Multiple brokers caught by FINRA stealing millions from retail by forcing over 5 million retail customers into share lending while keeping the profits.

Following up from today's earlier post:

About securities lending:

Fully paid securities lending is a practice through which a clearing firm borrows a customer's fully paid or excess margin securities and lends them to a third party in exchange for a daily borrowing fee. A clearing firm must obtain customer consent before borrowing or lending that customer's securities. Fully paid lending programs are operated by clearing firms, which custody customer securities.

If a customer is enrolled in a fully paid securities lending program, the clearing firm determines which securities to borrow, when, and on what terms. When the clearing firm identifies a security it wants to borrow in an enrolled customer's account, the clearing firm removes the security from the customer's account and deposits collateral (cash or cash equivalents) with a value equal to or greater than the value of the security in a bank account managed by a trustee for the benefit of the enrolled customer. The clearing firm then lends the security to a third party and collects a daily borrowing fee. The borrow rate is variable and generally reflects the market for the borrowed security. For example, a security for which there is high demand and limited supply typically will garner a higher interest rate than a security which is more liquid or for which there is limited demand.

Should a customer wish to sell borrowed securities, the clearing firm will recall them from the third-party borrower ( or otherwise obtain shares to make delivery on the customer's sale). When a customer's shares are borrowed over a dividend payment date, the customer receives a cash payment in lieu of the dividend. Payments in lieu of dividends are taxed as regular income, like nonqualified dividends. Payments in lieu of dividends may be taxed at a higher rate than qualified dividends. Customers who lend their shares out also lose, for the duration of the securities loan, both SIPC protection and voting rights (because voting rights for borrowed shares transfer to the third party borrowing those shares).

The third-party borrowing firm also posts collateral with the clearing firm, keeping the clearing firm net capital neutral.

FINRA pinched 3 other brokers for doing the same, let's review!

Open to the Public Investing, Inc.

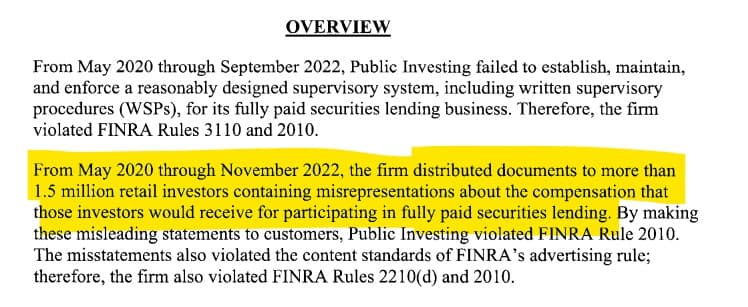

From May 2020 through November 2022, the firm distributed documents to more than 1.5 million retail investors containing misrepresentations about the compensation that those investors would receive for participating in fully paid securities lending.

