Federal Reserve Alert! The final 2022 quarterly Senior Credit Officer Opinion Survey on Dealer Financing Terms (SCOOS) released today.

Source: https://www.federalreserve.gov/data/scoos/files/scoos_202212.pdf

The Senior Credit Officer Opinion Survey on Dealer Financing Terms (SCOOS) is a quarterly survey providing information about the availability and terms of credit in securities financing and over-the counter (OTC) derivatives markets. The SCOOS is modeled after the long-established Senior Loan Officer Opinion Survey on Bank Lending Practices, which provides qualitative information about changes in supply and demand for loans to households and businesses at commercial banks.

The SCOOS collects qualitative information on credit terms and conditions in securities financing and OTC derivatives markets, which are important conduits for leverage in the financial system. The survey panel for the SCOOS began by including 20 dealers and over time has been expanded. These firms account for almost all of the dealer activity in dollar-denominated securities financing and OTC derivatives markets. The survey is directed to senior credit officers responsible for maintaining a consolidated perspective on the management of credit risks.

Summary

The December 2022 Senior Credit Officer Opinion Survey on Dealer Financing Terms collected qualitative information on changes in credit terms and conditions in securities financing and over-the-counter (OTC) derivatives markets. In addition to the core questions, the survey included a set of special questions about the provision of funding collateralized by agency residential mortgage-backed securities (RMBS) to trading real estate investment trust (REIT) clients and management of the associated counterparty risk.

The 20 institutions participating in the survey account for the vast majority of dealer financing of dollar-denominated securities to non-dealers and are the most active intermediaries in OTC derivatives markets. The survey was conducted between November 8, 2022, and November 21, 2022. The core questions asked about changes between mid-September 2022 and mid-November 2022.

With regard to the credit terms applicable to, and mark and collateral disputes with, different counterparty types across the entire range of securities financing and OTC derivatives transactions, responses to the core questions revealed the following:

- Roughly two-fifths of dealers, on net, reported that price terms on securities financing transactions and OTC derivatives offered to trading REITs have tightened over the past three months, and one-third reported tightening of price terms to nonfinancial corporations (see the exhibit “Management of Concentrated Credit Exposures and Indicators of Supply of Credit”). In addition, about one-fourth of dealers indicated a tightening of price terms to hedge funds, mutual funds, exchange-traded funds, pension plans, endowments, and investment advisors to separately managed accounts.

- About one-third of dealers reported that nonprice terms, such as haircuts, maximum maturity, or covenants, tightened somewhat for hedge funds over the past three months. About one-fourth of dealers indicated tightening of nonprice terms for trading REITs, and one-fifth indicated tightening for nonfinancial corporations. Nonprice terms remained basically unchanged for other client types.

- For both trading REITs and nonfinancial corporations, dealers cited deterioration in current or expected financial strength of counterparties as the most important reason for the tightening of price and nonprice terms. For hedge funds, mutual funds, exchange-traded funds, pension plans, endowments, and investment advisors to separately managed accounts, worsening in general market liquidity and functioning was cited as the main reason for the tightening.

- Respondents indicated that resources and attention devoted to managing concentrated credit exposure to dealers and central counterparties remained basically unchanged. Over one-half of respondents indicated that changes in central counterparty practices have affected, to at least a small degree, the credit terms they offer to clients on bilateral transactions that are not cleared.

