FINRA Alert! FINRA Requests Comment on Proposed Changes to TRACE Reporting Relating to Delayed Treasury Spot Trades Comment Period Expires: January 30, 2023

Good evening r/superstonk, neighborhood jellyfish back with another proposed rule change, this time with FINRA. for ease of reading, I have tried to format from the source into the following sections:

- Summary

- Action Requested (comment)

- Background and Discussion

- Proposal Relating to Delayed Treasury Spot Trades

- Economic Impact Assessment

- Regulatory Objective

- Economic Baseline

- Economic Impact

- Effects on Competition

- Alternatives Considered

- Request for Comment Questions

Source: https://www.finra.org/rules-guidance/notices/22-26

Summary

FINRA requests comment on a proposal to provide additional transparency into delayed Treasury spot trades in corporate debt securities—i.e., corporate bond trades where the dollar price of the trade is based on a spread to a benchmark U.S. Treasury security that was agreed upon at an earlier time on the same day. The proposed changes would provide for immediate transparency into the size and spread-based economics of delayed Treasury spot trades by requiring members to report the spread and identify the associated benchmark Treasury security (i.e., the CUSIP or other appropriate identifier) at the time at which the spread is agreed, and then subsequently report the dollar price of the transaction once the trade is spotted.

Action Requested

FINRA encourages all interested parties to comment on this proposal. Comments must be received by January 30, 2023.

Comments must be submitted through one of the following methods:

- Online using FINRA’s comment form for this Notice;

- Emailing comments to [email protected]; or

- Mailing comments in hard copy to:

Jennifer Piorko MitchellOffice of the Corporate SecretaryFINRA1735 K Street, NWWashington, DC 20006-1506

To help FINRA process and review comments more efficiently, persons should use only one method to comment on the proposal.

Important Notes: The only comments that FINRA will consider are those submitted pursuant to the methods described above. All comments received in response to this Notice will be made available to the public on the FINRA website. In general, FINRA will post comments as they are received.

FINRA will not edit personal identifying information, such as names or email addresses, from submissions. Persons should submit only information that they wish to make publicly available.

Before becoming effective, a proposed rule change must be filed with the Securities and Exchange Commission (SEC) pursuant to Section 19(b) of the Securities Exchange Act of 1934 (SEA).

Background and Discussion

A “delayed Treasury spot trade,” as discussed in this Notice, occurs when a market participant trades a corporate debt security on the basis of a spread to a benchmark U.S. Treasury security and agrees to subsequently calculate the dollar price of the trade by “spotting” the benchmark U.S. Treasury security at a designated time. For example, parties may determine to trade a corporate bond at 10:00 a.m. based on a spread to a specified U.S. Treasury security later in the day (e.g., at 3:00 p.m.); therefore, the dollar price subsequently is determined when the parties spot the spread against the benchmark U.S. Treasury security at the later time on the same day, e.g., at 3:00 p.m.

Under current TRACE reporting rules, firms are required to report transactions in corporate bonds within 15 minutes of the time of execution, which is the time when the parties agree to all of the terms of the transaction that are sufficient to calculate the dollar price of the trade. Therefore, in the example above, the delayed Treasury spot trade is not reportable to TRACE until the completion of the spotting process (in this example, at 3:00 p.m.), even though the spread and other terms were agreed upon at an earlier time that day. Further, current TRACE reporting rules require only reporting of the final dollar price, without identifying the transaction as a delayed Treasury spot trade or providing information about the agreed spread or benchmark U.S. Treasury Security.

The SEC’s Fixed Income Market Structure Advisory Committee (FIMSAC) unanimously approved a recommendation for FINRA to, among other things, amend its TRACE reporting rules to provide additional transparency into delayed Treasury spot trades. The FIMSAC noted that, because these trades are currently reported and disseminated only once a dollar price is available—which in some cases can be hours after the spread is agreed upon—the disseminated price may not reflect the market price for the bond at the time of dissemination. The FIMSAC believed that both the regulatory audit trail data and price transparency could be improved if these trades were specifically identified in TRACE data upon dissemination once the dollar price becomes available. Specifically, the FIMSAC believed that the appendage of a modifier identifying delayed Treasury spot trades, along with providing the time at which the spread was agreed, would both alert market participants that the spread-based economics of the trade had been agreed upon at an earlier time that day as well as provide market participants with the ability to estimate the agreed-upon spread.

