CME/FICC Cross Margining Enhancements Implementation effective 1/22/24. In 2020, CME exposures were large—likely in excess of $100bn notional. Savings with Enhanced Cross-Margining estimated at ~80% to protect the clearinghouses...

Background for this post:

- https://www.cftc.gov/media/9591/gmac_FICC_CME110623/download

- https://www.dtcc.com/-/media/Files/Downloads/legal/rule-filings/2023/FICC/SR-FICC-2023-010.pdf

- https://www.dtcc.com/~/media/Files/Downloads/legal/rules/ficc_cme_crossmargin_agreement.pdf

- https://www.dtcc.com/news/2023/july/18/cme-group-and-dtcc-to-increase-cross-margining-opportunities-for-the-treasury-markets

- https://www.cmegroup.com/media-room/press-releases/2023/9/12/cme_group_and_dtccreceiveregulatoryapprovalforenhancedtreasurycr.html

- https://www.sec.gov/files/rules/sro/ficc/2023/34-98327.pdf

- https://som.yale.edu/blog/cross-margining-and-financial-stability

- https://www.cfr.org/blog/revisiting-ides-march-part-ii-going-gets-weird

- https://www.cmegroup.com/trading/interest-rates/cleared-otc/faq-cme-ficc-cross-margining-arrangement-expansion.html

- https://www.cmegroup.com/trading/interest-rates/files/ficc-cme-cross-margining-deck-sept-2023.pdf

Background on FICC and Cross-Margining:

- FICC is a central counterparty (“CCP”), which means it interposes itself as the buyer to every seller and seller to every buyer for the financial transactions it clears.

- FICC operates two divisions: the Government Securities Division (“GSD”) and the Mortgage-Backed Securities Division (“MBSD”).

- GSD provides trade comparison, netting, risk management, settlement, and central counterparty services for the U.S. Government securities market.

- As such, FICC is exposed to the risk that one or more of its members may fail to make a payment or to deliver securities.

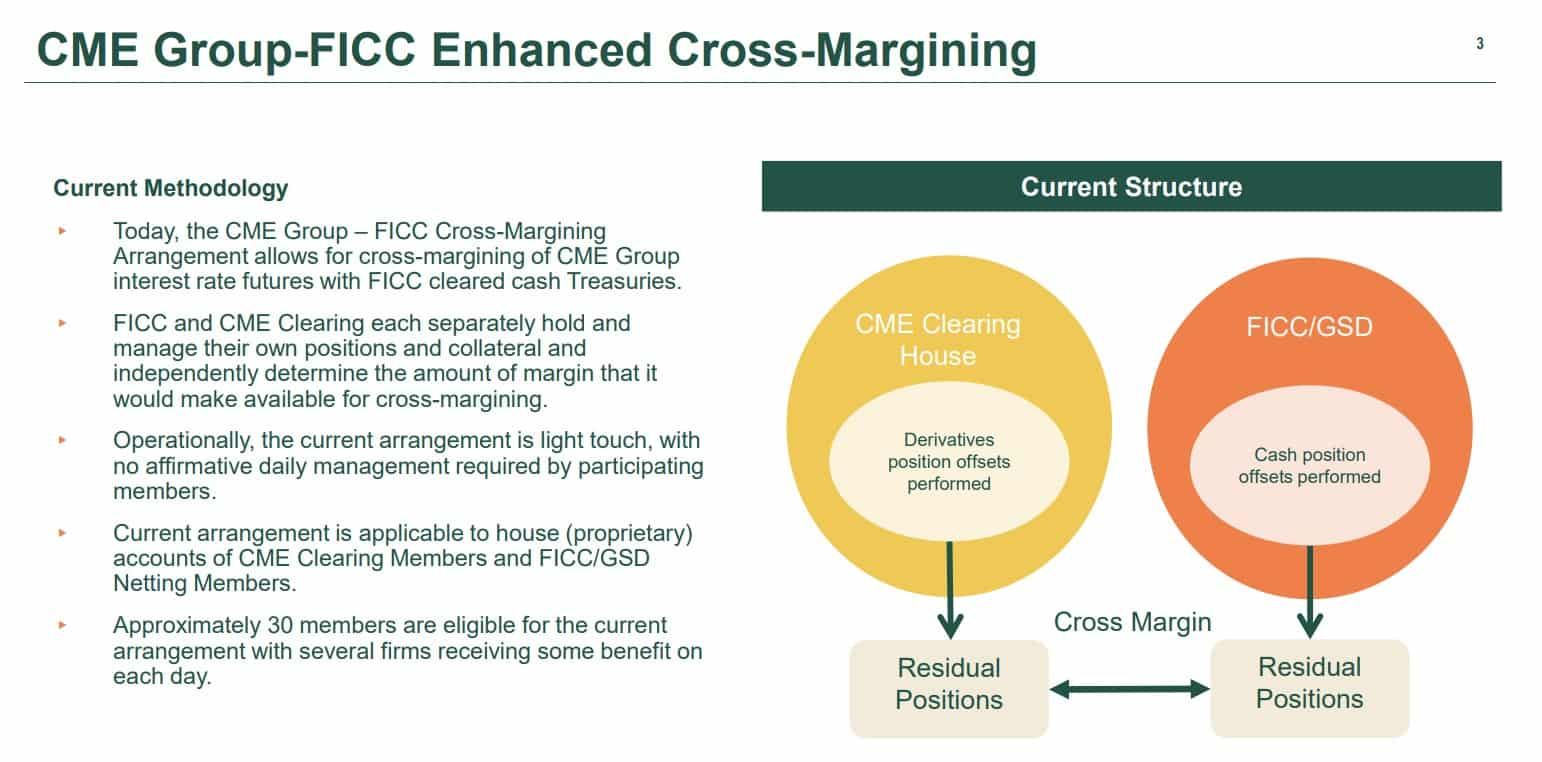

- To recognize potential offsets in the risk presented by related products, FICC has an ongoing cross-margining arrangement with CME, which acts as a CCP for futures related to the debt instruments that FICC clears.

