NSCC Alert! Year 2024 Obligation Warehouse (FTD Grave Yard) RECAPS Schedule Announced.

What is the Obligation Warehouse?:

Obligation Warehouse (OW) is a non-guaranteed, automated service of NSCC that facilitates the matching of broker-to-broker ex-clearing trades and provides Members with the ability to track, manage and resolve their failed obligations in real-time.

About:

OW facilitates the matching of obligations submitted by Members for U.S. securities classified as equities, corporates, or unit investment trusts. The centralized service supports bilateral matching of ex-clearing and failed obligations in real-time. OW is not a guaranteed service of NSCC.

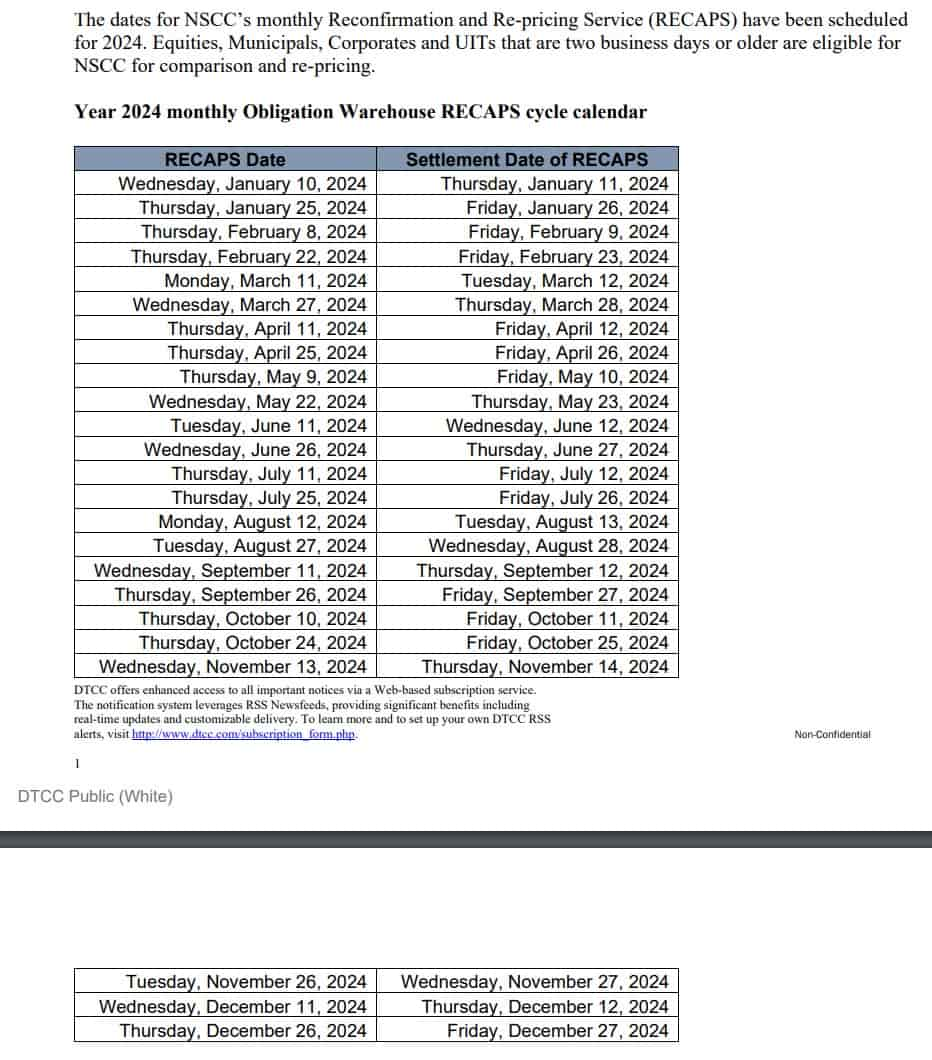

OW stores eligible unsettled obligations (including securities exited from NSCC’s Continuous Net Settlement (CNS) system, Non-CNS Automated Customer Account Transfer Service (ACATS) items, NSCC Balance Order transactions, and Special Trades) in a central location and provides on-going maintenance and servicing of such obligations, including daily checks for CNS-eligibility and periodic updates for certain mandatory corporate actions, until such obligations are settled, cancelled, or otherwise closed in the system. OW will also provide enhanced and more frequent RECAPS processing on a pre-announced schedule.