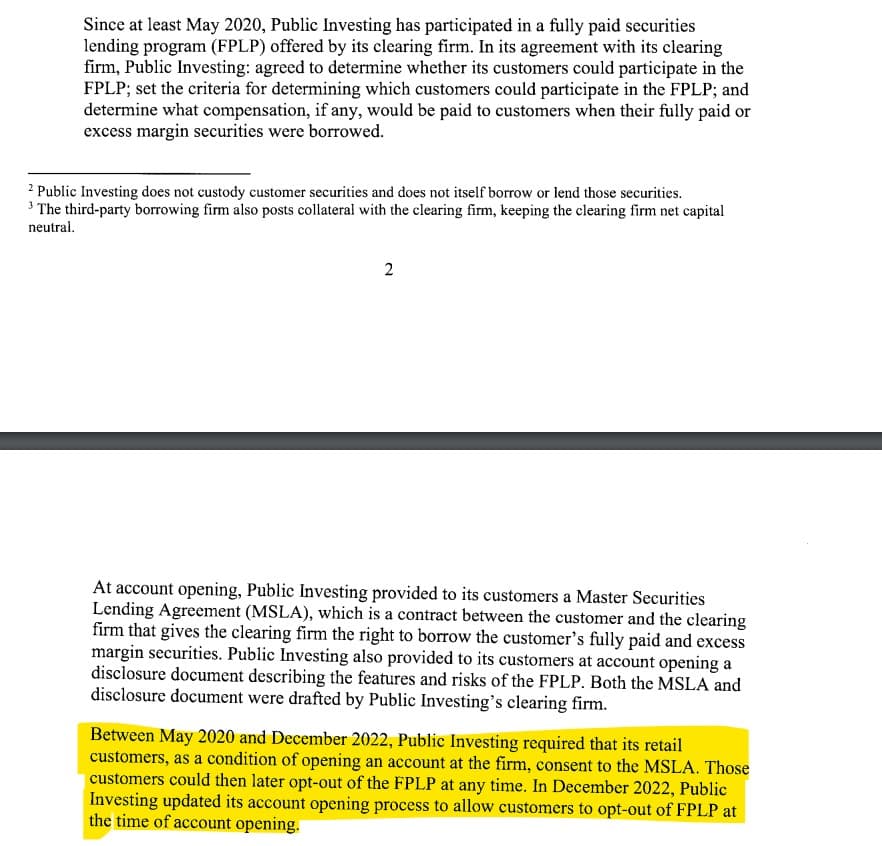

Between May 2020 and December 2022, Public Investing required that its retail customers, as a condition of opening an account at the firm, consent to the MSLA.