Following on the FIMSAC’s recommendation, in July 2020 FINRA published Regulatory Notice 20-24 requesting comment on, among other things, proposed changes to the TRACE reporting rules that would require firms to identify delayed Treasury spot trades and report the time at which the spread was agreed upon. FINRA received useful comments in response to Regulatory Notice 20-24, as did the SEC in connection with the subsequent rule filing.

FINRA is now issuing this Notice to solicit comment on a new proposed approach to improving transparency into delayed Treasury spot trades that FINRA believes would provide more timely and complete information in the regulatory audit trail and publicly disseminated data.

Proposal Relating to Delayed Treasury Spot Trades

FINRA is proposing to amend Rule 6730 to provide for a two-part reporting regime in connection with delayed Treasury spot trades. **First, members would be required to report the agreed upon spread and identify the associated benchmark U.S. Treasury security (**i.e., the CUSIP or other appropriate identifier) (along with the other items of information currently associated with a corporate debt TRACE report (other than the dollar price)) as soon as practicable but no later than within 15 minutes of the time that the spread is agreed to. Second, members would be required to supplement the initial report by subsequently reporting the calculated dollar price as soon as practicable, but no later than within 15 minutes of the time the trade is “spotted” to the benchmark U.S. Treasury security.

In both cases, FINRA would disseminate the reported information immediately upon receipt, providing immediate transparency into the volume of the corporate bond trade as well as the agreed upon spread and benchmark security, and subsequently into the final dollar price of the transaction.

The proposed two-step process would provide market participants with timelier and more complete information about delayed Treasury spot trades than is currently available or would have become available under the prior proposal. As noted above, members are already required to report the final dollar price within 15 minutes of the time of execution. Therefore, the proposal would only change existing reporting requirements by adding a requirement to report the agreed spread and benchmark U.S. Treasury security at the time those terms are agreed.

Economic Impact Assessment

FINRA has undertaken an economic impact assessment, as set forth below, to analyze the potential economic impacts, including anticipated costs, benefits, and distributional and competitive effects, relative to the current baseline, and the alternatives FINRA considered in assessing how to best meet its regulatory objectives. FINRA invites comments on all aspects of this assessment and requests that commenters provide empirical data or other factual support wherever possible.

Regulatory Objective

As discussed above, members are currently required to report delayed Treasury spot trades to TRACE when the dollar price of the transaction has been determined by spotting the benchmark U.S. Treasury security at the designated time. Under the current reporting rules, these trades are not disseminated through TRACE until the dollar price is known and the trade is reported. Disseminating the spread, volume, time of execution and other transaction information at the time the parties agree to the trade would support price formation and increase transparency. Furthermore, as noted above, because the trade was negotiated at an earlier time that day, the disseminated dollar price may not be reflective of the market price for the bond at the time of dissemination. Currently such trades are not identified in the disseminated data as having a price that potentially is off market.

This pricing information may therefore be less informative for market participants that rely on TRACE for price discovery or other analyses. The proposal would provide the market with timelier information about these trades, including the negotiated spread and benchmark U.S. Treasury security at the time of the agreement, and also will continue to provide the market with the dollar price of the transactions when available. Because such reports would be linked to the earlier report, market participants would be aware that the disseminated dollar price relates to a delayed Treasury spot trade and therefore may not be reflective of the market price at the time of dissemination.

