Office of Financial Research: Limiting Short Selling During Periods of Individual Stock Stress Reduces Volatility and Raises Prices

A working paper published today by the Office of Financial Research (OFR) finds that temporary short-selling restrictions, triggered by a sharp decline in a stock’s price, reduce market volatility and improve pricing and market liquidity.

Despite strong predictions based on theories of disagreement, limited empirical evidence has linked short-selling restrictions to higher prices. They test this relationship using quasi-experimental methods based on Rule 201, a threshold-based policy that restricts aggressive short selling when intraday returns cross −10%. When comparing stocks on either side of the threshold in the same hour of trading, we find that the restriction leads to short-sale volumes that are 8% lower and daily returns that are 35 bps higher. These price effects do not reverse after the restriction is lifted.

Abstract

Despite strong predictions based on theories of disagreement, limited empirical evidence has linked short-selling restrictions to higher prices. They test this relationship using quasi-experimental methods based on Rule 201, a threshold-based policy that restricts aggressive short selling when intraday returns cross −10%. When comparing stocks on either side of the threshold in the same hour of trading, they find that the restriction leads to short-sale volumes that are 8% lower and daily returns that are 35 bps higher. These price effects do not reverse after the restriction is lifted.

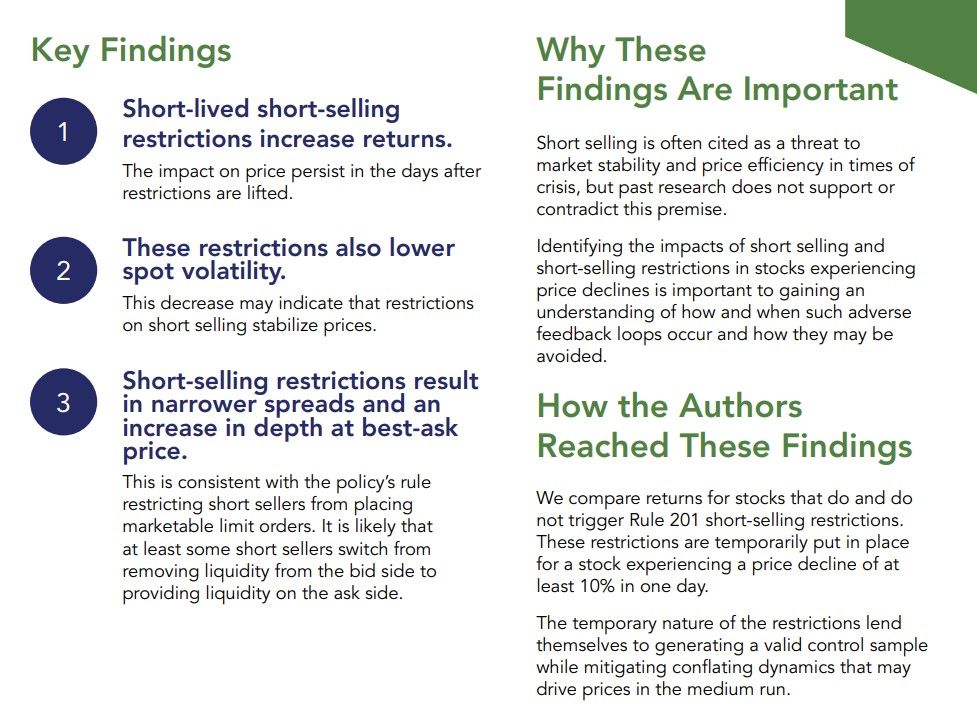

The authors found:

- Short-lived short-selling restrictions increase returns.

- These restrictions also lower spot volatility.

- Short-selling restrictions result in narrower spreads and an increase in depth at best-ask price.

TLDRS:

- Office of Financial Research: Limiting Short Selling During Periods of Individual Stock Stress Reduces Volatility and Raises Prices

- Short-lived short-selling restrictions increase returns.

- These restrictions also lower spot volatility.

- Short-selling restrictions result in narrower spreads and an increase in depth at best-ask price.