- The cross-margining arrangement is governed by a contract (the “Existing Agreement”) that, among other things, defines the methodology by which FICC and CME determine offsets between cleared products that could reduce the margin requirement of an FICC member.

- FICC and CME have negotiated a new agreement (What is going into effect 1/22/24) that FICC has adopted to govern the cross-margining arrangement between FICC and CME.

Key aspects of the Restated Agreement are:

- Member participation: Participation in the cross-margining arrangement would continue to be voluntary and the criteria for participation under the Restated Agreement would remain the same as it is under the Existing Agreement.

- Eligible products: Additional CME products become eligible under the Restated Agreement, allowing for greater potential margin offsets including CME Group SOFR futures, Ultra 10-Year U.S. Treasury Note futures and Ultra U.S. Treasury Bond futures. FICC-cleared U.S. Treasury notes and bonds and Repo transactions that have a time to maturity greater than one year will also be eligible.

- FICC-Cleared U.S. Treasury Notes and Bonds that have a time to maturity greater than one year, resulting from a buy/sell or repo/reverse repo transaction, will be eligible for the new arrangement.

- Other Treasury securities, including When Issued securities prior to settlement date and TIPS, may be considered for inclusion in the program in a later phase.

- FICC-Cleared U.S. Treasury Notes and Bonds that have a time to maturity greater than one year, resulting from a buy/sell or repo/reverse repo transaction, will be eligible for the new arrangement.

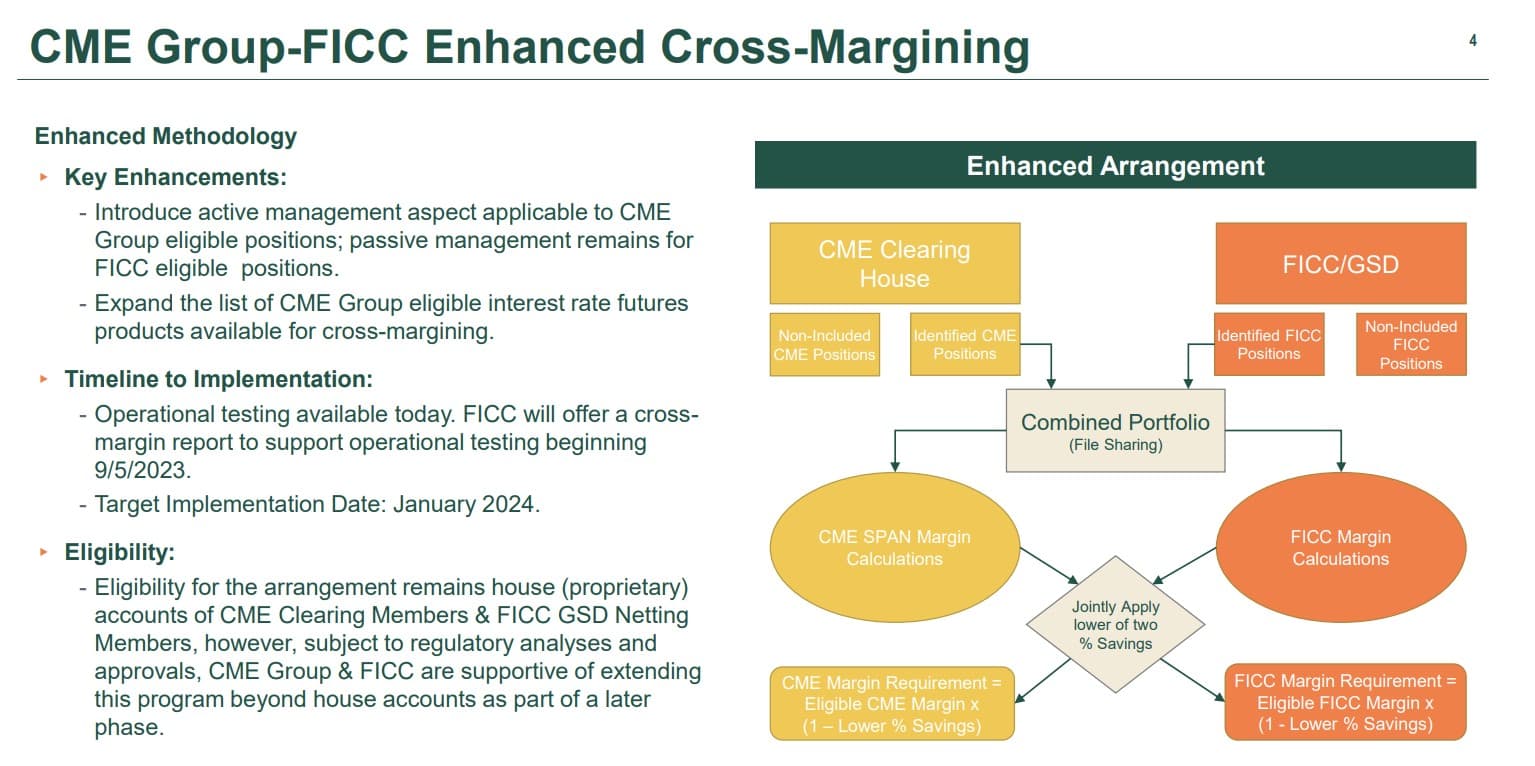

- Calculation of margin and margin reductions: The Restated Agreement, simplifies the overall margin calculation process by eliminating the need for application of offset classes of securities and conversion of CME Eligible Products into equivalent GSD Treasury security products.

- As a result, FICC believes, based on portfolio specific construction and market conditions, that these changes should generate margin savings in excess of those under the Existing Agreement.

- For example, based on a study comparing margin savings generated under the Existing Agreement and under the proposed Restated Agreement over the December 1, 2021 to November 30, 2022 period, margin savings went from a range of 0.1% to 17.4% under the Existing Agreement, to a range of 0% to 36.6% under the proposed Restated Agreement.

- As a result, FICC believes, based on portfolio specific construction and market conditions, that these changes should generate margin savings in excess of those under the Existing Agreement.