Economic Baseline

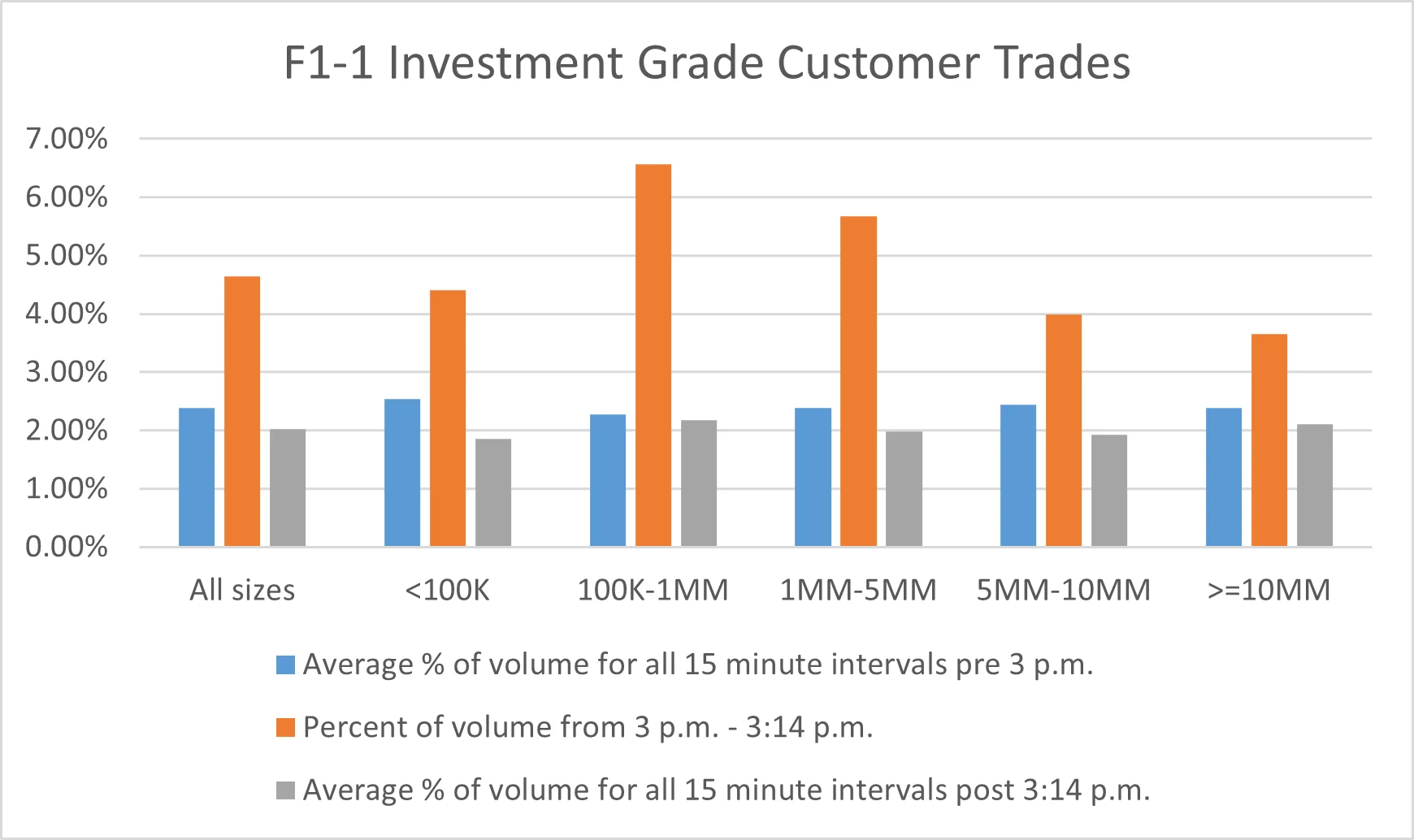

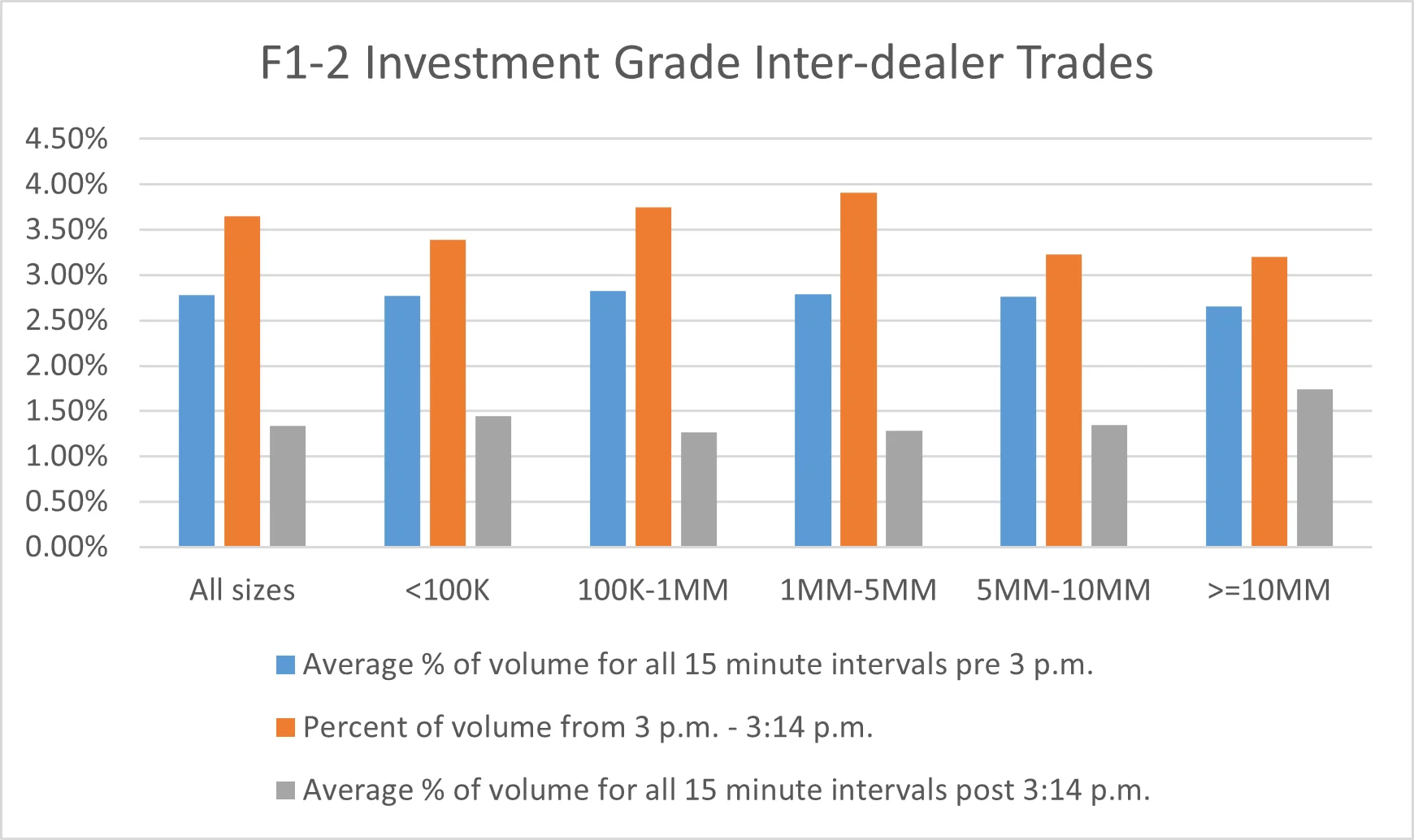

Delayed Treasury spot trades are currently not identified in the TRACE data; therefore, in establishing the economic baseline, FINRA has sought to identify the TRACE-reported trades most likely to be associated with delayed Treasury spot trades. Using TRACE data from January 2021 to December 2021, FINRA examined the daily average concentration of corporate bond trades around 3:00 p.m., which FINRA understands to be the “spotting” time dealers usually use for delayed Treasury spot trades. Figures F1-1 and F1-2 below compare the percentage of trades during the 3:00 p.m. to 3:14 p.m. time interval with: (1) the average percentage of trades for all 15-minute intervals before 3:00 p.m.; and (2) the average percentage of trades for all 15-minute intervals after 3:14 p.m. Figures F1-1 and F1-2 also provide these trade distributions based on the size of trades and for all trades combined. These data are likely to either overcount the number of delayed Treasury spot trades because some of the trades executed in the time interval are not delayed Treasury spot trades, or undercount because they exclude delayed Treasury spot trades executed at other times during the day. Nevertheless, given the current unavailability of a trade identifier, FINRA believes this methodology will provide a reasonable baseline for the analysis.

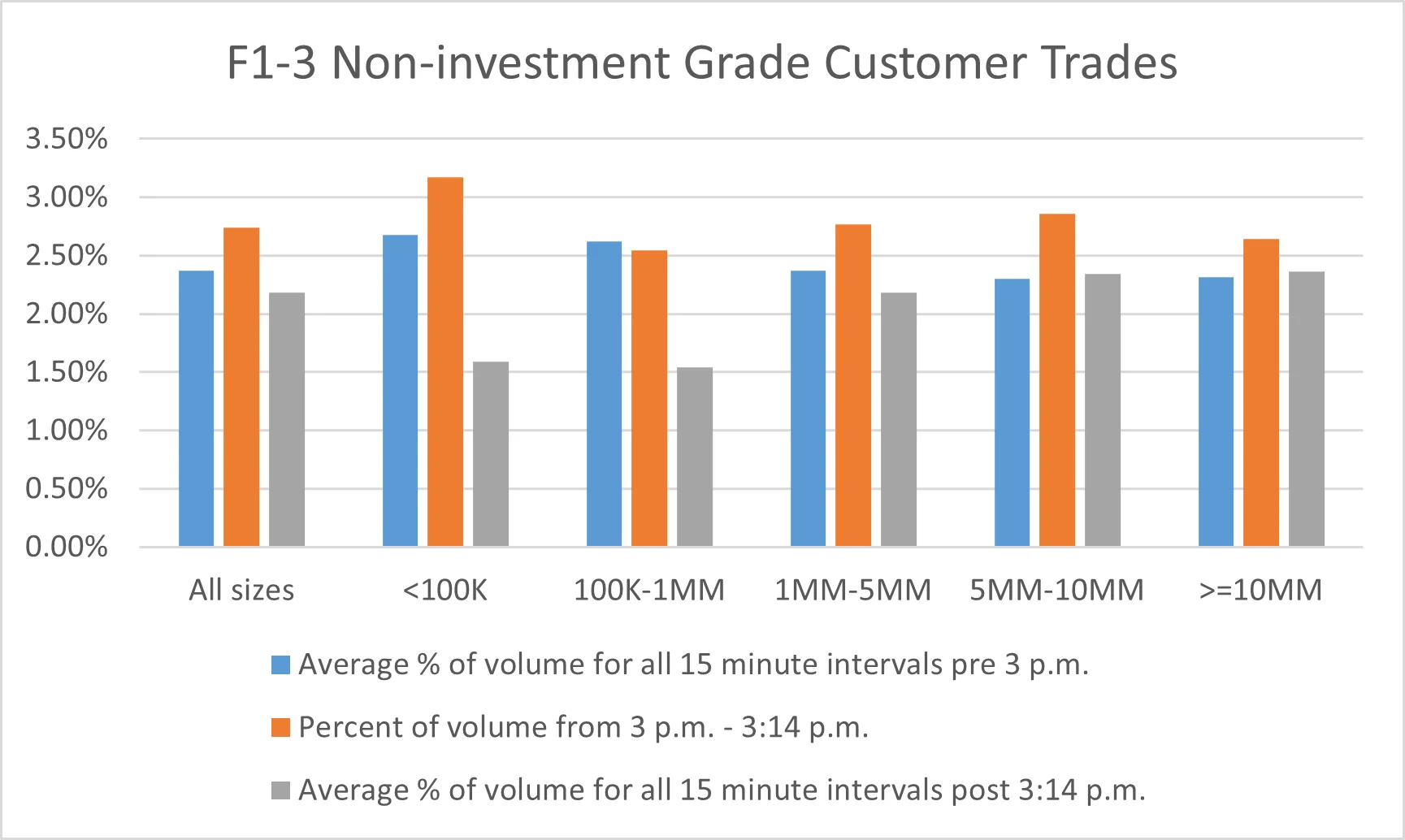

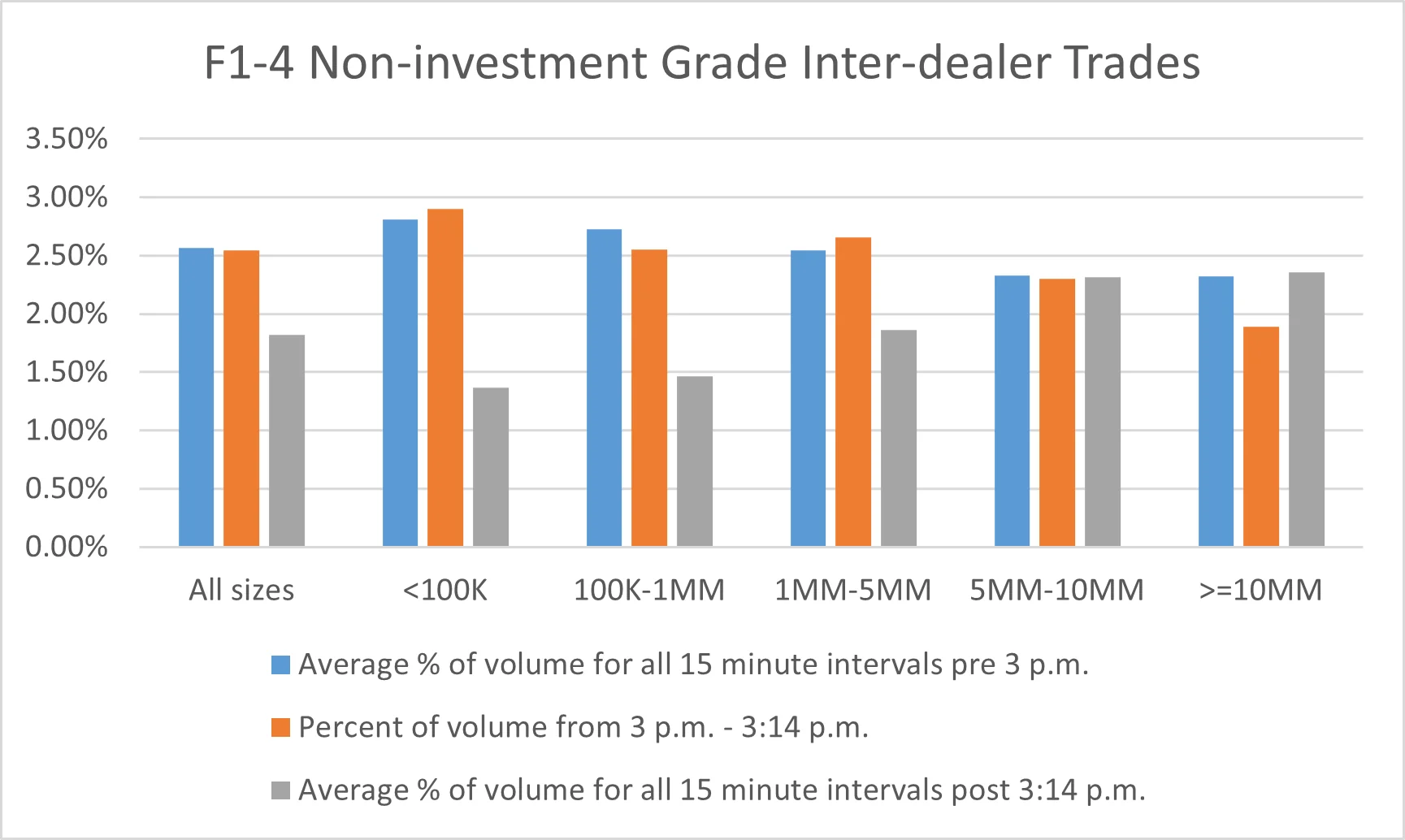

Figure F1-1 provides statistics for customer trades in investment grade bonds and Figure F1-2 provides statistics for inter-dealer trades in investment grade bonds. Figures F1-1 and F1-2 show that, across all trade sizes in investment grade bonds, volumes in the 3:00 p.m. trade interval are larger than both the pre-3:00 p.m. and the post-3:14 p.m. intervals. For investment grade customer trades, the 3:00 p.m. to 3:14 p.m. volumes are several times larger than both the pre-3:00 p.m. and the post-3:14 p.m. intervals. Figures F1-3 and F1-4 provide similar information for trades in non-investment grade bonds. These figures show that the differences in trades across the time intervals are much less material in non-investment grade bond trades. Although trades during the 3:00 p.m. to 3:14 p.m. time interval may not all be delayed Treasury spot trades, the stark increase in investment grade bond volume during the period is consistent with FINRA’s understanding of when delayed Treasury spot trades are priced and reported (regardless of when the spread was agreed upon), especially for investment grade corporate bond trades.

