Hester Peirce: "While providing transparency regarding securities lending is a worthy & statutorily mandated objective, the approach we are voting on today is not the right way to achieve that objective. Accordingly, I cannot support this recommendation."

Source: https://www.sec.gov/news/statement/peirce-statement-securities-lending-101323

Thank you, Mr. Chair. While providing transparency regarding securities lending is a worthy and statutorily mandated objective, the approach we are voting on today is not the right way to achieve that objective. Accordingly, I cannot support this recommendation.

Though I do have substantive concerns with aspects of the rule, my concerns are mostly practical. The final rule drops some of the most problematic parts of the proposal, including the requirement to disclose securities available to lend, and alters others, including the requirement to report within fifteen minutes. These changes should make the rule more workable than what was proposed, but they cannot save a rule which has not properly contemplated timing at every step of the process.

Consider, for example, the initial thirty-day comment period. A number of trade associations explained that thirty-day comment periods are appropriate for ministerial rulemakings, not for obtaining comment on “an entirely new regulatory framework with significant requirements on the securities lending markets and the varied participants in them, including broker-dealers, agent lender banks, and investment advisers of mutual funds, private funds and pension funds, among other investors.”[1] Although the Commission reopened the comment period for this rule in conjunction with another rulemaking,[2] the length of the initial comment period is key in commenters’ decisions on what kind of effort to expend in commenting. Given that we were already more than a decade out from Dodd-Frank, we could have started this rulemaking project with a concept release, a roundtable, and a long comment period.

Timing considerations continue to be a problem for implementation. At first glance, the implementation period seems reasonable, but this rule requires a multi-phase implementation process. First, FINRA, which will be collecting and publishing the securities lending data, has four months to propose its implementing rules. This timeline is extremely aggressive given that FINRA has to set up the reporting infrastructure, including creating a system for generating unique identifiers. Second, FINRA’s rules have to be effective within a year. This constrains its ability to work with industry participants, as the release acknowledges it must do to get this system right. Third, firms will have to begin reporting one year after FINRA’s rule is final. That timeline leaves little room to work out any glitches in early submissions. Finally, FINRA will barely be able to take a breath before it has to begin publicly reporting the information; the release affords it only ninety days after firms start reporting to get its process for disseminating the data up and running. The Commission may be getting its second CAT.

A better implementation approach not only would have afforded more time for each step of this process, but it would have taken a phased approach to applying the rule. We should have started with U.S. listed equity securities and then moved on to other asset classes. We also could have offered smaller entities additional time for compliance. A phased process would have allowed FINRA and market participants to transition more smoothly to a new reporting regime. I fear that we have set both up to fail.

Although practical obstacles stand in the way of a yes vote, I appreciate the staff’s hard work, including refining areas of the release to afford greater clarity. Haoxiang and Heather, thank you for working with me. I am sorry we did not get there on this rule. Thank you also to staff in the Division of Trading and Markets, the Division of Economic and Risk Analysis, and the Office of General Counsel. The improvements in the final rule are a reflection of your excellent work on a difficult rule.

I have a number of questions:

What are the initial and ongoing compliance costs associated with the rule? What are we planning to do to help minimize those costs during the implementation process?

While the release has some helpful language, the rule text could be more clear. One commenter recommended “revising the proposed securities loan definition to limit it to transactions covered by a securities lending agreement against a transfer of collateral, and documented as a securities loan on the lender’s books and records [and to] exclude short positions, short-arranged financing in connection with prime brokerage client short activities, and repurchase agreements.” Why didn’t we write a more definitive definition into the rule text?

Why are we requiring the publication of loan-by-loan data? Why not publish aggregate data by security instead?

One of the required data elements is the time that the covered securities loan was effected, which is in addition to the date the loan was effected. One of the reasons for moving away from fifteen-minute reporting was that terms of loans are finalized throughout the day. How is a covered person supposed to pinpoint a particular time a loan was effected? Why does the precise time even matter if we have the date?