- Default management: Under the Existing Agreement, there is no express language requiring the Parties to attempt to conduct a joint liquidation. Whereas the Restated Agreement makes clear that a joint liquidation is the preferred means of liquidation of cross-margining positions in the event of a member default.

- A joint liquidation is optimal because it maximizes the efficiency and effectiveness of the liquidation process by enabling each Clearing Organization to recognize reduced risk by offsetting risk positions together.

- The Restated Agreement also provides for the possible exchange of variation margin during the course of a joint liquidation.

- The exchange of variation margin during the course of a joint liquidation would be an improvement because instead of using other liquidity resources, it would enable a Party that has a mark-to-market loss arising out of cross-margining positions to use the variation margin gains on offsetting cross-margining positions held by the other Clearing Organization.

- The Existing Agreement has no such provisions and they would be added to improve the efficiency of the default management process.

- The new methodology is also less complex than the current methodology.

- FICC will calculate the margin reduction from cross-margining based on the combined portfolio of eligible products of a common member (i.e., both the products cleared at FICC and the related products cleared at CME) with a VaR methodology.

- The new methodology calculates portfolio margin reductions based on correlations at the security level.

- FICC and CME will separately calculate the potential margin reduction resulting from offsetting positions in a common member’s portfolio using their respective margin methodologies and agree to reduce the member’s margin requirement by the more conservative amount (i.e., the smaller reduction).

- Conversely, the current methodology involves a series of steps to allow FICC and CME to separately consider offsets for their respective products.

- These steps include the conversion of products into other products to facilitate comparison of a common member’s Treasury and futures contracts (e.g., FICC would convert CME products into equivalent FICC products).

- The current methodology also requires FICC and CME to group products by maturity into “Offset Classes” to facilitate the calculation of a member’s margin reduction.

- As noted above, the current process is complex and produces less accurate offsets that could negatively affect FICC’s ability to cover the exposures presented by its members.

- FICC is strengthening its default management coordination with CME and simplifying the sharing of losses arising out of a common member default.

- The Restated Agreement provides three potential default management paths and would favor joint action by FICC and CME as a first, best option.

- In contrast, the Existing Agreement merely seeks to align the time at which the CCPs liquidate a common member’s positions.

- With regard to loss sharing, the Restated Agreement provides for a relatively simple division of gains and losses and will align cashflows through the exchange of variation margin, which is not contemplated by the Existing Agreement.

Look who got into netting services:

Why do we care about all of this?

According to Joshua Younger:

Margin is set to offset counterparty risk in levered transactions. In most cases, there are two such requirements: first, variation margin (VM), in which collateral is posted by the party taking losses to protect the unrealized gains of the other, and second, initial or maintenance margin (IM), which provides additional protection (overcollateralization) against the practical uncertainties of dealing with defaults and liquidations. They are generally set either by centralized clearing counterparties (CCPs), where applicable (e.g., the listed futures market and most OTC swaps), or are negotiated on a bilateral basis (e.g., repurchase agreements and swaps not subject to mandatory clearing). Maintenance margin, in particular, is often a key driver of overall leverage capacity in the financial system, particularly in futures and other derivatives markets. It is also inherently pro-cyclical: when volatility is elevated, so too are the risks associated with the sale of collateral to cover liquidated positions, leading to commensurately higher maintenance margin requirements. This can drive further increases in volatility as levered investors sell assets to raise the cash to meet these margin calls—a potentially vicious cycle.

Due to practical and legal constraints, margin requirements are mostly set by the CCPs on the basis of their own risk rather than the economic exposure of market participants. As a result, portfolios that are preferentially long one type of instrument—for example, Treasury securities—and hedged with another—short futures on the same—will have to be treated as separate, outright exposures. That means that when volatility picks up, even if the portfolio is nearly perfectly hedged and exhibits virtually no change in value, the aggregate margin required to maintain those positions can increase dramatically. If for any reason those calls cannot be met on any component of the portfolio, they can be subject to forced sales and liquidation.

