DTC Risk Management Alert! Changes to DTC Collateral Haircuts beginning May 2, 2022, for Settlement Date May 3, 2021! DTC’s risk management controls, DTC applies a 100% haircut and assigns no collateral value to any current or future Lender

DTC Risk Management Alert! Changes to DTC Collateral Haircuts beginning May 2, 2022, for Settlement Date May 3, 2021! DTC’s risk management controls, DTC applies a 100% haircut and assigns no collateral value to any current or future Lender FIS held as Net Additions in a Participant account.

Source (pdf) for the Friday night News dump 💩!

Beginning May 2, 2022, for Settlement Date May 3, 2021, DTC will update the list of current lenders (“Lender”) to the joint DTC and NSCC committed 364-day line-of-credit facility with a consortium of banks (“LOC Agreement”). The list of current lenders to the LOC Agreement will be updated to include Lloyds Bank Corporate Markets Plc, which is a new Lender to the LOC Agreement. Please see the list of lenders in Appendix A below. As a reminder, to help manage intraday transaction blockages due to DTC’s risk management controls, Participants can (i) designate additional securities as collateral, (ii) process delivery-versus-payment transactions that will generate intraday credits, or (iii) submit settlement progress payments via Fedwire®. Participants can monitor their Collateral Monitor balance via the Risk Management Controls Inquiry link in the Cash and Balances tab in the Settlement Web.

