Inflation Alert! Sales of new single-family houses in June plunged by 6.6% from May, and by 32% from the peak in January, to a seasonally adjusted annual rate of 676,000 houses, the lowest June since 2018, according to the Census Bureau this morning.

Median sales price $361,800, Avg. price $428,700

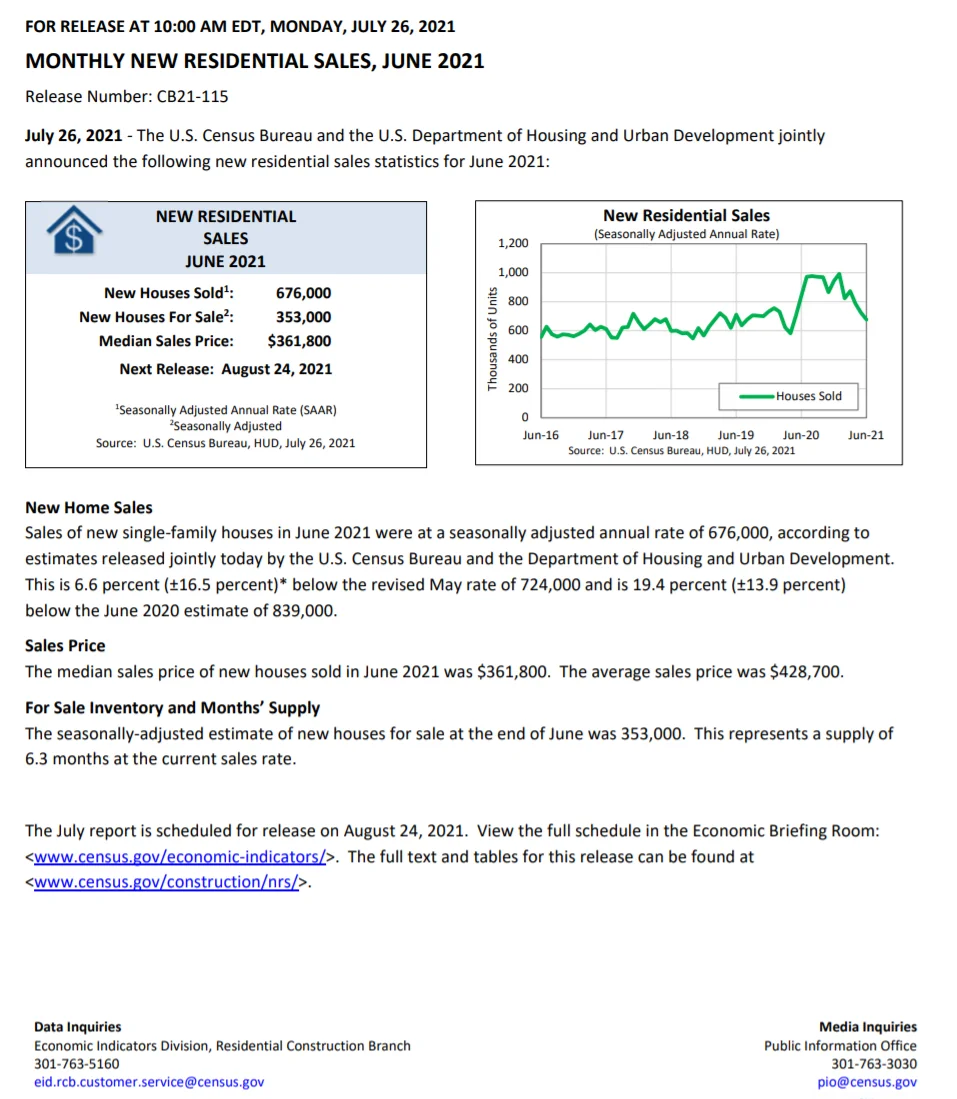

Sales of new single-family houses in June fell by 6.6% from May, and by 32% from the peak in January, to a seasonally adjusted annual rate of 676,000 houses, the lowest June since 2018, according to the Census Bureau today. This has brought new house sales back to pre-pandemic levels.

Supply jumped to 6.3 months at the current rate of sales, as unsold speculative inventory for sale jumped to 353,000 houses (seasonally adjusted), the most since December 2008

The median price dropped by 5.0% in June from May's $380,700 to $361,000, (lowest since March). In April, the median price was up 22% year-over-year; in May it was still up 20%; in June, it was up 6.1% year-over-year

Is the market starting to run out of steam?

So what is happening?

Almost nothing was sold in the under $200,000 price category (2% of sales in June). The under $300,000 price category accounted for only 29% of total new house sales (down from 39% June of last year).

That’s where all the buying had been occurring when everything was going gangbusters, but anyone looking for a new house under $300,000 is now priced out.

On the high end though, people with money are loving the Fed going brrr!

Houses with a price of over $500,000 accounted for 28% of total sales in June, up from a share of 23% in May, 15% in June 2020, and 14% in June 2019.

At the high end, big money is spending on new houses. If you can't spend more than 300k on a house? Enjoying renting for more than what a mortgage is.

This is what this new Fed-directed money-printing economy has turned into, inflated asset prices that has priced people out of homeownership!

I just wonder how long the high-end demand can prop up the housing market? Especially since it was the 'little guy' carrying the burden last year--numbers show they are now priced out.

Prices are all still jumping though!

The Construction Cost Index by the Commerce Department was also released today. It tracks construction-related costs of single-family houses under construction but excludes the cost of land and other non-construction costs.

In June the index rose by 0.7% from May. Over the past six months annualized, the index spiked by 13.8%. Year-over-year, the index spiked by 11.1%, the biggest year-over-year jump since May 1980!

https://www.census.gov/construction/nrs/pdf/price_uc.pdf

All of this happening in the backdrop of the Fed still plowing away with $120 billion in assets purchases each month:

$40 billion a month in mortgage-backed securities. This will continue to depress mortgage rates and only continues to add gasoline to the inflation fire.

$80 billion in Treasury securities a month (with policy rates near 0%): represses short-term and long-term interest rates in general, and inflates asset prices and consumer prices, which further DESTROYS the purchasing power of the dollar.

TL:DR The Dollar losing purchasing power + Inflation = Permanent Loss of purchasing power.

Unless one of the many other catalysts triggers the MOASS, I believe inflation is the match that has been lit that will light the fuse of the rocket.

Buckle Up.