Can FINRA allow pricing data to be reported as a spread to a benchmark rate, an issue raised by a number of commenters?

Should we require FINRA to take special steps to protect the sensitive data it will collect pursuant to this rule? By rushing FINRA’s process, are we increasing the likelihood of a potential data breach?

Why are we requiring reporting agents to be a broker, dealer, or clearing agency?

We require the reporting of inter-affiliate transactions, including those that are not arms-length.

Why? Won’t those transactions degrade the value of the data?

The release mentions that the decision not to exclude inter-affiliate loans turns in part on wanting to ensure that we capture loans by owners of large portfolios who conduct their lending programs using an affiliated agent lender. Wouldn’t we capture those loans without the inter-affiliate exemption because the agent lender acts on behalf of the pool and thus would be a covered person?

The release includes a section on cross-border application and states that the rule “will generally be triggered whenever a covered person effects, accepts, or facilitates (in whole or in part) in the U.S. a lending or borrowing transaction.” The release states that “there will be some overlap with” the foreign securities lending reporting regimes. What can we do to minimize duplicative reporting?

The release notes that crypto asset securities would be reportable under the rule. What are we planning to do to assist FINRA in identifying which crypto assets are covered so that it can reach out to the relevant market participants for their input as it is writing its implementation rules?

Section 10(c)(1) makes it unlawful for any person to effect a securities loan transaction in contravention of the rules we are adopting today. Given the granular, technical, prescriptive nature of these rules, foot faults are inevitable. Will a party to a securities lending transaction be able to void the transaction if it discovers that its counterparty violated our rules?

What has Hester Upset?

Background:

Statutory Mandate:

Section 984(a) of the Dodd-Frank Wall Street Reform and Consumer Protection Act (“Dodd-Frank Act”) added section 10(c) to the Exchange Act to provide the Commission with authority over securities lending.23 Section 984(b) of the Dodd-Frank Act mandates that the Commission increase transparency of information available to brokers, dealers, and investors.

The Commission stated that the data collected and made available by the proposed rule would improve price discovery in the securities lending market and lead to a reduction of the information asymmetry faced by end borrowers and beneficial owners in the securities lending market. In addition, the Commission stated its preliminary belief that the proposed rule would close securities lending data gaps, increase market efficiency, and lead to increased competition among providers of securities lending analytics services and reduced administrative costs for broker-dealers and lending programs. On balance, the final rule requirements are designed to achieve the objectives of the proposed rule, 28 as discussed below, in Parts VII and IX, and are designed to increase the transparency of information available to brokers, dealers, and investors with respect to loans or borrowing securities.

Proposed Rule 10c-1

The Commission proposed that any person that loans a security on behalf of itself or another person (a “Lender”) provide certain securities lending information (“Rule 10c-1 information”) to an RNSA in the time periods specified by the proposed rule (e.g., transaction data elements and confidential data elements would be reported within 15 minutes after each loan is effected). As proposed, all securities would be within the scope of the rule.

The proposed rule stated that a bank, clearing agency, broker, or dealer that acts as an intermediary to a loan of securities (lending agent) on behalf of a person that owns the loaned securities (beneficial owner) shall provide the Rule 10c-1 information to an RNSA on behalf of the beneficial owner within the time periods specified by the proposed rule or enter into a written agreement with a broker or dealer that agrees to provide the Rule 10c-1 information to an RNSA (reporting agent) in accordance with the proposed rule’s requirements. The proposed rule also provided that a beneficial owner would not be required to provide Rule 10c-1 information to an RNSA if a lending agent acts as an intermediary to the loan of securities on behalf of the beneficial owner.

The proposed rule would have permitted persons required to report (including intermediaries) to enter into a written agreement with a reporting agent that is a broker or dealer to provide the Rule 10c-1 information to an RNSA. Such a reporting agent would be required to establish, maintain, and enforce policies and procedures as well as preserve records. The reporting agent would also be required to provide an RNSA with an updated list of persons on whose behalf the reporting agent is providing information under the proposed rule.