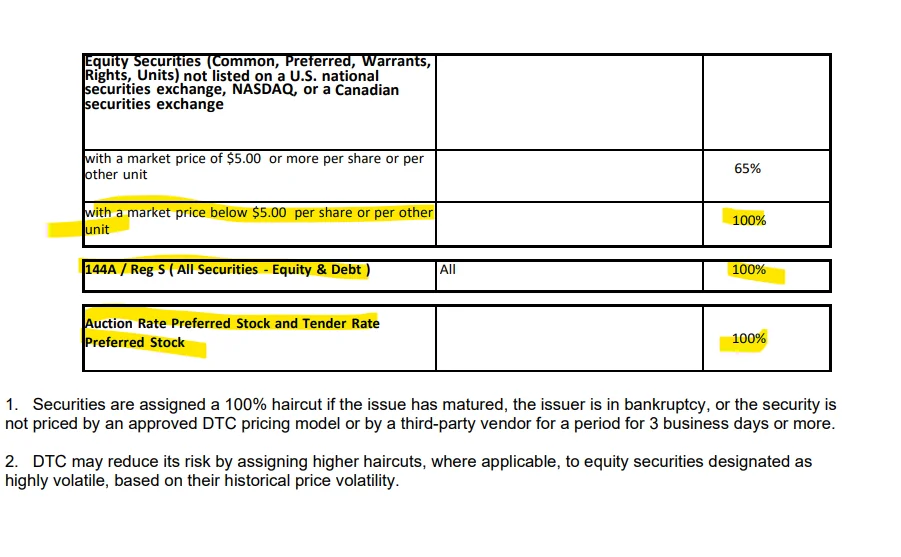

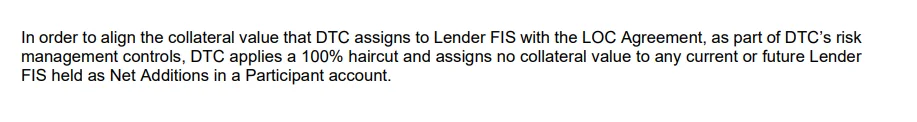

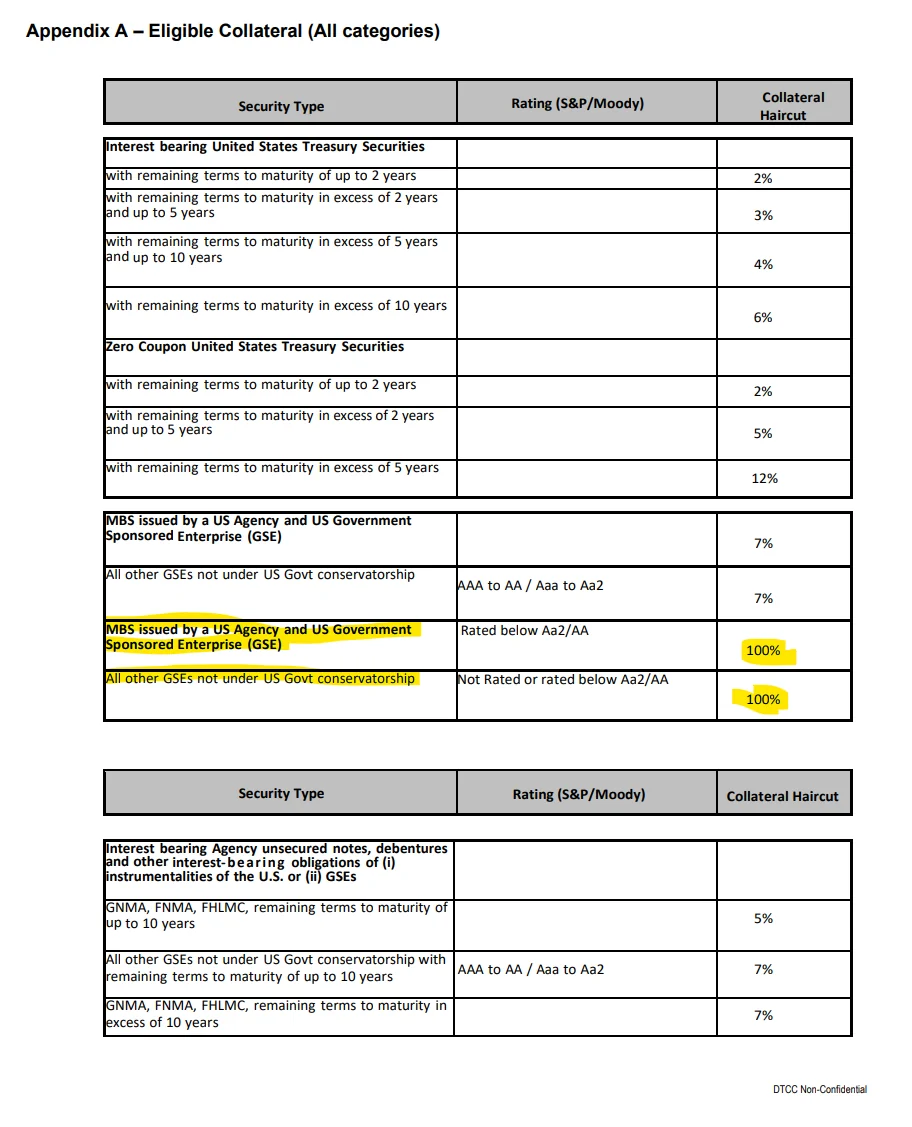

In order to align the collateral value that DTC assigns to Lender FIS with the LOC Agreement, as part of DTC’s risk management controls, DTC applies a 100% haircut and assigns no collateral value to any current or future Lender FIS held as Net Additions in a Participant account.

