Incoming No-Action Requests Under Exchange Act Rule 14a-8: GameStop Rejects Shareholder Claims, Debunks Heat Lamp, and Fully Supports 'Plan' For Shareholders

GameStop Rejects Shareholder Claims, Debunks Heat Lamp, and Fully Supports 'Plan' For Shareholders.

Incoming No-Action Requests Under Exchange Act Rule 14a-8

The SEC States:

This page contains pending Rule 14a-8 no-action requests received by the Division of Corporation Finance. Pursuant to the Federal Information Security Management Act of 2002 and OMB Memorandum M-07-16, we have removed, to the maximum extent practicable, personally identifiable information from the materials.

After we respond to a Rule 14a-8 no-action request, our response, as well as a link to the incoming request and any subsequent correspondence, will be available through the Rule 14a-8 No-Action Responses page.

For example, a flurry of no-action requests around GameStop have been recently received and posted by the Division of Corporation Finance.

- GameStop Corp., February 8, 2024

- GameStop Corp., February 8, 2024

- GameStop Corp., February 8, 2024

- GameStop Corp., February 8, 2024

Wut Mean?

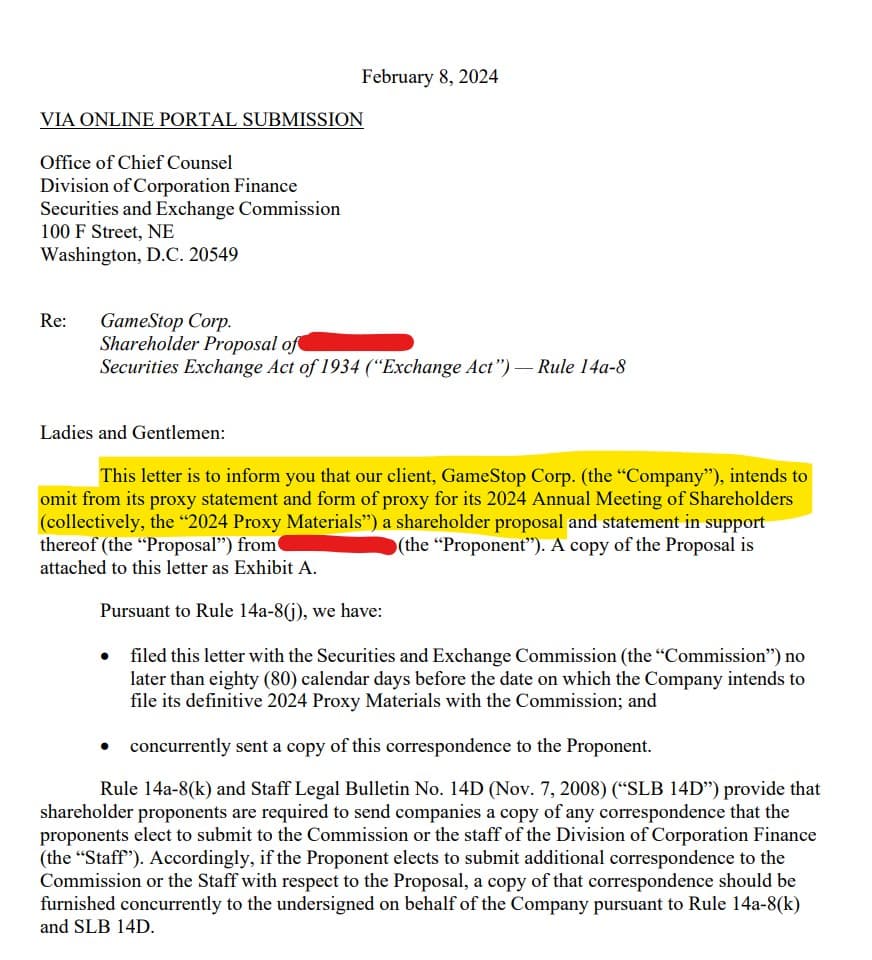

GameStop has received letters from shareholders requesting specific actions be included in its proxy statement and form of proxy for its 2024 Annual Meeting of Shareholders.

In its response, GameStop noted it intends to omit this proposals from the shareholders that used the 'heat lamp theory' as the basis for many of their proposals.

Since this is public information, the request is included as an exhibit.

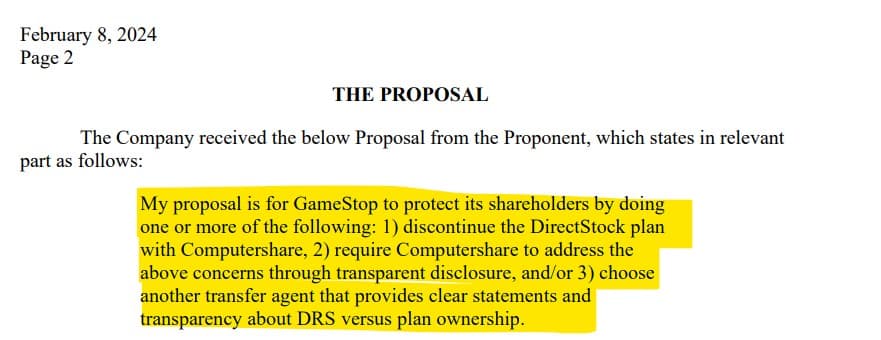

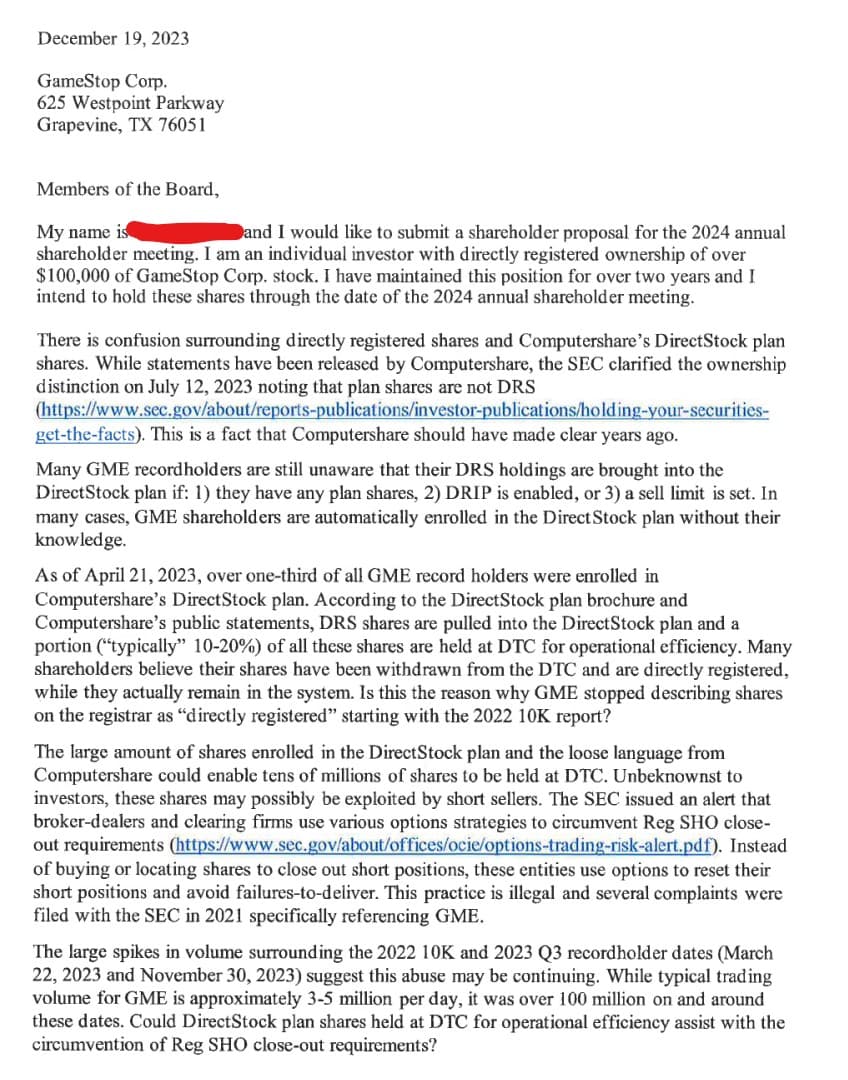

Proposal Rejected

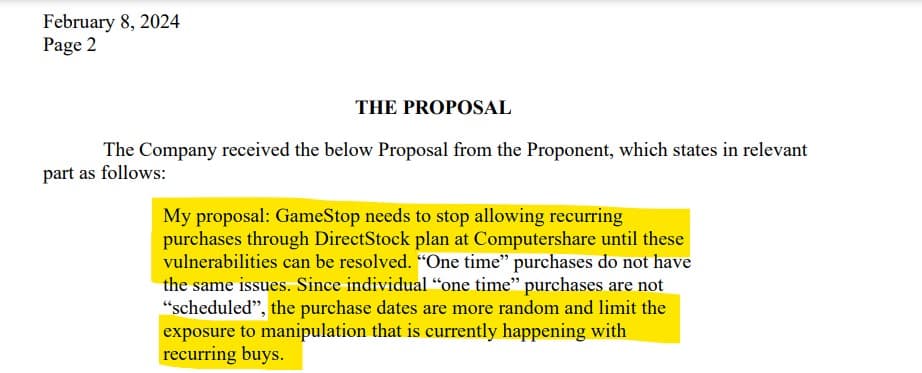

This author wishes GameStop to stop allowing recurring buys through DirectStock plan at Computershare.

