SEC Alert! Notice of the Text of the Amendment to the National Market System Plan Governing the Consolidated Audit Trail for Purposes of Short Sale-Related Data Collection: Effective Date is within 60 days from 11/1/23.

Background:

Short selling involves a sale of a security that the seller does not own, or a sale that is consummated by the delivery of a security borrowed by, or for the account of, the seller. In order to deliver the security to the purchaser, the short seller will generally borrow the security, usually from a broker-dealer or an institutional investor, and later close out the position by purchasing equivalent securities on the open market and returning the security to the lender.

Short selling is generally used to profit from an expected downward price movement, to provide liquidity in response to unanticipated demand, or to hedge the risk of a long position in the same security or a related security. Short selling provides the market with important benefits, such as providing market liquidity and pricing efficiency. While short selling can serve useful market purposes, such as facilitating price discovery, there are concerns that it could be used to drive down the price of a security, to accelerate a declining market in a security, or to manipulate stock prices.

The Commission has plenary authority under section 10(a) of the Exchange Act to regulate short sales of securities as necessary or appropriate in the public interest or for the protection of investors. Regulation SHO, which became effective on January 3, 2005, imposes four general requirements with respect to short sales of equity securities. Under 17 CFR 242.200 (“Rule 200 of Regulation SHO”), broker-dealers must properly mark sale orders as “long,” “short,” or “short exempt.” Under 17 CFR 242.203 (“Rule 203 of Regulation SHO”), a brokerdealer must locate a source of shares that the broker-dealer reasonably believes can be delivered in time for settlement (commonly referred to as the “locate requirement”) before effecting a short sale. Under 17 CFR 242.204 (“Rule 204”), if the broker or dealer that is a member of a registered clearing agency fails to deliver the security to the registered clearing agency in time for settlement, the broker or dealer must take action to close out the failure to deliver if that failure results from a long or short sale. Separately, under 17 CFR 242.201 (“Rule 201”), trading centers must have policies and procedures in place to restrict short selling when a covered security has triggered a short sale price test circuit breaker. In addition, the Commission adopted an antifraud provision, 17 CFR 240.10b-21 (“Rule 10b-21”), to address failures to deliver in securities that have been associated with “naked” short selling.

Section 929X of the DFA added section 13(f)(2) of the Exchange Act, entitled “Reports by institutional investment managers,” requiring the Commission to prescribe rules to make certain short sale data publicly available no less frequently than monthly. Specifically, section 13(f)(2) provides: “[t]he Commission shall prescribe rules providing for the public disclosure of the name of the issuer and the title, class, CUSIP [Committee on Uniform Securities Identification Procedures] number, aggregate amount of the number of short sales of each security, and any additional information determined by the Commission following the end of the reporting period. At a minimum, such public disclosure shall occur every month.” In addition, the Commission has received multiple petitions to adopt reporting requirements for short sellers similar to those required for holders of long positions.

The Proposals:

In February 2022, in an effort to increase transparency regarding short position and short activity data to both market participants and regulators, and to address the requirements of section 13(f)(2), the Commission proposed new rule 13f-2 (“Proposed Rule 13f-2”) and related form (“Proposed Form SHO”) under the Exchange Act. Proposed Rule 13f-2 would require certain institutional investment managers (“Managers”) with gross short positions that meet certain quantitative reporting thresholds to report, on a monthly basis on new Proposed Form SHO, certain short position data and short activity data for certain equity securities. Proposed Form SHO included two parts: Information Table 1–reports of information including, but not limited to, data elements explicitly referenced in section 13(f)(2), gross end-of-month short positions in equity securities that meet the reporting thresholds, and whether such positions are fully hedged, partially hedged, or not hedged; and Information Table 2–reports of information including, but not limited to, certain daily activity data (including options assignments and exercises) that affect a Manager’s gross short positions during the calendar month reporting period. Managers would file Proposed Form SHO with the Commission via the Commission’s Electronic Data Gathering, Analysis, and Retrieval system (“EDGAR”) within 14 calendar days after the end of the calendar month. The Commission would then expect to publish on EDGAR aggregated information derived from the data reported on Proposed Form SHO within one month after the end of the reporting calendar month.

In the Proposing Release, the Commission stated that the required short sale disclosures that would be collected under Proposed Form SHO and the aggregated data published pursuant to Proposed Rule 13f-2 would increase transparency and provide several important benefits to market participants and regulators. Such aggregated information would help inform market participants regarding the overall short sale activity by reporting Managers. More information about the short sale activity and gross short positions of reporting Managers may promote greater risk management among market participants and may facilitate capital formation to the extent that greater transparency bolsters confidence in the markets. As discussed in the Proposing Release, the Commission’s regular access to Proposed Form SHO data would bolster the Commission’s oversight of short selling, as Proposed Rule 13f-2 and Proposed Form SHO would improve the utility of information available to the Commission and other regulators.