The proposed rule would have required that an RNSA make certain reported information publicly available as soon as practicable but no later than the next business day. To track the securities lending transaction, the proposed rule would require an RNSA to assign each securities lending transaction with a unique transaction identifier. Loan modifications would be provided to an RNSA if the modifications to the loan involved any of the terms required to be reported. The terms of the loan modification, but not the parties to the loan, would be made public. In addition, proposed Rule 10c-1 required that by the end of each business day information concerning securities “on loan” and “available to loan” would be provided to an RNSA. Such information would be made publicly available by an RNSA on an aggregated basis per security.

Not all information reported to an RNSA would have been made publicly available under the proposed rule. Certain information reported to an RNSA would be necessary for regulatory functions, but would not have been made publicly available due to the likelihood that it would identify market participants or reveal investment decisions. Proposed Rule 10c-1 would have required an RNSA to keep certain information confidential, subject to the provisions of applicable law.

The proposed rule would have allowed an RNSA to charge fees to lenders, but prohibited an RNSA from charging for or limiting the use of the publicly reported data. Specifically, the proposed rule would have required an RNSA to make the published information available without use restrictions and without charge, for at least five years.

In response to the Proposing Release, the Commission received numerous comments expressing a diversity of perspectives, which are discussed in detail below. Many commenters supported enhanced transparency of information about securities loans. Other commenters did not support the rule. Certain commenters addressed the scope of the proposed rule and the timing for reporting information to an RNSA as discussed below, in Parts VII.A through VII.G.

Overview of Final Rule:

The final rule requires covered persons to provide securities loan information concerning reportable securities to an RNSA, in the format and manner required by an RNSA, and within specified time periods (“Rule 10c-1a information”). The term “covered person” is defined to mean: (1) any person that agrees to a covered securities loan on behalf of a lender (“intermediary”); (2) any person that agrees to a covered securities loan as a lender when an intermediary is not used unless 17 CFR 240.10c-1a(j)(1)(iii) (“final Rule 10c-1a(j)(1)(iii)”) applies to a broker or dealer borrowing fully paid or excess margin securities; or (3) a broker or dealer when borrowing fully paid or excess margin securities. In addition, 17 CFR 240.10c 1a(a) (“final Rule 10c-1a(a)”) specifies that any covered person that agrees to a covered securities loan must comply with the rule.

If any person agrees to a covered securities loan on behalf of the lender (an “intermediary”), the intermediary has the obligation to provide Rule 10c-1a information to an RNSA. If an intermediary is not used, the lender is required to provide Rule 10c-1a information to an RNSA. If a covered securities loan consists of a broker or dealer borrowing fully paid or excess margin securities, only the broker or dealer is required to provide the Rule 10c-1a information to an RNSA, not the lender.

However, in a change from the proposed rule, as discussed below, in Part VII.A, the final rule excludes from the definition of the term “covered person” a clearing agency when providing only the functions of a central counterparty as defined pursuant to 17 CFR 240.17Ad-22(a)(3) (“Rule 17Ad-22(a)(2)”) of the Exchange Act or a central securities depository as defined pursuant to 17 CFR 240.17Ad-22(a)(3) (“Rule 17Ad-22(a)(3)”) of the Exchange Act. Thus, a clearing agency is not required to report Rule 10c-1a information to an RNSA for a covered securities loan when acting in the capacity or engaged in activities as a central counterparty or a central securities depository in connection with a covered securities loan.

The final rule permits a covered person to rely on a reporting agent that is a broker, dealer, or registered clearing agency to provide Rule 10c-1a information to an RNSA to fulfill such covered person’s reporting obligation. To do so, the covered person must enter into a written agreement with a reporting agent, that agrees to provide Rule 10c-1a information to an RNSA, and provide such reporting agent with timely access to such information. If the reporting agent receives the Rule 10c-1a information from the covered person on a timely basis, the reporting agent assumes responsibility for compliance with the reporting requirements under the final rule.

