From at least February 2017 through the present, Merrill Lynch failed to establish and maintain a supervisory system designed to achieve compliance with its best execution obligations for certain retail equities orders.

Overview:

"From at least February 2017 through the present, Merrill failed to establish and maintain a supervisory system, including written supervisory procedures, reasonably designed to achieve compliance with its best execution obligations for certain retail equities orders"

FACTS AND VIOLATIVE CONDUCT:

- Merrill failed to reasonably supervise the execution timeliness of customer orders.

"EOS allows external investment managers to transmit files that can contain up to thousands of orders at a time"

By omitting from its supervisory reviews the electronic order systems’ order handling time from order receipt to the route time to a market center, Merrill failed to reasonably supervise whether it made every effort to execute marketable customer orders that it received fully and promptly.

- Merrill failed to reasonably supervise the accuracy of memoranda for electronic

orders.

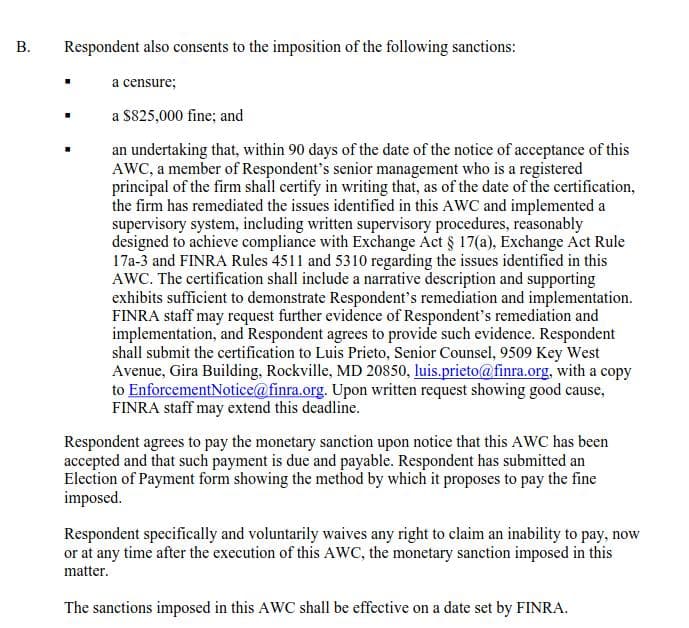

Punishment?

TLDRS:

- From at least February 2017 through the present, Merrill Lynch failed to establish and maintain a supervisory system designed to achieve compliance with its best execution obligations for certain retail equities orders.

- Due to Merrill's failure to supervise the order handling time properly, there may have been delays in the execution of retail marketable orders.

- This means that orders placed to buy or sell GameStop could have taken longer to execute than they should have.

- These delays could result in orders being executed at less favorable prices.

- In a volatile stock like GameStop, even small delays during times of volatility can lead to significant price differences, potentially affecting your trading results.

- Punishment? Without admitting to the findings, a $825k fine, and censure.