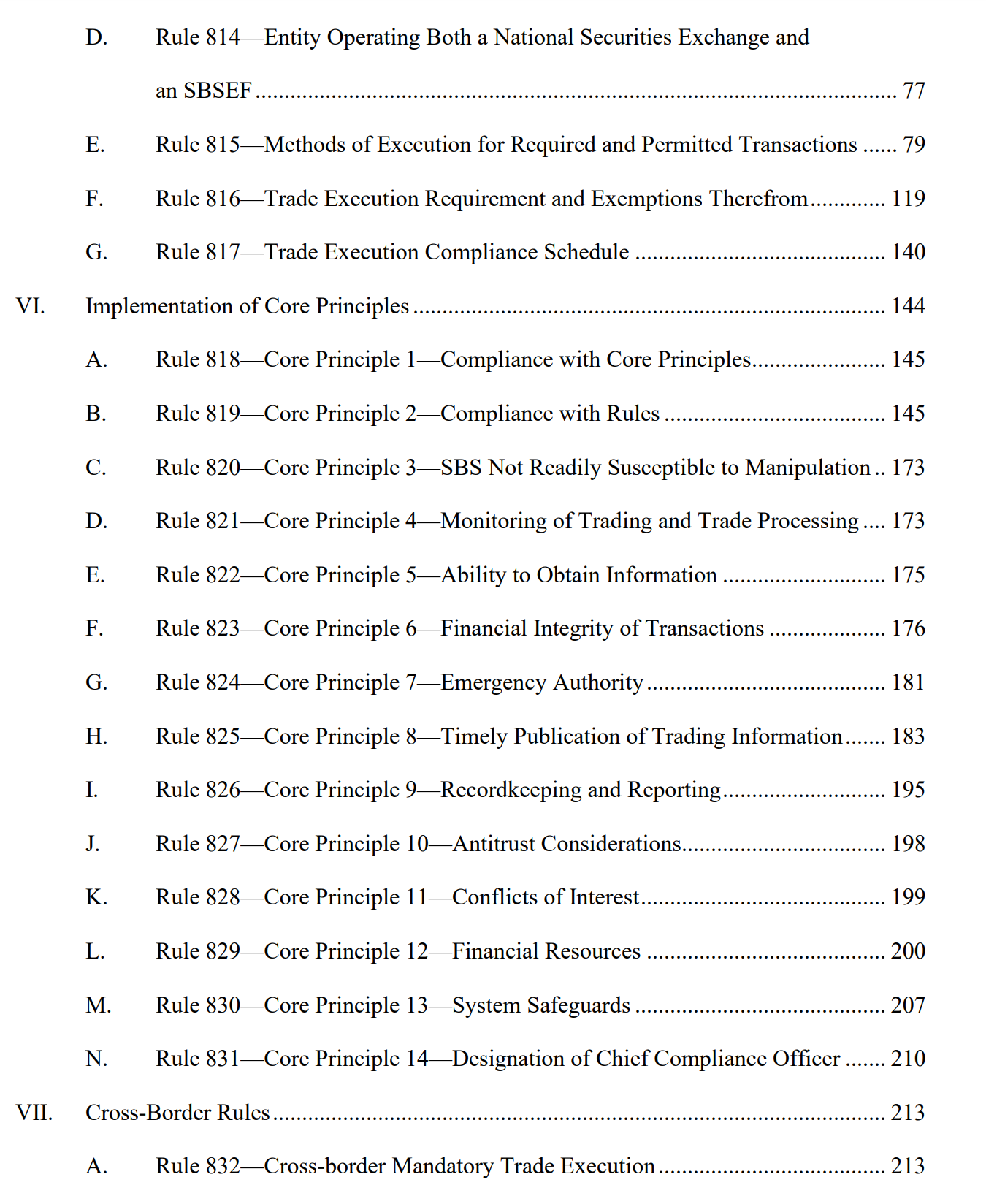

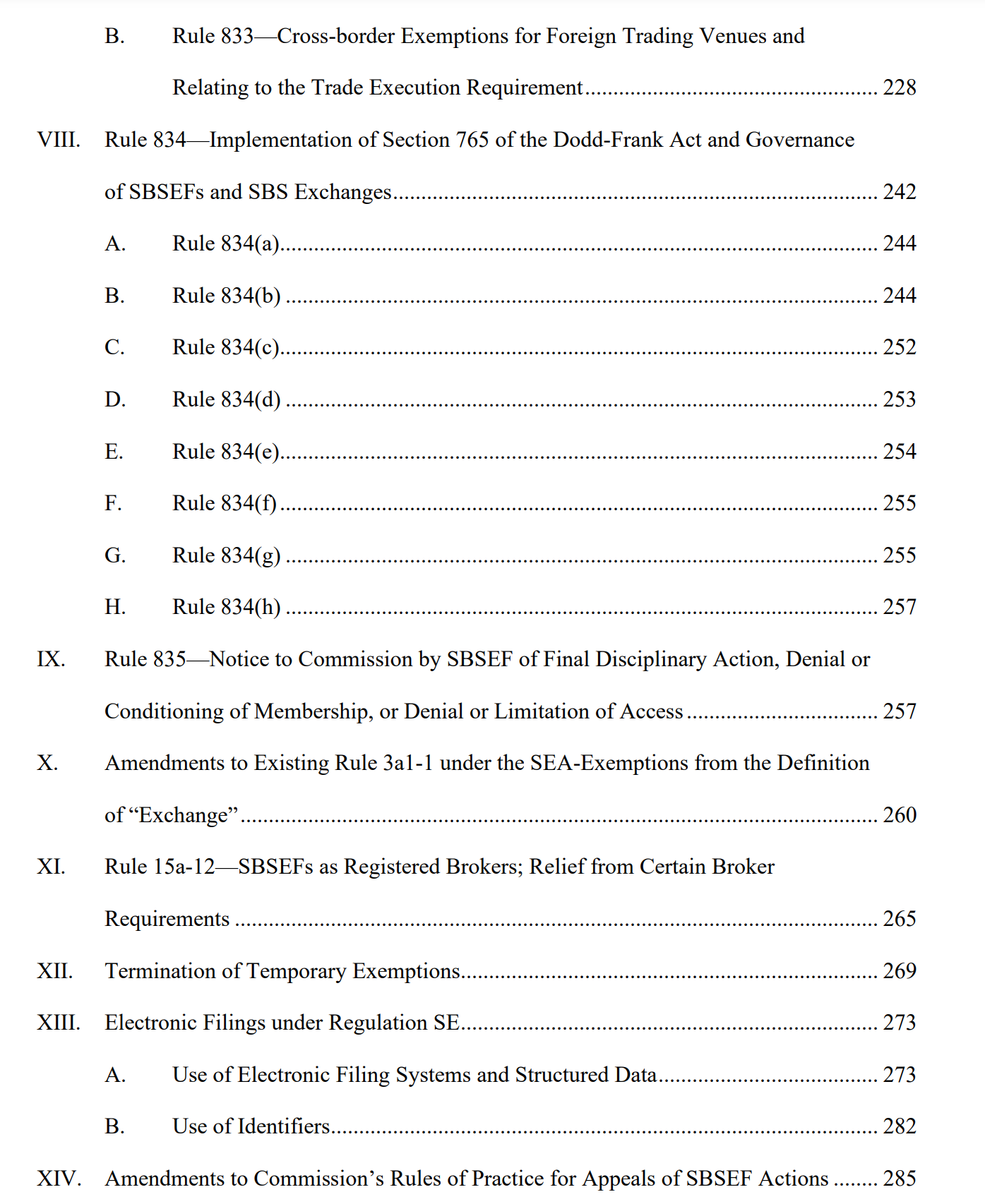

