Hedgies R Fuk Alert! July was the 14th consecutive month of net outflows for the hedge fund industry. Investors removed an estimated net $5.6 billion from hedge funds in July.

TLDRS:

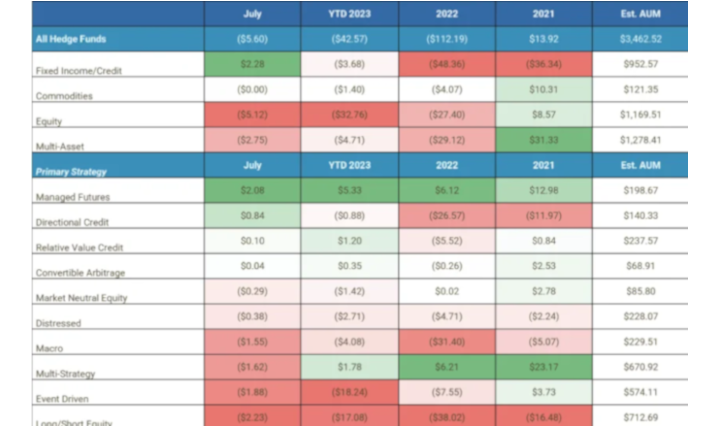

- July was the 14th consecutive month of net outflows for the hedge fund industry. Investors removed an estimated net $5.6 billion from hedge funds in July.

- June 2023 witnessed the 13th straight month of net outflows in the hedge fund industry, with an estimated net $13.12 billion taken out.

- May marked the 12th consecutive monthly net outflow for the hedge fund industry and was also the largest net outflow for the month of May since at least 2009.

- Investors removed an estimated net $9.96 billion from hedge funds in May.

- Investors pulled $11.57 billion out of hedge funds in April

- Investors removed an estimated net $3.32 billion from hedge funds in March.

- Investors removed an estimated net $4.83 billion from hedge funds in February.

- Investors removed an estimated net $4.18 billion from hedge funds in January.

- Investors removed an estimated net $111 billion from hedge funds in 2022.

- From 1/1/2022-7/31/23, Investors have removed $163.58 billion from hedge funds.

- Hedgies r fuk!

Source: https://www.evestment.com/news/hedge-fund-industry-asset-flow-report-july-2023/

Highlights:

- July marked the 14th consecutive monthly net outflow for the hedge fund industry.

- Investors removed an estimated net $5.6 billion from hedge funds in July

- From 1/1/2022-7/31/23, Investors have removed $163.58 billion from hedge funds.

Performance accounted for an increase in assets.

- The result of both factors was a $26.3 billion increase in assets to an estimated $3.463 trillion.

- "It is notable that while directional and relative value credit funds have seen interest, distressed managers saw net outflows for a second consecutive month in July."

REMINDER:

https://www.reddit.com/r/Superstonk/comments/12eba61/treasury_alert_janet_yellens_remarks_ring_al