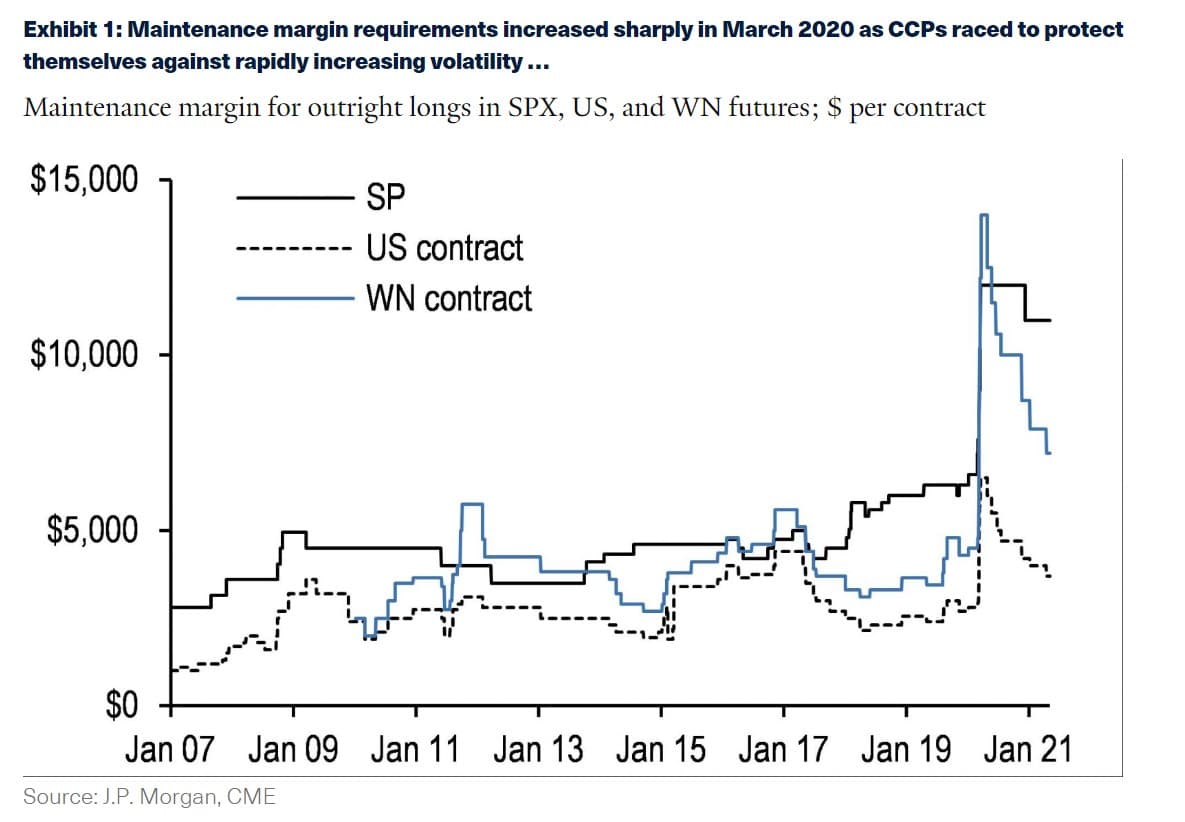

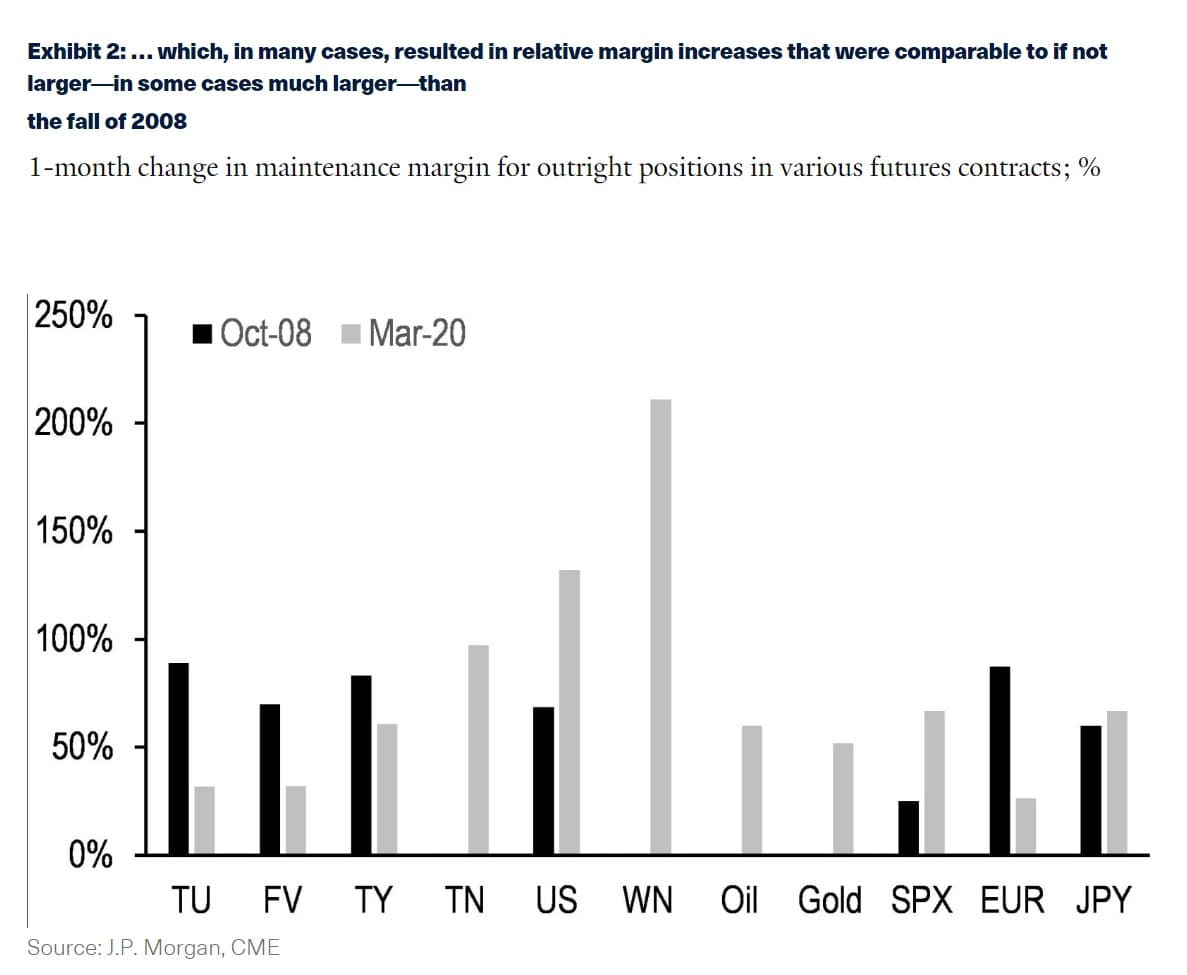

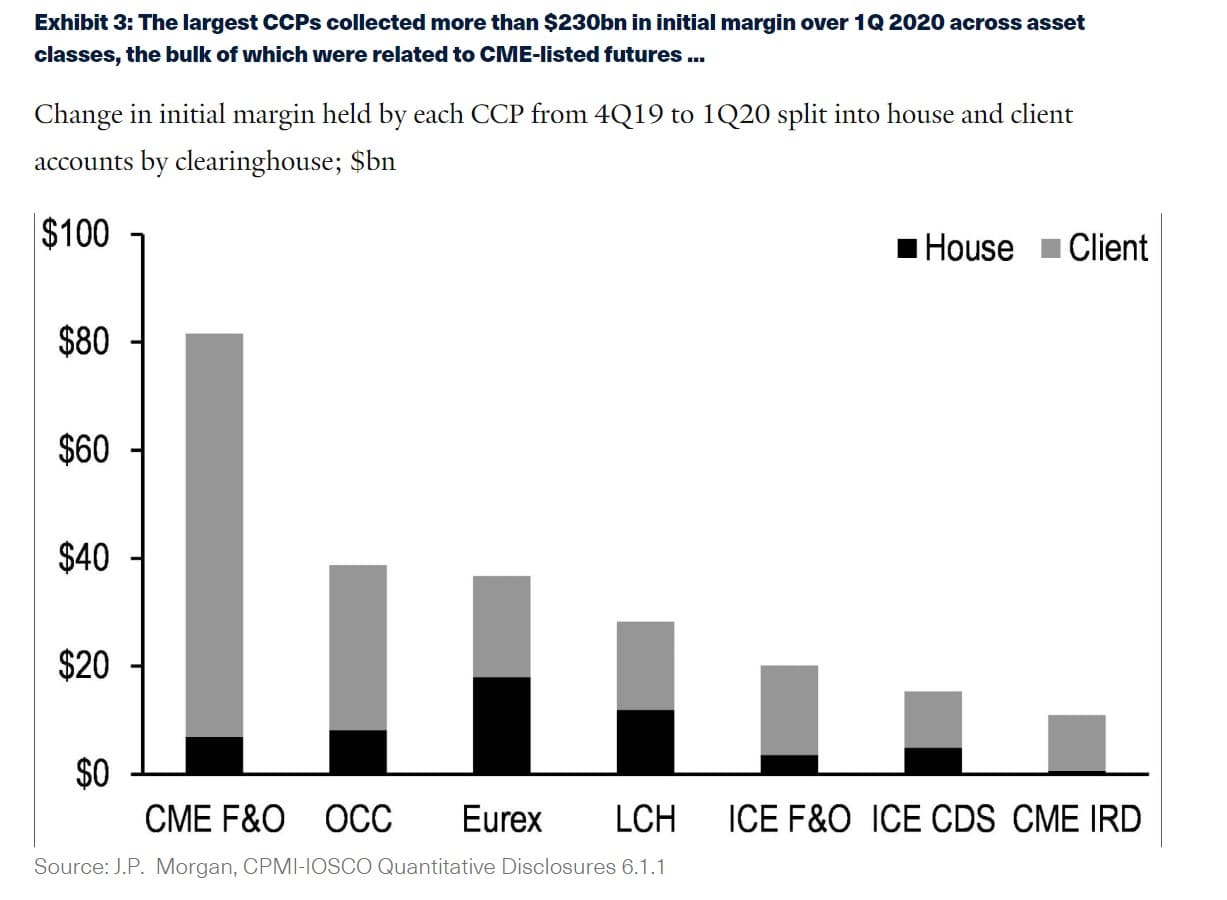

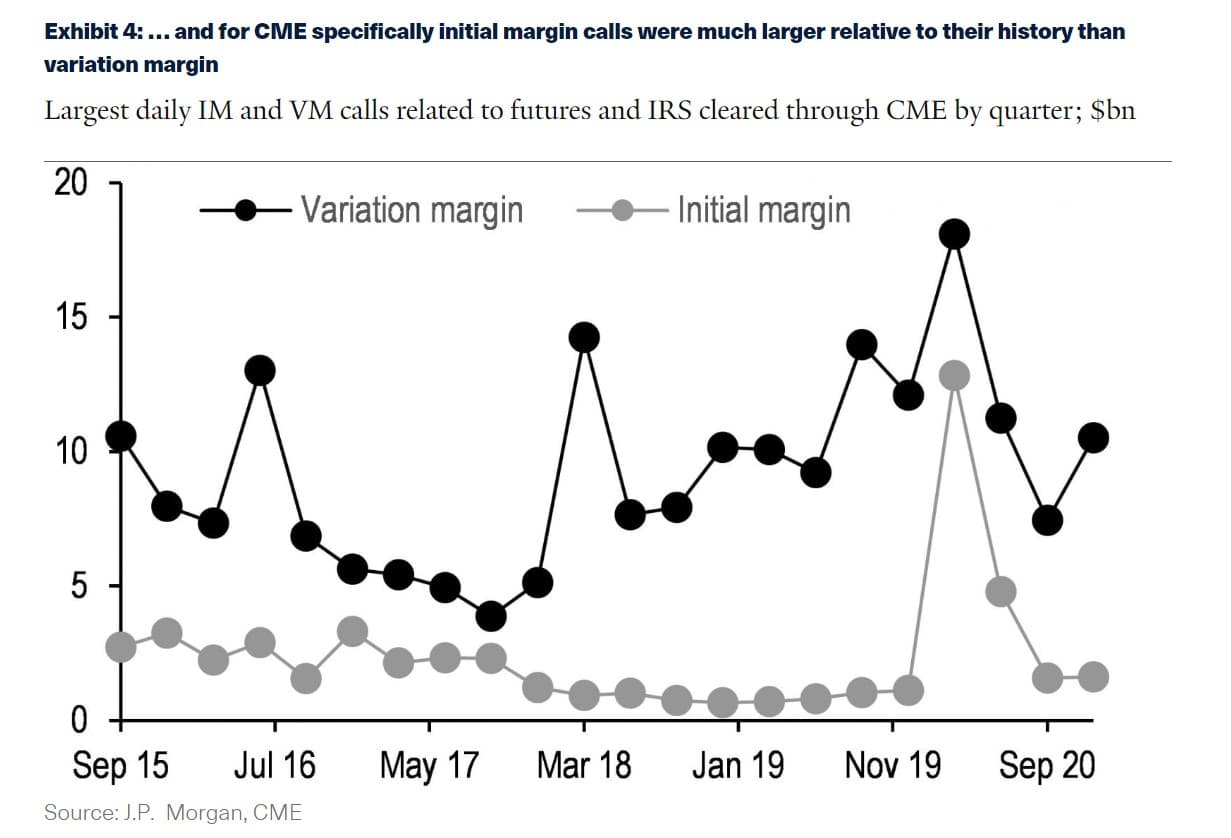

With the possible exception of 2008, at no time was this risk greater than in the spring of 2020. The spike in volatility led to significant margin calls across global markets. Though more realistic portfolios are more complicated; for example, the maintenance margin on various futures contracts increased substantially over this period—in many cases by a much larger amount than was true around peak of volatility in 2008 (Exhibit 1 & 2). We can see the impact most clearly in cash deposited at the Fed by financial market utilities, which includes the most systemically important CCPs, and increased sharply—more than $200bn over two weeks in March 2020, the largest such monthly collection since data became available. More granular disclosure[2] shows a more than $230bn IM call across major U.S. and European CCPs, but the bulk came from futures and options cleared through the CME. Their disclosure also shows that maintenance margin requirements, rather than variation margin, drove these calls[3], suggesting that the primary driver was increased risk aversion among CCPs rather than rapidly accumulated losses on existing positions (Exhibit 3 & 4).

