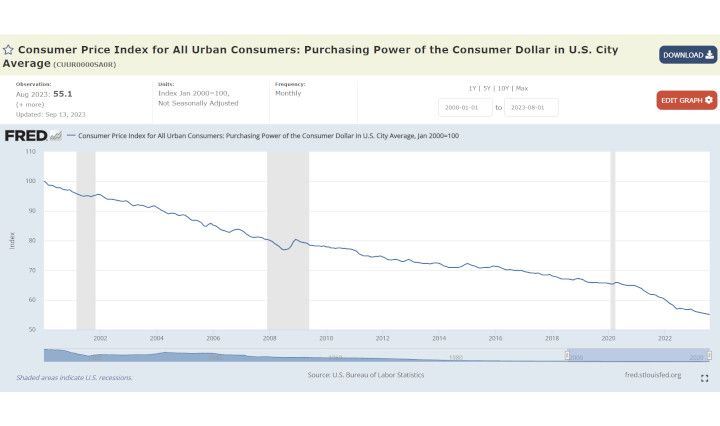

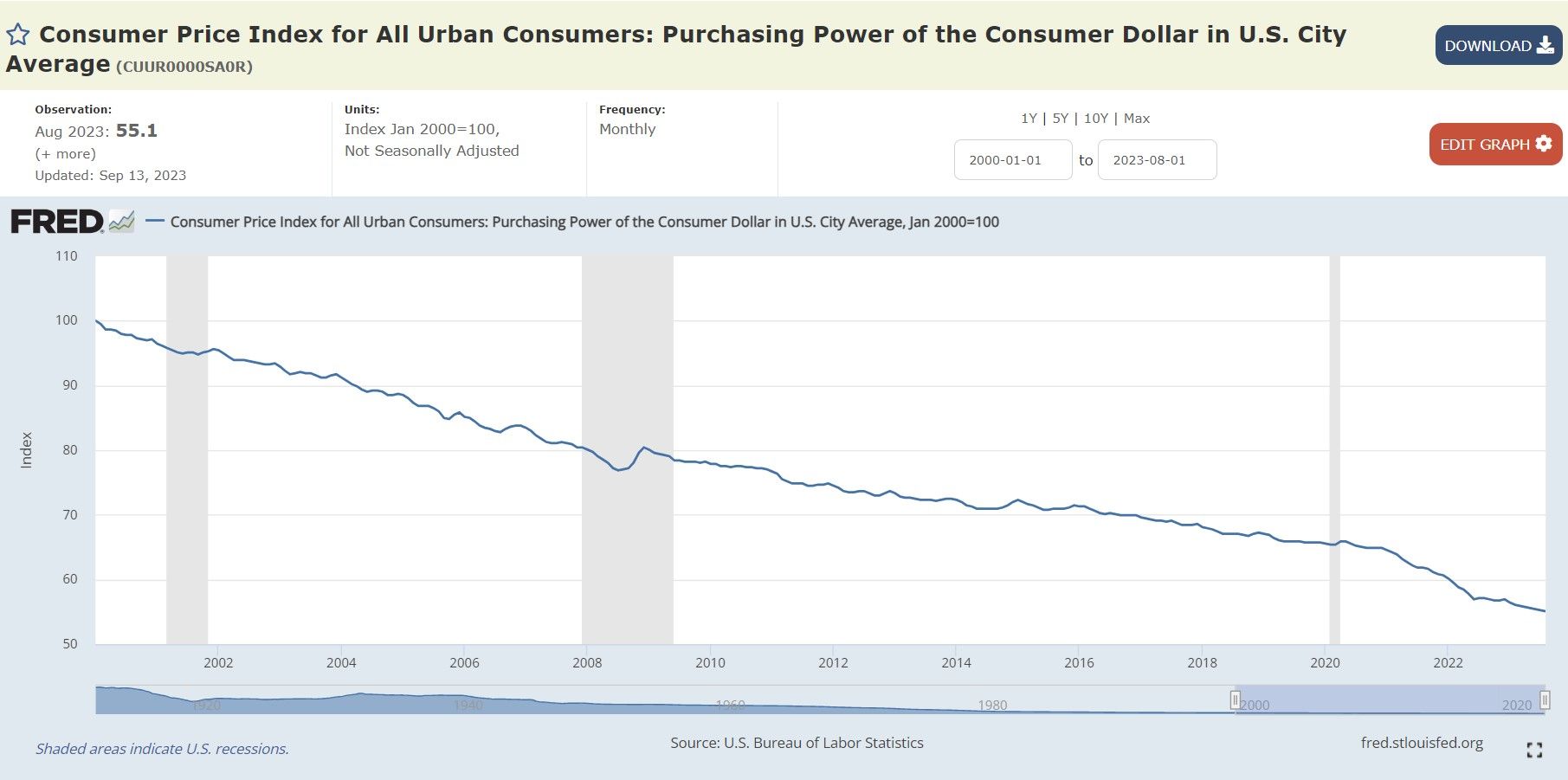

Inflation Alert! In August, the purchasing power of $100 in January 2000 dropped to $55.10 (-$.10 from July).

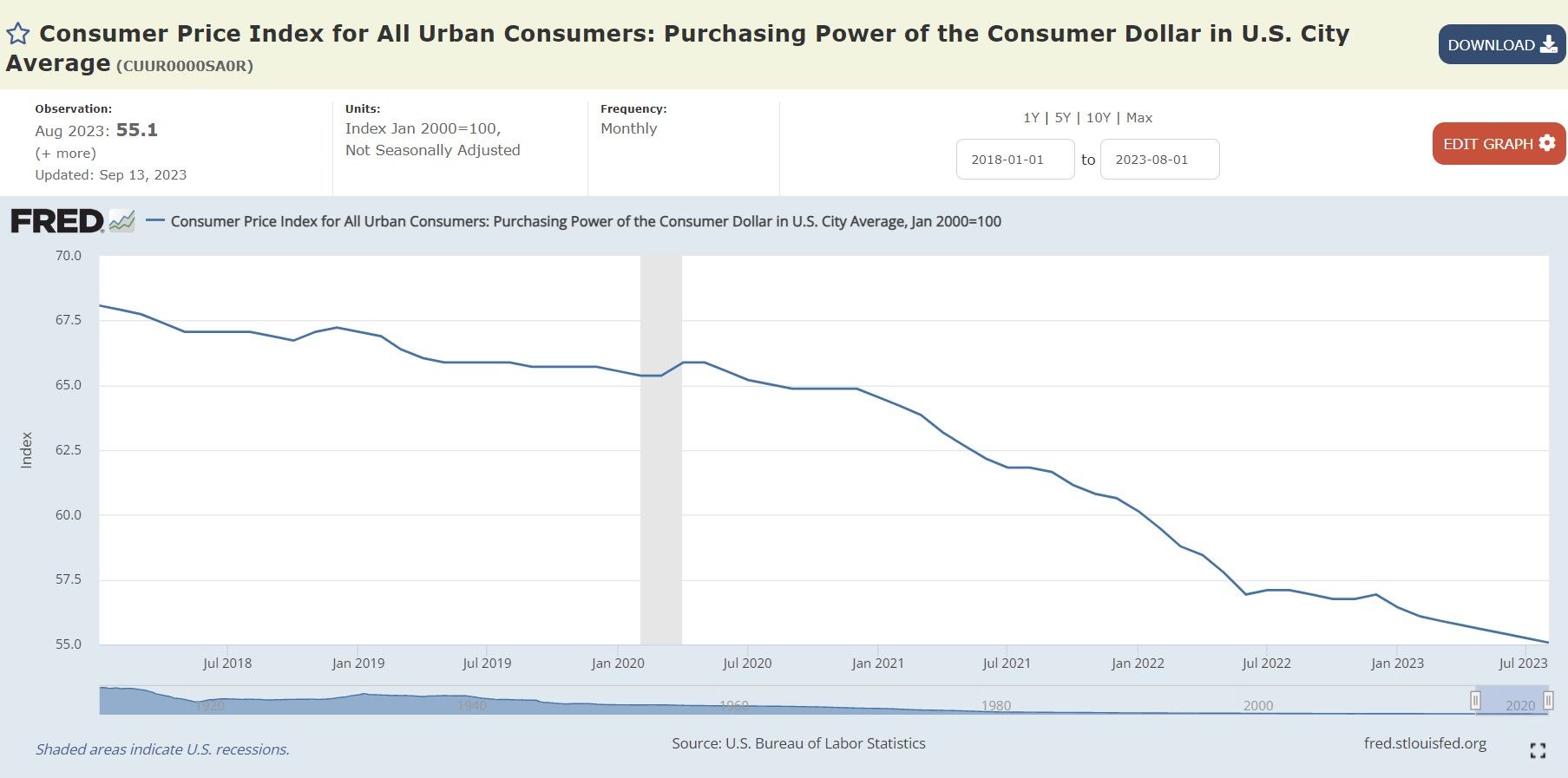

Zooming in:

CPI tracks the loss of the purchasing power of your dollars, and thereby the purchasing power of your hard earned labor!

- August 2022 purchasing power of $100 in January 2000: 57.1 (down -3.5% in purchasing power in the last year!)

- August 2021 purchasing power of $100 in January 2000: 61.8 (down -10.8%% in purchasing power in two years!)

- August 2020 purchasing power of $100 in January 2000: 65.0 (down -15.2% in purchasing power in three years!)

For those looking for proof CPI is understated:

When the loss of purchasing power is growing faster than the rate of inflation, it means that the real value or purchasing ability of money is decreasing at a pace that's greater than what the official inflation rate suggests.

- In August purchasing power declined -.18% month-to-month and -3.5% year-over-year.

- The Consumer Price Index for All Urban Consumers (CPI-U) rose 0.6 percent in August on a seasonally adjusted basis, after increasing 0.2 percent in July, the U.S. Bureau of Labor Statistics reported today. Over the last 12 months, the all items index increased 3.7 percent before seasonal adjustment.

What does this mean for household's well being?:

- In August purchasing power declined -.18% month-to-month and -3.5% year-over-year.

- The decline in purchasing power means consumers would be able to buy 3.5% less with the same amount of money compared to the previous year.

- The monthly decline of -0.18% indicates this loss on purchasing power is ongoing.

- Inflation: Rose by 0.6% month-to-month and 3.7% over the last 12 months.

- Goods and services, on average, have become 3.7% more expensive over the year.

- The 0.6% month-to-month increase shows inflation is STILL growing in a BIG way.

- Real average hourly earnings for all employees decreased 0.5 percent from July to August, seasonally adjusted

- Real average hourly earnings increased 0.5 percent, seasonally adjusted, from August 2022 to August 2023.

- Over the past year, the combined effect of reduced purchasing power (-3.5%) and increased inflation (3.7%) suggests that folks are 7.2% worse off in terms of the value their money can provide.

- With the wages rising by .5% year-over-year, it compensates for some of the loss in value from reduced purchasing power and inflation.

- Essentially, while the money's value in terms of what it can buy has decreased by 7.2%, folks are earning .5% more of it.

- So to bring this all together, on net, folks are 6.7% worse off in terms of real value over the past year (7.2% - .5% = 6.7%).

TLDRS:

- The Consumer Price Index (CPI) is a measure that helps us understand how the average price of a basket of goods and services has changed over time.

- August 2022 purchasing power of $100 in January 2000: 57.1 (down -3.5% in purchasing power in the last year!)

- August 2021 purchasing power of $100 in January 2000: 61.8 (down -10.8%% in purchasing power in two years!)

- August 2020 purchasing power of $100 in January 2000: 65.0 (down -15.2% in purchasing power in three years!)

- In other words, it's an indicator of inflation, or the increase in prices over time.

- When I say that the purchasing power of your dollars has decreased, I'm talking about how much less you can buy with the same amount of money due to rising prices.

- The purchasing power of your hard-earned labor is eroded by inflation!

- Folks are 6.7% worse off in terms of real value over the past year!

- Oh yeah, the FDIC noticed that some banks aren't correctly reporting the amount of deposits they have that aren't covered by federal insurance. Some banks mistakenly think that if a deposit is backed by assets (like collateral), it doesn't need to be reported as uninsured.

- This isn't right! The deposit's status doesn't change just because it has collateral.

- When banks incorrectly report uninsured deposits, it could create a perception in the market that these banks are more stable than they actually are.

- Banks that incorrectly report uninsured deposits might face liquidity challenges in extreme circumstances, where depositors simultaneously demand their funds.

- Reminder, while banks have the liquidity fairy, 'we' get the promise of 2 more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.