The final rule defines a “covered securities loan” as a transaction in which any person on behalf of itself or one or more other persons, lends a “reportable security” to another person (except for a position at a clearing agency that results from certain central counterparty or central securities depository services). In addition, the use of margin securities, as defined in 17 CFR 240.15c3-3(a)(4) (“Rule 15c3-3(a)(4)”) of the Exchange Act, by a broker or dealer is not a covered securities loan for purposes of the final rule unless the broker or dealer lends such margin securities to another person.

The term “reportable security” is defined as any security or class of an issuer’s securities for which information is reported or required to be reported to the consolidated audit trail as required by Rule 613 of the Exchange Act and the CAT NMS Plan (“CAT”), the Financial Industry Regulatory Authority’s Trade Reporting and Compliance Engine (“TRACE”), or the Municipal Securities Rulemaking Board’s (“MSRB”) Real-Time Transaction Reporting System (“RTRS”), or any reporting system that replaces one of these systems.

The final rule requires a covered person, directly or indirectly through a reporting agent, to report three types of data, which together comprise the Rule 10c-1a information. The first type of data concerns the material terms of the covered securities loan and must be provided to an RNSA by the end of the day on which the covered securities loan is effected (“data elements”). The second type of data concerns modifications to a covered securities loan and must be provided to an RNSA by the end of the day on which a covered securities loan is modified, if the modification occurs after other information about the covered securities loan has already been provided to an RNSA, and results in a change to such information. The third type of data concerns confidential information in connection with a covered securities loan and must be provided to an RNSA by the end of the day on which a covered securities loan is effected. The final rule requires that an RNSA keep the third type of information confidential subject to applicable law. The final rule also requires an RNSA to make the Rule 10c-1a information available to the Commission; or other persons as the Commission may designate by order upon a demonstrated regulatory need.

An RNSA is required to make publicly available the following information not later than the morning of the business day after the covered securities loan is effected: (1) the unique identifier assigned to a covered securities loan by an RNSA and the security identifier; (2) the data elements, except for loan amount; and (3) information pertaining to the aggregate transaction activity and the distribution of rates among loans and lenders (“distribution of loan rates”) for each reportable security and related unique identifier. An RNSA is also required to make publicly available the loan amount on the twentieth business day after the covered securities loan is effected along with loan and security identifying information.

In addition, an RNSA is required to make publicly available any modification to the data elements, except for modification to the loan amount, not later than the morning of the business day after the covered securities loan is modified. An RNSA is also required to make publicly available modifications to the loan amount on the twentieth business day after the loan amount is modified along with loan and security identifying information.

The final rule requires an RNSA to implement rules regarding the format and manner of its collection of information and make publicly available such information in accordance with rules promulgated pursuant to 15 U.S.C. 78s(b) (“section 19(b)”) and 17 CFR 240.19b-4 (“Rule 19b-4”) of the Exchange Act. The final rule also contains requirements regarding an RNSA’s data retention and availability. Specifically, an RNSA must maintain the information on its website or a similar means of electronic distribution, without use restrictions, for a period of at least five years. In addition, the final rule permits an RNSA to establish and collect reasonable fees pursuant to rules promulgated pursuant to section 19(b) and Rule 19b-4.

Final Rule 10c-1a is designed to provide access to timely, comprehensive securities loan information to market participants, the public, and regulators, which will help provide borrowers and lenders with better tools to assess the terms of their securities loans and enhance the ability of regulators to oversee the securities lending market. In addition, the final rule will result in the public availability of new information for investors and other market participants to consider in the mix of information about the securities lending market and the securities markets generally to better inform their decisions.

The final rule will also provide regulators with information that may be used in conjunction with other information that is currently available to regulators to help assess market events.

