FINRA 'discipline' Alert! From at least November 2012 through March 2022, Goldman included incorrect information for at least 97 million transactions.

Hello and happy Monday, I hope everyone had a GREAT weekend!

I would like to share some more FINRA 'discipline' with y'all, this time it's Goldman Sachs--after the SEC fined them for something similar last week.

As these releases convey a ton of information, I hope this format makes sense:

- I am going to outline what Goldman did from points from the filing.

- I am going to pull the rules they broke and attempt to provide wut mean definitions while breaking each section against Goldman down a bit further.

- I will talk about the penalty levied.

- I will discuss how the nefarious behavior could impact GameStop.

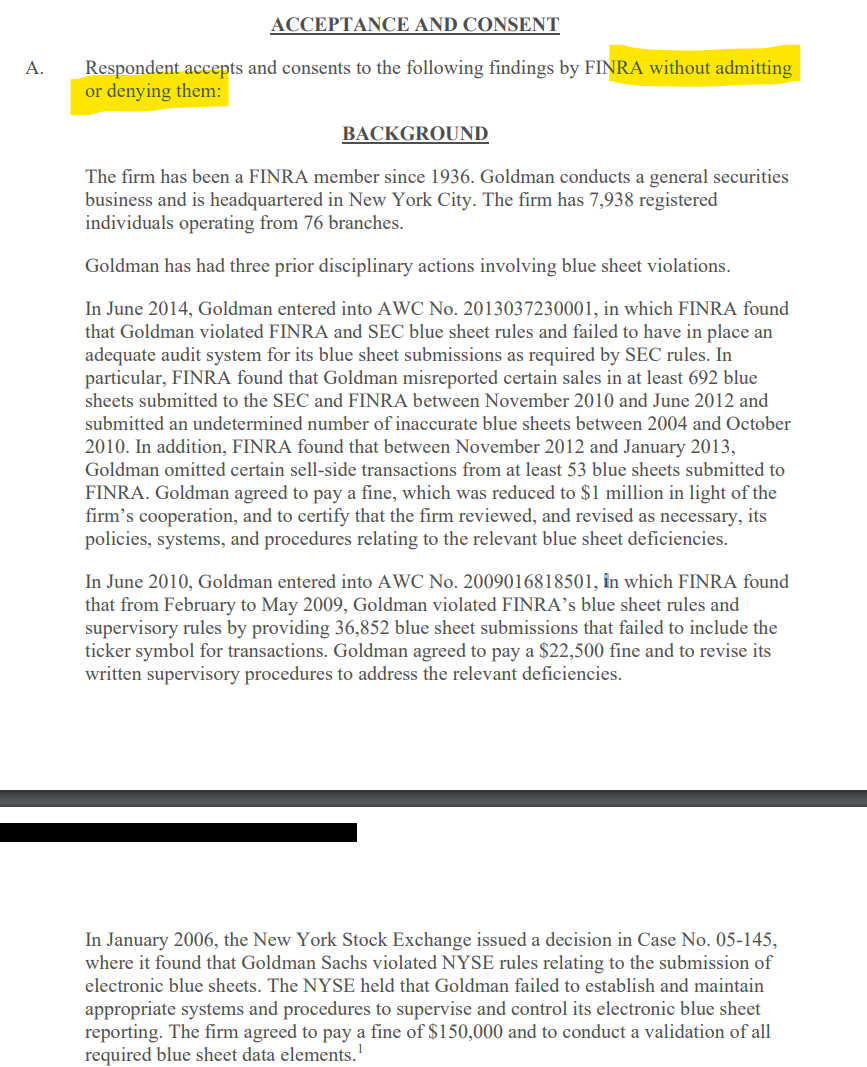

What Goldman Sachs did (without admitting or denying):

Wut Mean?

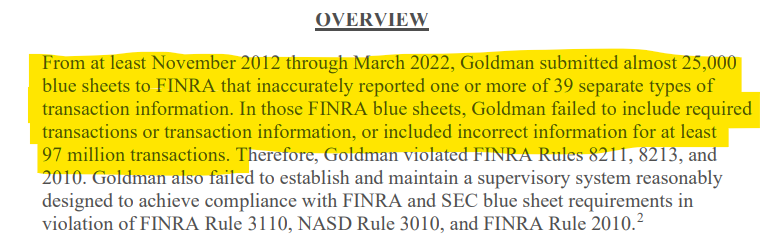

- From at least November 2012 through March 2022, Goldman submitted almost 25,000 blue sheets to FINRA that inaccurately reported one or more of 39 separate types of transaction information.

- In those FINRA blue sheets, Goldman failed to include required transactions or transaction information, or included incorrect information for at least 97 million transactions.

