Gary Gensler on proposed Rule 6b-1: "Currently, the playing field upon which broker-dealers compete is unlevel." "we request public comment regarding whether volume-based discounts should be prohibited, & if so to what degree."

Highlights:

- "Currently, the playing field upon which broker-dealers compete is unlevel. Mid-sized and smaller broker-dealers effectively pay higher fees than larger brokers to trade on most exchanges. This is because exchanges generally charge brokers net trading fees or pay rebates back to brokers that vary depending on the brokers’ trading volume. As a consequence, brokers with the largest trading volume receive the largest rebates and thus pay the lowest net fees. Sometimes, large brokers get rebates that are even larger than the fees they paid—leading to a situation where the exchange actually pays on net large brokers for their order flow."

- "These larger trading firms thus are able to offer customers more favorable transaction prices than smaller brokers."

- "Further, this has contributed to a practice whereby mid-sized or smaller brokers—in an effort to capture higher rebates—route their orders through a handful of the largest brokers."

- "A handful of the largest brokers are then able to collect a fee for that service and use that volume to qualify for even better tiers for themselves and other customers."

- "What’s more, some have suggested that there might be some information leakage to the largest brokers due to these routing practices."

Full Statement:

Today, the Commission is considering a proposal regarding exchanges’ volume-based rebates and fees. I am pleased to support this proposal because it will elicit important public feedback on how the Commission can best promote competition amongst equity market participants.

Congress long has mandated that the SEC work to promote competition in the capital markets. In 1975, Congress amended the Exchange Act largely to address anticompetitive practices by market intermediaries. Congress added the word “competition” to the Exchange Act 20 times.[1]

In those 1975 provisions, Congress also mandated that exchanges’ rules “not [be] designed to permit unfair discrimination between customers, issuers, brokers, or dealers” and “provide for the equitable allocation of reasonable dues, fees, and other charges among its members.”[2]

Later, in 1996, Congress mandated that, in addition to investor protection and public interest, the SEC consider efficiency and competition, as well as capital formation, when considering rules.[3]

In light of these mandates, I think it’s appropriate that the Commission make today’s proposal along with alternatives requesting public feedback on a practice the exchanges use called volume-based transaction pricing—or, what one might call volume-based discounts.

Currently, the playing field upon which broker-dealers compete is unlevel. Mid-sized and smaller broker-dealers effectively pay higher fees than larger brokers to trade on most exchanges. This is because exchanges generally charge brokers net trading fees or pay rebates back to brokers that vary depending on the brokers’ trading volume. As a consequence, brokers with the largest trading volume receive the largest rebates and thus pay the lowest net fees. Sometimes, large brokers get rebates that are even larger than the fees they paid—leading to a situation where the exchange actually pays on net large brokers for their order flow.

These larger trading firms thus are able to offer customers more favorable transaction prices than smaller brokers. Further, this has contributed to a practice whereby mid-sized or smaller brokers—in an effort to capture higher rebates—route their orders through a handful of the largest brokers. A handful of the largest brokers are then able to collect a fee for that service and use that volume to qualify for even better tiers for themselves and other customers. What’s more, some have suggested that there might be some information leakage to the largest brokers due to these routing practices.

We have heard from a number of market participants that volume-based transaction pricing along with these market practices raise concerns about competition in the markets.

In response, through today’s proposal, we request public comment regarding whether volume-based discounts should be prohibited, and if so to what degree. In addition, we request public input regarding the role that new disclosure requirements could play to address these practices.

Today’s release offers a number of alternatives for public comment regarding both possible prohibitions and disclosure requirements.

In addition, today’s release includes questions about how to promote competition amongst and between trading venues as well as brokers.

I look forward to the public’s input on these matters.

I’d like to thank members of the SEC staff for their work on this proposal, including:

Haoxiang Zhu, David Saltiel, Andrea Orr, David Shillman, Eric Juzenas, Richard Holley, Terri Evans, Yvonne Fraticelli, Julia Zhang, Yue Ding, Sharon Park, and Roni Bergoffen in the Division of Trading and Markets;

Jessica Wachter, Jill Henderson, Oliver Richard, Paul Barton, Ariel Lohr, Sherry Wu, John Ritter, Caroline Schulte, Lauren Moore, Charles Woodworth, Parhaum Hamdi, Gregory Scopino, and Julie Marlowe in the Division of Economic and Risk Analysis;

Megan Barbero, Meredith Mitchell, Robert Teply, Janice Mitnick, Cynthia Ginsberg, and Ronesha Butler in the Office of the General Counsel;

John Polise, Connie Kiggins, Michael Hershaft, and Carrie O’Brien in the Division of Examinations;

Jane Patterson in the EDGAR Business Office;

Charlotte Buford and Kerry Knowles in the Division of Enforcement; and

Kevin Burris and David Fernandez in the Office of Legislative and Intergovernmental Affairs.

[1] See Securities Acts Amendments of 1975, available at https://www.govtrack.us/congress/bills/94/s249.