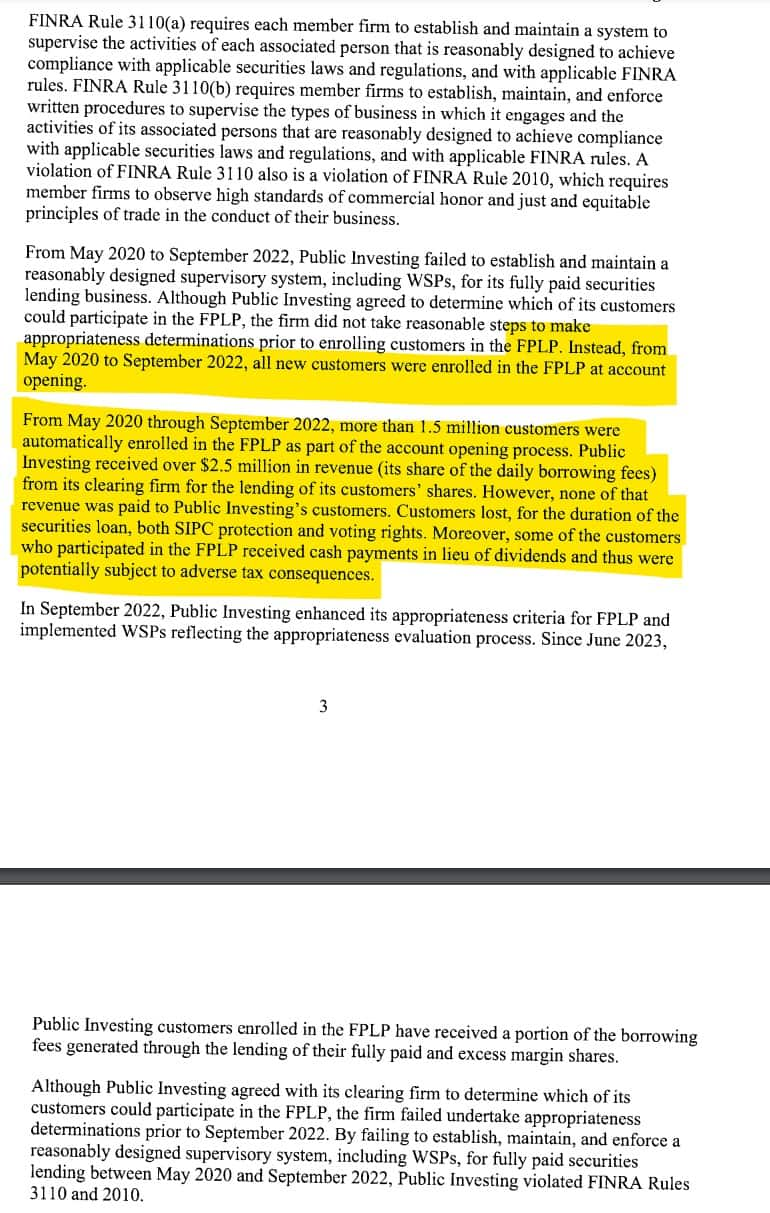

From May 2020 through September 2022, more than 1.5 million customers were automatically enrolled in the FPLP as part of the account opening process. Public Investing received over $2.5 million in revenue (its share of the daily borrowing fees) from its clearing firm for the lending of its customers' shares. However, none of that revenue was paid to Public Investing's customers. Customers lost, for the duration of the securities loan, both SIPC protection and voting rights. Moreover, some of the customers who participated in the FPLP received cash payments in lieu of dividends and thus were potentially subject to adverse tax consequences.

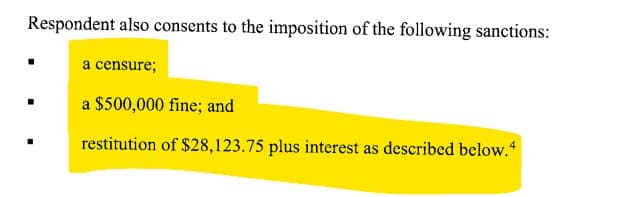

Penalty?:

SogoTrade, Inc. (SogoTrade)

From January 2019 to June 2023, more than 17,000 customers were automatically enrolled in the FPLP as part of the account opening process. SogoTrade received over $2 million in revenue (its share of the daily borrowing fees) from its clearing firm for the lending of its customers’ shares. However, none of that revenue was paid to SogoTrade’s customers. Customers lost, for the duration of the securities loan, both SIPC protection and voting rights. Moreover, some of the customers who participated in the FPLP received cash payments in lieu of dividends and thus were potentially subject to adverse tax consequences.

Penalty?:

M1 Finance LLC (M1 Finance)

From January 2019 to February 2023, the firm distributed documents to more than 1.5 million retail investors containing misrepresentations about the compensation that those investors would receive for participating in fully paid securities lending.

From January 2019 to June 2023, more than 1.5 million customers were automatically enrolled in the FPLP as part of the account opening process. M1 Finance received over $12.5 million in revenue (its share of the daily borrowing fees) from its clearing firm for the lending of its customers’ shares. However, none of that revenue was paid to M1 Finance’s customers. Customers lost, for the duration of the securities loan, both SIPC protection and voting rights. Moreover, some of the customers who participated in the FPLP received cash payments in lieu of dividends and thus were potentially subject to adverse tax consequences.

Penalty?:

Together they all respectively brought in $8 million, $2.5 million, $2 million, $12.5 million and shared none of it with their customers.

What were they fined? $1.6 million. Restitution? $1,071,091.25

How much did the profit? $22,328,908.75

Crime really does pay!

Well over 5 million retail customers were automatically enrolled to have their securities lent!

Considering these are retail accounts setup during the 'meme frenzy' how many of those accounts held GameStop?

How does this affect GameStop?

- 5 million plus retail customers unknowingly lent out shares and, for the duration of the securities loan, LOST both SIPC protection and voting rights (because voting rights for borrowed shares transfer to the third party borrowing those shares)

- Any of those accounts holding GameStop saw these brokers actively working against their investment by loaning out their shares for shorting while not even compensating them!

- For the retail investors, there's a conflict of interest. If their own securities are being used to facilitate short selling, it could contribute to downward pressure on the stock prices, negatively impacting their investment, especially if the stock is heavily shorted like GameStop.

TLDRS:

- Not your name, not your shares!

- 4 firms respectively brought in $8 million, $2.5 million, $2 million, $12.5 million lending retail's shares and shared none of it with their customers.

- After fines and restitution they profited $22,328,908.75

- Well over 5 million retail customers were automatically enrolled to have their securities lent and didn't see a penny form it!

- Considering these are retail accounts setup during the 'meme frenzy' how many of those accounts held GameStop do you think?