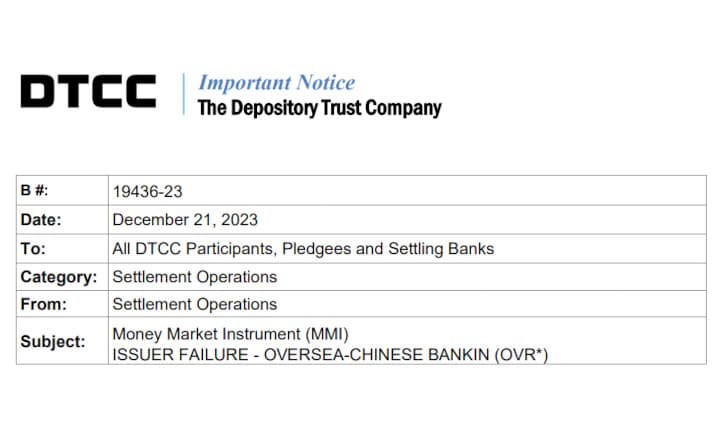

J.P. MORGAN SECURITIES LLC up to something by sponsoring Convexity Ltd as a Sponsored Member of the Government Securities Division?

The DTCC posted this new sponsored member posting today:

Who is Convexity?

So I did a company search on Convexity:

This is starting to feel like a Russian nesting doll...

Ok, why is J.P. MORGAN SECURITIES LLC backing this sponsored member when Mellon could?

As an aside, they appear to be under newish leadership:

Going to look those names up and see if they connect anywhere else in the story

How Does Sponsored Membership Work?

My understanding is in a typical bilateral repo, a cash borrower posts U.S. Treasuries to its dealer counterparty in exchange for cash. Similarly, cash investors seeking increased liquidity can lend cash in exchange for U.S. Treasuries via a reverse repo.

Since the transactions typically result in an increase in the dealer’s balance sheet, there is an increased capital requirement that drives the cost of repo higher, while also broadly reducing industry capacity.

For a sponsored member, my understanding is a cleared repo starts out like a bilateral repo trade with J.P. MORGAN SECURITIES LLC. However, after a trade has been agreed and settled between J.P. MORGAN SECURITIES LLC and Convexity Ltd, Convexity Ltd then “steps out” of the trade via a novation.

This means FICC replaces Convexity Ltd as the counterparty to the repo for the remainder of the transaction’s lifecycle.

Question: by replacing Convexity LTD for the transaction lifecycle, does that mean whatever they have borrowed of their $80 billion limit at the Reverse Repo is now on J.P. MORGAN SECURITIES LLC balance sheet? A way to get around the $80 billion limit if you will?