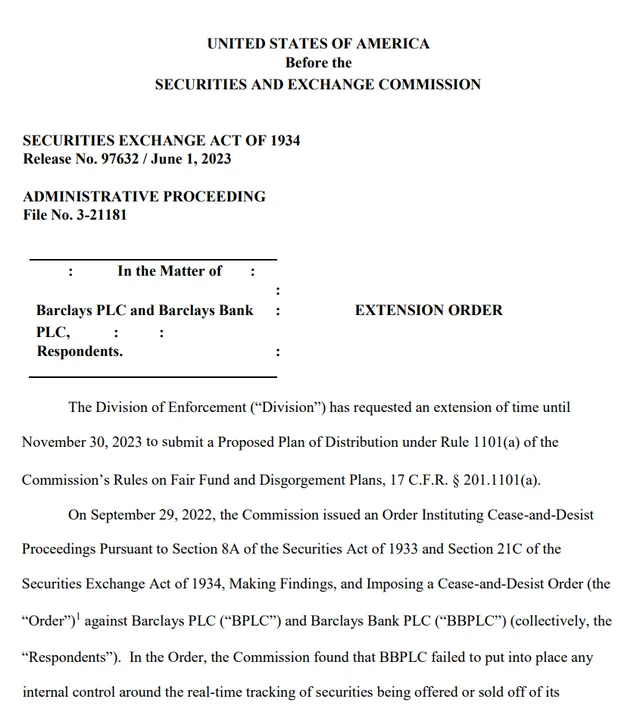

Do y'all remember when Barclays offered and sold an unprecedented amount of securities— cumulatively totaling approximately $17.7 billion from June 26, 2019 - March 9, 2022 & the SEC ordered a $200,000,000 civil penalty?

SEC requests an extension until November 30, 2023 to submit plan on being paid.

Source: https://www.sec.gov/litigation/admin/2023/34-97632.pdf

In the Order, the Commission found that BBPLC failed to put into place any internal control around the real-time tracking of securities being offered or sold off of its Commission-registered shelf registration statements. As a result of this failure, between June 26, 2019 and March 9, 2022, BBPLC offered and sold an unprecedented amount of securities— cumulatively totaling approximately $17.7 billion—in excess of what it had registered with the Commission, in violation of Sections 5(a) and 5(c) of the Securities Act. In connection with the over-issuances and internal control failure, BPLC and BBPLC restated their year-end 2021 audited financial statements filed with the Commission.

In its request for an extension of time, the Division states that additional time is needed to engage a third-party to assist with some of the administrative tasks of implementing the distribution, develop the distribution methodology, and prepare the proposed plan of distribution.