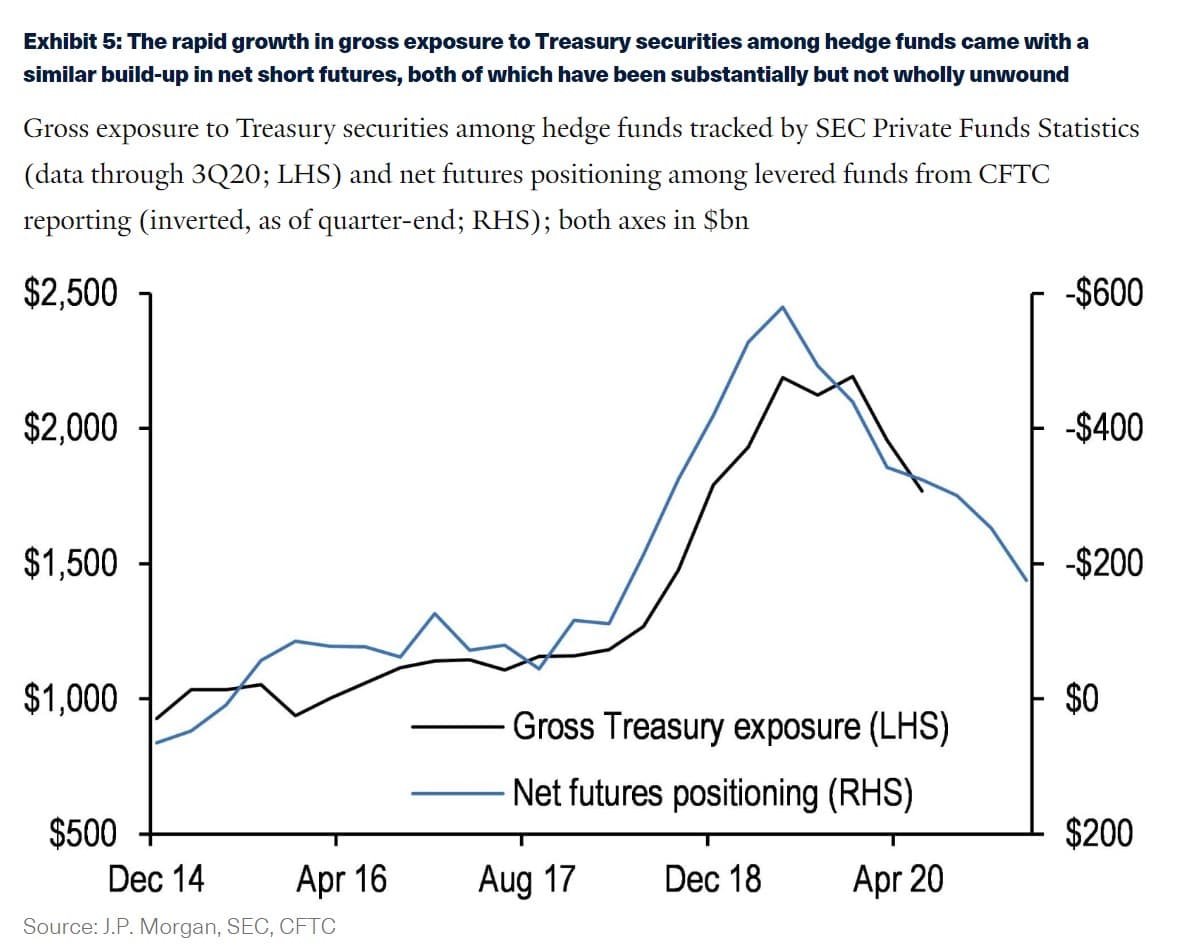

Highly levered positions, mostly held by hedge funds and other more speculative market participants, constituted a kind of shadow dealer network for Treasury securities. How they took on this role has been examined in detail elsewhere but is reflected in the sheer quantity of Treasury collateral locked in the hedge fund complex: more than $2.2tn of 4Q 2020, nearly doubling over just a couple of years and associated with a similar build-up of a large net short in Treasury futures (Exhibit 5). As a general matter, this looks quite a bit like a traditional market maker portfolio, in which inventories of off-the-run securities are hedged with a mix of shorts in futures and more liquid current issues. Though SEC data on cash exposures is only updated through 3Q 2020 owing to reporting lags, it shows initial evidence of a rapid reduction in this position, which futures data suggest has continued but is not yet wholly unwound. In that sense, shadow dealing likely remains a key component of Treasury market structure.

What is the solution? We are all arguably better served by margin requirements sized to the market risk of participants, rather than the individual exposures of each CCP[4]. So-called cross-margining involves setting up the information technology and legal infrastructure to allow loss sharing between two (or more) CCPs in the event of a default or liquidation. Doing so generally leads to lower maintenance requirements on well-hedged positions like cash/futures basis trades. It would also allow minimums to be set more conservatively relative to market risk, making it much less likely that they would have to be raised quickly in the event of a volatility shock like last March and April. Reducing the risk of liquidity shocks triggered by liquidations of otherwise well-hedged and low-risk positions is at the core of good macro-prudential policymaking.

