From December 2015-present, Merrill and, since 2019, BofA, failed to have a supervisory system reasonably designed to detect and prevent potentially manipulative trading by the firm's customers.

Merrill/BofA/BAML did not have a supervisory system or written procedures in place that were sufficiently designed to detect potentially manipulative trading activities, such as wash trading and prearranged trading.

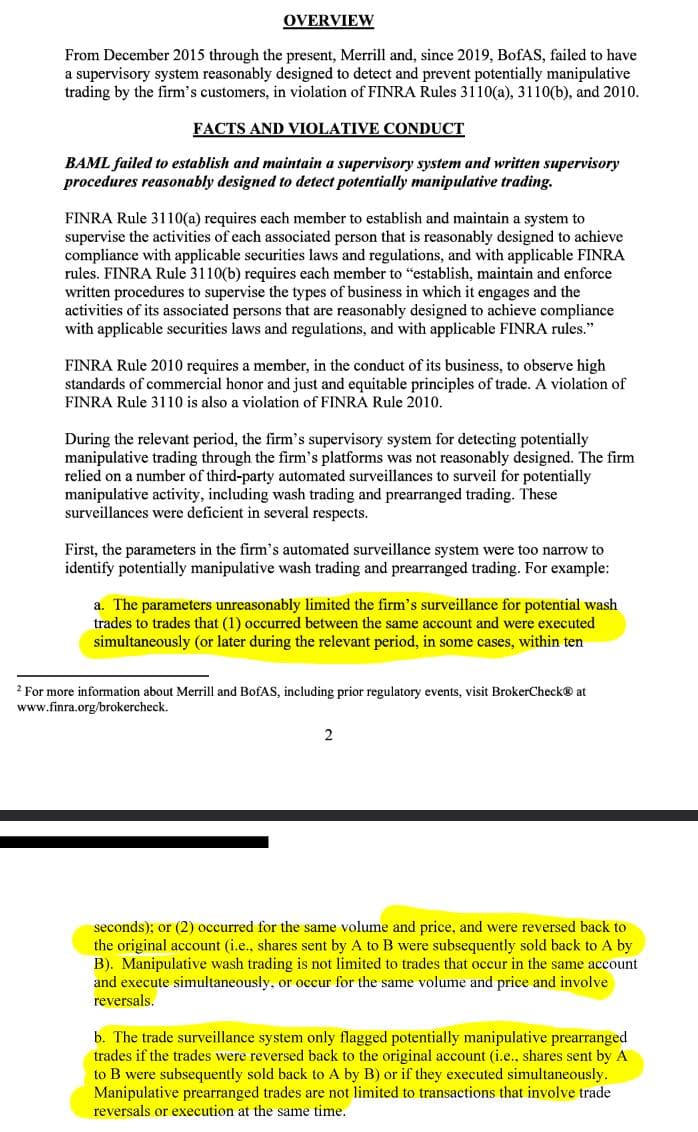

The automated surveillance systems used by Merrill/BofA/BAML had narrow parameters that failed to capture all forms of potentially manipulative trading. The surveillance systems were inadequate in detecting manipulative activities that did not meet specific criteria like simultaneous execution or exact trade reversals.

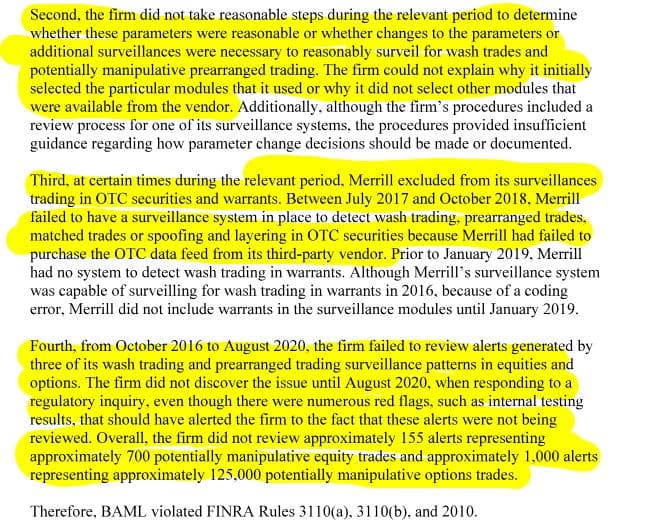

Merrill/BofA/BAML did not take appropriate steps to review or update the parameters of its surveillance systems. There was a lack of guidance on how to make or document changes to these parameters.

During certain periods, Merrill/BofA/BAML’s surveillance system did not include trading in OTC securities and warrants due to the absence of data feeds and coding errors, respectively.

From October 2016 to August 2020, Merrill/BofA/BAML failed to review numerous alerts indicating potentially manipulative trades. This oversight included about 155 alerts related to approximately 700 potentially manipulative equity trades and 1,000 alerts related to ~125,000 potentially manipulative options trades, which collectively represented thousands of potentially manipulative trades.

Manipulative practices such as wash trading (where traders buy and sell the same stock to create a misleading impression of activity) or prearranged trading (where trades are planned in advance to give a false appearance of trading volume) would distort the market value of GameStop and this manipulation could explain some of the extreme price volatility we have seen.

Penalty?:

TLDRS:

- Merrill/BofA/BAML lacked an adequate supervisory system and written procedures to detect potentially manipulative trading activities, such as wash trading and prearranged trading.

- The automated surveillance systems used by Merrill/BofA/BAML had narrow parameters, failing to detect all forms of potentially manipulative trading, especially those involving simultaneous execution or exact trade reversals.

- The firm did not properly review or update the surveillance system parameters and lacked guidance on how to make or document these changes.

- During certain periods, Merrill/BofA/BAML’s surveillance systems did not monitor trading in OTC securities and warrants due to missing data feeds and coding errors.

- Between October 2016 and August 2020, Merrill/BofA/BAML failed to review numerous alerts for potentially manipulative trades, including about 155 alerts for ~700 equity trades and 1,000 alerts for ~125,000 options trades, representing thousands of potentially manipulative trades.

- Penalty?

- A censure and $3 million fine.

- Manipulative trading practices like wash trading and prearranged trading distort market values, potentially explaining some of the extreme price volatility we have observed in GameStop.

From December 2015-present, Merrill and, since 2019, BofA, failed to have a supervisory system reasonably designed to detect and prevent potentially manipulative trading by the firm's customers. Penalty? Censure and a $3 million fine.

by u/Dismal-Jellyfish in Superstonk

From December 2015-present, Merrill and, since 2019, BofA, failed to have a supervisory system reasonably designed to detect and prevent potentially manipulative trading by the firm's customers.https://t.co/SyuBmoZWDs

— dismal-jellyfish (@DismalJellyfish) August 28, 2024