Full Proposal

GameStop's Response Rejecting the Proposal

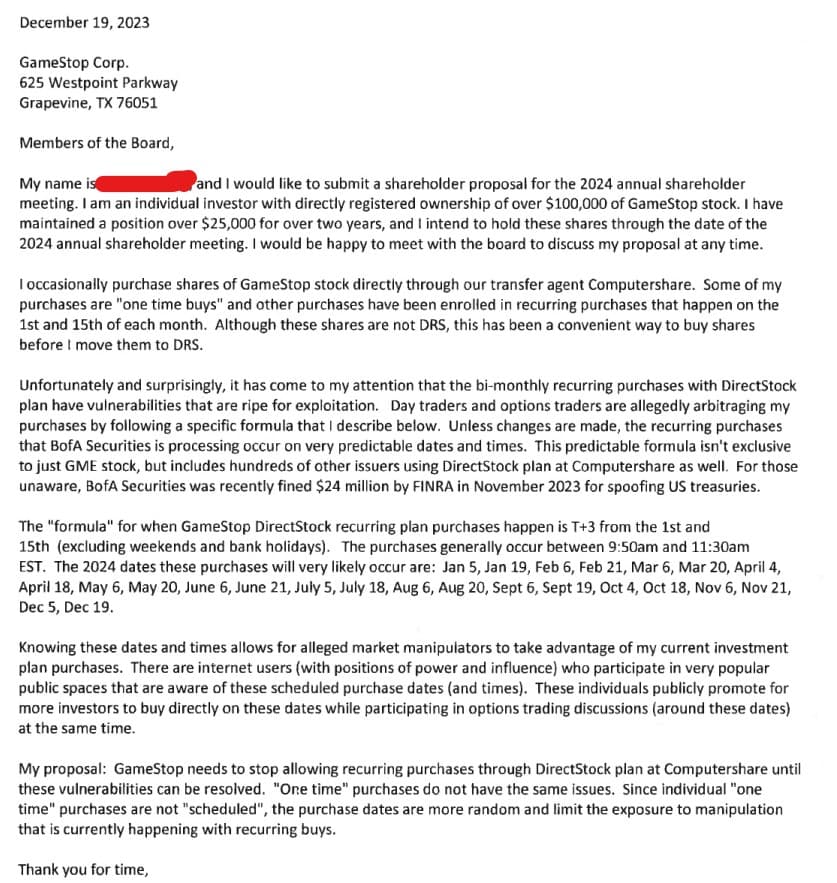

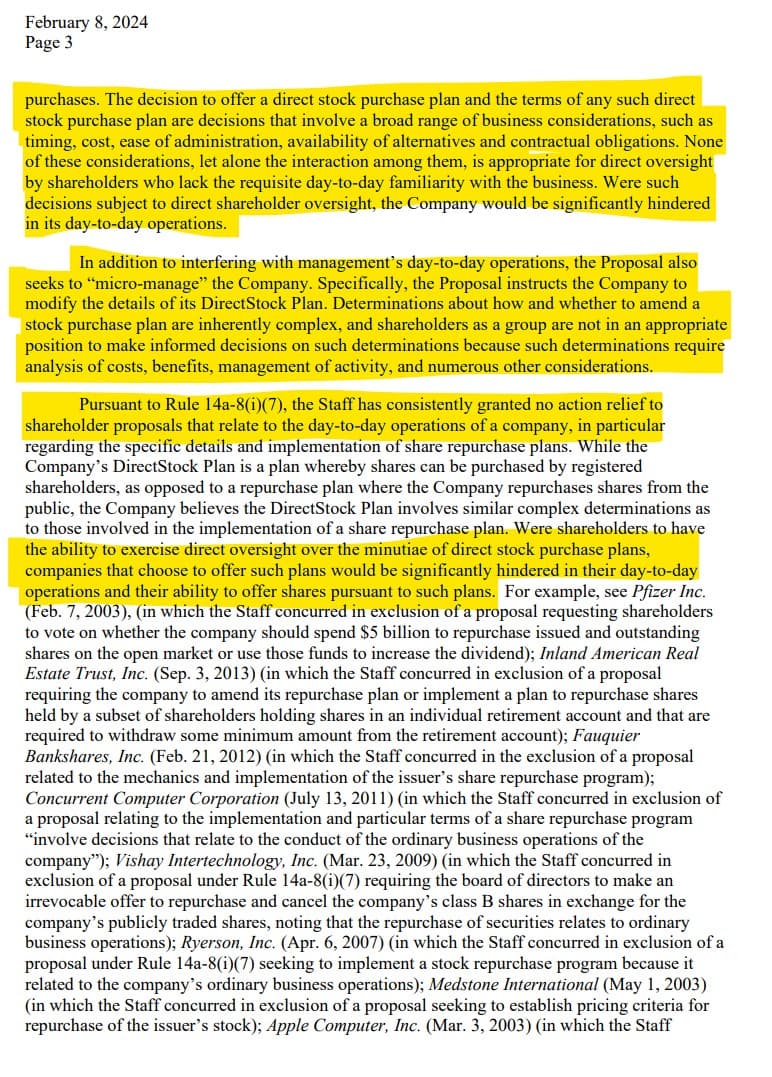

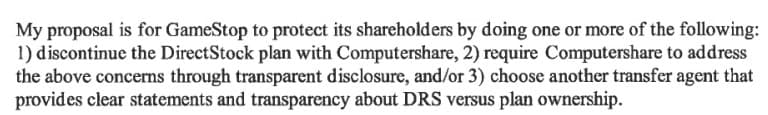

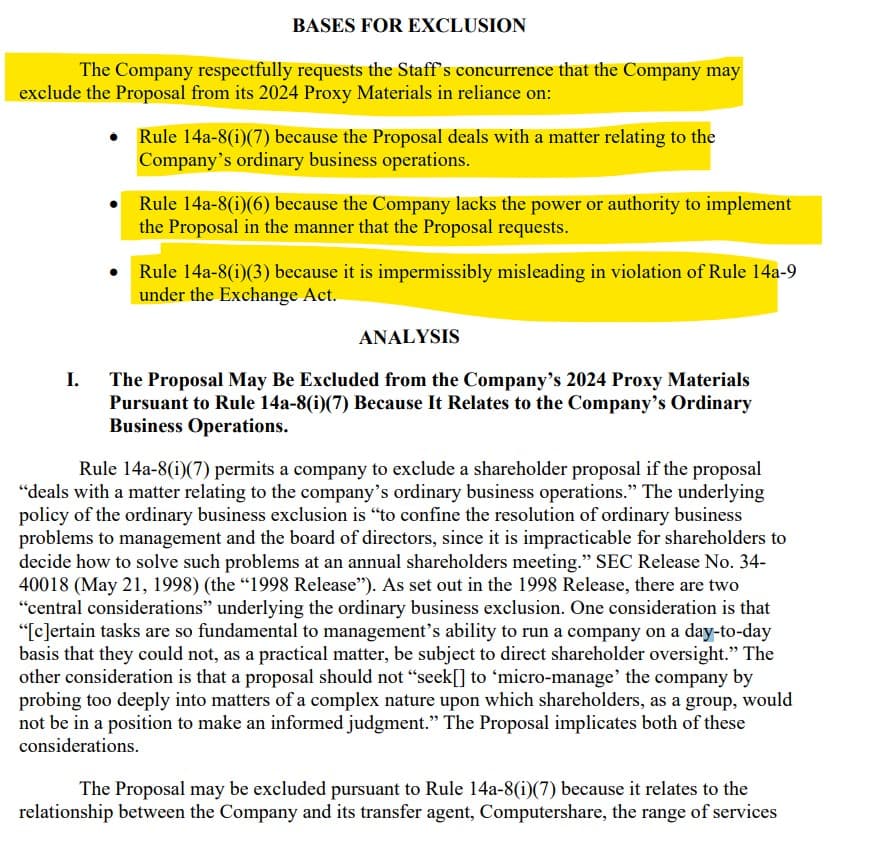

The Company respectfully requests the Staff’s concurrence that the Company may exclude the Proposal from its 2024 Proxy Materials

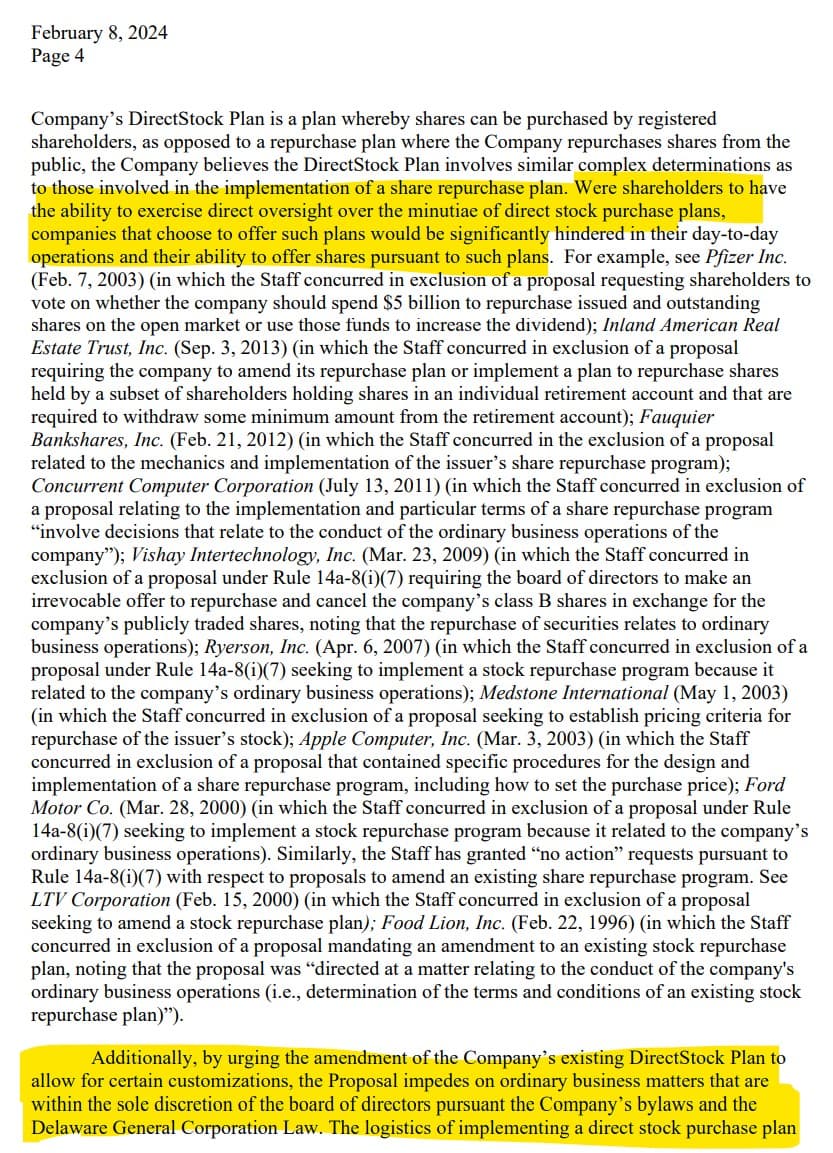

![The other consideration is that a proposal should not “seek[] to ‘micro-manage’ the company by probing too deeply into matters of a complex nature upon which shareholders, as a group, would not be in a position to make an informed judgment.”](https://dismal-jellyfish.com/content/images/2024/02/33--1-.jpg)

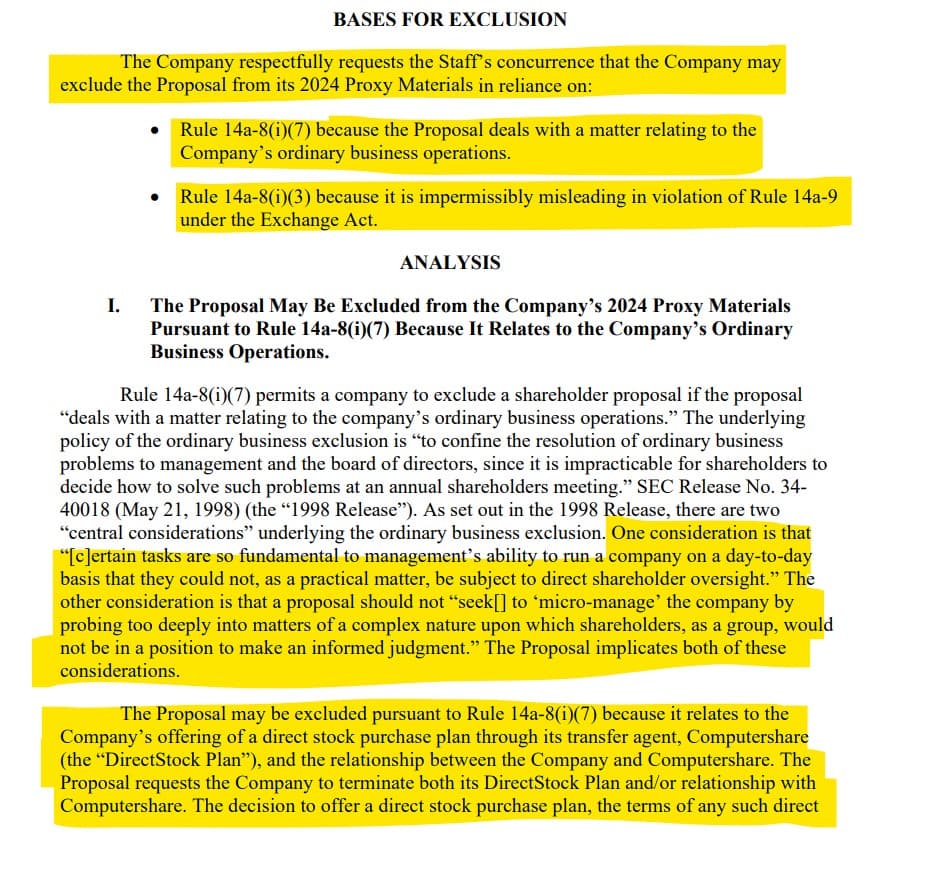

"None of these considerations, let alone the interaction among them, is appropriate for direct oversight by shareholders who lack the requisite day-to-day familiarity with the business. Were such decisions subject to direct shareholder oversight, the Company would be significantly hindered in its day-to-day operations."