Fact Sheet:

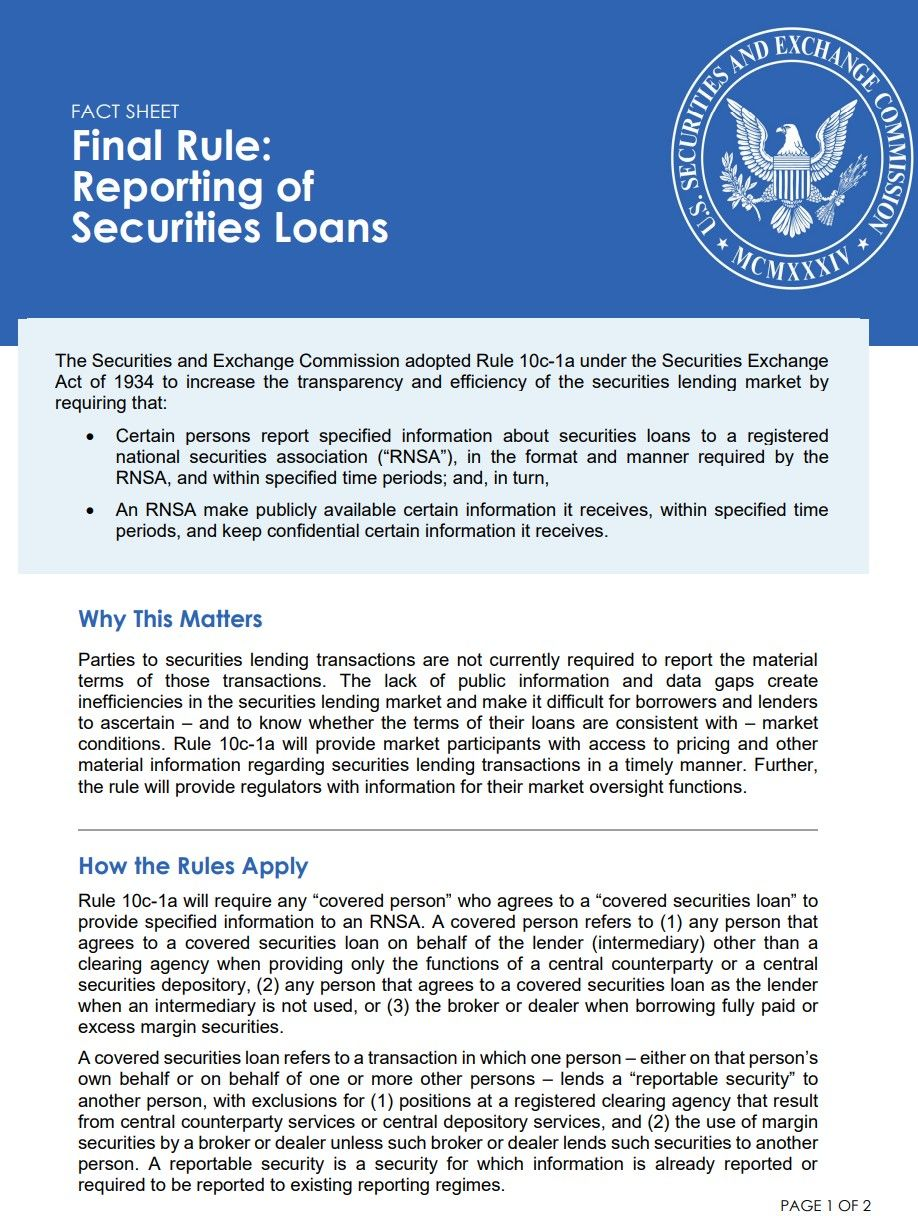

Rule 10c-1a will require any “covered person” who agrees to a “covered securities loan” to provide specified information to an RNSA. A covered person refers to (1) any person that agrees to a covered securities loan on behalf of the lender (intermediary) other than a clearing agency when providing only the functions of a central counterparty or a central securities depository, (2) any person that agrees to a covered securities loan as the lender when an intermediary is not used, or (3) the broker or dealer when borrowing fully paid or excess margin securities.