Figure 1: Distribution of Corporate Bond Trading Volume During Trading Hours (January 2021 to December 2021)

Economic Impact

The proposed requirement that members report the spread and benchmark U.S. Treasury security for delayed Treasury spot trades at the time when the spread is agreed upon would allow FINRA to disseminate valuable information to the marketplace sooner regarding such trades. Specifically, more timely insight into spread and volume information regarding a delayed Treasury spot trade would help the market to understand the pricing of the bonds and traded volume. In addition, disseminating the dollar price along with an indication that the transaction is a delayed Treasury spot trade would eliminate potential confusion that may result from the dissemination of a dollar price that may not reflect the market price for the security at the time of dissemination because it was negotiated on a spread basis earlier in the day. Thus, the proposal will increase post-trade transparency, provide clarity on the nature of reported trades, facilitate investors’ execution quality analysis by providing more accurate and timelier trade and price information, and support price formation.

Members would incur costs to modify systems to report delayed Treasury spot trades, including the spread and benchmark U.S. Treasury security, at the time the spread is agreed upon. These costs may be higher for members that house relevant information, including the negotiated spread or the benchmark Treasury security, in a different platform or system that is not connected to its TRACE reporting system. In addition, members would be required to subsequently report to TRACE once the dollar price is determined and ensure that such subsequent reports are accurately associated with the correct earlier report.

Effects on Competition

FINRA does not believe that the proposal will unduly burden competition. The costs associated with implementing the necessary changes under the proposal may correlate with how actively a firm engages in delayed Treasury spot trades. For example, firms with no activities in delayed Treasury spot trades may not need to update their system; firms with limited activities may choose to manually input the new trade reports; firms with significant activities may choose to automate any necessary process changes. Firms can also use third-party vendors to report the new information, which may allow firms to take advantage of lower costs due to economies of scale.

FINRA anticipates that increasing transparency into delayed Treasury spot trades as described in this proposal would provide all market participants with important information, such as the negotiated spread, the benchmark Treasury security and the traded volume, for transactions in corporate bonds. This increased information availability may, in turn, encourage dealers to provide greater liquidity to the market and provide customers with more information with which to assess the market for a security. Thus, FINRA anticipates that the proposal will enhance competition among broker-dealers participating in the corporate bond market.

Alternatives Considered

As discussed above, FINRA previously issued Regulatory Notice 20-24 proposing, among other things, changes to TRACE reporting for delayed Treasury spot trades. The approach proposed in Regulatory Notice 20-24 would have required firms to continue to report such trades only once the dollar price for the transaction is known, but would have required members to append a modifier to identify the trades as delayed Treasury spot trades and to report the earlier time at which the spread was agreed upon. FINRA is now issuing this Notice to solicit comment on a modified approach to improving transparency into delayed Treasury spot trades that FINRA believes would provide more timely and complete information in the regulatory audit trail and publicly disseminated data.

Request for Comment

FINRA requests comment on all aspects of the proposal. FINRA requests that commenters provide empirical data or other factual support for their comments wherever possible. In addition to general comments, FINRA specifically requests comments on the following questions:

- FINRA requests comment on whether the proposal would provide useful information to the marketplace. Why or why not?

- Would the proposal benefit some market participants more than others? If so, why?

What challenges do commenters anticipate with reporting the spread and benchmark U.S. Treasury security at the time the spread is agreed, and then reporting the dollar price when known?

- How do firms that engage in delayed Treasury spot trades internally record the agreed upon spread and the benchmark CUSIP for trades?

- FINRA’s understanding is that it is unusual for the material terms of a delayed Treasury spot trade to change once the spread and benchmark U.S. Treasury security are agreed upon. Do market participants agree? Are there circumstances under which the material terms of a trade (e.g., the agreed upon spread or the identity of the benchmark security) may change prior to the agreed upon spot time?

- How frequently are agreed upon delayed Treasury spot trades cancelled prior to the “spotting” time? What are the reasons for such cancellations?

- What operational or other challenges would be associated with implementing the proposal? How do these challenges compare to those associated with the prior proposal?

What costs are associated with the proposal? How do these costs compare to the costs associated with the prior proposal as set forth in Regulatory Notice 20-24?

- What costs are associated with modifying firms’ reporting systems to report pursuant to the proposal? How do these costs compare to the costs associated with the prior proposal?

- Will there be any other costs for TRACE reporters or other market participants related to the proposal? If so, please describe.

- Will the requirements of the proposal impose costs on some reporters more than others? If so, why?

- How much time would firms need to make systems and other changes required to implement the proposal?

- Are there any modifications or alternatives to the proposal that FINRA should consider in providing additional insight into delayed Treasury spot trades? Please describe in detail.

- For example, should FINRA consider requiring firms to report a delayed Treasury spot trade at the time the spread is agreed upon, as described in this proposal, without requiring firms to subsequently report the dollar price when known? Why or why not?

- Should FINRA instead consider permitting firms to report the transaction details as they do today (i.e., report the trade only once the dollar price is known), but require firms to append at that time a new flag identifying the trade as a delayed Treasury spot trade?

- If FINRA were to permit firms to report transaction details as they do today (i.e., only once the dollar price is known), would it be beneficial to require firms to also report the spread and benchmark U.S. Treasury security at that time (which FINRA would disseminate)?

- In Regulatory Notice 20-24, FINRA requested comment on its understanding that the most common pricing benchmark used for delayed Treasury spot trades is the on-the-run U.S. Treasury security with the maturity that corresponds to the maturity of the corporate bond being priced (e.g., the most recently issued 10-year U.S. Treasury security typically is used as the benchmark for pricing a 10- year corporate bond issue). Commenters expressed agreement with this understanding. Given this understanding, should FINRA require firms to report the benchmark U.S. Treasury security along with the spread? How confident are market observers that they share the same understanding of the specific U.S. Treasury security used as the benchmark?

- What operational or other challenges would be associated with these or other alternatives?

- As noted in endnote #4, FINRA issued Regulatory Notice 22-17 requesting comment on a proposal to shorten the trade reporting timeframe for transactions in certain TRACE-Eligible securities, including corporate bonds, from 15 minutes to one minute. If that proposal is adopted, the timeframe for reporting the final dollar price for delayed Treasury spot trades would coincide with the reporting timeframe for transaction reports in corporate bonds. Should FINRA also require firms to report the spread and benchmark U.S. Treasury security as soon as practicable but no later than within one minute of the time at which the spread was agreed for delayed Treasury spot trades? Why or why not?

Market participants also engage in spread trades on a non-delayed basis where they negotiate a trade for a corporate bond, or other TRACE-eligible security, on the basis of a spread to a benchmark (U.S. Treasury security or otherwise) that is immediately converted to a dollar price. With respect to such non-delayed spread trades:

- FINRA understands that, in many cases, the spread for non-delayed spot trades can be immediately deduced based on the disseminated dollar price and U.S. Treasury spread at the time of the trade. Is this an accurate understanding?

- FINRA requests comment on whether it would, on balance, be beneficial to the marketplace if members were required to report, and FINRA disseminated, the agreed upon spread for non-delayed spread trades. Why or why not?

- If the spread price were required to be reported and disseminated for non-delayed spread trades, should the dollar price also be required to be reported and disseminated? Why or why not?

- If the spread price were required to be reported and disseminated for non-delayed spread trades, should the benchmark used to calculate the dollar price also be required to be reported and disseminated? Why or why not?

- Might the benefits and costs of the proposal be different if FINRA were to also require reporting of the spread for non-delayed spread trades? If so, how?