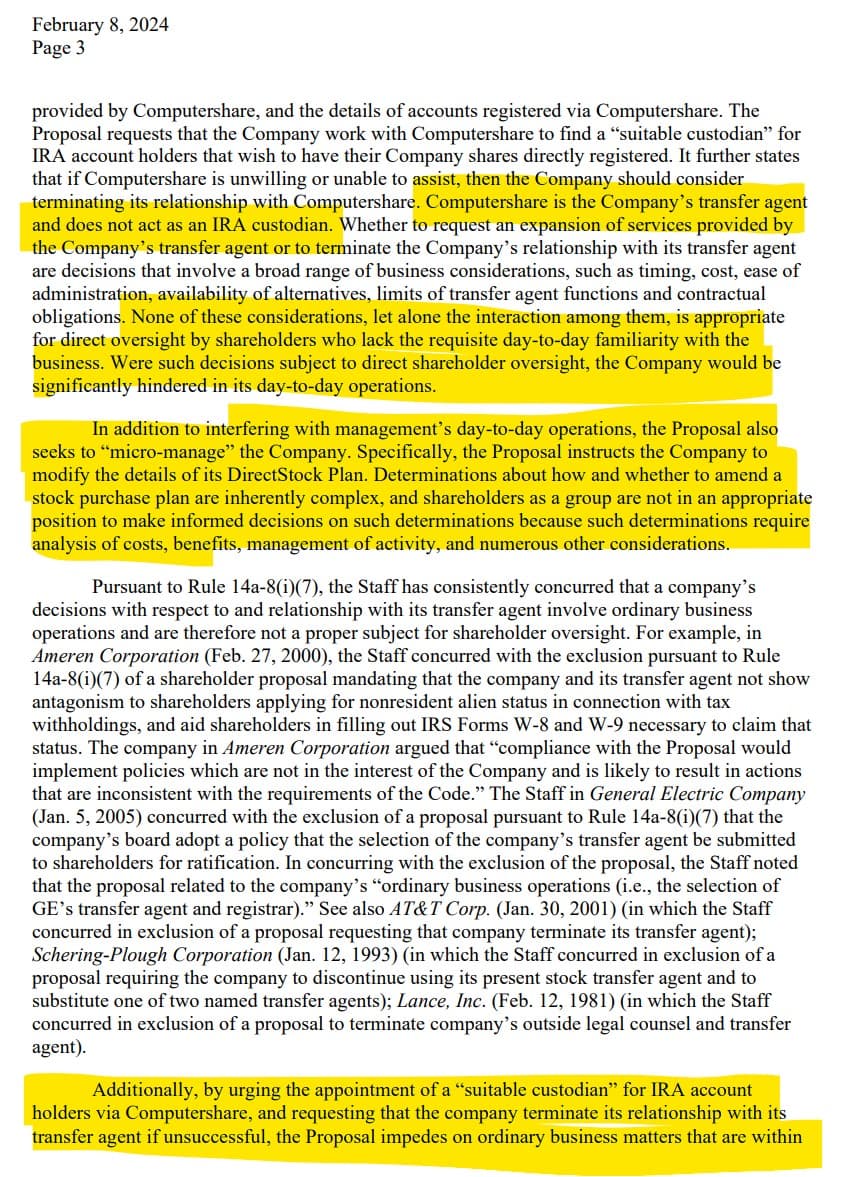

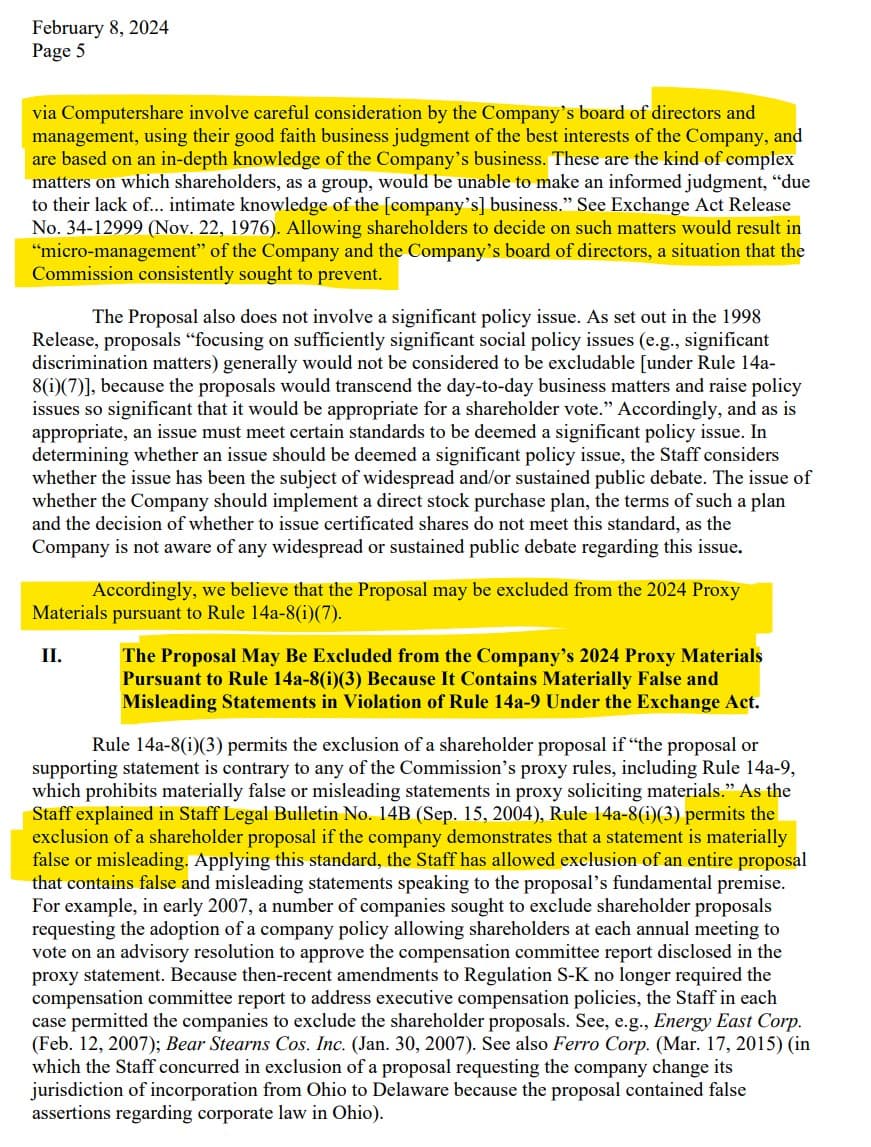

![The logistics of implementing a direct stock purchase plan via Computershare involve careful consideration by the Company’s board of directors and management, using their good faith business judgment of the best interests of the Company, and are based on an in-depth knowledge of the Company’s business. These are the kind of complex matters on which shareholders, as a group, would be unable to make an informed judgment, “due to their lack of... intimate knowledge of the [company’s] business.”](https://dismal-jellyfish.com/content/images/2024/02/35--1-.jpg)

The logistics of implementing a direct stock purchase plan via Computershare involve careful consideration by the Company’s board of directors and management, using their good faith business judgment of the best interests of the Company, and are based on an in-depth knowledge of the Company’s business. These are the kind of complex matters on which shareholders, as a group, would be unable to make an informed judgment, “due to their lack of... intimate knowledge of the [company’s] business.”

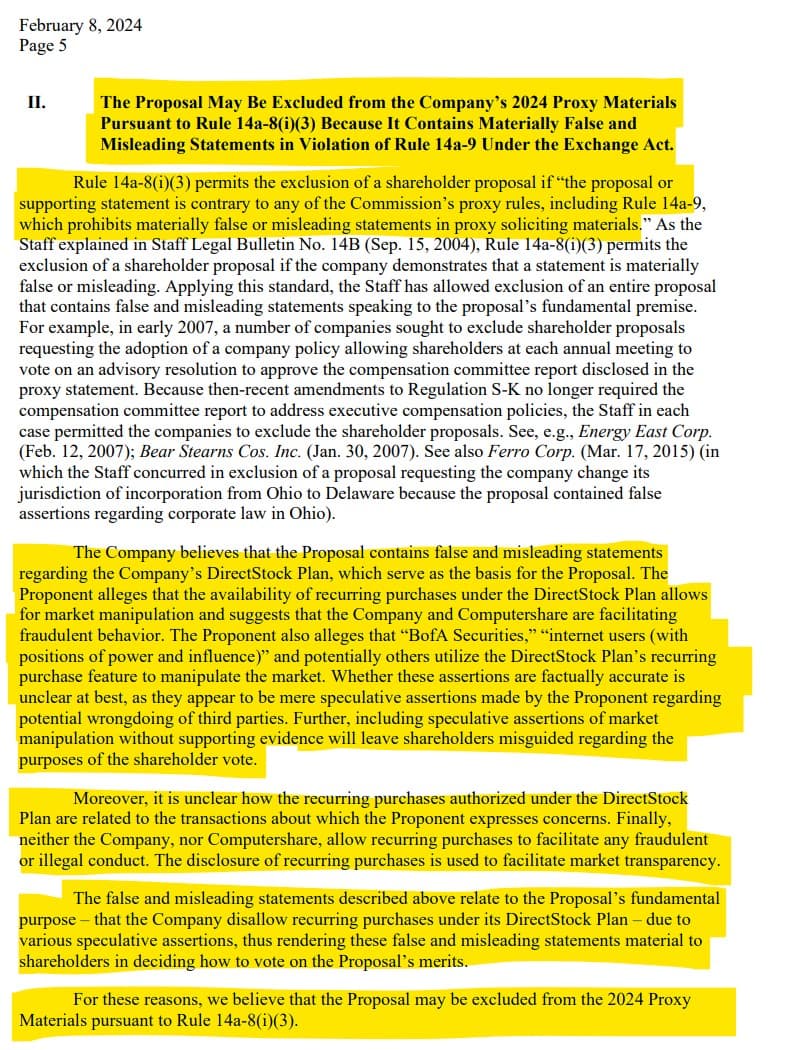

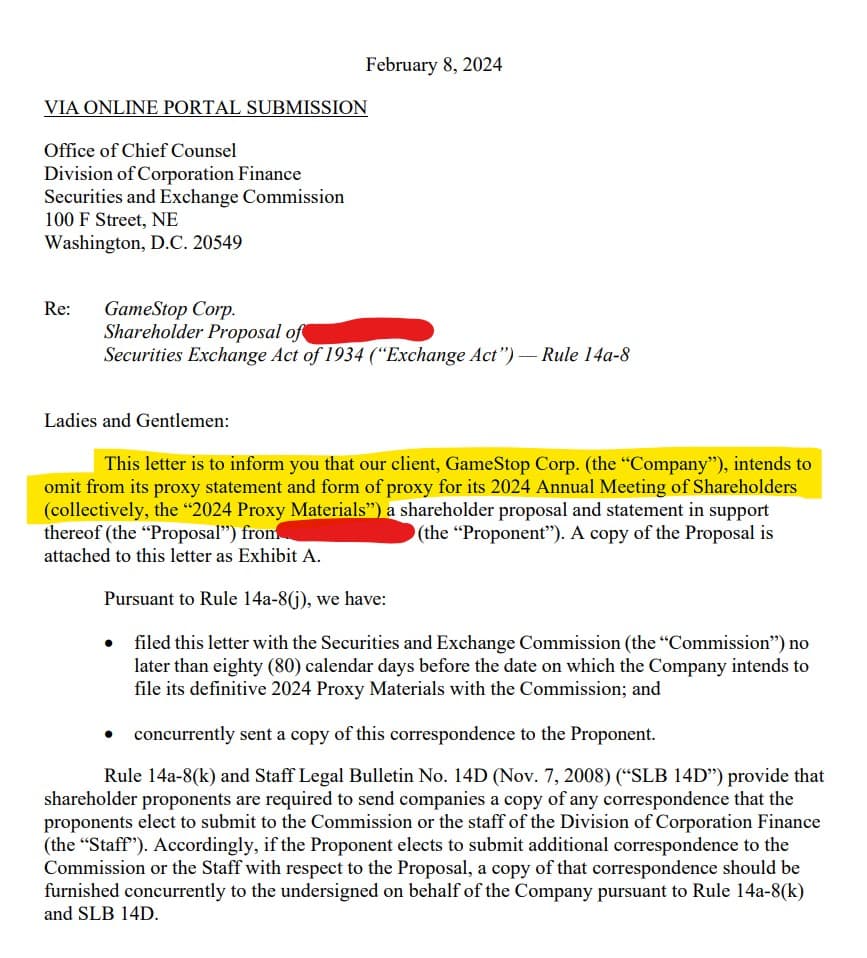

The Proposal May Be Excluded from the Company’s 2024 Proxy Materials Pursuant to Rule 14a-8(i)(3) Because It Contains Materially False and Misleading Statements in Violation of Rule 14a-9 Under the Exchange Act.

