NSCC Alert! Order Approving of Proposed Rule Change to Enhance Capital Requirements and Make Other Changes

Description of the Proposed Rule Change:

NSCC proposes to amend its Rules to (A) increase the capital requirements applicable to its members, 10 (B) revise its credit risk monitoring system, and (C) make certain other clarifying, technical, and supplementary changes to implement changes (A) and (B).

As is the case with the current capital requirements applicable to Registered Broker-Dealers, the enhanced capital requirements for U.S. broker-dealers would depend on whether a member self-clears or clears for others. NSCC states that a broker-dealer that clears transactions for others has the potential to present different and greater risks to NSCC than a broker-dealer that clears transactions only for itself because it could clear for a large number of correspondent clients (i.e., indirect participants), which would expand the scope and volume of risk presented to NSCC and the direct participant itself when the indirect participant’s trades are submitted to NSCC for settlement via the direct participant.

The indirect nature of this risk exposure also increases risk to NSCC as there is generally less transparency into the indirect activity versus if the direct participant generated all of the activity itself. NSCC states the proposed heightened capital requirements for these members would help ensure that NSCC is better able to manage the material risks to NSCC arising from these arrangements.

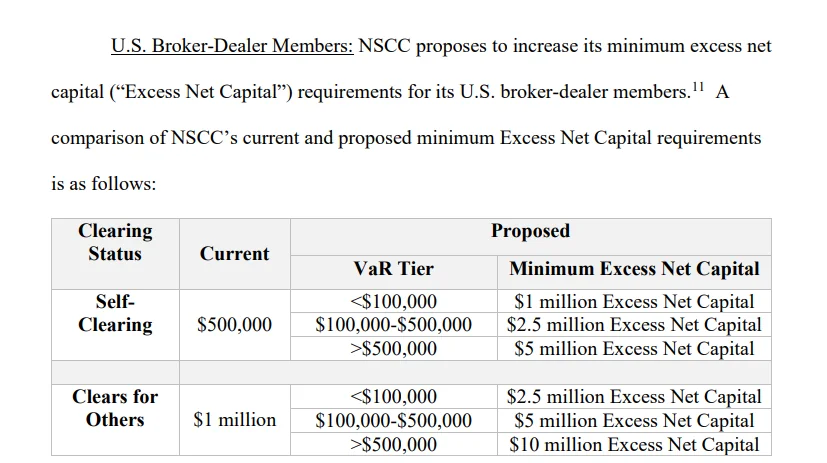

Currently, the minimum capital requirements for U.S. broker-dealers only consider the risk of membership type (i.e., self clears or clears for others), without considering any other risks. NSCC would continue to consider membership type, but would also incorporate volatility risk of the U.S. brokerdealer’s own positions at NSCC (i.e., a measurement of the risk that the member’s transactions pose to NSCC) in order to more strategically group U.S. broker-dealer Members into tiers, with each tier being assigned a specific minimum capital requirement.

As part of the tiered approach, a member’s daily volatility component may exceed its then-current VaR Tier four times over a rolling 12-month period. Upon the fifth instance, the member would be moved to the next-greatest VaR Tier. The member would then have 60 calendar days from that date to meet the higher required minimum Excess Net Capital for that VaR Tier and would remain in that greater VaR Tier for no less than one continuous year from the date of the move before being eligible to move to a lesser VaR Tier. NSCC states that U.S. broker-dealer members could move between tiers based on sustained changes to their daily volatility component, thus allowing them to have control over the tier in which they are placed and, in turn, the capital they need to maintain.

U.S. Bank and Trust Company Members:

For members who are U.S. banks or U.S. trust companies who are also banks, NSCC proposes to (1) change the capital measure from equity capital to common equity tier 1 capital (“CET1 Capital”), (2) raise the minimum capital requirements from $50 million in equity capital to $500 million in CET1 Capital, and (3) require such members to be well capitalized (“Well Capitalized”).

Securities Exchanges:

Currently, NSCC does not provide a capital requirement standard for national securities exchanges. NSCC proposes to require that a Member that is a national securities exchange registered under the Exchange Act and/or a non-U.S. securities exchange or multilateral trading facility must have and maintain at all times at least $100 million in equity capital.

Index Receipt Agent: Currently, NSCC does not provide a capital requirement standard for Index Receipt Agents, which are exchange-traded funds agents that serve a number of functions in the create/redeem process. NSCC proposes to require that a broker-dealer member that is acting as an Index Receipt Agent must have and maintain at all times minimum Excess Net Capital of $100 million.

NSCC is proposing these new capital requirements to address the potential credit risk posed by the current exchange members due to the systemic importance of these members and the need to hold these members to a consistent, high standard to ensure that they have sufficient capital to fulfill their systemically important role.

DTC is also doing the same with SR-DTC-2021-017 and 34-95615