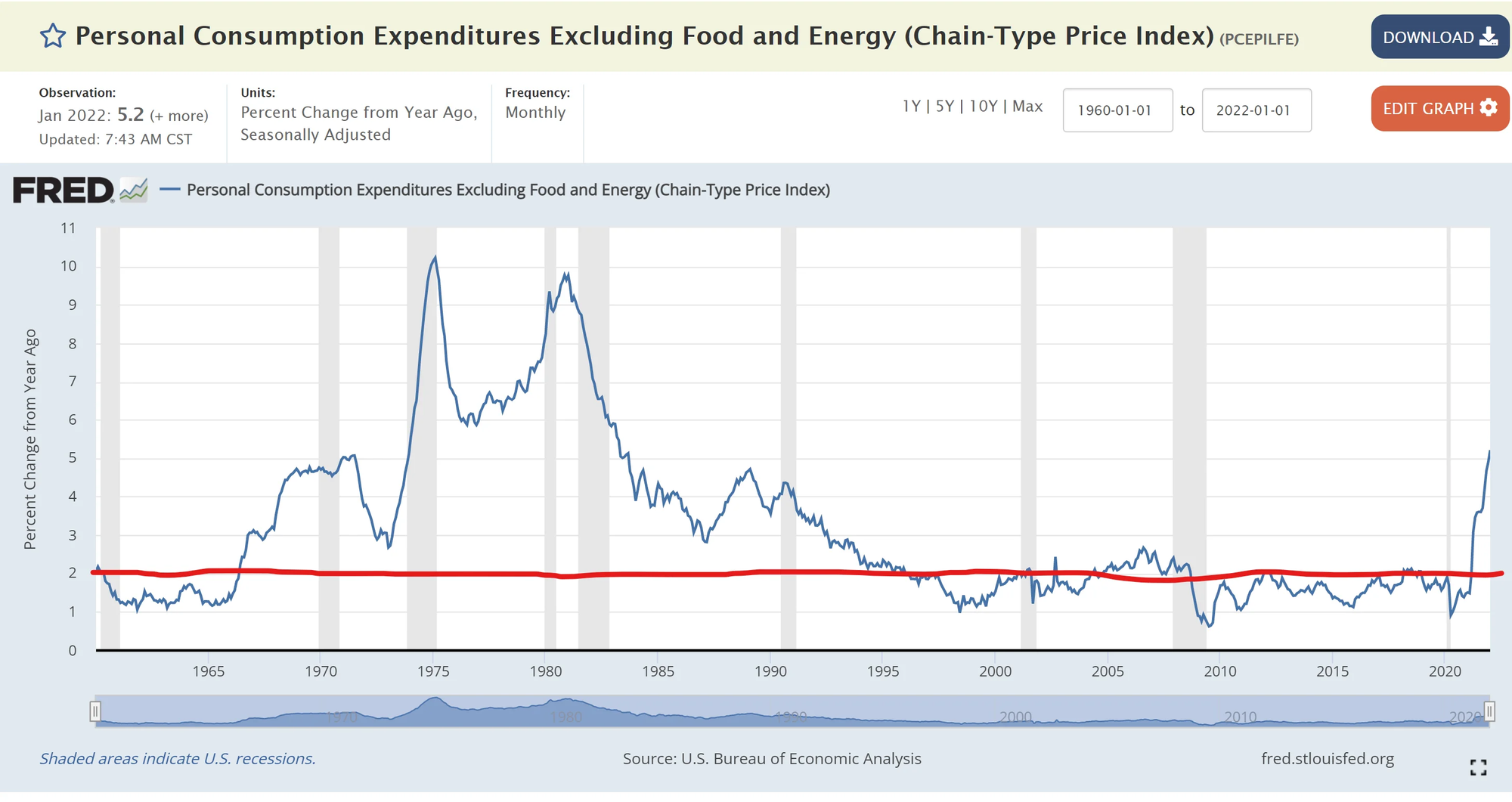

Inflation Alert! The Fed's favorite tool for measuring inflation “core PCE” price index, which excludes food and energy jumped another 0.5% in Jan from Dec, and 5.2% the last year the worst inflation spike since April 1983.

According to data today from the Bureau of Economic Analysis, the “core PCE” price index, which excludes food and energy, jumped another 0.5% in January from December, and by 5.2% year-over-year, the worst inflation spike since 1983.

Remember, JPow states the Fed's target is 2% inflation. They were only off by 260% last year, which brings me to my next point--how could they not see this coming?!?!?!?!?

Yesterday, I posted Federal Reserve Governor Christopher J. Waller stated in his speech about inflation:

As for what inflation does next, I think anyone who makes a forecast has to own the fact that very few of us foresaw how much inflation would increase in 2021.

At this point, I am reminded of Winston Churchill's correspondence with King George VI in February 1943 regarding disagreements with Charles De Gaulle: "'His 'insolence ... may be founded on stupidity rather than malice.'"

If this is on purpose or incompetence, both reasons for the actions taken to date are equally terrifying. If it is incompetence, where are the adults? If this is malice, what's next?