That is not to say broadly available cross-margining of cash and futures positions in Treasury securities would have prevented the market dysfunction of March 2020, nor would it necessarily do so in the future. Other reforms can and should be implemented, in our view. But this is arguably low-hanging fruit. Not only have such arrangements been implemented in the past, but the CME and Depository Trust Clearing Corporation (DTCC)—which clears a significant fraction of Treasury securities owned via repurchase agreements—have a preexisting relationship and are already looking into ways to expand its reach. Legal and logistical hurdles definitely remain[5]. And of course it becomes substantially more effective if paired with a clearing mandate for the Treasury market, as some have proposed. But the process of implementing reforms to improve the stability of the Treasury market under stress, expanding cross-margining and reducing the risk of pro-cyclical margin calls is likely an attractive plank.

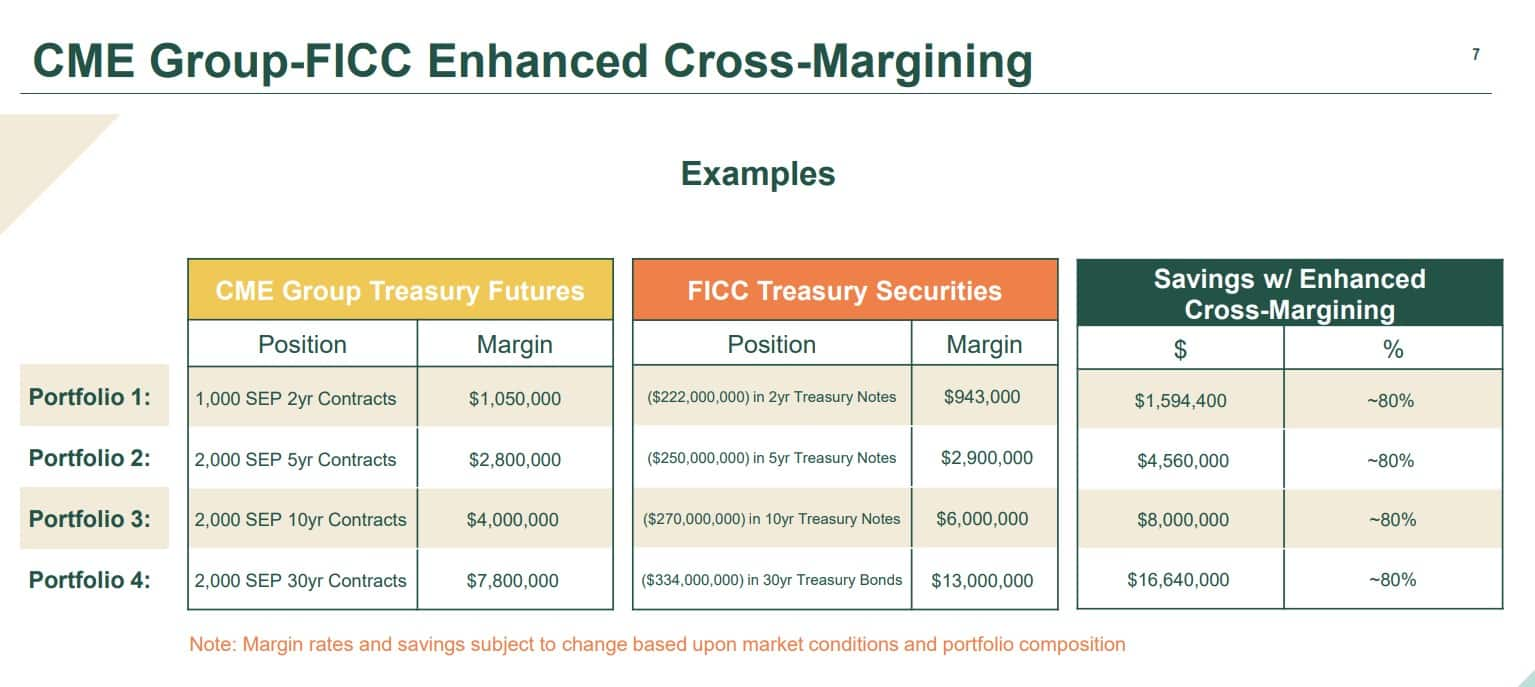

The results show a significant savings—often more than 70%. This would, of course, allow for more leverage in the system, all else equal, which is not necessarily desirable.

Wut Mean?:

- Margin, comprising variation margin (VM) and initial or maintenance margin (IM), is set to offset counterparty risk in leveraged transactions. VM protects unrealized gains, while IM provides overcollateralization against defaults and liquidations. Margins are set by clearing counterparties (CCPs) or negotiated bilaterally.

- The spring of 2020 saw extreme volatility leading to significant margin calls across global markets, surpassing even the 2008 crisis in some respects. .

- This was largely driven by heightened risk aversion among CCPs, as evidenced by spikes in maintenance margin requirements.

- Highly leveraged positions in Treasury securities, mostly held by hedge funds, acted as a shadow dealer network. This led to a substantial amount of Treasury collateral being held by hedge funds and a corresponding increase in short positions in Treasury futures.

- Cross-margining, which allows loss sharing between CCPs, can reduce maintenance requirements on well-hedged positions and minimize rapid increases during volatility shocks.

- While cross-margining of cash and futures positions in Treasury securities wouldn't have entirely prevented the March 2020 market dysfunction, it could reduce the risk of liquidity shocks from pro-cyclical margin calls.

- Implementing cross-margining could result in significant savings and potentially allow for more leverage in the financial system, though increased leverage isn't necessarily desirable in all cases.

As we have covered above:

- Eligible products for the Restated Agreement for cross-margining are expanded to include additional CME Group products like SOFR futures and Ultra U.S. Treasury Note and Bond futures, as well as FICC-cleared U.S. Treasury notes, bonds, and Repo transactions with over one-year maturity.

- The Restated Agreement streamlines margin calculations by eliminating the need to apply offset classes and convert CME products into equivalent Treasury security products, leading to expected greater margin savings.

- Margin savings are projected to increase significantly under the Restated Agreement.

- A study comparing savings under both agreements showed an increase from 0.1%-17.4% (Existing Agreement) to 0%-36.6% (Restated Agreement).

- DTCC calls out it could be ~80%!