A covered securities loan refers to a transaction in which one person – either on that person’s own behalf or on behalf of one or more other persons – lends a “reportable security” to another person, with exclusions for (1) positions at a registered clearing agency that result from central counterparty services or central depository services, and (2) the use of margin securities by a broker or dealer unless such broker or dealer lends such securities to another person. A reportable security is a security for which

Press Release:

The Securities and Exchange Commission today adopted new Rule 10c-1a, which will require certain persons to report information about securities loans to a registered national securities association (RNSA) and require RNSAs to make publicly available certain information that they receive regarding those lending transactions. The rule is intended to increase the transparency and efficiency of the securities lending market.

“Securities lending played a role in the 2008 financial crisis, and, currently, the securities lending market is opaque,” said SEC Chair Gary Gensler. “In the Dodd-Frank Act, Congress mandated that the Commission enhance the transparency of the securities lending market. Such transparency gets to the heart of the SEC’s mission. It promotes competition. It promotes fair, orderly, and efficient markets. In fulfilling Congress’s mandate, today’s adoption will promote greater transparency in the securities lending markets both to regulators and the public.”

Rule 10c-1a will require certain confidential information to be reported to an RNSA to enhance the RNSA’s oversight and enforcement functions. Further, the new rule requires that an RNSA make certain information it receives, along with daily information pertaining to the aggregate transaction activity and distribution of loan rates for each reportable security, available to the public. The Financial Industry Regulatory Authority (FINRA) is currently the only RNSA.