While our heartstrings are pulled with what is going on in Ukraine, this Fed is already talking about how this conflict is a reason to not raise rates as aggressively needed to actually make a dent on 7.5%+ CPI inflation:

The pace of tightening will depend on the data. One possibility is that the target range is raised 25 basis points at each of our next four meetings. But if, for example, tomorrow's PCE inflation report for January, and jobs and CPI reports for February indicate that the economy is still running exceedingly hot, a strong case can be made for a 50-basis-point hike in March. In this state of the world, front-loading a 50-point hike would help convey the Committee's determination to address high inflation, about which there should be no question. Of course, it is possible that the state of the world will be different in the wake of the Ukraine attack, and that may mean that a more modest tightening is appropriate, but that remains to be seen.

I guess they never let a crisis go to waste...

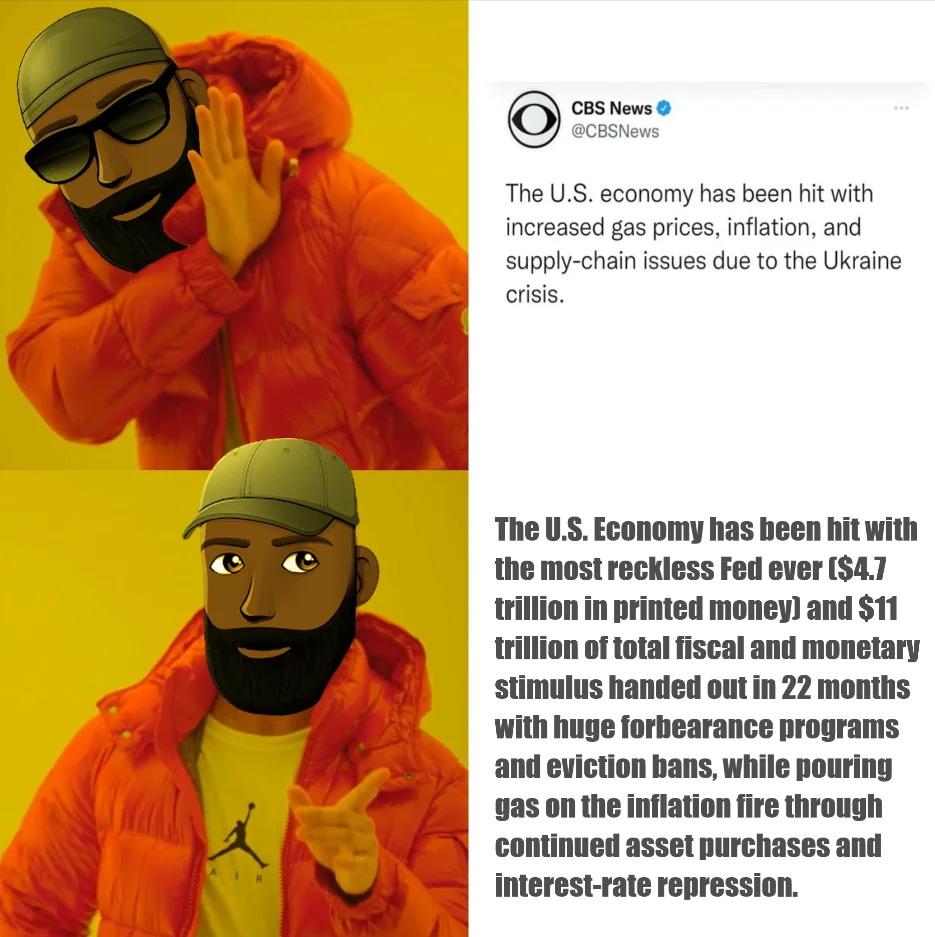

Well, inflation is blowing up as they have a full-blown liquidity crisis on their hands!

The Fed has backed themselves & the banks MMFs in a corner after letting the printer run brrrrr. High Reverse Repo Purchase usage signals that they don't have the balance sheets to accept the excess reserves.

Thus, they are forced to park them right back with the Fed using the Overnight Reverse Repo Purchase and 0.05% lending.

This has created a dangerous game of chicken in the market. Currently, the liquidity in the market is entirely artificial because of the aforementioned brrrrr. If the Fed lets up the slightest bit on the central-bank asset purchases (it has started tapering but keeps buying...), it could shut down the entire game. However, if JPow keeps letting the printer run, he risks hyperinflation.

It's turned into either no more liquidity for anyone or so much liquidity that the value of USD becomes near worthless and we see Weimar Republic levels of hyperinflation.

My understanding is for hyperinflation to rage, consumers must continue accepting higher prices and paying them.

I have been trying to pay attention to any data around this from the Census Bureau.

In January 2022, not-seasonally-adjusted retail sales dropped 18.5% from December to $581 billion. However, this drop is smaller than the past 11 Januarys, which averaged 20.4%.

Compared to January 2021 (eliminates holiday season skewing), retail sales jumped by 12.3%. In December, retail sales were up by 16.6% from the previous year.

Every month since March 2020, retail sales have increased by double digits.

These increases are huge and indicative to me that people aren't going to stop buying anytime soon, which is going to continue to add fuel to the raging inflation fire.

For GME, I believe the thought is that no liquidity means institutions will have to sell off other assets to increase their capital supply. This will continue until they can no longer increase their capital supply to meet margin requirements.

When/if institutions cannot meet their margin requirements (aka prove liquidity to be able to cover positions), DTCC will forcibly close all of their positions and MOASS takes flight

🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀🚀