Inflation Alert! Kansas City Federal Reserve President Esther George says removing stimulus should be systematic and that the Central Bank should weigh asset sales to curb inflation.

Good afternoon r/Superstonk. Before diving into Esther George's interview in the Wall Street Journal, I would like to begin by trying to describe what the Fed is currently trying to pull off with a motorcycle analogy:

In the prior crisis, the Fed slowed the motorcycle down by pumping the rear brake hard (tapering MBS security purchases), then when the bike was slow enough to bring to a complete stop, they worked the front, more sensitive and powerful front brake (rates).

In 08, because inflation was kept low (let's say this is rain on the pavement while riding), the surface was clear and the bike could stop 'ok' (super generalized many lost homes and life savings).

Now, it is raining hard (inflation rising faster for PCE annualized for any time since the 80's!), and the other riders the Fed is riding with are pumping their back brakes (cutting asset purchases) with most even grabbing the front brake and adjusting rates.

The Fed keeps riding like this is fine. In this scenario, all the riders need to stop at the same finish point. The other world banks are starting to slow while JPow and the Fed are Ricky Bobbying 'you ain't first your last' gunning it. In order to stop inflation, this is going to require slamming the front brake so hard while trying not to lock up the front wheel and go over the handlebars.

How the Fed thinks it can handle this:

Reality:

By my estimation, the best they can hope for is a controlled slide of a crash (better hope they are wearing gear, road rash sucks!).

So why bring up this analogy again? Well, Esther George said something similar (along with some other choice quotes) today:

“Whether you call it slamming on the brakes or racing to the finish line, it’s probably going to be reasonable given where the economy is and given how much accommodation is out there.”

“It is always preferable to go gradual, and I think given where we are, and the uncertainties around the pandemic effects and other things, I’d be hard-pressed to say, we have to get to neutral really fast. I think what is important to me is that’s our long-run aim and that we begin to systematically move in that direction.”

Beginning to deflect blame?:

“If you look at the transcripts for meetings going back to 2012 and 2013, you will see there was an explicit recognition that introducing quantitative easing was going to complicate monetary policy. So I don’t think we can avoid the complexity that has come with a decision to deploy this tool.”

Err, where was your voice on not to oversteer with JPow running the printer brrr? But now we need to show consideration to rate hikes and quantitative tightening?:

“What you don’t want to do is oversteer here. You are going to have to be thoughtful about the interaction of these two tools”

“I said in my speech that our policy is out of sync with where we are. I don’t think you can look at 7.5% inflation and a tight labor market and think that zero interest rates are the right calibration.”

Selling securities is on the table?:

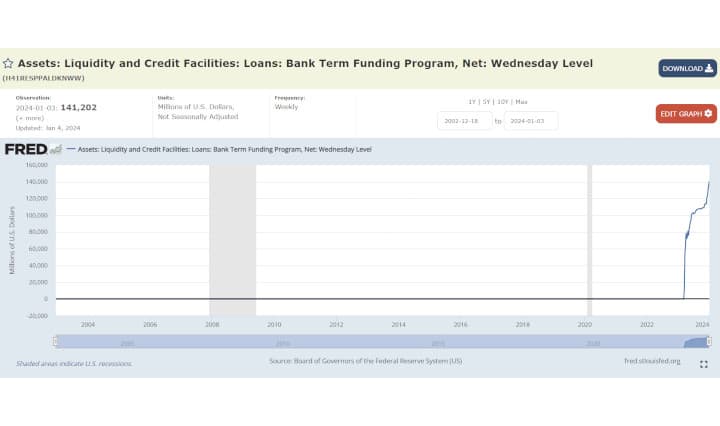

“With a $9-trillion balance sheet pushing down on long-term rates, we’re going to have to face some considerations: How much downward pressure, what implications for the yield curve, for risk, in terms of how that balance sheet affects the economy?”

Selling securities outright would:

- Allow long-term yields to rise (steepening the yield curve).

- Allow the Fed greater control in what comes off the balance sheet--like the glut of MBS.

But hey, they can continue to talk about taking action, it's not like people are getting hurt by this economy this Fed presides over, right?!?! oh wait...