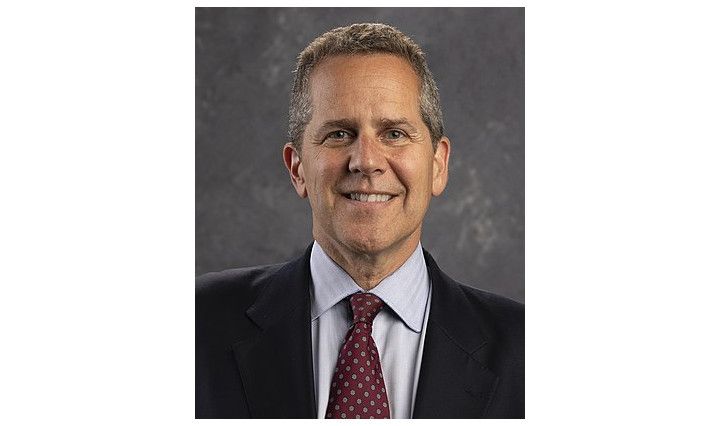

Fed Vice Chair for Supervision Michael S. Barr: "It is particularly important for us to consider a range of market shocks because some concentrated counterparty exposures may be revealed only under certain scenarios."

Highlights:

- "A recent study confirms this experience, finding that banks subject to the stress test were less exposed to common systemic risks. In addition, the stress test helps to make capital requirements less susceptible to gaming by firms and therefore more likely to be set at adequate levels. This is so because the design of the scenario can change based on our observations of growing risks in the system."

- "As we move forward, we must remain cognizant that none of us can predict future stressful events and their consequences with confidence."

Limitations of Stress Testing

- "First, the current stress test uses a single scenario that is focused on a credit-driven recession and single global market shock to test the financial condition of firms. A single scenario cannot cover the range of plausible risks faced by all large banks. This has been confirmed time and time again, including in recent experience."

- "The failures of three large banks last spring showed that acute banking strains can emerge even without a severe recession."

- "the Federal Reserve's stress testing policy statement requires that the severely adverse scenario include a rapid increase in the unemployment rate to at least 10 percent, as well as steep declines in house prices. Such conditions are historically associated with subdued inflation and a fall in interest rates. The fact that significant banking stress emerged in very different conditions underscores the limitations of our current stress testing processes."

- "We also do not take into account second-order effects of stress within the financial system, which are channels that amplify the effects of the shocks hitting bank's balance sheets, leading to losses spreading throughout the financial system. A good example of this is the reaction of funding markets to stress at an individual firm or many firms. These network effects may result in losses across the system not fully captured by our stress tests."

- "our stress tests may not fully capture the evolving interconnections in today's financial system."

- "However, all models have limitations—they are generally trained on historical data and therefore may not be robust to structural breaks, such as a once-in-a-lifetime pandemic, or important changes in technology"

- "The third limitation is how the stress test affects bank behavior. Using scenarios that test for the same underlying risks year after year could disincentivize firms from investing in their own risk management as the test becomes predictable, and may encourage concentration across the system in assets that receive comparably lighter treatment in the test."

Expanding the Risks Captured in the Stress Test

- "With respect to market risk, the current single market shock used in the test is a one-time shock to several thousand variables in bank trading books. This is just one realization of a large set of risk factors that determine changes in market values."

- "Using additional market shocks would help us understand how the trading books and counterparty concentrations of firms would change under a range of financial conditions."

- "This could include testing the exposure of firms to different directional risks, such as a sudden rise or fall in certain asset values, or to an unexpected divergence in values of correlated assets."

- "It is particularly important for us to consider a range of market shocks because some concentrated counterparty exposures may be revealed only under certain scenarios."

Using the Additional Stress Test Results

- "Additional exploratory stress test scenarios could allow supervisors to better probe the internal risk management of firms and assess whether they are holding sufficient capital for their risks."

- "For example, the 2018 stress test revealed that one firm had highly concentrated counterparty exposures that would materialize under the hypothetical stress scenario. This led to supervisory feedback to that firm and its prompt mitigation of the concern"

- "Large banking organizations should maintain a solid line of sight into their own risks and focus their efforts to capture those risks and determine capital needs. Our stress test is designed to provide a consistent measure of risk across firms, and is not a replacement for comprehensive modeling, risk management, and capital planning by the largest banks that enable them to measure and manage their own unique risks."

Conclusion

- The stress test needs to continue to evolve. Introducing multiple exploratory scenarios—both for the broader macroeconomic scenario and the global market shock for trading banks—would be beneficial for supervising potential risks on bank balance sheets.

Wut Mean?:

The stress test, as known today, originates from the 2009 Supervisory Capital Assessment Program, introduced during the global financial crisis. During 2008-09, due to market uncertainties, the Federal Reserve and Treasury examined the 19 largest banks' health in an adverse economic scenario, publishing the findings.

Dodd-Frank Act made it mandatory for the Federal Reserve to annually stress-test large banks. This test, and its supporting data collection, is pivotal for assessing and ensuring bank resilience.

However, Batt calls out the stress test has limitations. One is its reliance on a single scenario centered on a credit-fueled recession. This doesn't cater to all potential risks. Recent events, such as the failure of banks, showed that banking pressures can arise even without a severe recession. The current process also doesn't consider the amplifying effects of financial system stresses.

"We also do not take into account second-order effects of stress within the financial system, which are channels that amplify the effects of the shocks hitting bank's balance sheets, leading to losses spreading throughout the financial system."

Another limitation is the models used. While they're based on historical data, they might not be robust against unprecedented events like pandemics or technological disruptions. Lastly, Barr notes that repeated testing for the same risks might lead banks to neglect their risk management, as the test becomes predictable.

Barr believes to mitigate these, the idea is to include exploratory stress test scenarios. These won't be used for determining a firm's stress capital buffer but will offer insights into the banks' risk management.

On the macroeconomic front, these scenarios might investigate different financial conditions. Market risks can also be diversified by using varying shocks, capturing effects of different financial conditions or sudden asset value changes...

The Federal Reserve has started developing both exploratory macroeconomic scenarios and market shocks for the upcoming stress test. The results will not be for capital buffer calculations but for improving the understanding of risks.

Although stress test results are informative, they shouldn't replace a firm's own risk management or stress testing processes. Banks should maintain an in-depth understanding of their risks, ensuring that they have mechanisms to capture and manage them.

TLDRS:

Fed Vice Chair for Supervision Michael S. Barr calls out "the stress test needs to continue to evolve":

- "As we move forward, we must remain cognizant that none of us can predict future stressful events and their consequences with confidence."

- "It is particularly important for us to consider a range of market shocks because some concentrated counterparty exposures may be revealed only under certain scenarios."

- "A single scenario cannot cover the range of plausible risks faced by all large banks. This has been confirmed time and time again, including in recent experience."

- "We also do not take into account second-order effects of stress within the financial system, which are channels that amplify the effects of the shocks hitting bank's balance sheets, leading to losses spreading throughout the financial system."