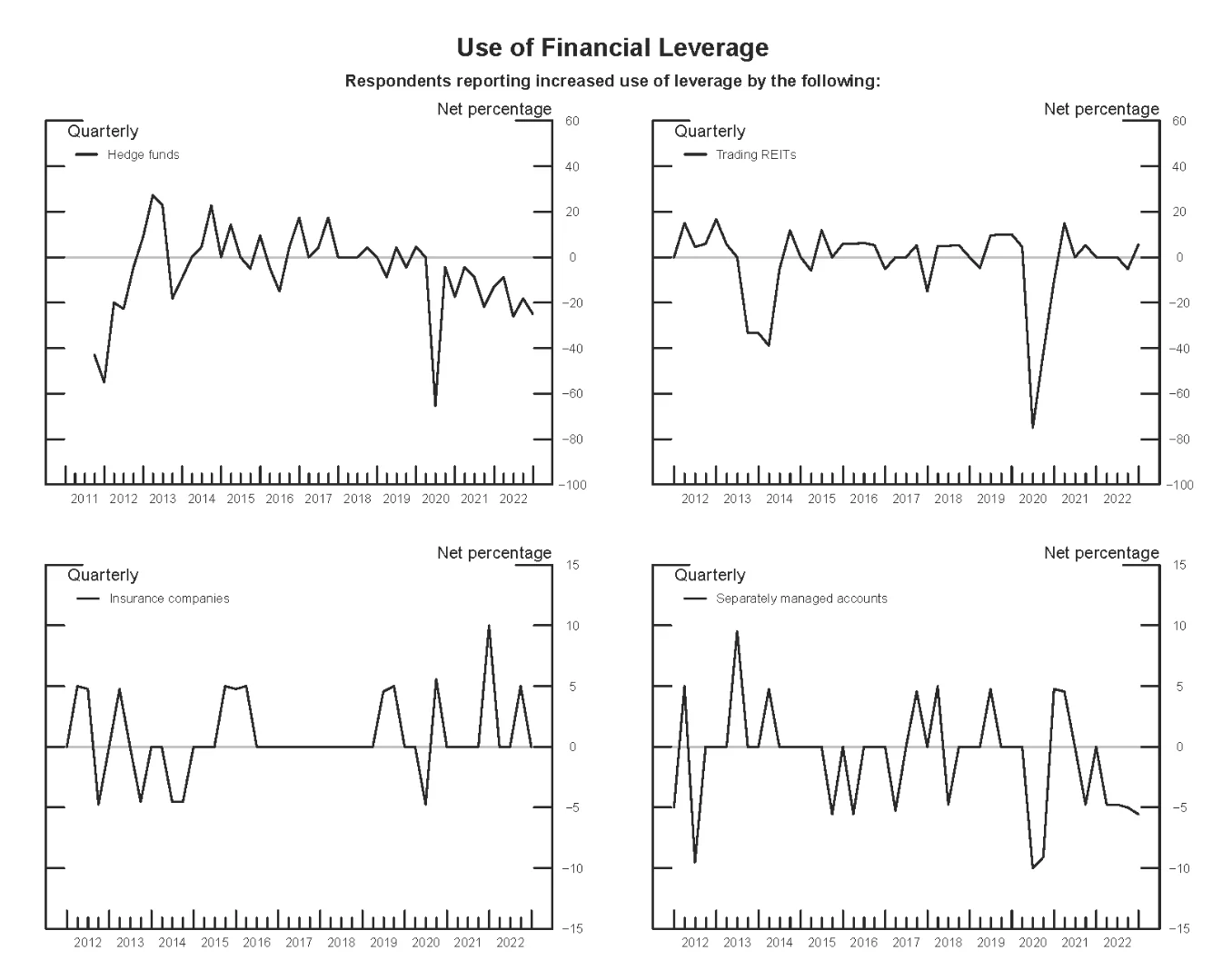

With respect to clients’ use of financial leverage, one-fourth of dealers indicated decreased use of leverage by hedge funds, continuing a trend of decreasing hedge fund leverage observed in several recent surveys:

With regard to OTC derivatives markets, responses revealed the following:

- About one-fourth of dealers reported an increase in the volume of mark and collateral disputes relating to OTC foreign exchange derivatives. A smaller fraction of dealers reported an increase in the duration and persistence of mark and collateral disputes relating to OTC interest rate derivatives. The volume, duration, and persistence of mark and collateral disputes relating to other types of OTC derivatives remained largely unchanged.

- Nonprice terms in master agreements for OTC derivatives remained largely unchanged.

- One-fifth of respondents reported an increase in the posting of nonstandard collateral as permitted under relevant agreements.

With respect to securities financing transactions, respondents indicated the following:

- One-half of respondents reported a tightening of funding terms for average clients with respect to collateral spreads for high-yield corporate bonds, and a similar fraction reported tightening with respect to collateral spreads and haircuts for non-agency RMBS. At least one-fifth of dealers reported a tightening with respect to collateral spreads and haircuts for average clients across all collateral classes except equities.

- Roughly one-fourth of dealers, on net, indicated tightening of funding terms for average clients with respect to the maximum amount and maturity of funding for equities and non-agency RMBS.