Who can use the service?:

All NSCC Members can use the OW service. Full service broker dealer Members are required by FINRA Rules to use RECAPS.

Benefits:

- Promotes transparency by providing a complete view of virtually all open obligations traded in the U.S. marketplace for equities, corporates, municipals, and unit investment trust securities.

- Provides one common repository for failed obligations.

- Mitigates counterparty risk and reduces net capital charges by reconfirming and re-pricing failed open obligations to current market value on a more frequent basis.

How the service works:

Members submit their ex-clearing trades to OW for real-time matching by the contra-party. Once the submitting party enters the required transaction information, an advisory is sent by OW to the contra-party requesting that they respond by submitting identical transaction details to facilitate a compared obligation, or by affirming the obligation via the OW Web screen. The matched trade is then considered an open obligation.

Open obligations are tracked and maintained in the OW until those obligations are settled, cancelled, or otherwise closed in the system. A daily maintenance function will apply certain mandatory corporate action events, and will forward to CNS those open obligations stored in OW that become CNS-eligible. However, OW is not a guaranteed service, and an obligation forwarded to CNS will only be guaranteed to the extent that the Member meets its settlement obligation on the date the item is originally scheduled to settle in CNS. Additionally, the non-CNS obligations being stored in OW are re-priced to the current market value and re-netted during the periodic RECAPS cycle.

Firms can submit real-time input and receive real-time output using MQ messaging as well as within the OW Web browser screens. Firms will also receive end of day reports reflecting their positions.

u/TherealMicahlive from r/Superstonk:

DTCC Obligation Warehouse (FTD Grave Yard)

Quote from 2019 Article: "Instead of complying with the rule, however, DiIorio alleges that Knight circumvented it by manipulating an obscure process within the machinery of the nation’s clearing system known as the “Obligation Warehouse.”

Last one promise: "The Obligation Warehouse instead simply asks the buyer and seller of these ex-cleared trades if they “know” the transaction. If they both agree, the trade gets confirmed with a journal entry — and the buyer receives their stock purchase. It actually shows up in the buyer’s brokerage account."

I lied last one: "Those trades can sit in the Obligation Warehouse forever, in theory. But the “aged fails” — essentially orphaned naked short transactions — remain on the naked shorter’s balance sheet as a liability to be paid later."

Links: https://www.dtcc.com/clearing-services/equities-clearing-services/ow

Blog discussing the OW and how its interesting to say the least

https://tremendous.blog/2022/02/23/how-dtcc-makes-fails-to-deliver-disappear/

2019 Naked Shortselling by KNight: https://theintercept.com/2016/09/24/naked-shorts-cant-stay-naked-forever/

Naked shorting, The (DTCC) Obligation Warehouse, and Securities sold but not yet purchased (WUT MEAN?!)

1)Naked Shorting - the seller does not borrow or arrange to borrow the securities in time to make delivery to the buyer within the standard settlement period (https://www.sec.gov/investor/pubs/regsho.htm)

2) The Obligation Warehouse - Obligation Warehouse (OW) is a non-guaranteed, automated service of NSCC that facilitates the matching of broker-to-broker ex-clearing trades and provides Members with the ability to track, manage and resolve their failed obligations in real-time. Here is a link from SEC 1 (https://www.sec.gov/rules/sro/nscc/2013/34-69694-ex5.pdf)

3) Securities sold but not yet purchased - Securities a Market Maker has sold to participants however they have not gone and located the security so it sits on their books as a liability. Updates 2 times a month RECAPS cycle. (sooooo accurate lol) This is fraud.

TLDRS:

- Year 2024 Obligation Warehouse (FTD Grave Yard) RECAPS Schedule Announced.

- "Those trades can sit in the Obligation Warehouse forever, in theory. But the “aged fails” — essentially orphaned naked short transactions — remain on the naked shorter’s balance sheet as a liability to be paid later."

- "Securities sold but not yet purchased - Securities a Market Maker has sold to participants however they have not gone and located the security so it sits on their books as a liability. Updates 2 times a month RECAPS cycle."