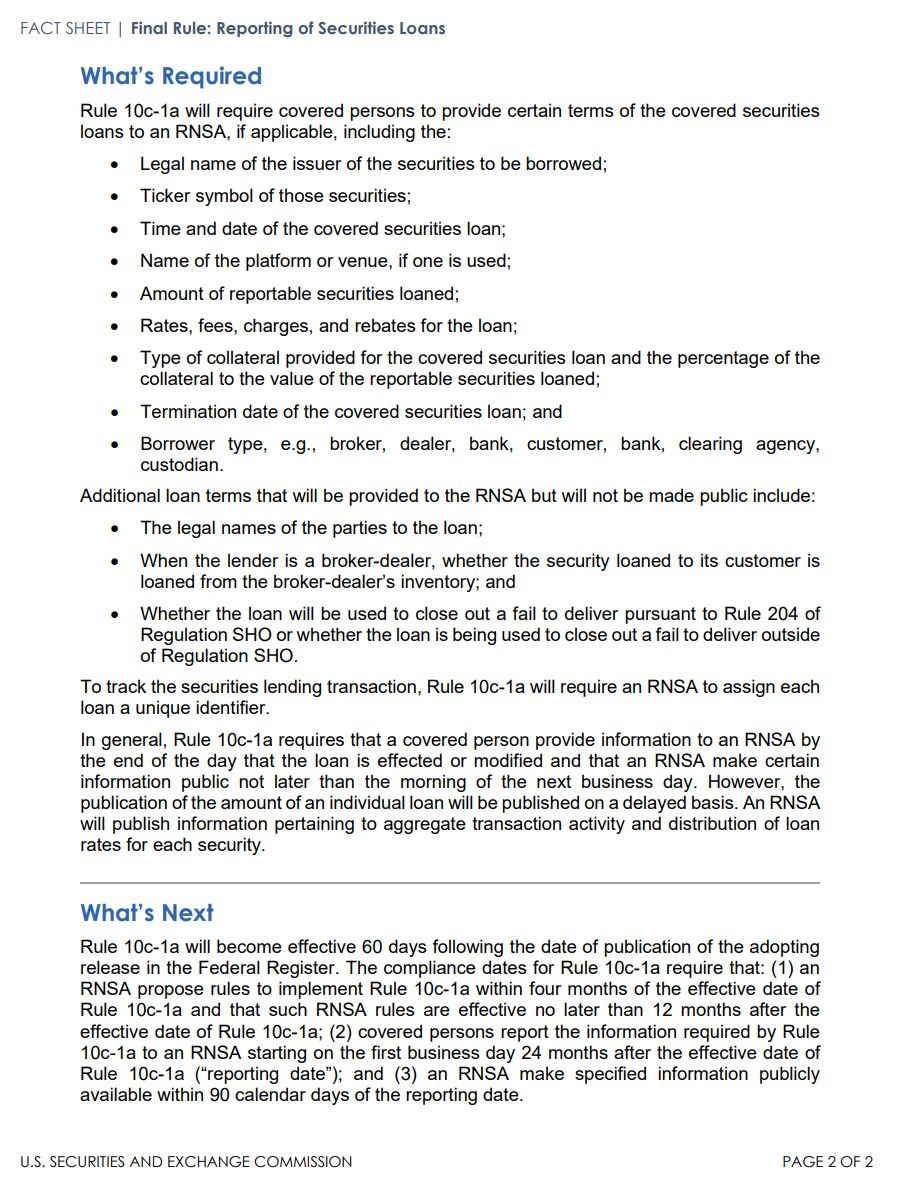

The adopting release will be published in the Federal Register. The final rule will become effective 60 days after publication in the Federal Register. The compliance dates for the new rule will be as follows: (1) an RNSA is required to propose rules within four months of the effective date; (2) the proposed RNSA rules are required to be effective no later than 12 months after the effective date; (3) covered persons are required to report information required by the rule to an RNSA starting on the first business day 24 months after the effective date; and (4) RNSAs are required to publicly report information within 90 calendar days of the reporting date.

TLDRS:

- SEC Adopts Rule to Increase Transparency in the Securities Lending Market.

- Commissioner Hester M. Peirce: "While providing transparency regarding securities lending is a worthy and statutorily mandated objective, the approach we are voting on today is not the right way to achieve that objective. Accordingly, I cannot support this recommendation."

- Rule 10c-1a will require any “covered person” who agrees to a “covered securities loan” to provide specified information to an RNSA.

A covered person refers to:

- Any person that agrees to a covered securities loan on behalf of the lender (intermediary) other than a clearing agency when providing only the functions of a central counterparty or a central securities depository.

- Any person that agrees to a covered securities loan as the lender when an intermediary is not used.

- The broker or dealer when borrowing fully paid or excess margin securities.

A covered securities loan refers to

- A transaction in which one person – either on that person’s own behalf or on behalf of one or more other persons – lends a “reportable security” to another person, with exclusions for:

- positions at a registered clearing agency that result from central counterparty services or central depository services.

- the use of margin securities by a broker or dealer unless such broker or dealer lends such securities to another person.

Rule 10c-1a will require covered persons to provide certain terms of the covered securities loans to an RNSA, if applicable, including the:

- Legal name of the issuer of the securities to be borrowed;

- Ticker symbol of those securities;

- Time and date of the covered securities loan;

- Name of the platform or venue, if one is used;

- Amount of reportable securities loaned;

- Rates, fees, charges, and rebates for the loan;

- Type of collateral provided for the covered securities loan and the percentage of the collateral to the value of the reportable securities loaned;

- Termination date of the covered securities loan; and

- Borrower type, e.g., broker, dealer, bank, customer, bank, clearing agency, custodian. Additional loan terms that will be provided to the RNSA but will not be made public include:

- The legal names of the parties to the loan;

- When the lender is a broker-dealer, whether the security loaned to its customer is loaned from the broker-dealer’s inventory; and

- Whether the loan will be used to close out a fail to deliver pursuant to Rule 204 of Regulation SHO or whether the loan is being used to close out a fail to deliver outside of Regulation SHO.

- Effective within 60 days of publishing in the Federal Register.