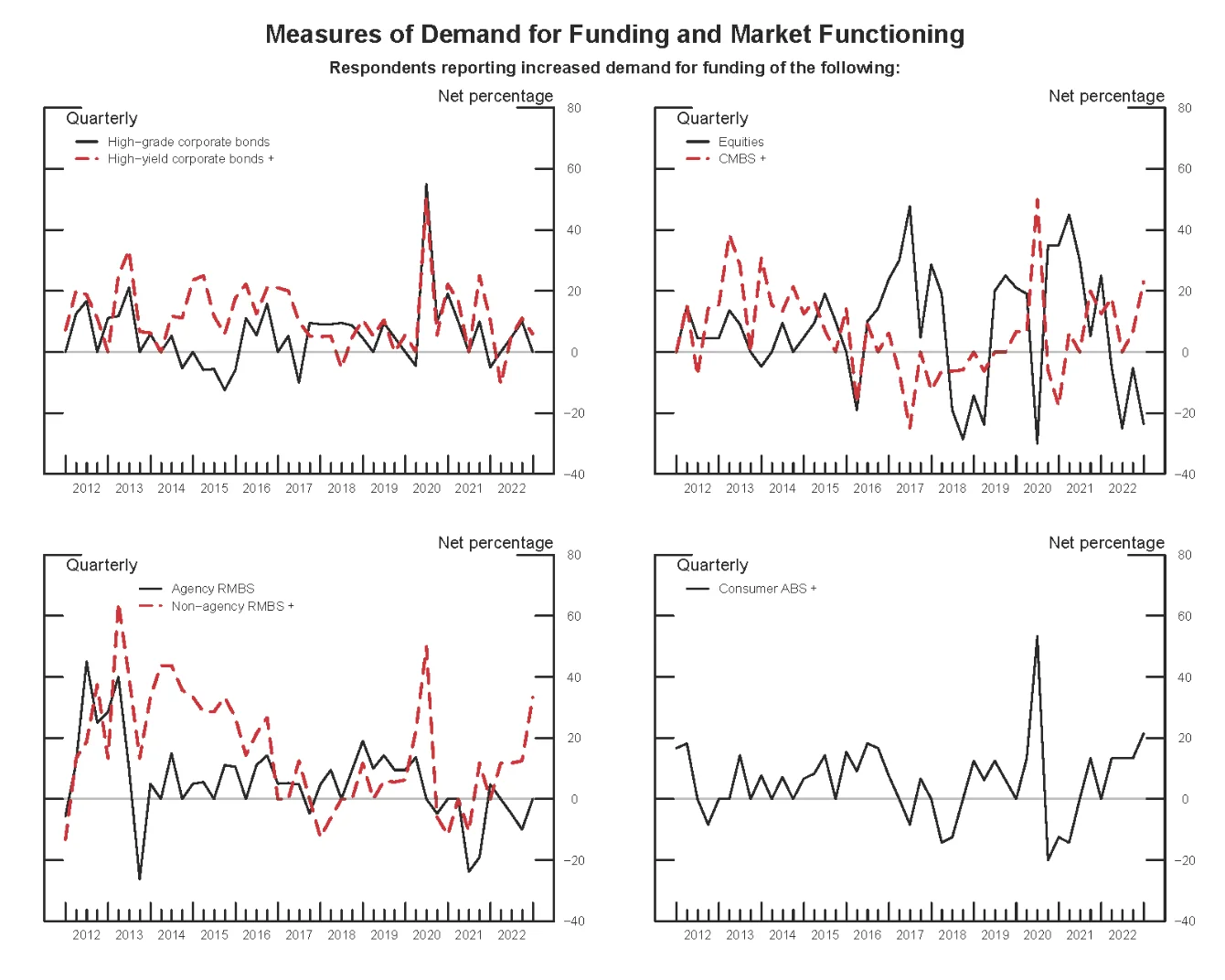

- One-third of respondents reported an increase in demand for funding of non-agency RMBS, and roughly one-fifth reported the same for commercial mortgage-backed securities (CMBS) and asset-backed securities (ABS)

- Additionally, one-fourth reported increased demand for term funding of non-agency RMBS, while a smaller fraction reported increased demand for term funding of agency RMBS. On net, about one-fourth of dealers indicated decreased demand for funding of equities.