FACTS AND VIOLATIVE CONDUCT:

Wut mean?

Imagine you're in a big school, and there are rules to make sure everyone plays fair and safe. The school is like the stock market, where students are like member firms buying and selling things and the teachers and principals are like the SEC, FINRA, and other regulators who make sure everyone follows the rules.

The teachers and principals need to check if everyone is playing fair. So, they ask for something called "blue sheets" from the students (who are like the member firms). These blue sheets are like homework assignments where students write down what they traded, with whom, and for how much.

The teachers and principals use these blue sheets to check if anyone is breaking the rules, like cheating in a game or trading things they shouldn’t. If the students don’t give the right information or don’t turn in their blue sheets on time, it’s harder for the teachers and principals to make sure everyone is playing fair and safe.

So, it’s really important for the students (member firms) to turn in complete and correct blue sheets when the teachers and principals (regulators) ask for them. This helps keep the school (market) a safe and fair place for everyone!

Goldman submitted almost 25,000 inaccurate blue sheets to FINRA, misreporting or failing to report at least 97 million transactions:

Wut Mean?

Back to our school example, imagine your school has a rule that students need to turn in their homework (the blue sheets) correctly and on time. This homework helps the teachers make sure everyone is playing fair.

Now, there’s a student named Goldman. Goldman had to turn in a lot of homework – almost 25,000 sheets! But, Goldman made many mistakes on them, missing or messing up information about a whopping 97 million transactions!

The school has specific rules (like FINRA Rules 8211, 8213, and 2010) that say students must turn in their homework correctly and be good and fair students. But Goldman didn’t follow these rules for a long time, from 2012 to 2022.

The teachers first noticed something was wrong in 2018 when they saw mistakes on Goldman’s homework. They found out that Goldman knew about some mistakes but didn’t fix all of them or tell the teachers. Then when Goldman kept reviewing their homework and found even more mistakes--some the same age as the last time they turned in bad homework and supposedly caught all these!

These mistakes make it hard for the teachers to know if students are trading fairly. For example, they couldn’t tell if a student was taking or giving more, who was trading (because of mixed-up student ID numbers), or when the trades happened. This is important to catch any unfair trades or cheating--ESPECIALLY insider trading!!!

Goldman failed to establish and maintain a reasonable supervisory system for the submission of blue sheets:

Wut Mean?

Imagine in our school example, there’s a rule (like FINRA Rule 3110(a) and the old NASD Rule 3010(a)) that says every student needs to have a helper buddy (supervisory system on trades). This buddy makes sure their friend follows all the school rules and does their homework correctly. If the buddy notices any mistakes or rule-breaking (red flags), they need to tell the teacher and help fix it. Not doing this is breaking another school rule (FINRA Rule 2010).

Now, Goldman is a student who also has a helper buddy. But, Goldman and their buddy didn’t check the homework properly. Between 2016 and 2018, they found 18 mistakes in the homework but didn’t look carefully enough to see if there were more mistakes or problems. They noticed the red flags but didn’t do enough to fix them or find other possible mistakes.

Because Goldman and their buddy didn’t have a good system to check the homework and didn’t investigate the red flags properly, they broke the school rules about having a helper buddy and making sure all the rules are followed. This means they also broke the rule that says every student needs to be good and fair (FINRA Rule 2010).

Penalty?:

How could this impact GameStop?

- Blue Sheets and Regulatory Oversight: Blue sheets are crucial for regulatory oversight as they provide detailed information about trades, including the identity of the trader, the time of the trade, the price, and whether it was a buy, sell, or short sale. Since Goldman Sachs submitted inaccurate blue sheets, it could potentially hinder the ability of regulators like FINRA to investigate and identify improper trading activities, such as naked short selling.

- Concerns of Naked Shorting: In the context of GameStop, there are concerns that entities might be engaged in naked short selling. If regulators are unable to accurately track trades and positions due to inaccurate blue sheets, it could potentially allow such illicit activities to go undetected or make enforcement more challenging.

- Investigations and Enforcement: The accurate reporting of trade data is essential for maintaining market integrity. Since there were concerns about naked shorting in GameStop, regulators would rely on accurate blue sheet data to investigate these allegations. The inaccuracies in Goldman’s blue sheet submissions, as described to the tune of 97 million transactions!, impacts the ability of regulators to conduct thorough investigations into market manipulation and other improper trading activities.

TLDRS:

- From at least November 2012 through March 2022, Goldman submitted almost 25,000 blue sheets to FINRA that inaccurately reported one or more of 39 separate types of transaction information.

- In those FINRA blue sheets, Goldman failed to include required transactions or transaction information, or included incorrect information for at least 97 million transactions.

- Penalty? Without admitting or denying anything, a censure, and $6 million fine...