Inflation Alert! You have got to be kidding me! Governor Christopher J. Waller: As for what inflation does next, I think anyone who makes a forecast has to own the fact that very few of us foresaw how much inflation would increase in 2021.

On Inflation

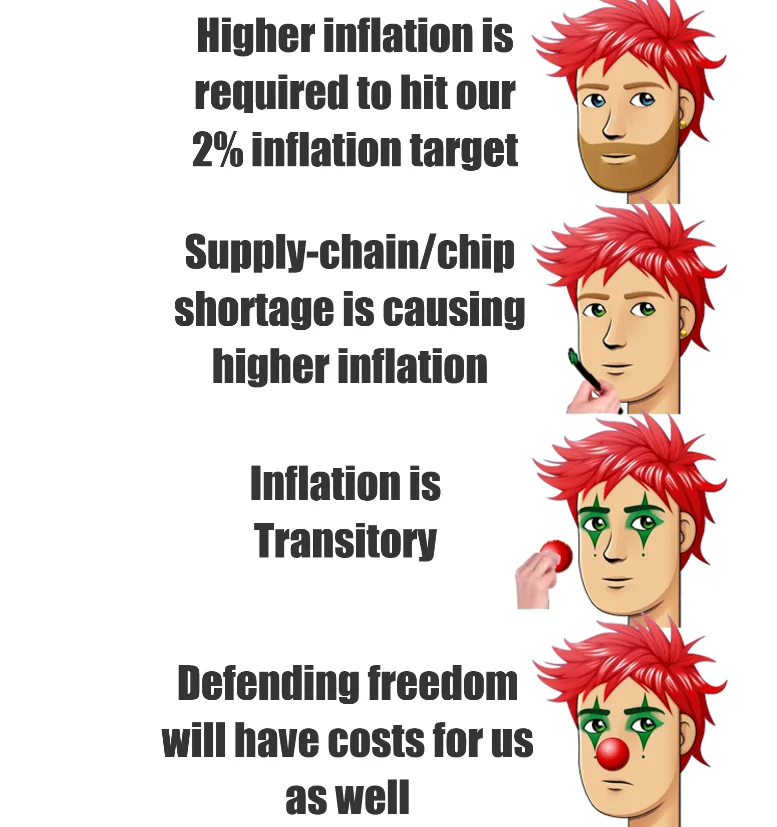

As for what inflation does next, I think anyone who makes a forecast has to own the fact that very few of us foresaw how much inflation would increase in 2021.