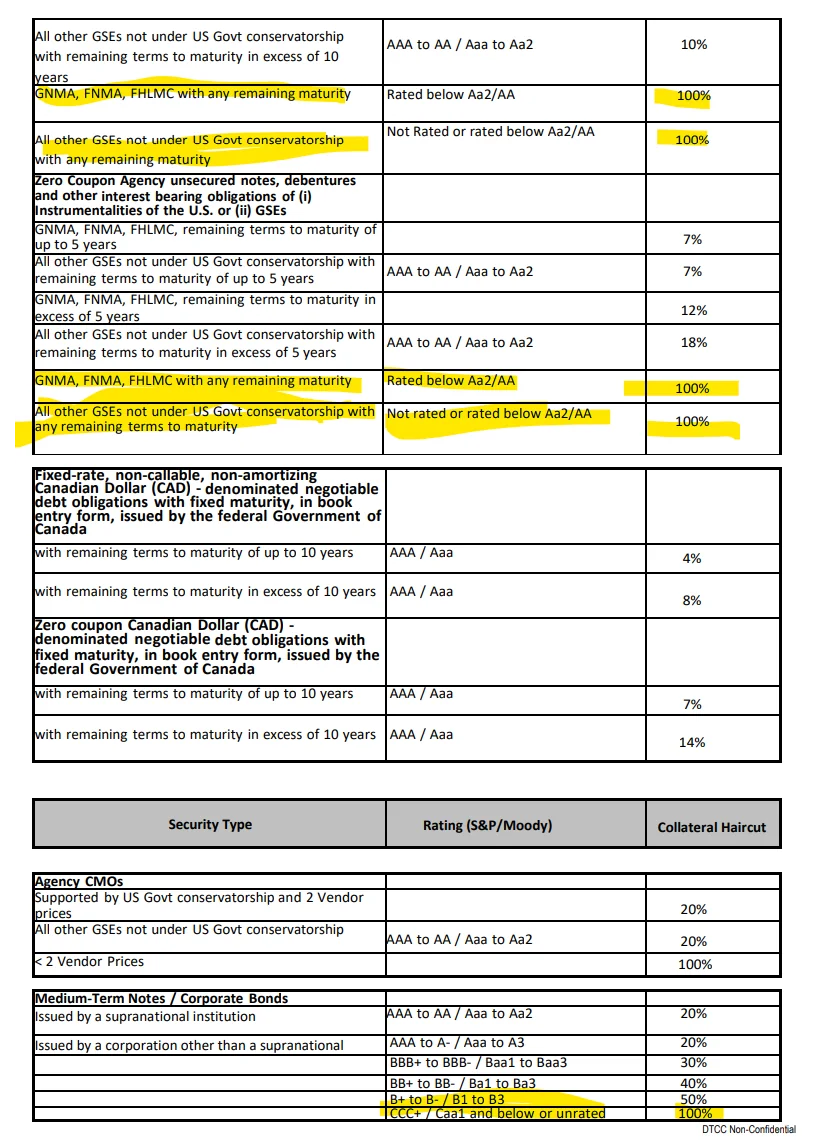

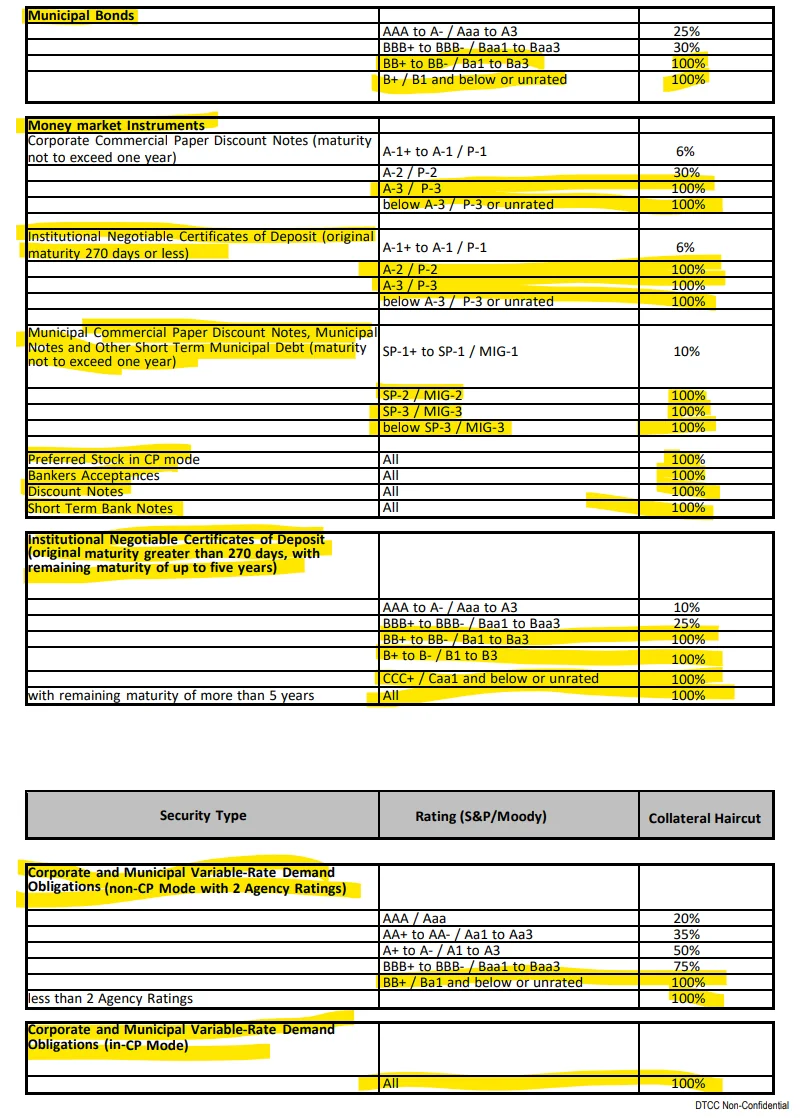

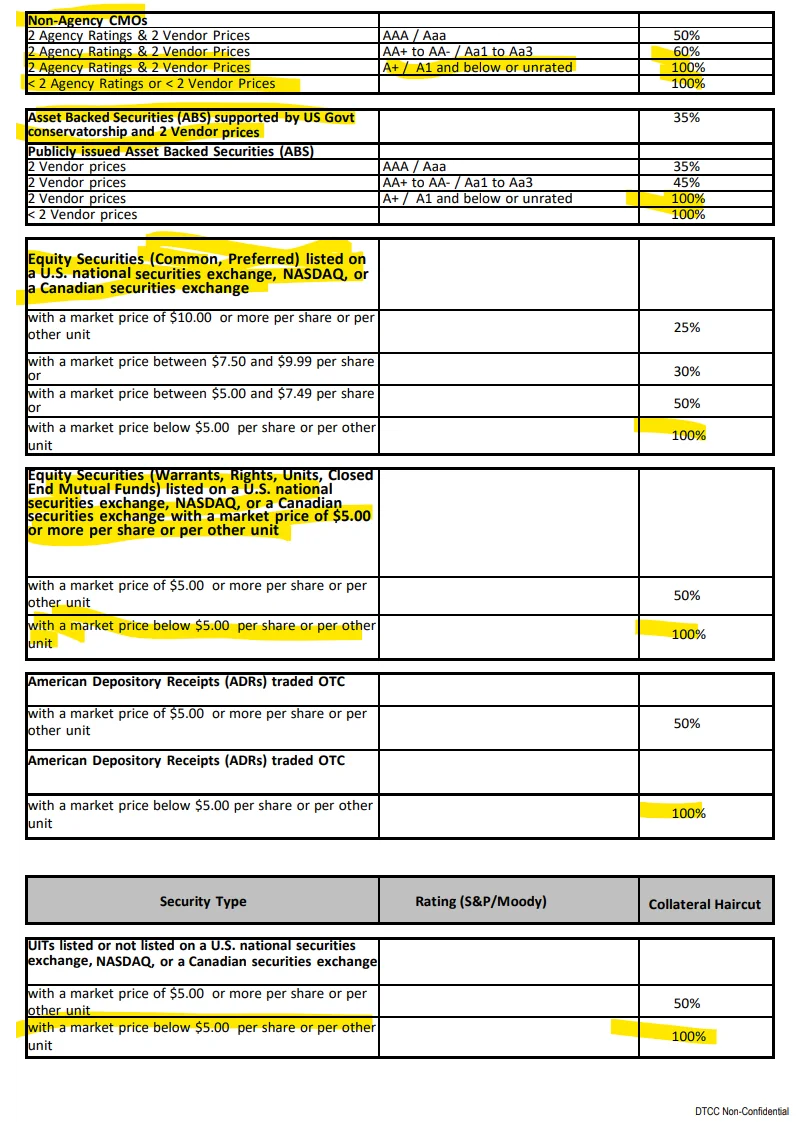

MBS issued by a US Agency and US Government Sponsored Enterprise (GSE) 100% Collateral haircut.