- Citadel Securities is eligible to participate--saving them margining and allows them to take on MORE leverage.

- The Restated Agreement emphasizes joint liquidation as the preferred method for liquidating cross-margining positions in case of a member default, improving efficiency and effectiveness by enabling risk position offsets.

- Margin reductions will be calculated using a VaR methodology based on the combined portfolio of eligible products, simplifying the process compared to the current methodology that involves converting products and grouping them into Offset Classes.

- The Restated Agreement enhances default management coordination between FICC and CME and simplifies loss sharing. It proposes three potential default management paths, favoring joint action as the primary option, and aligns cashflows through the exchange of variation margin.

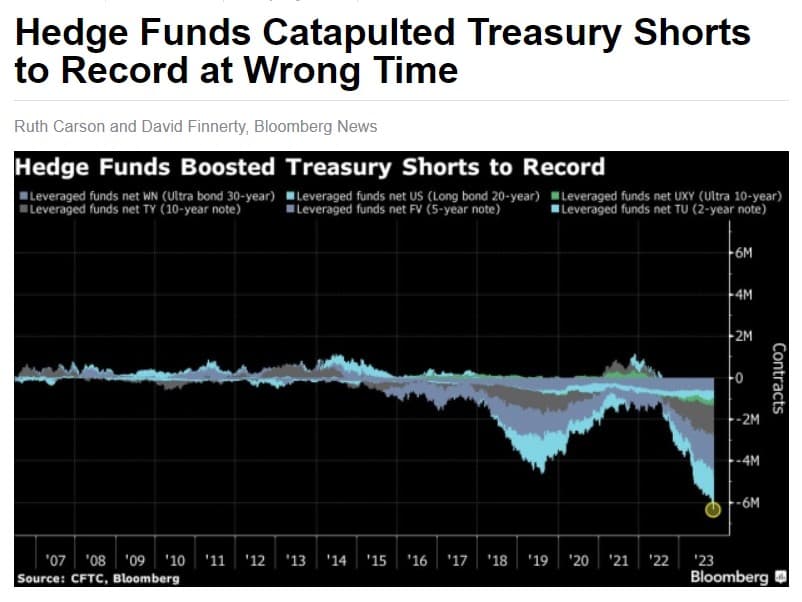

We talked about 2020 above but hedge funds have NOT stopped shoring treasuries:

Hedge funds extended short positions on Treasuries to a record just before smaller-than-expected US bond sales and weaker jobs data spurred a rally.

Leveraged funds ramped up net short Treasury futures positions to the most in data going back to 2006, according to an aggregate of the latest Commodity Futures Trading Commission figures as of Oct. 31. The bets persisted even though the cash bonds had rallied the week before.

“It feels like short US Treasuries positioning was at an extreme last week, which was an accident waiting to happen,” said Gareth Berry, strategist at Macquarie Group Ltd. in Singapore. “Price action in Treasuries for the past few months was a classic case of a persuasive story feeding the price action, until it went too far, leading to an overshoot which is now correcting.”

Yields on 10-year Treasuries have fallen more than 40 basis points since their 5.02% peak on Oct. 23, as traders for the $26 trillion bond market swung back to pricing the end of rate hikes. The combination of more benign US refunding needs, weaker-than-expected jobs data and signs of the Federal Reserve turning less hawkish may have spurred wide-spread covering of short positions.

Investors may also have taken short positions as part of the basis trade, a strategy that seeks to benefit from small pricing mismatch between futures and the underlying bonds for the contract. The trade often involves heavy borrowing, which can worsen market volatility when funds are forced to close positions in a hurry.

According to the latest CFTC data, asset managers extended their bullish positions in Treasury futures.

Read the QuickTake: What’s the Basis Trade? Why Does It Worry Regulators?

Traders are pricing in more than 100 basis points of cuts by the end of next year from an expected peak rate of 5.37%, swaps data show. They have brought forward their predictions for the first cut to June from July following the policy decision and payrolls data.

US officials signaling discomfort with higher yields “puts the brake on momentum-driven selling,” Citigroup Inc. strategists including Jabaz Mathai wrote in a note. “The combination of weaker data, dovish signals from Powell and a better-than-expected refunding outlook means that Treasuries are likely to continue rallying” into the new week.

Following Friday’s price action, open interest — or the amount of risk held — rose sharply across two- and five-year note futures consistent with new long positions as traders built-up expectations of Federal Reserve rate cuts for next year and beyond. Some small declines in positioning were also seen in 10-year note tenors, consistent with an element of short covering and giving a boost to Friday’s rally in Treasuries.

Buckle up!

TLDRS:

- The CME/FICC Cross Margining Enhancements are set to be implemented on 1/22/24, with the enhancements expected to significantly increase margin savings, potentially up to approximately 80%, thereby enhancing the protection of clearinghouses.

- The expanded list of eligible products for cross-margining under the Restated Agreement includes additional CME Group products like SOFR futures, Ultra U.S. Treasury Note and Bond futures, and FICC-cleared U.S. Treasury notes, bonds, and Repo transactions with over one-year maturity.

- The Restated Agreement simplifies margin calculations by eliminating the need for offset classes and product conversions, leading to greater margin savings, with projected increases from 0.1%-17.4% under the Existing Agreement to 0%-36.6% under the Restated Agreement.

- Citadel Securities, is eligible to participate in this arrangement, which allows them to save on margin requirements and allow for increased leverage.

- The Restated Agreement advocates for joint liquidation in the event of a member default, enabling more efficient and effective liquidation by allowing for the offsetting of risk positions.

- The agreement also improves default management coordination between FICC and CME, with simplified loss sharing and three potential default management paths, emphasizing joint action as the first choice.

- The stated objective of these enhancements is to reduce the risks associated with highly leveraged positions in Treasury securities and to mitigate rapid increases in margin requirements during volatility shocks, as seen in the spring of 2020.

- Implementing cross-margining could allow for more system leverage, though its increase is not universally seen as desirable.

- Hedge funds have NOT stopped shorting treasuries and have only increased their positions!