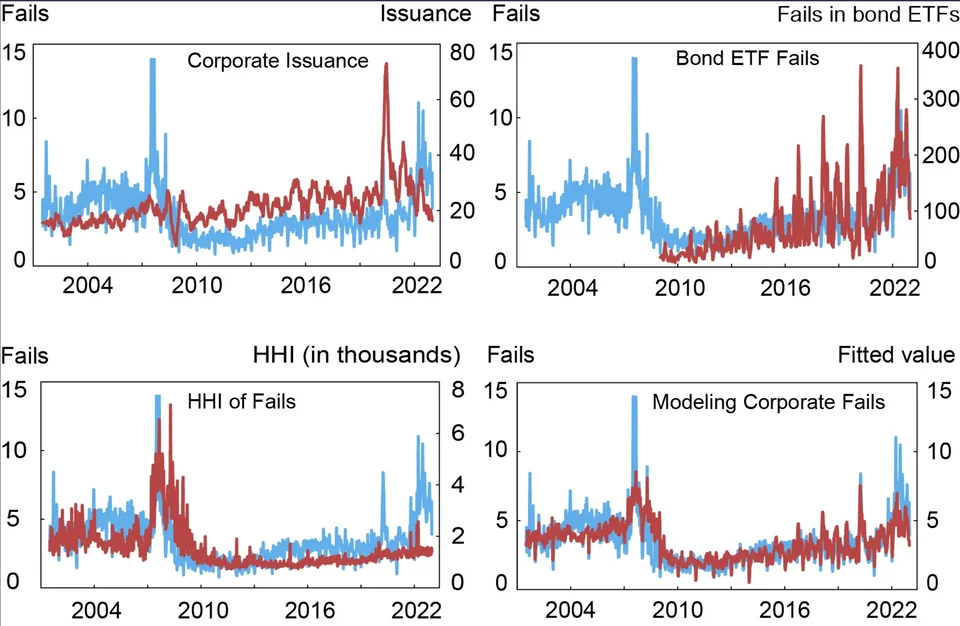

"Idiosyncratic Factors help explain fails": Settlement fails in corporate securities increased sharply in 2022, reaching levels not seen since the 2007-09 financial crisis.

As a fraction of trading volume, fails that involve primary dealers reached an all-time high in the week of March 23, 2022.

Good morning, hoping to call out a bit of data that I buried the lead on in a larger post overnight.

About the image:

Authors’ calculations, based on data from the Federal Reserve’s FR 2004 reports; Mergent FISD; and the Securities and Exchange Commission.

Notes: The chart plots average daily corporate fails (blue) in billions per day against

- (i) corporate issuance in billions per week as a twelve-week moving average,

- (ii) bond ETF fails in millions per day as a twenty-one trading day moving average for the largest investment grade and high yield bond ETFs by market capitalization,

- (iii) an HHI measure that equals the sum of squared weekly shares of fails across primary dealers multiplied by 10,000, and

- (iv) the fitted value from a regression model that controls for trading volume, corporate issuance, bond ETF fails, the HHI measure, and seasonal effects.

- They calculate weekly new issuance as of the end of Wednesday and apply the following conditions to better align with the FR 2004 definition of corporate securities: include only corporate bonds that are USD denominated issues, include only bonds by U.S. domiciled issuers, and exclude non-convertible bonds and issues with zero offering amount.

- Issuance, ETF Activity, and Idiosyncratic Factors Help Explain Fails.