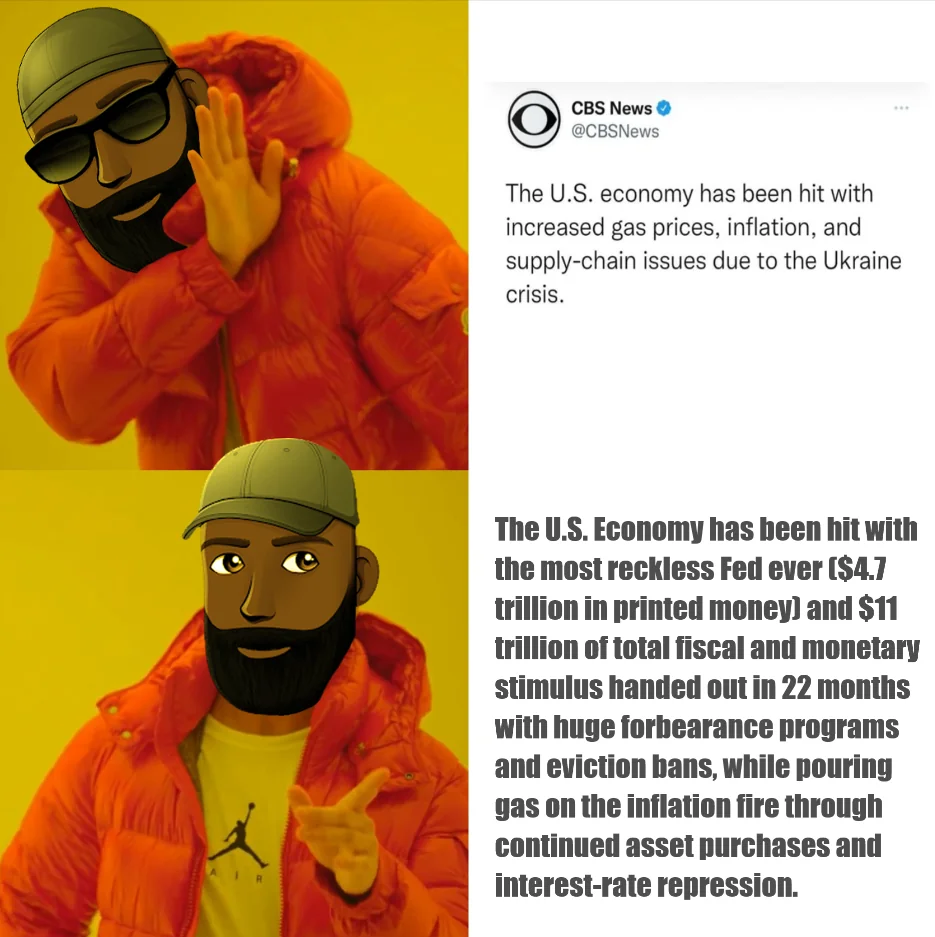

We underestimated the extent to which supply constraints—from bottlenecks to labor supply shortages—and strong demand would drive up inflation, and we thought bottlenecks and shortages would begin to resolve sooner than now. I think we have a clearer idea today of the effect of those factors on inflation but going forward we need see how geopolitical effects influence energy, commodity, and other prices. With some humility, while I am alarmed about the level of inflation and a bit uncertain about how the near-term may play out, I am hopeful that these factors and their price effects are likely to ease in the second half of 2022 and that with appropriate monetary policy, inflation will be coming down significantly by year end.

I will be watching closely the data on supply pressures and how those feed into total consumer prices, and I'll be monitoring carefully to see whether expectations rise out of a range that would suggest they are becoming unanchored. As I said earlier, it is too soon to know how Russia's attack on Ukraine will affect the U.S. economy, and it may not be much easier by the time of our March meeting.

Excuse Me?!?!?!?!!?

- https://www.reddit.com/r/Superstonk/comments/szel2p/inflation_alert_the_russiaukraine_conflict_is/

- https://www.reddit.com/r/Superstonk/comments/stby6f/inflation_alert_kansas_city_federal_reserve/

- https://www.reddit.com/r/Superstonk/comments/sqjevu/inflation_alert_with_the_median_asking_rent_for_1/

- https://www.reddit.com/r/Superstonk/comments/sq5780/inflation_alert_a_deep_dive_into_the_bureau_of/

- https://www.reddit.com/r/Superstonk/comments/sfk73l/inflation_alert_bureau_of_economic_analysis/

- https://www.reddit.com/r/Superstonk/comments/rxjazc/inflation_alert_ftc_publishes_inflationadjusted/

- https://www.reddit.com/r/Superstonk/comments/qr7bk1/inflation_alert_come_take_a_dive_with_me_and_lets/

- https://www.reddit.com/r/Superstonk/comments/qqy18d/inflation_alert_inflation_in_the_producer/

- https://www.reddit.com/r/Superstonk/comments/qiluwe/inflation_alert_the_bureau_of_economic_analysis/

- https://www.reddit.com/r/Superstonk/comments/q6zked/inflation_alert_short_and_mediumterm_inflation/

- https://www.reddit.com/r/Superstonk/comments/pcoam6/inflation_alert_in_the_speech_today_by_fed_chair/

- https://www.reddit.com/r/Superstonk/comments/pcmwrx/inflation_alert_bureau_of_economic_analysis_bea/

- https://www.reddit.com/r/Superstonk/comments/p2c4hc/inflation_alert_july_consumer_price_index_for_all/

- https://www.reddit.com/r/Superstonk/comments/oy8fku/inflation_alert_the_auto_industrystandard/

- https://www.reddit.com/r/Superstonk/comments/owub83/inflation_alert_a_dive_into_the_bureau_of/

- https://www.reddit.com/r/Superstonk/comments/otfj67/inflation_alert_fomc_update_rates_remain/

- https://www.reddit.com/r/Superstonk/comments/otazw6/inflation_alert_wildfires_continue_to_cause/

- https://www.reddit.com/r/Superstonk/comments/ot1e2h/inflation_alert_sp_corelogic_caseshiller_index/

- https://www.reddit.com/r/Superstonk/comments/oscgbg/extreme_weather_and_inflation_alert_associated/

- https://www.reddit.com/r/Superstonk/comments/os6hwi/inflation_alert_sales_of_new_singlefamily_houses/

- https://www.reddit.com/r/Superstonk/comments/ory9uz/inflation_and_data_alert_a_dive_into_week_28_rail/

- https://www.reddit.com/r/Superstonk/comments/oroshg/inflationgme_alert_airports_in_the_us_west/

- https://www.reddit.com/r/Superstonk/comments/ooy1ja/inflation_alert_back_in_june_the_fertilizer/

- https://www.reddit.com/r/Superstonk/comments/oox0o6/inflation_alert_in_an_advisory_today_norfolk/

- https://www.reddit.com/r/Superstonk/comments/ooublz/inflation_alert_a_dive_into_the_transcript_from/

- https://www.reddit.com/r/Superstonk/comments/ooihoz/inflation_alert_ux1pitviper1x_makes_a_taco_bell/

- https://www.reddit.com/r/Superstonk/comments/oof6yd/inflation_alert_noaa_is_predicting_another/

- https://www.reddit.com/r/Superstonk/comments/oof6yd/inflation_alert_noaa_is_predicting_another/

- https://www.reddit.com/r/Superstonk/comments/oo80ru/inflation_alert_on_yesterdays_earnings_call_for/

- https://www.reddit.com/r/Superstonk/comments/onftvx/inflation_alert_extreme_and_deadly_floods_close/

- https://www.reddit.com/r/Superstonk/comments/oma9w0/inflation_alert_union_pacific_extreme_weather/

- https://www.reddit.com/r/CryptoCurrency/comments/ol6p0r/inflation_alert_in_june_the_consumer_price_index/

- https://www.reddit.com/r/Superstonk/comments/okicjz/inflation_alert_bank_of_canada_and_bank_of_new/

- https://www.reddit.com/r/Superstonk/comments/ok8wzq/inflation_alert_cass_freight_index_grew_268_yy_in/

- https://www.reddit.com/r/Superstonk/comments/ok45ql/inflation_alert_a_dive_into_yesterdays_cpi_report/

- https://www.reddit.com/r/Superstonk/comments/ojem8k/inflation_alert_in_june_consumer_price_index_for/

- https://www.reddit.com/r/Superstonk/comments/oj1t7x/inflation_recap_a_deep_dive_with_the_jellyfish/

- https://www.reddit.com/r/Superstonk/comments/oix656/inflation_alert_the_june_2021_survey_of_consumer/

- https://www.reddit.com/r/Superstonk/comments/oiglhm/inflation_alert_st_louis_fed_lead_economist_in/

- https://www.reddit.com/r/Superstonk/comments/ohy4mi/inflation_alert_rent_prices_are_spiking_as/

- https://www.reddit.com/r/Superstonk/comments/ohw99t/inflation_alert_a_dive_into_the_drewry_supply/

- https://www.reddit.com/r/Superstonk/comments/ofe7s8/inflation_alert_by_request_of_uanonymousname_and/

- https://www.reddit.com/r/Superstonk/comments/of5kt0/inflation_alert_the_reserve_bank_of_australia/

- https://www.reddit.com/r/Superstonk/comments/oe6i3l/tldr_i_believe_inflation_is_the_match_that_has/

- https://www.reddit.com/r/Superstonk/comments/oagsnw/sp_corelogic_caseshiller_us_national_home_price/

- https://www.reddit.com/r/Superstonk/comments/o7r4zw/the_feds_favorite_inflation_measure_which_is_the/