- Rule 14a-8(i)(3) permits the exclusion of a shareholder proposal if “the proposal or supporting statement is contrary to any of the Commission’s proxy rules, including Rule 14a-9, which prohibits materially false or misleading statements in proxy soliciting materials.”

- The Company believes that the Proposal contains false and misleading statements regarding the Company’s DirectStock Plan, which serve as the basis for the Proposal.

- The Proponent alleges that the availability of recurring purchases under the DirectStock Plan allows for market manipulation and suggests that the Company and Computershare are facilitating fraudulent behavior. The Proponent also alleges that “BofA Securities,” “internet users (with positions of power and influence)” and potentially others utilize the DirectStock Plan’s recurring purchase feature to manipulate the market.

- Whether these assertions are factually accurate is unclear at best, as they appear to be mere speculative assertions made by the Proponent regarding potential wrongdoing of third parties.

- Further, including speculative assertions of market manipulation without supporting evidence will leave shareholders misguided regarding the purposes of the shareholder vote.

- Moreover, it is unclear how the recurring purchases authorized under the DirectStock Plan are related to the transactions about which the Proponent expresses concerns.

- Finally, neither the Company, nor Computershare, allow recurring purchases to facilitate any fraudulent or illegal conduct. The disclosure of recurring purchases is used to facilitate market transparency.

- The false and misleading statements described above relate to the Proposal’s fundamental purpose – that the Company disallow recurring purchases under its DirectStock Plan – due to various speculative assertions, thus rendering these false and misleading statements material to shareholders in deciding how to vote on the Proposal’s merits.

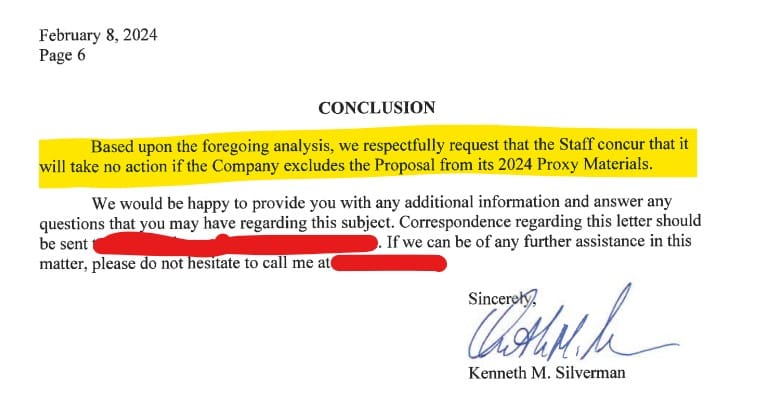

- For these reasons, we believe that the Proposal may be excluded from the 2024 Proxy Materials pursuant to Rule 14a-8(i)(3).

Wut Mean?

- Rule 14a-8(i)(3) allows for the exclusion of shareholder proposals containing materially false or misleading statements, as they violate the Commission’s proxy rules.

- The Proposal in question accuses the GameStop’s DirectStock Plan of enabling market manipulation, claiming it facilitates fraudulent behavior by the Company, Computershare, and others, including "BofA Securities" and influential internet users, through its recurring purchase feature.

- GameStop states these allegations by the Proponent are speculative and lack factual evidence, misleading shareholders about the integrity of the Company and its DirectStock Plan.

- GameStop goes on to say the connection between the DirectStock Plan's recurring purchases and the alleged market manipulations is not substantiated, casting doubt on the relevance of these claims to the shareholder vote.

- GameStop and Computershare assert that recurring purchases are intended for market transparency, not for facilitating any illegal activities.

- Given these points, the GameStop argues that the Proposal, based on speculative and misleading assertions, can be excluded from the 2024 Proxy Materials under Rule 14a-8(i)(3) due to its potential to mislead shareholders.

Next Proposal Rejection

This author also wishes GameStop to stop allowing recurring buys through DirectStock plan at Computershare--this times with more elements of 'Heat Lamp' included in their letter to the board.

Full Proposal

GameStop's Response Rejecting the Proposal

The Company respectfully requests the Staff’s concurrence that the Company may exclude the Proposal from its 2024 Proxy Materials

Additionally, by urging the creation of a new stock purchase plan containing specific terms and conditions, the Proposal impedes on ordinary business matters that are within the sole discretion of the board of directors pursuant the Company’s bylaws and the Delaware General Corporation Law. The logistics of implementing a new stock purchase plan via Computershare involve careful consideration by the Company’s board of directors and management, using their good faith business judgment of the best interests of the Company, and are based on an in-depth knowledge of the Company’s business. These are the kind of complex matters on which shareholders, as a group, would be unable to make an informed judgment, “due to their lack of... intimate knowledge of the [company’s] business.”

- The Company believes that the Proposal contains false and misleading statements regarding the Company’s DirectStock Plan.

- The Proposal misrepresents the operation of the DirectStock Plan, the relationship between directly registered shares and shares acquired through the DirectStock Plan and interactions between shares acquired through the DirectStock Plan and The Depository Trust Company (“DTC”).

- Including the Proposal and supporting statement would materially mislead shareholders as to what they are being asked to vote on. In particular, the Proposal asserts that:

- (1) if a person has directly registered shares and has any shares purchased through the DirectStock Plan all shares are moved into the DirectStock Plan,

- (2) enabling the dividend reinvestment feature of the DirectStock Plan causes shares to be moved into the DirectStock Plan,

- (3) having a sell order limit removes the shareholder’s shares from direct registration and

- (4) 10% to 20% of directly registered shares are put into DTC for operational efficiency.

- If a shareholder’s shares are in the DirectStock Plan, it is because the shareholder purchased those shares and the shareholder is free to remove them from the DirectStock Plan at any time.

- If the shares are removed from the DirectStock Plan, they cannot be reinserted into any plan without the consent of the shareholder.

- Additionally, the Company understands from Computershare that it does in fact send notices to shareholders when shares are purchased through the DirectStock Plan.

- The direct reinvestment feature is only available to shareholders whose shares were purchased through and continue to be subject to the DirectStock Plan.

- However, this feature is not currently applicable as the Company has not declared dividends since 2019 and, as disclosed in its periodic filings with the Commission, currently has no intention of paying dividends.

- Having an open sell order limit does not automatically take such shares out of direct registration (to the extent such shares were directly registered), but Computershare does restrict the ability of the shareholder to take certain actions with respect to such shares given that they are subject to an active trade order.

- In addition, the shares that have been moved to the DTC are moved in order to complete sales initiated by shareholders.

- Computershare has endeavored to clarify these issues for concerned shareholders through its Frequently Asked Questions page (the “FAQ Page”) on Computershare’s website.

- Specifically, the FAQ Page states, “DRS shares do not require enrollment into a ‘plan.’”

- Additionally, the FAQ page also states that an “investor can, at any time, withdra[w] all or part of their shares in [the DirectStock Plan] book-entry form and have them added to their DRS holding.

- The investor is able to transfer whole shares from [the DirectStock Plan] book-entry to DRS at any time.”

- The FAQ page explains that Computershare holds only “a portion of the aggregate DSPP book-entry shares via its broker in DTC for operational efficiency, i.e. to enable any sales to be settled efficiently (and Computershare determines the portion needed for operational efficiency reasons. Such shares are not available for lending. These shares are eligible to be withdrawn from DTC)”.

- The false and misleading statements described above relate to the Proposal’s fundamental purpose – that the Company discontinue its DirectStock Plan and choose a new transfer agent – due to various incorrect assertions thus rendering these false and misleading statements material to shareholders in deciding how to vote on the Proposal’s merits.

- For these reasons, we believe that the Proposal may be excluded from the 2024 Proxy Materials pursuant to Rule 14a-8(i)(3).

Wut Mean?

- GameStop again seeks the Staff's agreement to exclude the Proposal from its 2024 Proxy Materials, arguing it involves ordinary business matters and misrepresents the DirectStock Plan, thus misleading shareholders.

- This proposal suggests creating a new stock purchase plan, a decision traditionally within the board's discretion, highlighting the complexity and the necessity of management's intimate business knowledge.

- GameStop calls out misrepresentations in the Proposal include incorrect claims about the operation of the DirectStock Plan, the process of direct registration, the impact of dividend reinvestment and sell order limits, and the handling of shares by The Depository Trust Company (DTC).

- GameStop clarifies that shareholders have control over their shares in the DirectStock Plan, can remove or transfer shares at any time, and that Computershare provides accurate information regarding the plan's operations.

- GameStop states misleading statements in the Proposal could materially affect shareholder decisions, particularly regarding the fundamental purpose of discontinuing the DirectStock Plan and choosing a new transfer agent.

- GameStop additionally states that Computershare has endeavored to clarify these issues for concerned shareholders through its Frequently Asked Questions page (the “FAQ Page”) on Computershare’s website.

- Based on these factors and the potential for misleading shareholders, GameStop argues that the Proposal can be excluded under Rule 14a-8(i)(3) from its 2024 Proxy Materials.