[2] Ibid.

[3] See National Securities Markets Improvement Act of 1996, available at https://www.govtrack.us/congress/bills/104/hr3005.

What Gary is happy about:

SEC Proposes Rule to Address Volume-Based Exchange Transaction Pricing for NMS Stocks.

Background:

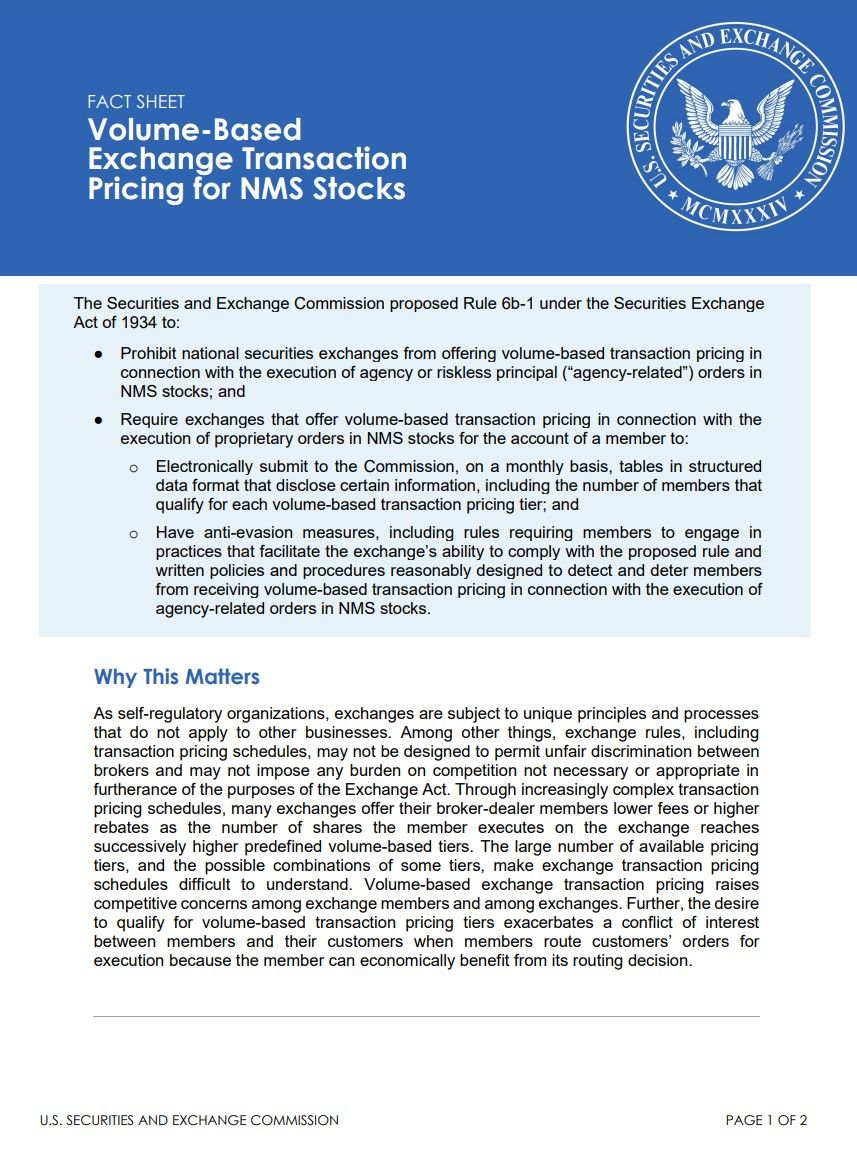

National securities exchanges (“exchanges”) that trade NMS stocks maintain pricing schedules that set forth the transaction pricing they apply to their broker-dealer members that execute orders on their trading platforms. As self-regulatory organizations under the Exchange Act, exchanges are subject to unique principles and processes that do not apply to other businesses. For example, all proposed rules of an exchange, including exchange transaction pricing proposals, must be filed with the Commission. In addition, pricing schedules must be publicly posted on the exchange’s website.

The Exchange Act further requires that exchange pricing proposals, among other things, provide for the “equitable allocation of reasonable dues, fees, and other charges among its members and issuers and other persons using its facilities” that “are not designed to permit unfair discrimination between customers, issuers, brokers, or dealers” and “do not impose any burden on competition not necessary or appropriate in furtherance of the purposes of” the Exchange Act. With respect to the requirement that the rules of an exchange not impose any burden on competition not necessary or appropriate in furtherance of the purposes of the Exchange Act, the Senate Banking, Housing and Urban Affairs Committee report that accompanied the 1975 amendments to the Exchange Act stated that “this paragraph is designed to make clear that a balance must be struck between regulatory objectives and competition, and that unless an interference with competition is justified in terms of the achievement of a statutory objective, it cannot stand.”