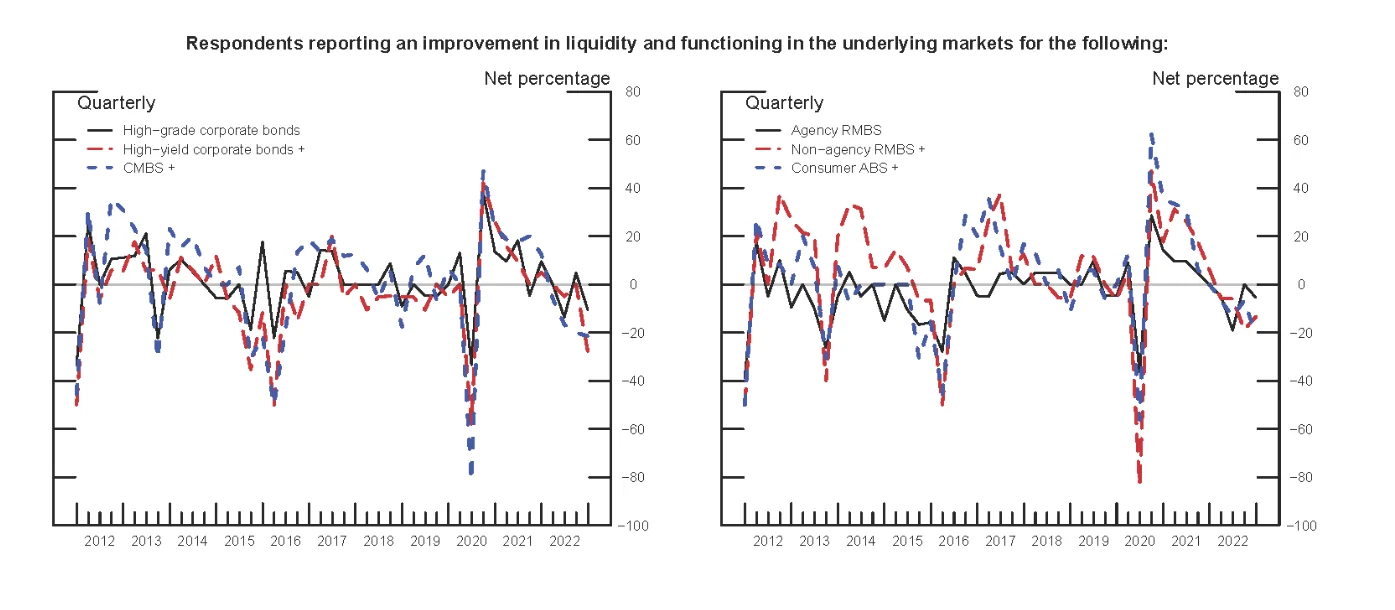

- Roughly one-fourth of dealers indicated that liquidity and market functioning deteriorated over the past three months for high-yield corporate bonds, while about one-fifth reported a deterioration for CMBS and ABS. On net, dealers reported that liquidity and market functioning for agency and non-agency RMBS remained basically unchanged.

In the special questions, dealers were asked about their provision of funding collateralized by agency RMBS to trading REIT clients and their management of the associated counterparty risk. Four-fifths of dealers indicated that they provide funding collateralized by agency RMBS to trading REIT clients.

With regard to the provision of funding collateralized by agency RMBS to trading REIT clients, these respondents indicated the following changes over the past three months:

- About two-fifths of dealers reported having tightened collateral spreads on funding with a maturity between 0 and 30 days, and one-half reported having tightened collateral spreads on funding with a maturity greater than 30 days. Smaller net fractions reported tightening with respect to the maximum amount of funding for both shorter- and longer-term funding.

- Roughly two-thirds of dealers reported that the weighted average maturity (WAM) of funding was between 31 and 90 days, while the rest reported it was between 2 and 30 days. On net, dealers reported that the WAM remained basically unchanged over the past three months.

- A small fraction of respondents indicated that the maximum amount of such funding offered had decreased somewhat, and a similar fraction indicated that they anticipate the maximum amount offered will decrease further over the next three months. On net, respondents reported that the amount of funding provided and the demand for funding remained basically unchanged.

With regard to managing counterparty risk associated with the provision of funding collateralized by agency RMBS to trading REIT clients over the past three months, respondents indicated the following:

- Roughly two-thirds of respondents indicated that collection of initial margin or haircuts was the most important method for managing counterparty risk. A small fraction reported that limits on counterparty borrowing were most important, while over one-half reported that the limits were the second or third most important. About two-thirds of respondents indicated that the collection of variation margin was the second or third most important method.

- Almost two-thirds of respondents reported that at least 50 percent of their trading REIT clients were subject to a collateral or margin call during the past three months. Of the dealers who reported using liquidity covenants for this funding, over one-fourth reported that 1 to 9 percent of their trading REIT clients were subject to a liquidity covenant violation notice. Most dealers reported that none of their clients received leverage or net worth covenant violation notices.