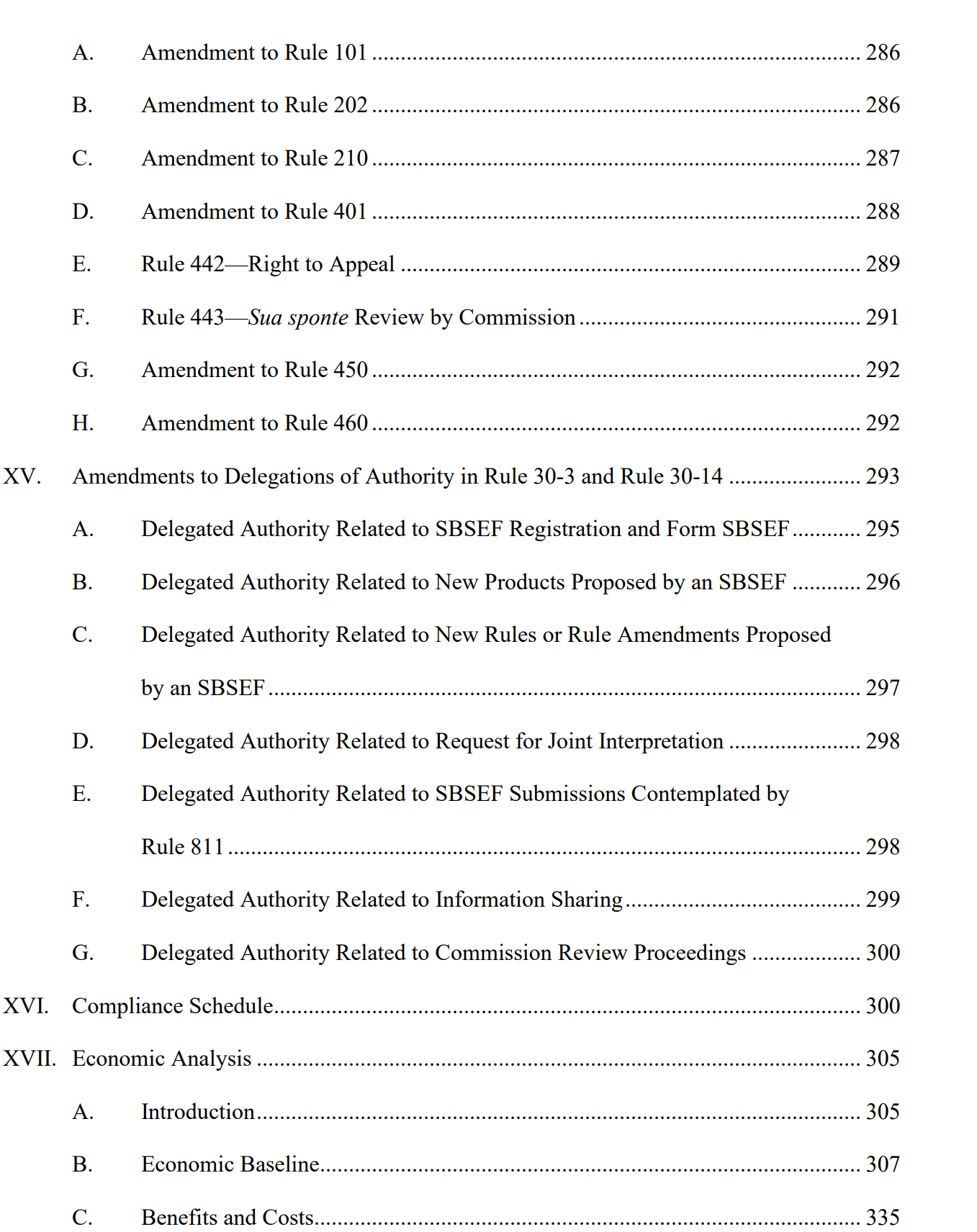

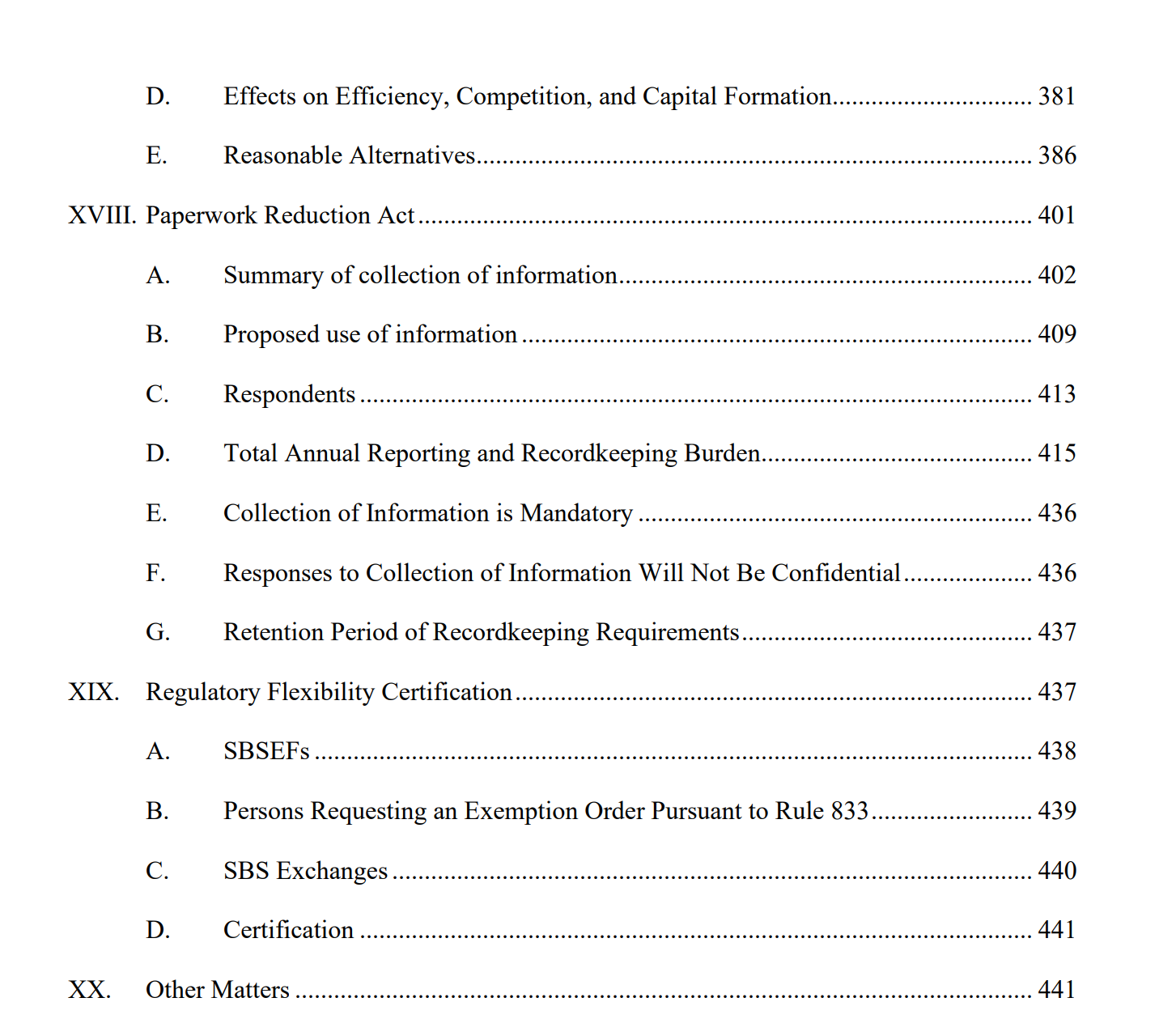

SEC Adopts Rules for the Registration and Regulation of Security-Based Swap Execution Facilities

604 pages of light reading....

Fact Sheet:

Press Release:

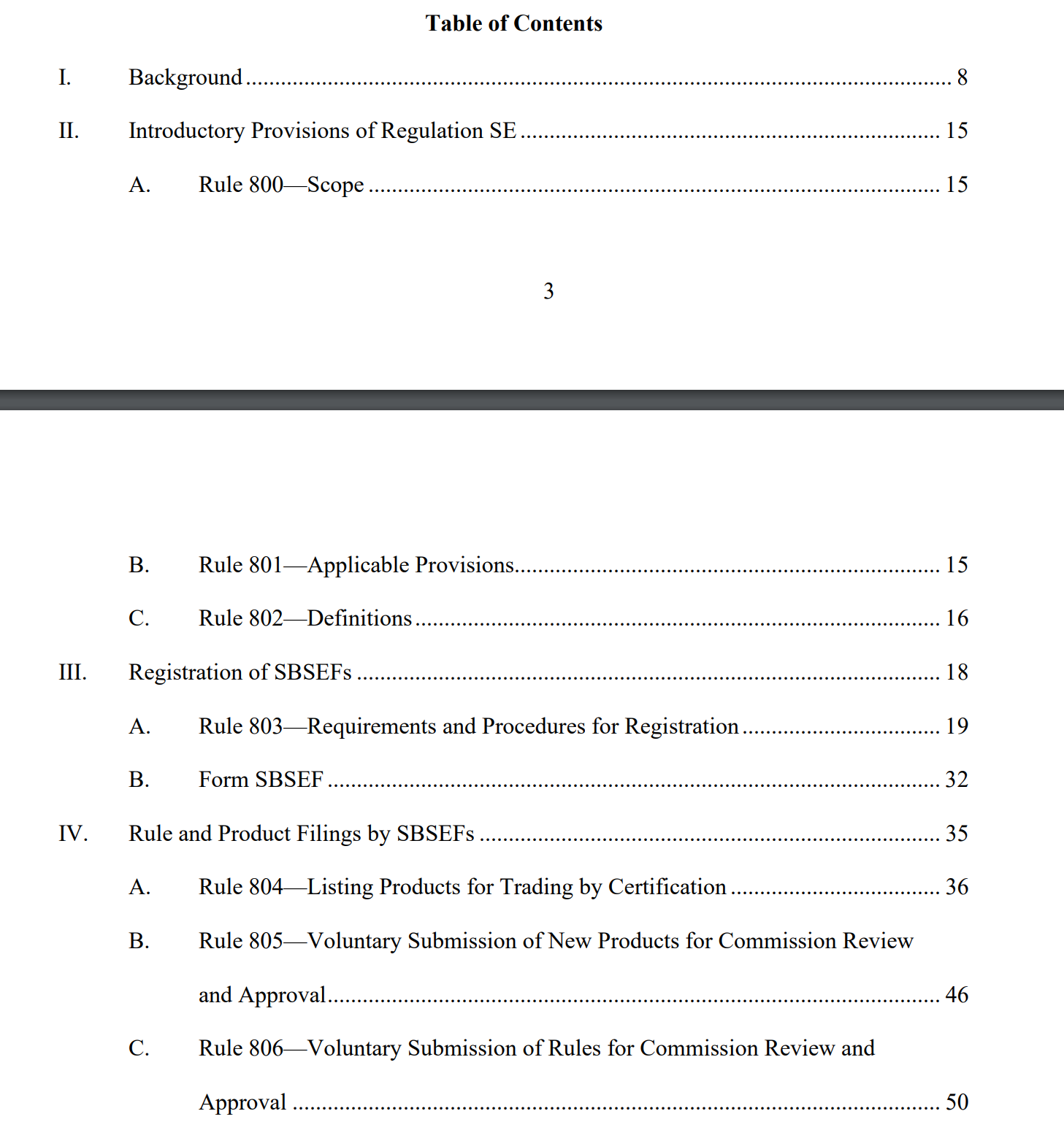

The Securities and Exchange Commission today adopted new Regulation SE under the Securities Exchange Act of 1934 to create a regime for the registration and regulation of security-based swap execution facilities (SBSEFs). The new regulatory framework was required under Title VII of the Dodd-Frank Wall Street Reform and Consumer Protection Act relating to the over-the-counter derivatives market.

“Adopting Regulation SE fulfills Congress’s mandate and increases the transparency and integrity of the security-based swap market,” said SEC Chair Gary Gensler. “In taking up these matters in 2021, we heard from many market participants suggesting that we should look to the Commodity Futures Trading Commission’s (CFTC) rules for swap execution facilities as our template. I believe aligning the SEC’s regime closely with the CFTC’s garners many of the same benefits – bringing together buyers and sellers with transparent, pre-trade pricing. That lowers risk in the marketplace and protects investors.”

Today’s adoption addresses the Exchange Act’s trade execution requirement for security-based swaps and the cross-border application of that requirement, implements Section 765 of the Dodd-Frank Act to mitigate conflicts of interest at SBSEFs and national securities exchanges that trade security-based swaps, and promotes consistency between Regulation SE and existing rules under the Exchange Act.

In adopting Regulation SE, the Commission has sought to harmonize as closely as practicable with parallel rules of the CFTC that govern swap execution facilities (SEFs) and swap execution generally.

The adopted rules will become effective 60 days following the date of publication in the Federal Register. Any entity that meets the definition of SBSEF may file an application to register with the Commission on Form SBSEF at any time after the effective date, and would need to do so within 180 days of the effective date and have its application on Form SBSEF be complete within 240 days of the effective date in order to continue to operate as an SBSEF while its application is pending.

TLDRS:

- SEC Adopts Rules for the Registration and Regulation of Security-Based Swap Execution Facilities

- Create a regime for the registration and regulation of security-based swap execution facilities (SBSEFs).

- Address various issues relating to the “trade execution requirement” for security-based swaps (SBS), such as by setting out the cross-border application of that requirement.

- Address conflicts of interest at SBSEFs and national securities exchanges that trade SBS.

- Promote consistency between the rules governing SBSEFs and existing rules under the Securities Exchange Act of 1934 (Exchange Act).

For an entity meeting the definition of “security-based swap execution facility”:

- Register with the Commission as an SBSEF on Form SBSEF or register as a national securities exchange.

- Foreign SBS trading venues may seek an exemption, pursuant to Rule 833(a), from the requirement to register.

