Federal Reserve Alert! Federal Reserve Board releases hypothetical scenarios for its 2022 bank stress tests. This year, 34 large banks will be tested against a severe global recession with heightened stress in commercial real estate and corporate debt

2022 Stress Test Scenarios (PDF)

This year, 34 large banks will be tested against a severe global recession with heightened stress in commercial real estate and corporate debt markets.

The Board's stress tests evaluate the resilience of large banks by estimating losses, net revenue, and capital levels—which provide a cushion against losses—under hypothetical recession scenarios that extend more than two years into the future. The scenarios are not forecasts.

In the 2022 stress test scenario, the U.S. unemployment rate rises 5 3/4 percentage points to a peak of 10 percent over two years. The large increase in the unemployment rate is accompanied by a 40 percent decline in commercial real estate prices, widening corporate bond spreads, and a collapse in asset prices, including increased market volatility.

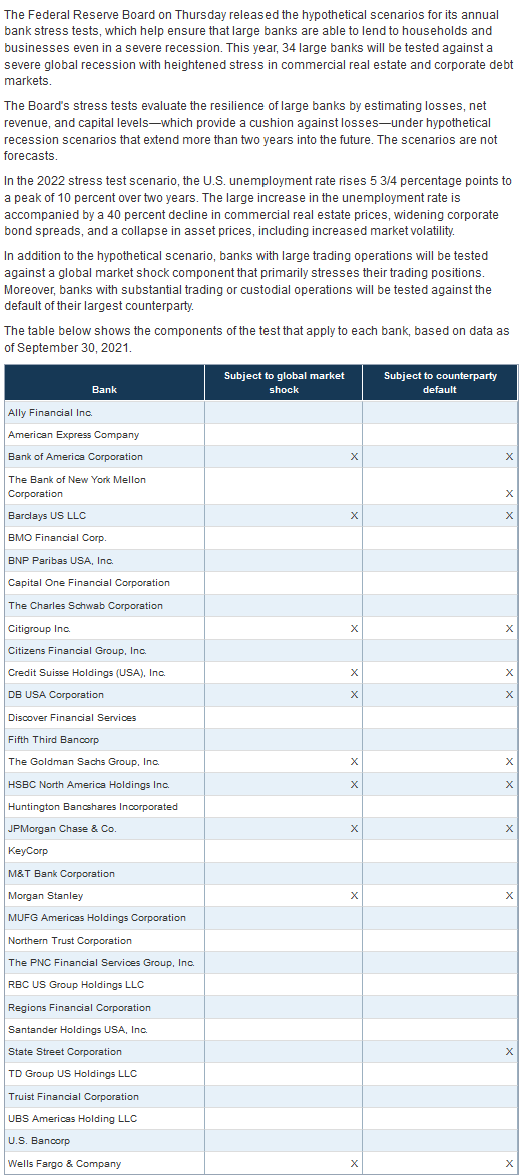

In addition to the hypothetical scenario, banks with large trading operations will be tested against a global market shock component that primarily stresses their trading positions. Moreover, banks with substantial trading or custodial operations will be tested against the default of their largest counterparty.

Banks Subject to global market shock:

Bank of America Corporation, Barclays US LLC, Citigroup Inc., Credit Suisse Holdings (USA), Inc., DB USA Corporation, The Goldman Sachs Group, Inc., HSBC North America Holdings Inc., JPMorgan Chase & Co., Morgan Stanley, Wells Fargo & Company

Banks Subject to counterparty default:

Bank of America Corporation, Barclays US LLC, Citigroup Inc., Credit Suisse Holdings (USA), Inc., DB USA Corporation, The Goldman Sachs Group, Inc., HSBC North America Holdings Inc., JPMorgan Chase & Co., Morgan Stanley, State Street Corporation, Wells Fargo & Company