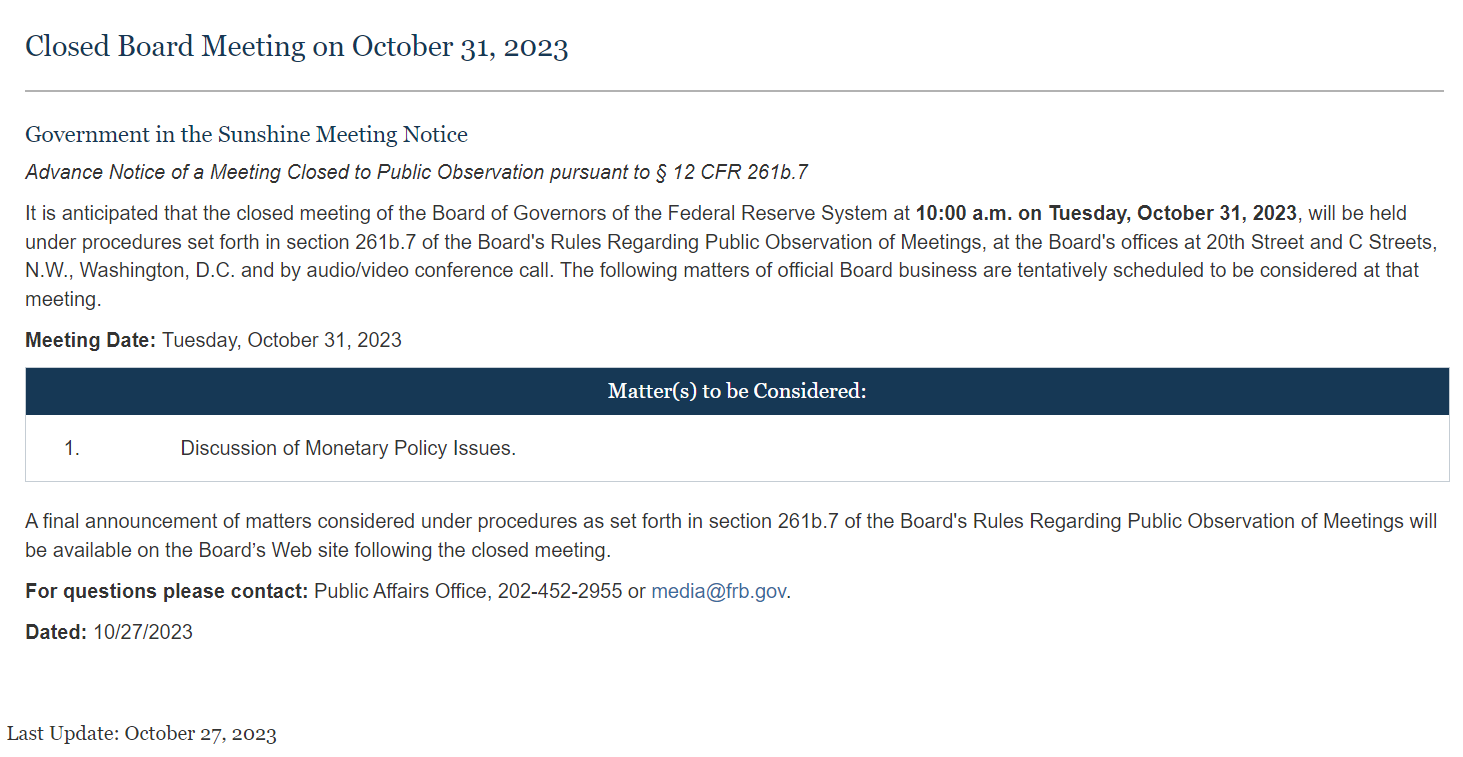

Government in the Sunshine Meeting Notice! Advance Notice of a Meeting CLOSED to Public of the Board of Governors of the Federal Reserve System at 10:00 a.m. on Tuesday, October 31, 2023 for a discussion of Monetary Policy Issues.

TLDRS:

- Advance Notice of a Meeting CLOSED to Public of the Board of Governors of the Federal Reserve System at 10:00 a.m. on Tuesday, October 31, 2023 for a discussion of Monetary Policy Issues.

- On the heels of:

- DTCC: A Protocol Activation Event has occurred. ISDA Determinations Committee: a credit event has taken place with respect to Country Garden Holdings Company Limited.

- A credit event is a sudden and tangible (negative) change in a borrower's capacity to meet its payment obligations, which triggers a settlement under a credit default swap (CDS).

- Regulators talking about the too big to fail label for other entities.

- Fed Vice Chair for Supervision Michael S. Barr: "It is particularly important for us to consider a range of market shocks because some concentrated counterparty exposures may be revealed only under certain scenarios."

- Treasury International Capital Data for August: China sells the most U.S. securities in 4 years.

- Senior officials from the Bank of England, FDIC, CFTC, SEC, & the Fed convened a hybrid meeting today "to discuss certain issues relating to the resolution of a central counterparty (CCP)."

- DTCC: A Protocol Activation Event has occurred. ISDA Determinations Committee: a credit event has taken place with respect to Country Garden Holdings Company Limited.

- Canada's Financial System Regulator: "we now consider CRE to be a higher risk item" "Elevated inflation puts pressure on retail, corporate, & commercial borrowers' ability to service debt."

- S&P Global Market Intelligence: US corporate bankruptcies showed no signs of slowing in September, closing out the quarter with the most bankruptcies (62) so far in 2023.

- Fed Governor Michelle Bowman: "I am also monitoring the potential financial stability implications of nonperforming CRE loans that are packaged as part of commercial mortgage-backed securities (CMBS)."

- Financial Stability Board calls out Swiss Government handling of Credit Suisse, stating they ignored accepted resolution frameworks. I argue they did it for the 50 years of secrecy.

- Fed Vice Chair for Supervision Michael S. Barr: The rise in required capital is for activities that have generated outsized losses at large banks & areas where current rules have shortcomings.