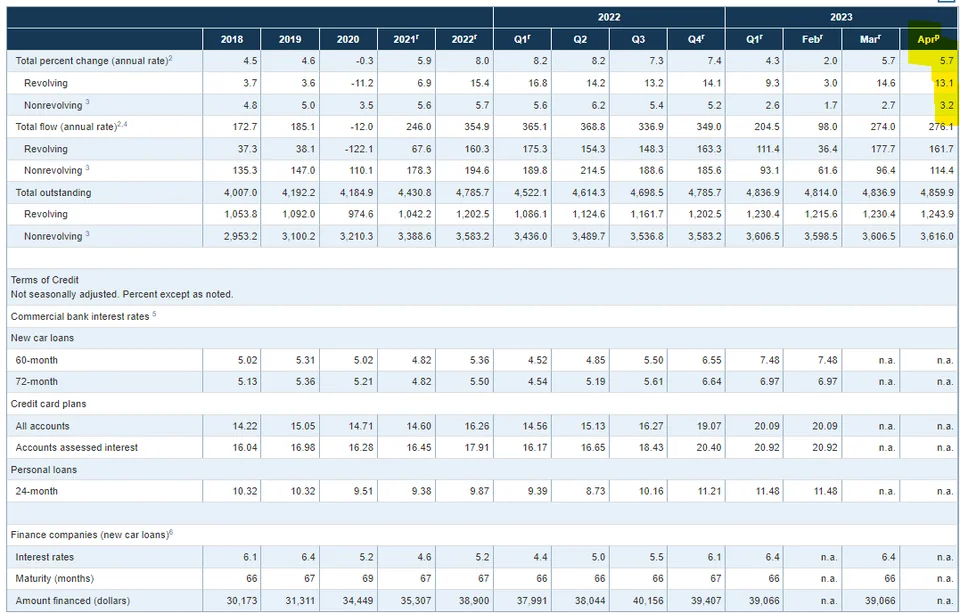

In April, consumer credit (AKA consumer DEBT) increased at a seasonally adjusted annual rate of 5.7%. Revolving credit (credit cards) increased at an annual rate of 13.1%

nonrevolving credit (student loans, personal loans, mortgages) increased at an annual rate of 3.2%.

Source: https://www.federalreserve.gov/releases/g19/current/g19.pdf

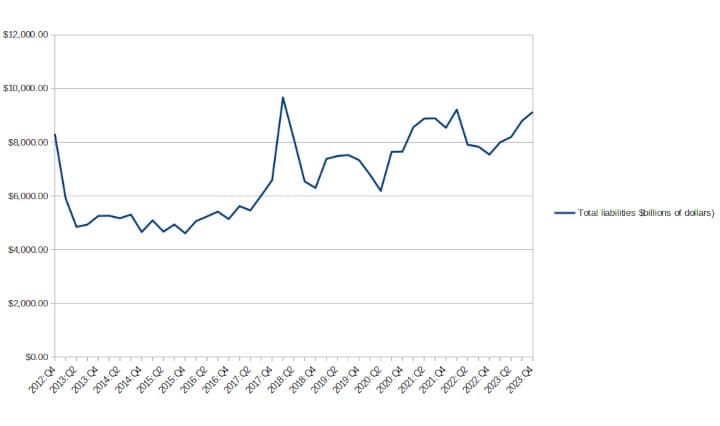

- Total household debt has risen by $148 billion, or 0.9 percent, to $17.05 trillion in the first quarter of 2023.

- Mortgage balances climbed by $121 billion and stood at $12.04 trillion at the end of March.

- Auto loans to $1.56 trillion.

- Student loans to $1.60 trillion.

- Credit Card debt $986 billion.

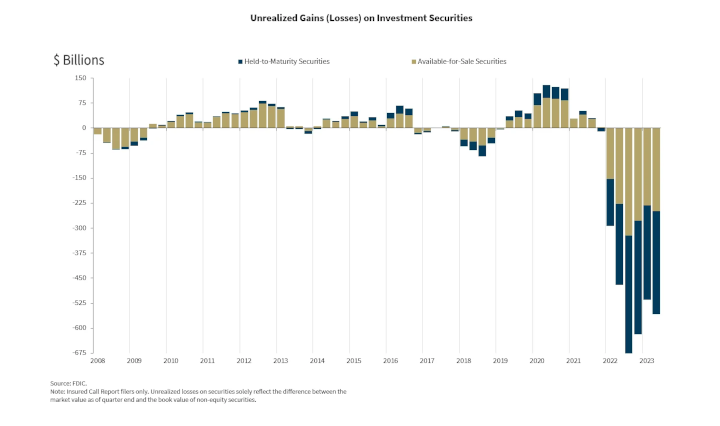

However, unlike the banks above, there are no fancy programs designed to keep households afloat in this inflating economy--and boy are households starting to feel it, especially in the areas like services and housing (that are BIG components of CPI--and way more 'sticky' than goods).

To try and further drive home the shaky ground households are on, let's revisit the Fed's Economic Well-being US Household 2022.

- "fewer adults reported having money left over after paying their expenses. 54% of adults said that their budgets had been affected "a lot" by price increases."

- "51% of adults reported that they reduced their savings in response to higher prices."

- The share of adults who reported that they would cover a $400 emergency expense using cash or its equivalent was 63 percent.

It is the younger generations starting to see itself break into delinquency now:

- Auto loans are above 3% delinquency for (30-39) and approaching 5% for (18-29)

- Credit Cards are above 6% delinquency for (30-39) and approaching 9% for (18-29)

Student Loan delinquency is being artificially suppressed currently.

- Speculation: when folks (18-29) and (30-39) have to pay Auto loans, Credit Card debt, and Student loans all at the same time, delinquencies across all 3 will jump bigly.

- People will DIE being priced out of their lives in favor of raising interest rates to fight inflation for a problem the Fed created to begin with: