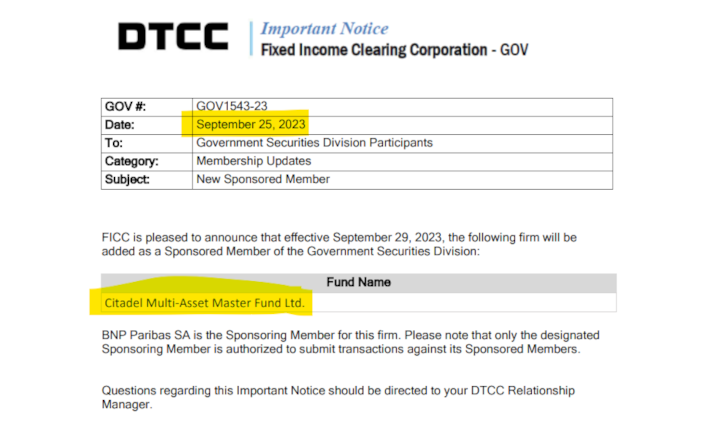

FICC-GOV New Sponsored Member: Citadel Multi-Asset Master Fund Ltd.

FICC’s Sponsored Service allows certain Netting Members to sponsor, as Sponsoring Members, eligible legal entities, as Sponsored Members, into FICC/GSD Membership. A Sponsoring Member is permitted to submit to FICC on behalf of its Sponsored Members, transactions in eligible securities for comparison and novation.

Overview:

Sponsoring Members facilitate the submission of their Sponsored Members’ trading activity to FICC. For operational and administrative purposes, FICC interacts solely with the relevant Sponsoring Member as processing agent for purposes of the day-to-day satisfaction of its Sponsored Members’ obligations to or from FICC, including their securities and funds-only settlement obligations.

Sponsored Service includes two offerings:

- Sponsored DVP service – offers eligible clients the ability to lend cash or eligible collateral via FICC-cleared DVP repo transactions in U.S. Treasury and Agency Securities on an overnight and term basis, as well as outright purchases and sales of such securities, to be settled on a Delivery-vs-Payment (DVP) basis, and

- Sponsored General Collateral (GC) service – offers eligible clients the ability to execute general collateral repo transactions (in the same asset classes currently eligible for Netting Members to transact in via FICC’s existing GCF Repo® Service) with each other and settle such repo transactions on the tri-party repo platform of BNY Mellon.

Benefits:

FICC’s Sponsored Service has made it possible to bring a much larger percentage of the market into clearing, while still maintaining robust risk management standards.

The Sponsored service offers the following benefits to Sponsoring Members, Sponsored Members and the U.S. financial market:

- Reduction of Counterparty Risk: Central clearing reduces counter-party risk through FICC’s guarantee of the completion of settlement in a Member default scenario.

- Balance Sheet and Capital Relief Opportunities: Central clearing of repo transactions at FICC could alleviate constraints on Members by enabling them to reduce capital usage via novation and balance sheet netting. The Sponsored Service provides Sponsoring Members with the ability to offset on their balance sheets their obligations to FICC on Sponsored Member Trades with their Sponsored Members against their obligations to FICC on other eligible FICC-cleared activity, including trades with other Netting Members.

- Market Liquidity: The service may allow eligible institutional firms to engage in greater activity than otherwise feasible outside of central clearing, thereby promoting greater market liquidity and helps to mitigate the risk of a large-scale exit by institutional firms from the U.S. financial market in a stress scenario. Furthermore, enabling more term (rather than overnight) repo activity in the service can serve to help reduce repo rate volatility in the market.

Risk Management:

- The Sponsoring Member is responsible to FICC for posting all of the Clearing Fund associated with the activity of its Sponsored Members. This activity is captured in the Sponsoring Member Omnibus Account. The Clearing Fund requirement for the Sponsoring Member Omnibus Account is calculated twice daily on a gross basis. For Clearing Fund calculation purposes, each Sponsored Member’s trading activity is risk margined separately and the sum of the individual Sponsored Member risk charges constitutes the Clearing Fund requirement for the Sponsoring Member Omnibus Account, which is collected and held by FICC separate from the Clearing Fund posted by the Sponsoring Member for its Sponsoring Member netting account.

- While the Sponsored Members are principally liable to FICC for their securities and funds-only settlement obligations, the Sponsoring Member is required to provide a guaranty to FICC with respect to all obligations of its Sponsored Members, so that if a Sponsored Member does not satisfy any of its obligations to FICC, FICC can invoke the Sponsoring Member’s guaranty.

- Liquidity needs created by activity in the Sponsoring Member Omnibus Account are considered when calculating the Sponsoring Member’s Capped Contingent Liquidity Facility (CCLF) requirement. Because Sponsored Member Trades between a Sponsoring Member and its Sponsored Member do not independently create liquidity risk for FICC, FICC recognizes for the Sponsoring Member’s CCLF calculations any offsetting settlement obligations as between a Sponsoring Member’s netting account and its Sponsoring Member Omnibus Account.

Sponsored DVP service:

Sponsored DVP service offers eligible clients the ability to lend cash or eligible collateral via FICC-cleared DVP repo transactions in U.S. Treasury and Agency Securities on an overnight and term basis, as well as outright purchases and sales of such securities, to be settled on a Delivery-vs-Payment basis.

Eligible securities types include:

- U.S. Treasury Bills, Bonds and Notes

- U.S. Treasury Inflation Protected Securities (TIPS)

- U.S. Treasury STRIPS

- Non-Mortgage-Backed Agency Securities

- Floating Rate Notes (FRNs)

Sponsoring Members, at their discretion, have the ability to let their clients trade with counterparties other than themselves, providing Sponsored Members with the same execution flexibility they have in the bilateral market today.

Sponsored GC service:

The Sponsored GC service allows Sponsoring Members to transact financing transactions with their Sponsored Members on a general collateral (GC) basis and settle those transactions on the tri-party repo platform of BNY Mellon in a similar manner to the way Sponsoring Members and Sponsored Members settle tri-party repo transactions with each other outside of central clearing, thereby making it more operationally efficient for them to submit for central clearing repo transactions (including term repo transactions) with each other.

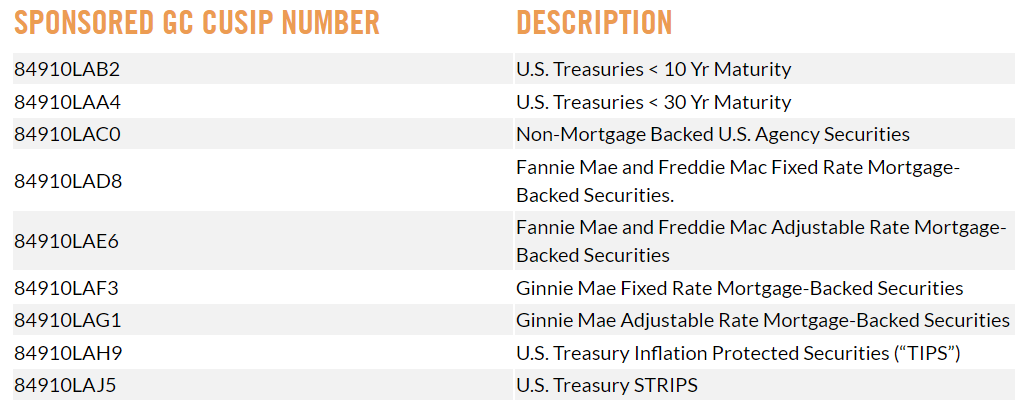

The Sponsored General Collateral (GC) service is transacted using the following Generic CUSIP Numbers (Sponsored GC CUSIP Numbers):

- Collateralization: Each Sponsored GC Trade is required to be fully collateralized with securities eligible under the applicable Sponsored GC CUSIP Number and/or cash.

- Settlement: Consistent with the manner in which tri-party repo transactions are settled today outside of central clearing, the Start Leg of a Sponsored GC Trade settles on a trade for trade basis on the tri-party repo platform of BNY Mellon between the Sponsoring Member and the Sponsored Member.

- Novation: Novation to FICC of the End Leg of a Sponsored GC Trade occurs after the Start Leg of the Sponsored GC Trade has fully settled on the tri-party repo platform of BNY Mellon by the 5:30PM NYT deadline and BNY Mellon has provided FICC a report with information regarding the specific securities that were delivered in Start Leg settlement.

- Repo Interest: BNY Mellon on FICC’s behalf, administers the collection and payment of repo interest on a daily basis as between the Sponsoring Member and Sponsored Member (deadline 12:00 PM NYT, except on the Scheduled Settlement Date of the End Leg where it will be passed as part of End Leg settlement).

- Haircuts: Consistent with the parameters of the existing Sponsored Service, a Sponsoring Member and Sponsored Member can also elect (as a commercial matter) to transfer haircut in the form of additional collateral above 100% of the cash value lent.

More Information:

- Download the Sponsored Service Fact Sheet.

- Download the Sponsored GC Fact Sheet.

- Download answers to FAQs.

- View the Sponsored Service Volumes.

- Request additional information.

TLDRS:

- FICC-GOV New Sponsored Member: Citadel Multi-Asset Master Fund Ltd.

- BNP Paribas SA is the Sponsoring Member

- All sorts of services available to Citadel including:

- "The service may allow eligible institutional firms to engage in greater activity than otherwise feasible outside of central clearing, thereby promoting greater market liquidity and helps to mitigate the risk of a large-scale exit by institutional firms from the U.S. financial market in a stress scenario."