Next Proposal Rejection

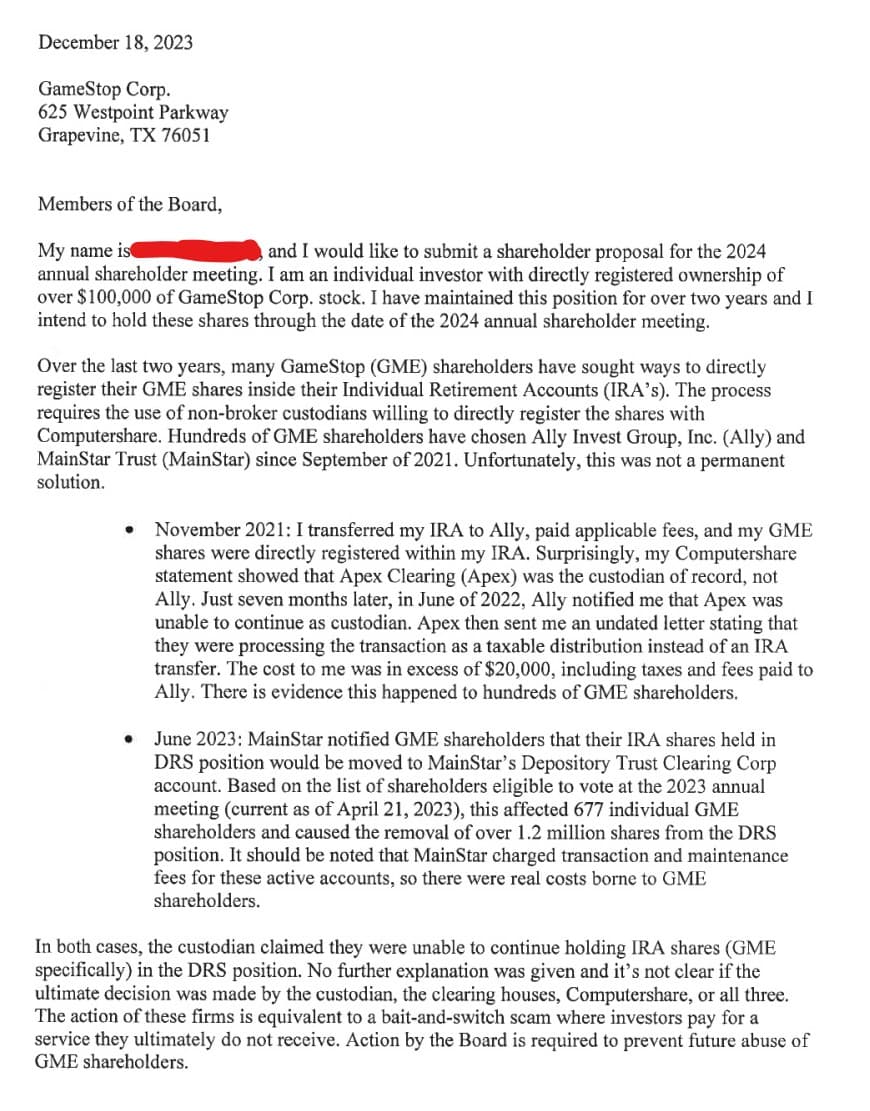

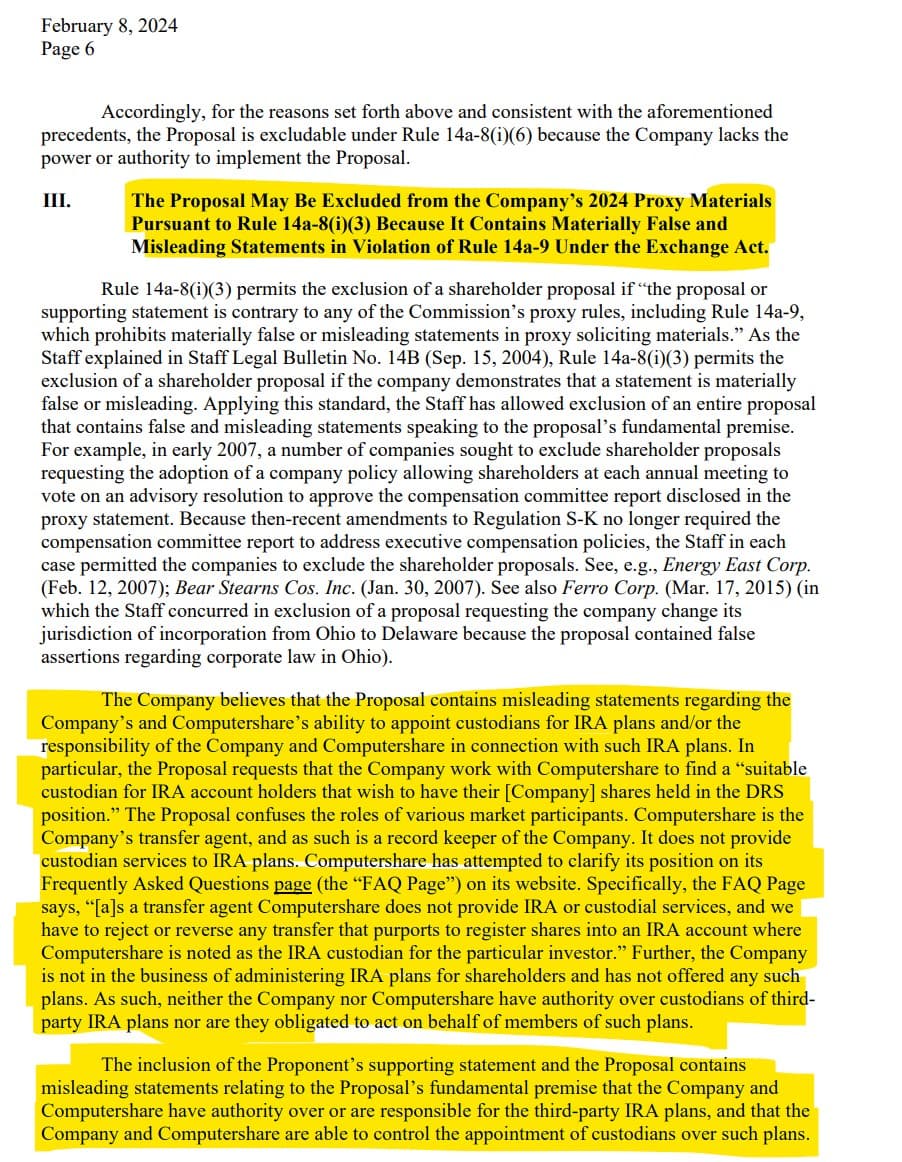

The Proposal

Full Proposal

GameStop's Response Rejecting the Proposal

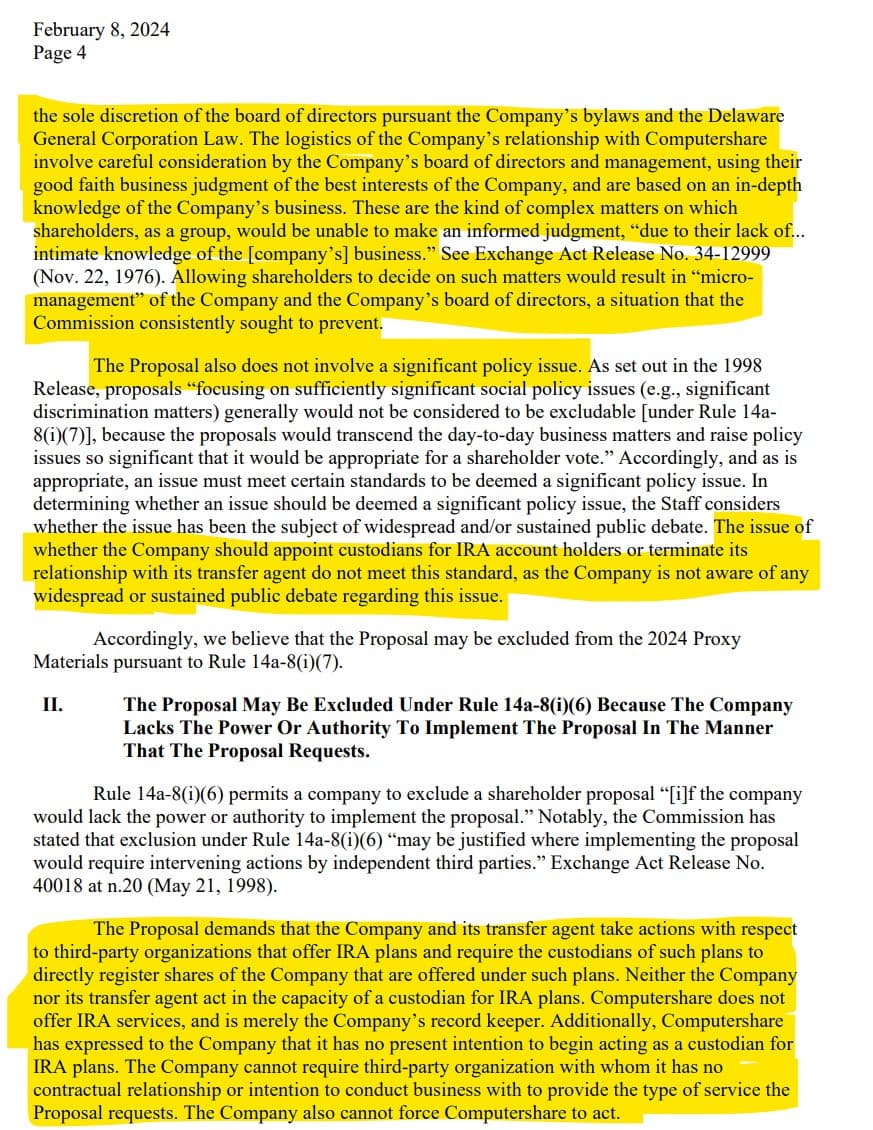

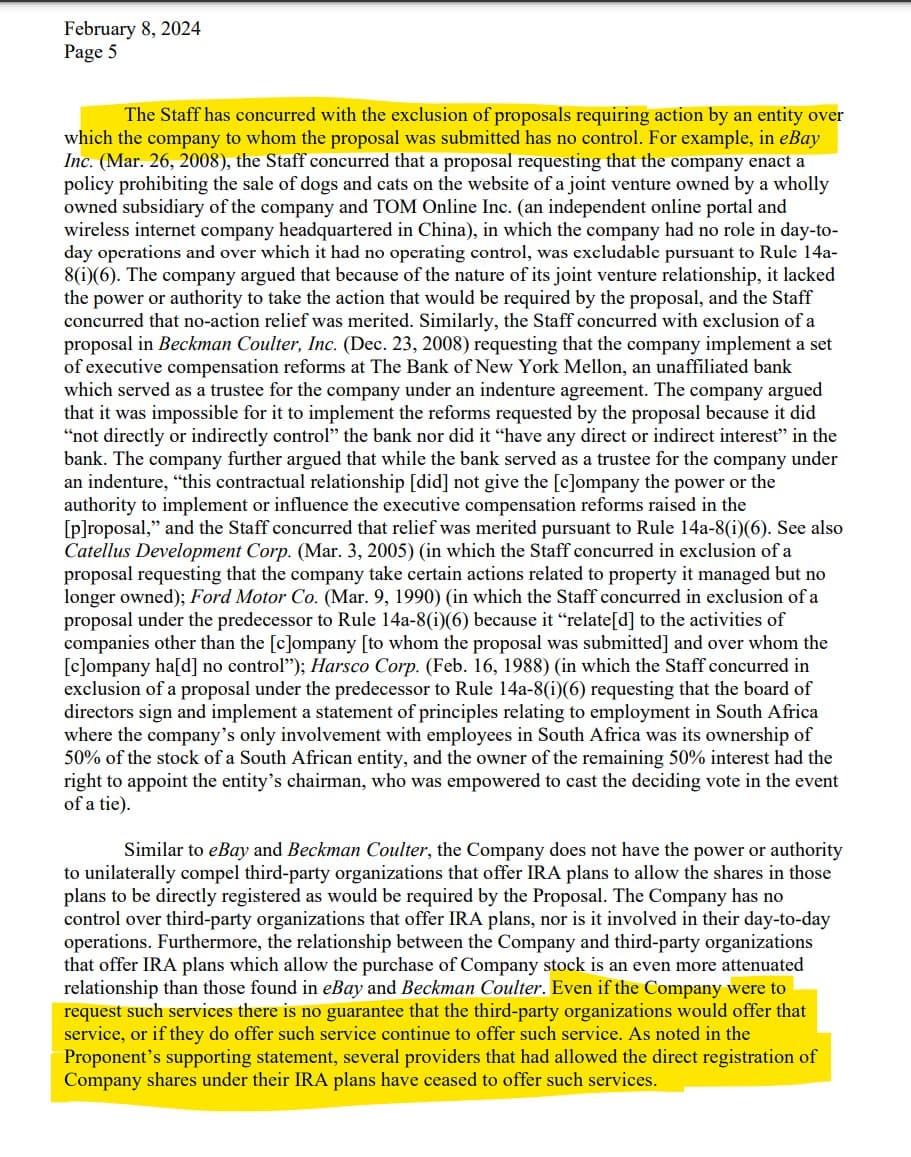

The Company respectfully requests the Staff’s concurrence that the Company may exclude the Proposal from its 2024 Proxy Materials

- Even if the Company were to request such services there is no guarantee that the third-party organizations would offer that service, or if they do offer such service continue to offer such service.

- As noted in the Proponent’s supporting statement, several providers that had allowed the direct registration of Company shares under their IRA plans have ceased to offer such services.

- The Company believes that the Proposal contains misleading statements regarding the Company’s and Computershare’s ability to appoint custodians for IRA plans and/or the responsibility of the Company and Computershare in connection with such IRA plans.

- In particular, the Proposal requests that the Company work with Computershare to find a “suitable custodian for IRA account holders that wish to have their [Company] shares held in the DRS position.”

- The Proposal confuses the roles of various market participants.

- Computershare is the Company’s transfer agent, and as such is a record keeper of the Company.

- It does not provide custodian services to IRA plans. Computershare has attempted to clarify its position on its Frequently Asked Questions page (the “FAQ Page”) on its website.

- Specifically, the FAQ Page says, “[a]s a transfer agent Computershare does not provide IRA or custodial services, and we have to reject or reverse any transfer that purports to register shares into an IRA account where Computershare is noted as the IRA custodian for the particular investor.”

- Further, the Company is not in the business of administering IRA plans for shareholders and has not offered any such plans.

- As such, neither the Company nor Computershare have authority over custodians of third party IRA plans nor are they obligated to act on behalf of members of such plans.