A registered SBSEF must:

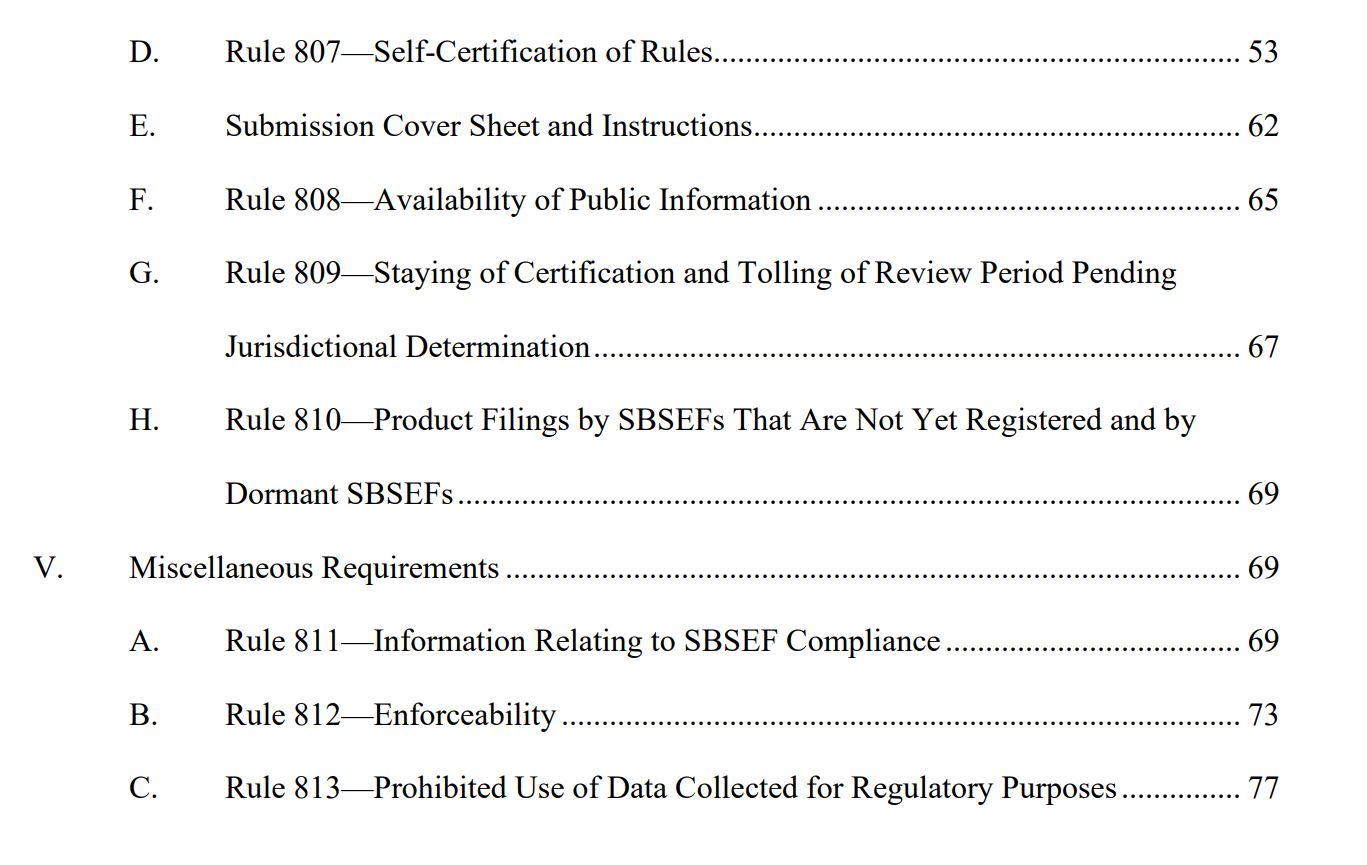

- Submit filings with the Commission for new rules, rule amendments, and products.

- Establish and enforce compliance with its rules, which must include, among other things, rules regarding impartial access, trading and trade processing, the operation of the SBSEF, the financial integrity of SBS on its facility, the exercise of emergency authority, and conflicts of interest.

- Monitor trading to prevent manipulation, price distortion, and delivery or settlement disruptions.

- Make public timely information on price, trading volume, and other trading data on SBS transactions and publish on its website a Daily Market Data Report.

- Maintain records of all activities of the facility, including a complete audit trail, in a form and manner acceptable to the Commission, for a period of five years.

- Have adequate financial, operational, and managerial resources.

- Establish and maintain a program of automated systems and risk analysis.

- Establish and maintain emergency procedures, backup facilities, and a disaster recovery plan.

- Designate a chief compliance officer (CCO) and establish regulatory and reporting obligations for the CCO.