- https://www.reddit.com/r/Superstonk/comments/o6zt01/a_dive_into_the_spring_2021_manhattan_retail/

- https://www.reddit.com/r/Superstonk/comments/o6soxw/part_ii_a_deep_dive_into_the_housing_data/

- https://www.reddit.com/r/Superstonk/comments/o6ie6p/a_deep_dive_into_the_housing_data_released/

- https://www.reddit.com/r/Superstonk/comments/nxxwqt/tldr_i_believe_inflation_is_the_match_that_has/

Again, excuse Me?!?!?!?!!? Here are 50 warnings from the data you guys put out the whole time!Other things of note from this speech:The Labor Market

Let's start with where the economy stands with respect to maximum employment. In December, I said that we were "closing in" on this objective.3 Since then, the labor market has continued to strengthen. I now believe we have achieved the FOMC's objective of maximum employment.

Appropriate Monetary Policy

Now let me spell out what my outlook implies for appropriate monetary policy over the course of 2022. Based on the inflation data in hand, I believe the Fed needs to act promptly to begin tightening monetary policy. As I said earlier, I believe that we have achieved our employment goal and that the labor market will keep improving, which means there should be no delay in responding to inflation that is significantly above our target.

The FOMC has already taken actions to end asset purchases in early March, and I believe that the recent inflation and jobs reports have made the case to begin raising the target range for the federal funds rate at our March FOMC meeting.

Based on my outlook, my preference is to increase the target range 100 basis points by the middle of this year. That is, I expect inflation to remain elevated and only show modest signs of deceleration over the next several months. As a result, I believe appropriate interest rate policy brings the target range up to 1 to 1.25 percent early in the summer. That would be a bit below where rates were at the outbreak of the pandemic, when inflation was considerably lower, and before we more than doubled the Fed's balance sheet, so I consider this a necessary and prudent start to tightening policy.

The pace of tightening will depend on the data. One possibility is that the target range is raised 25 basis points at each of our next four meetings. But if, for example, tomorrow's PCE inflation report for January, and jobs and CPI reports for February indicate that the economy is still running exceedingly hot, a strong case can be made for a 50-basis-point hike in March. In this state of the world, front-loading a 50-point hike would help convey the Committee's determination to address high inflation, about which there should be no question. Of course, it is possible that the state of the world will be different in the wake of the Ukraine attack, and that may mean that a more modest tightening is appropriate, but that remains to be seen.

With the economy at full employment and inflation far above target, we should signal that we are moving back to neutral at a fast pace based on the performance of the economy, and a 50-basis point hike would help do that. Consequently, should the data break against us in the coming weeks, we need to be prepared to hike the policy rate by 50-basis points.

Appropriate Balance Sheet Policy

Turning to balance sheet policy, as I noted, the Committee has decided to end asset purchases in early March. Initially, we will be keeping the size of the Fed's balance sheet constant by reinvesting the proceeds of maturing securities. The FOMC has not decided when to begin the reduction in the size of the balance sheet, but we issued a set of principles last month that makes it clear that changing the target range of the federal funds rate is our principal monetary policy tool, and that balance sheet reductions through the "runoff" from maturing securities would commence after rate hikes have begun.

In terms of the appropriate size of the caps, I believe they can be larger than last time for several reasons. First, we have a very large balance sheet—securities holdings have increased $4.5 trillion since the start of the pandemic and the balance sheet is nearly $9 trillion. So even with a hefty reduction in holdings over the next year, we will still have a balance sheet that will be more than sufficiently large enough to conduct monetary policy.

Second, the Fed's overnight reverse repurchase agreement facility, put in place to help conduct monetary policy, receives a large amount of deposits each day. The daily average take-up of $1.6 trillion so far in 2022 tells me that there is tremendous excess liquidity in financial markets. Large redemption caps will assist in removing this excess liquidity.One MORE Laugh:

Let me conclude by saying I hope my remarks today contribute to the Fed's effective and credible communications. One message you should take away is that the course of policy is not pre-set, and the course I favor will be determined by my interpretation of new data.