- The inclusion of the Proponent’s supporting statement and the Proposal contains misleading statements relating to the Proposal’s fundamental premise that the Company and Computershare have authority over or are responsible for the third-party IRA plans, and that the Company and Computershare are able to control the appointment of custodians over such plans.

- Further, it suggests that GameStop and Computershare bear responsibility for the tax treatment of shareholder's holdings.

- None of these assertions are true, and if included would materially mislead the public regarding the Company and Computershare's role in IRA plans and the market.

Wut Mean?

- GameStop highlights there's no assurance third-party organizations would agree to or continue offering direct registration services for IRA plans, noting past instances where providers ceased such services.

- GameStop states the proposal misleadingly suggests the Company and Computershare can appoint custodians for IRA plans, overlooking their actual roles and capabilities.

- Computershare, acting as the Company's transfer agent and record keeper, does not offer custodian services for IRA plans, a fact clarified on its FAQ page.

- GameStop itself does not administer IRA plans or offer such plans to shareholders, thus neither the Company nor Computershare have control over third-party IRA plan custodians.

- The author's proposal incorrectly implies GameStop and Computershare have responsibilities regarding the tax treatment of shareholders' holdings and the appointment of IRA plan custodians.

- Including the Proposal could materially mislead shareholders about the roles and responsibilities of the Company and Computershare in relation to IRA plans.

- None of these assertions are true, and if included would materially mislead the public regarding the Company and Computershare's role in IRA plans and the market.

Next Proposal Rejection

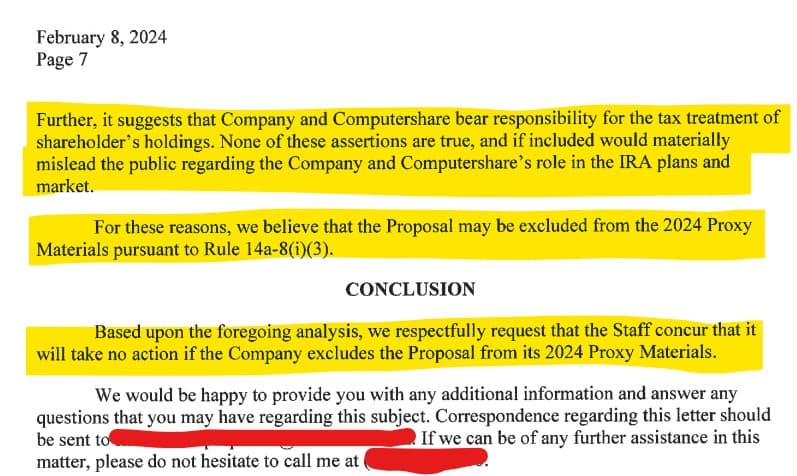

The Proposal

Full Proposal

GameStop's Response Rejecting the Proposal

The Company respectfully requests the Staff’s concurrence that the Company may exclude the Proposal from its 2024 Proxy Materials

