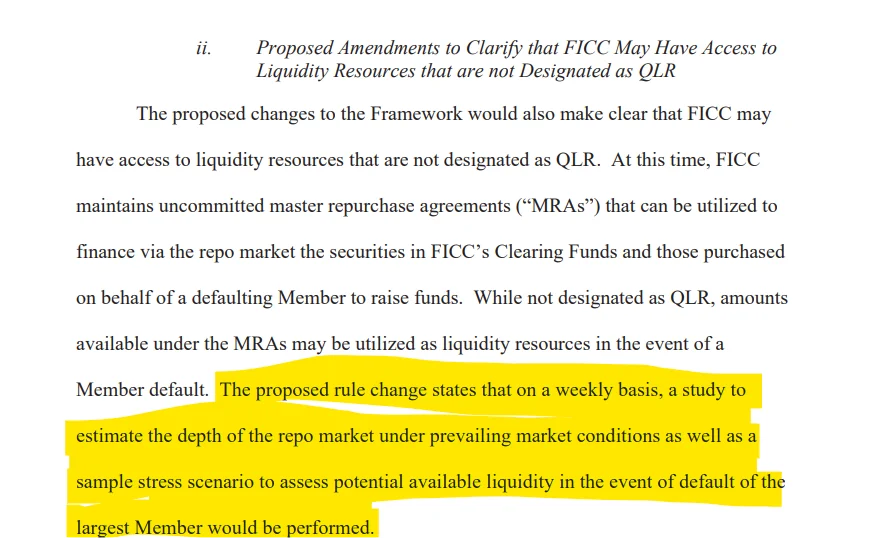

NSCC/DTC/FICC Alert! Proposed rule change states that on a weekly basis, a study to estimate the depth of the repo market under prevailing market conditions

NSCC/DTC/FICC Alert! Proposed rule change states that on a weekly basis, a study to estimate the depth of the repo market under prevailing market conditions as well as a sample stress scenario to assess potential available liquidity in the event of default of the largest Member would be performed.

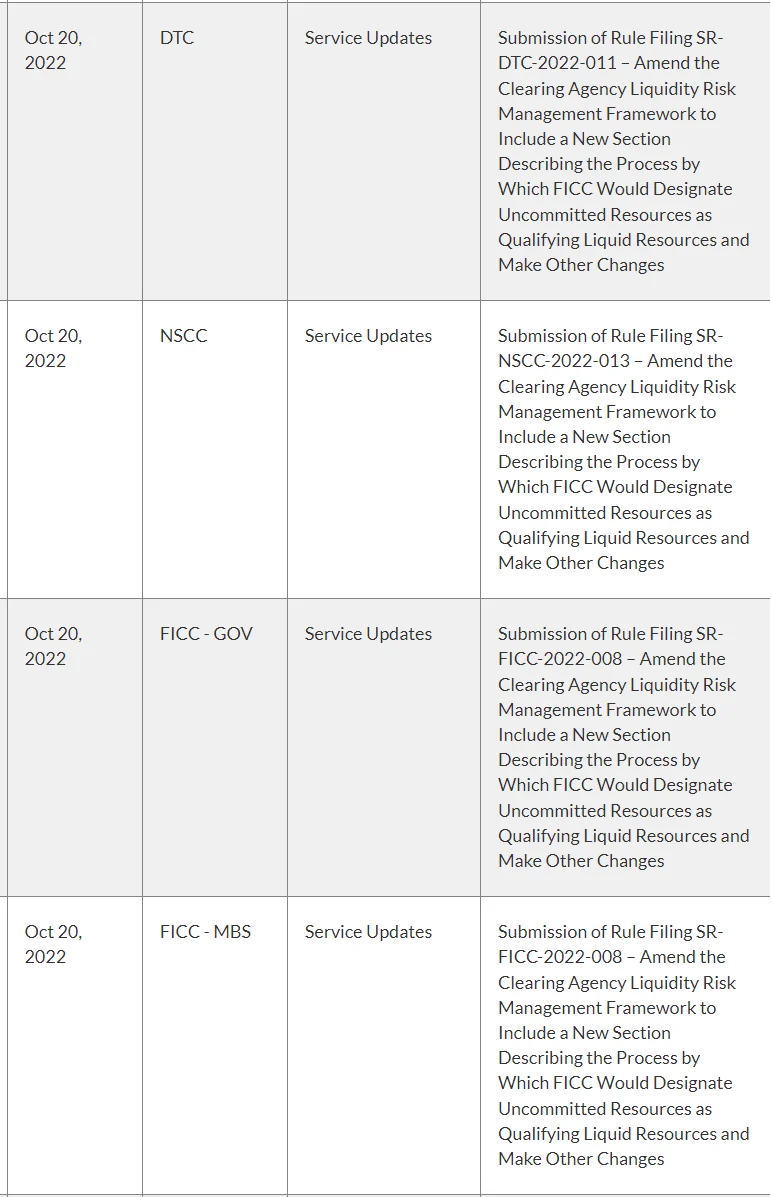

On October 20, 2022, National Securities Clearing Corporation (“NSCC”) filed a proposed rule change (SR-NSCC-2022-013) (“Filing”) with the Securities and Exchange Commission (“SEC”) to amend the Clearing Agency Liquidity Risk Management Framework (“Framework”).

The proposed rule change would amend the Framework to:

(1) add a new section describing the process by which Fixed Income Clearing Corporation (“FICC”) would designate uncommitted liquidity resources as qualifying liquid resources (“QLR”);

(2) clarify that FICC may have access to liquidity resources that are not designated as QLR;

(3) delete the stand-alone section on due diligence and testing of liquidity providers, and instead add due diligence and testing descriptions where each liquidity resource is described or state where testing is not performed, as applicable;

(4) clarify the description of FICC’s QLR;

(5) clarify the description of NSCC’s and The Depository Trust Company’s (“DTC’s”) QLR, add language to reflect NSCC’s and DTC’s current due diligence and testing processes for their committed line of credit, and make a correction to the description of DTC’s Collateral Monitor; and

(6) make technical changes, as described in the Filing.

The Clearing Agencies have not received or solicited any written comments relating to this proposal. If any written comments are received, they will be publicly filed as an Exhibit 2 to this filing, as required by Form 19b-4 and the General Instructions thereto.

Persons submitting comments are cautioned that, according to Section IV (Solicitation of Comments) of the Exhibit 1A in the General Instructions to Form 19b-4, the Commission does not edit personal identifying information from comment submissions. Commenters should submit only information that they wish to make available publicly, including their name, email address, and any other identifying information. All prospective commenters should follow the Commission’s instructions on how to submit comments, available at https://www.sec.gov/regulatory-actions/how-to-submitcomments.