Additionally, to supplement the short sale data made available to the Commission in Proposed Form SHO filings, the Commission proposed a new rule at 17 CFR 242.205 prescribing a “buy to cover” order marking requirement under Regulation SHO (“Proposed Rule 205”) for certain purchase orders effected by a broker-dealer for its own account or for the account of another person at the broker-dealer, if, at the time of order entry, the purchaser had a gross short position in such security in the account for which the purchase is being made. The Commission also proposed amendments to the NMS plan governing the CAT (“Proposed CAT Amendments”) to require the reporting of “buy to cover” order marking information and of reliance on the bona fide market making exception in Rule 203(b)(2)(iii) of Regulation SHO (“BFMM locate exception”). Proposed Rule 205 and the Proposed CAT Amendments were designed to fill an information gap for the Commission and other regulators by providing insights into the lifecycle of a short sale that are not available under existing data sources.

Wut Mean?:

- The Securities and Exchange Commission (SEC) has published an amendment to the National Market System Plan Governing the Consolidated Audit Trail (CAT NMS Plan) related to short sale data collection.

- This amendment is in line with the SEC's Adopting Release No. 34-98738 for "Short Position and Short Activity Reporting by Institutional Investment Managers."

- The amendment will become effective 60 days after publication in the Federal Register (11/1/23), with a compliance date set for July 1, 2025.

- New Rule 13f-2 and Form SHO will require certain institutional investment managers to report short position data and short activity data for equity securities on a monthly basis.

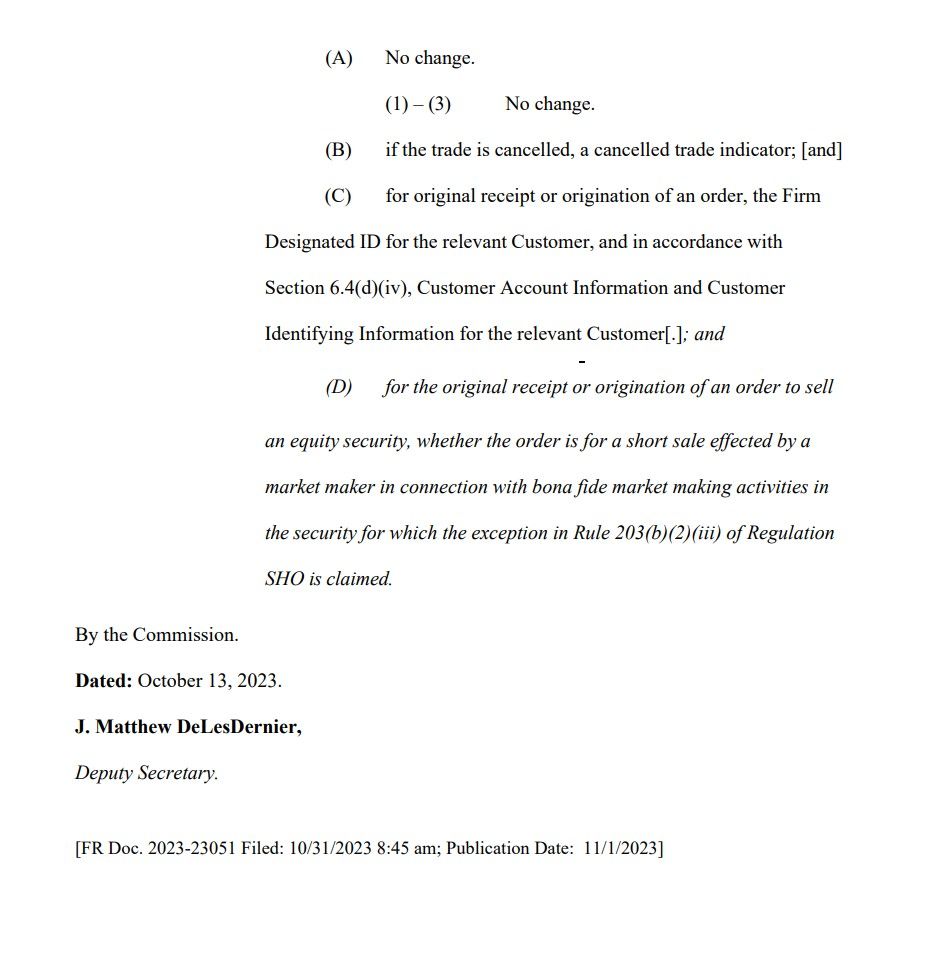

- The amendment modifies and adds to Section 6.4 of the CAT NMS Plan, including changes to data reporting requirements for cancelled trades and the origination of orders, particularly noting whether a short sale order is part of bona fide market making activities.

TLDRS:

- The Securities and Exchange Commission (SEC) has published an amendment to the National Market System Plan Governing the Consolidated Audit Trail (CAT NMS Plan) related to short sale data collection.

- This amendment is in line with the SEC's Adopting Release No. 34-98738 for "Short Position and Short Activity Reporting by Institutional Investment Managers."

- The amendment will become effective 60 days after publication in the Federal Register (11/1/23), with a compliance date set for July 1, 2025.

- New Rule 13f-2 and Form SHO will require certain institutional investment managers to report short position data and short activity data for equity securities on a monthly basis.

- You can read more about the rule here.