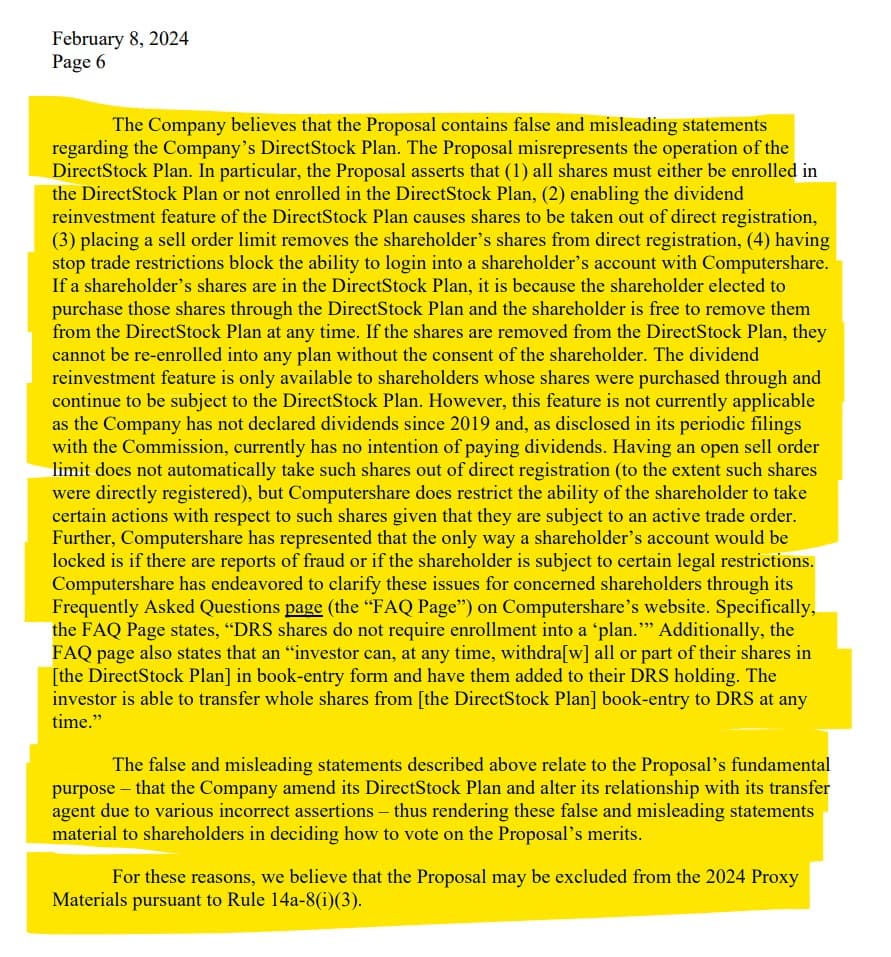

- The Company believes that the Proposal contains false and misleading statements regarding the Company’s DirectStock Plan.

- The Proposal misrepresents the operation of the DirectStock Plan.

- In particular, the Proposal asserts that:

- (1) all shares must either be enrolled in the DirectStock Plan or not enrolled in the DirectStock Plan

- (2) enabling the dividend reinvestment feature of the DirectStock Plan causes shares to be taken out of direct registration

- (3) placing a sell order limit removes the shareholder’s shares from direct registration

- (4) having stop trade restrictions block the ability to login into a shareholder’s account with Computershare.

- If a shareholder’s shares are in the DirectStock Plan, it is because the shareholder elected to purchase those shares through the DirectStock Plan and the shareholder is free to remove them from the DirectStock Plan at any time.

- If the shares are removed from the DirectStock Plan, they cannot be re-enrolled into any plan without the consent of the shareholder.

- The dividend reinvestment feature is only available to shareholders whose shares were purchased through and continue to be subject to the DirectStock Plan.

- However, this feature is not currently applicable as the Company has not declared dividends since 2019 and, as disclosed in its periodic filings with the Commission, currently has no intention of paying dividends.

- Having an open sell order limit does not automatically take such shares out of direct registration (to the extent such shares were directly registered), but Computershare does restrict the ability of the shareholder to take certain actions with respect to such shares given that they are subject to an active trade order.

- Further, Computershare has represented that the only way a shareholder’s account would be locked is if there are reports of fraud or if the shareholder is subject to certain legal restrictions.

- Computershare has endeavored to clarify these issues for concerned shareholders through its Frequently Asked Questions page (the “FAQ Page”) on Computershare’s website.

- Specifically, the FAQ Page states, “DRS shares do not require enrollment into a ‘plan.’”

- Additionally, the FAQ page also states that an “investor can, at any time, withdra[w] all or part of their shares in [the DirectStock Plan] in book-entry form and have them added to their DRS holding. The investor is able to transfer whole shares from [the DirectStock Plan] book-entry to DRS at any time.”

- The false and misleading statements described above relate to the Proposal’s fundamental purpose – that the Company amend its DirectStock Plan and alter its relationship with its transfer agent due to various incorrect assertions – thus rendering these false and misleading statements material to shareholders in deciding how to vote on the Proposal’s merits.

- For these reasons, we believe that the Proposal may be excluded from the 2024 Proxy Materials pursuant to Rule 14a-8(i)(3).

Wut Mean?

- GameStop argues the Proposal contains misleading statements about its DirectStock Plan, inaccurately describing its operation and the implications of certain shareholder actions.

- GameStop states the proposal incorrectly asserts that shares must be entirely enrolled or not in the DirectStock Plan, misrepresents the effects of enabling dividend reinvestment, and inaccurately claims placing a sell order or having stop trade restrictions impacts direct registration and account access.

- Shareholders have the freedom to enroll in the DirectStock Plan, withdraw their shares anytime, and re-enrollment requires shareholder consent, contrary to the Proposal's implications.

- The dividend reinvestment feature, not applicable since GameStop hasn't declared dividends since 2019, doesn't affect the direct registration status of shares, and Computershare's policies do not automatically alter the direct registration status due to sell orders.

- Computershare clarifies that account access restrictions occur only under specific conditions like fraud or legal restrictions, not routine shareholder actions as suggested by the Proposal.

- GameStop states: "The false and misleading statements described above relate to the Proposal’s fundamental purpose – that the Company amend its DirectStock Plan and alter its relationship with its transfer agent due to various incorrect assertions – thus rendering these false and misleading statements material to shareholders in deciding how to vote on the Proposal’s merits."

- Due to these misleading statements, the Company believes the Proposal qualifies for exclusion from the 2024 Proxy Materials under Rule 14a-8(i)(3).

TLDRS

- GameStop Rejects Shareholder Claims, Debunks Heat Lamp, and Fully Supports 'Plan' For Shareholders.

- GameStop states these allegations by the Proponent are speculative and lack factual evidence, misleading shareholders about the integrity of the Company and its DirectStock Plan.

- GameStop goes on to say the connection between the DirectStock Plan's recurring purchases and the alleged market manipulations is not substantiated, casting doubt on the relevance of these claims to the shareholder vote.

- GameStop and Computershare assert that recurring purchases are intended for market transparency, not for facilitating any illegal activities.

- GameStop calls out misrepresentations in the Proposal include incorrect claims about the operation of the DirectStock Plan, the process of direct registration, the impact of dividend reinvestment and sell order limits, and the handling of shares by The Depository Trust Company (DTC).

- GameStop clarifies that shareholders have control over their shares in the DirectStock Plan, can remove or transfer shares at any time, and that Computershare provides accurate information regarding the plan's operations.

- GameStop states misleading statements in the Proposal could materially affect shareholder decisions, particularly regarding the fundamental purpose of discontinuing the DirectStock Plan and choosing a new transfer agent.

- GameStop additionally states that Computershare has endeavored to clarify these issues for concerned shareholders through its Frequently Asked Questions page (the “FAQ Page”) on Computershare’s website.

- GameStop calls out having an open sell order limit does not automatically take such shares out of direct registration (to the extent such shares were directly registered), but Computershare does restrict the ability of the shareholder to take certain actions with respect to such shares given that they are subject to an active trade order.

- In addition, the shares that have been moved to the DTC are moved in order to complete sales initiated by shareholders.

- GameStop highlights there's no assurance third-party organizations would agree to or continue offering direct registration services for IRA plans, noting past instances where providers ceased such services.

- GameStop states the proposal misleadingly suggests the Company and Computershare can appoint custodians for IRA plans, overlooking their actual roles and capabilities.

- GameStop itself does not administer IRA plans or offer such plans to shareholders, thus neither the Company nor Computershare have control over third-party IRA plan custodians.

- None of these assertions are true, and if included would materially mislead the public regarding the Company and Computershare's role in IRA plans and the market.

- GameStop argues the Proposal contains misleading statements about its DirectStock Plan, inaccurately describing its operation and the implications of certain shareholder actions.

- GameStop states the proposal incorrectly asserts that shares must be entirely enrolled or not in the DirectStock Plan, misrepresents the effects of enabling dividend reinvestment, and inaccurately claims placing a sell order or having stop trade restrictions impacts direct registration and account access.

- Shareholders have the freedom to enroll in the DirectStock Plan, withdraw their shares anytime, and re-enrollment requires shareholder consent, contrary to the Proposal's implications.

- The dividend reinvestment feature, not applicable since GameStop hasn't declared dividends since 2019, doesn't affect the direct registration status of shares, and Computershare's policies do not automatically alter the direct registration status due to sell orders.

- Computershare clarifies that account access restrictions occur only under specific conditions like fraud or legal restrictions, not routine shareholder actions as suggested by the Proposal.

- GameStop states: "The false and misleading statements described above relate to the Proposal’s fundamental purpose – that the Company amend its DirectStock Plan and alter its relationship with its transfer agent due to various incorrect assertions – thus rendering these false and misleading statements material to shareholders in deciding how to vote on the Proposal’s merits."