

Employment & Wages:

- Employment showed resilience with a five-point rise in the index to 8.9, indicating a modest increase.

- Wages continued to grow at a pace similar to August, with the index staying nearly unchanged at 39.5.

- Prices paid and received both decreased by three points, reflecting a slight moderation in price increases.

- The capital spending index was at 5.1, pointing to a minor increase in capital expenditures.

Future Outlook:

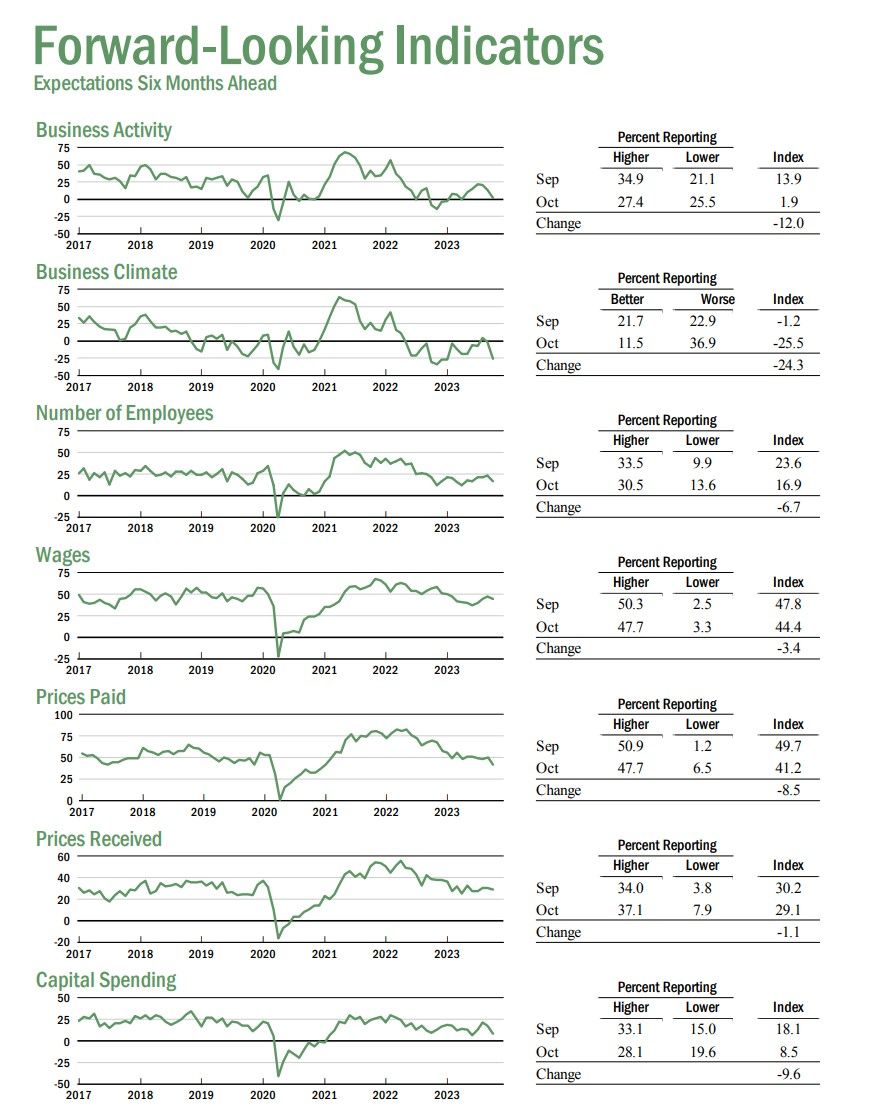

- Firms are less optimistic about the future, with the future business activity index barely above zero at 1.9.

- The future business climate index plummeted twenty-four points to -25.5.

- Expectations suggest a moderate growth in employment and continued wage increases in the upcoming months--more fuel for inflation!

About the Survey

The Business Leaders Survey is a monthly survey conducted by the Federal Reserve Bank of New York that asks companies across its District - which includes New York State, Northern New Jersey, and Fairfield County, Connecticut - about recent and expected trends in key business indicators.

This survey is designed to parallel the Empire State Manufacturing Survey, though it covers a wider geography and the questions are slightly different. Participants from the service sector respond to a questionnaire and report on a variety of indicators, both in terms of recent and expected changes.

The survey is sent on the first business day of each month to the same pool of about 150 business executives, usually the president or CEO, in the region's service sector. In a typical month, about 100 responses are received by around the tenth of the month when the survey closes.

Respondents come from a wide range of industries outside of the manufacturing sector, with the mix of respondents closely resembling the industry structure of the region.

The survey's headline index, general business activity, is a distinct question posed on the survey (as opposed to a composite of responses to other questions). Currently, no indexes are seasonally adjusted since none of the series exhibits stable seasonal patterns from a statistical perspective.

TLDRS:

NY Fed October Business Leader Survey:

- "Activity declined significantly in the region’s service sector."

- "The headline business activity index dropped sixteen points to -19.1, its lowest level in several months."

- Despite the downturn in activity, there was an increase in employment and wages continued to grow at a similar pace to the previous month.

- More fuel for inflation!

- Reminder, while banks have the liquidity fairy, 'we' get the promise of more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.