Section 11A of the Exchange Act directs the Commission to facilitate the establishment of a national market system in accordance with specified Congressional findings. Among the Congressional findings are assuring (i) fair competition among brokers and dealers and among exchange markets, and (ii) the practicability of brokers executing investors’ orders in the best market. Rather than setting forth minimum components of the national market system, the Exchange Act grants the Commission broad authority to oversee the implementation, operation, and regulation of the national market system consistent with Congressionally determined goals and objectives.

Fact Sheet:

Press Release:

The Securities and Exchange Commission today proposed a new rule that would prohibit national securities exchanges from offering volume-based transaction pricing in connection with the execution of agency or riskless principal (“agency-related”) orders in NMS stocks. The proposal also would require national securities exchanges to have certain anti-evasion rules and written policies and procedures and disclose certain information if they offer volume-based transaction pricing for member proprietary volume in NMS stocks.

“Currently, the playing field upon which broker-dealers compete is unlevel,” said SEC Chair Gary Gensler. “Through volume-based transaction pricing, mid-sized and smaller broker-dealers effectively pay higher fees than larger brokers to trade on most exchanges. We have heard from a number of market participants that volume-based transaction pricing along with related market practices raise concerns about competition in the markets. I am pleased to support this proposal because it will elicit important public feedback on how the Commission can best promote competition amongst equity market participants.”

Proposed Rule 6b-1 under the Securities Exchange Act of 1934 would prohibit national securities exchanges from offering volume-based transaction pricing in connection with the execution of agency-related orders in NMS stocks. It also would require exchanges that offer volume-based transaction pricing in connection with the execution of members’ proprietary orders in NMS stocks to disclose certain information, including the number of members that qualify for each transaction pricing tier that the exchange offers. Exchanges would be required to submit this information to the Commission on a monthly basis, and the public would be able to access the information through the Commission’s EDGAR system.

In addition, proposed Rule 6b-1 would require exchanges that have volume-based transaction pricing for member proprietary orders in NMS stocks to have anti-evasion measures, including rules requiring members to engage in practices that facilitate the exchange’s ability to comply with the prohibition on volume-based exchange transaction pricing for agency-related orders in NMS stocks and to have written policies and procedures reasonably designed to detect and deter members from receiving volume-based pricing in connection with the execution of agency-related orders in NMS stocks.

The proposing release will be published in the Federal Register. The public comment period will remain open until 60 days after the date of publication of the proposing release in the Federal Register.

How to comment:

Electronic Comments:

- Use the Commission’s online form at: https://www.sec.gov/rules/2023/10/feetiers

- Alternatively, send an email to [email protected]. Ensure the subject line includes the file number S7-18-23.

Paper Comments:

- Mail your paper comments to: Secretary, Securities and Exchange Commission, 100 F Street NE, Washington, DC 20549-1090.

Important Notes:

- Always refer to the file number S7-18-23 in your submission.

- If using email, include the file number in the subject line.

- For efficiency, only use one method of submission.

- All comments will be posted on the Commission’s website at: https://www.sec.gov/rules/proposed.shtml

- Refrain from including personal details in your comments. Only provide information you're comfortable being public.

- Obscene or copyrighted material may be redacted or not published.

TLDRS:

- SEC Proposes Rule to Address Volume-Based Exchange Transaction Pricing for NMS Stocks.

- Gary Supports it!

- "Currently, the playing field upon which broker-dealers compete is unlevel. Mid-sized and smaller broker-dealers effectively pay higher fees than larger brokers to trade on most exchanges."

- "As a consequence, brokers with the largest trading volume receive the largest rebates and thus pay the lowest net fees."

- "Sometimes, large brokers get rebates that are even larger than the fees they paid—leading to a situation where the exchange actually pays on net large brokers for their order flow."

- "These larger trading firms thus are able to offer customers more favorable transaction prices than smaller brokers."

- "Further, this has contributed to a practice whereby mid-sized or smaller brokers—in an effort to capture higher rebates—route their orders through a handful of the largest brokers."

- "A handful of the largest brokers are then able to collect a fee for that service and use that volume to qualify for even better tiers for themselves and other customers."

- "What’s more, some have suggested that there might be some information leakage to the largest brokers due to these routing practices."

Proposed Rule 6b-1 would:

- Prohibit exchanges from offering volume-based transaction pricing in connection with the execution of agency or riskless principal orders in NMS stocks.

- Require exchanges that offer volume-based transaction pricing in connection with the execution of proprietary orders in NMS stocks for the account of a member to have anti-evasion measures, including rules requiring members to engage in practices that facilitate the exchange’s ability to comply with the prohibition, and written policies and procedures reasonably designed to detect and deter members from receiving volume-based pricing in connection with the execution of agency related orders in NMS stocks.

- Require exchanges that offer volume-based transaction pricing in connection with the execution of proprietary orders in NMS stocks for the account of a member to submit electronic, machine-readable structured data tables of certain information about their volume-based transaction pricing tiers and the number of members that qualify for each tier in an Interactive Data File in accordance with Rule 405 of Regulation S-T, which the public would be able to access through the Commission’s EDGAR system.

- OPEN FOR COMMENT!