'Citadel Securities Is Muscling Its Way Into Credit Trading'

https://dnyuz.com/2023/07/25/citadel-securities-is-muscling-its-way-into-credit-trading/

Highlights:

- Citadel Securities is entering the corporate debt world, competing with Wall Street banks.

- The firm recently began offering investment-grade trading and will soon introduce high-yield bond trading.

- Already handling over one-third of all US retail stock trades via online platforms like Robinhood, Citadel is expanding into fixed income. They plan to offer portfolio trades, boosted by the growth of ETFs.

- Previously partnering with MarketAxess Holdings, Citadel now plans to collaborate with platforms such as TradeWeb Markets and Bloomberg.

- The firm's global head of fixed-income distribution, Jordan Cila, commented that it's a logical extension for the firm.

- Citadel, led by CEO Peng Zhao, handles about one in every five US stock trades, using algorithms to benefit from minute price differences, and made about $7.5 billion in revenue last year.

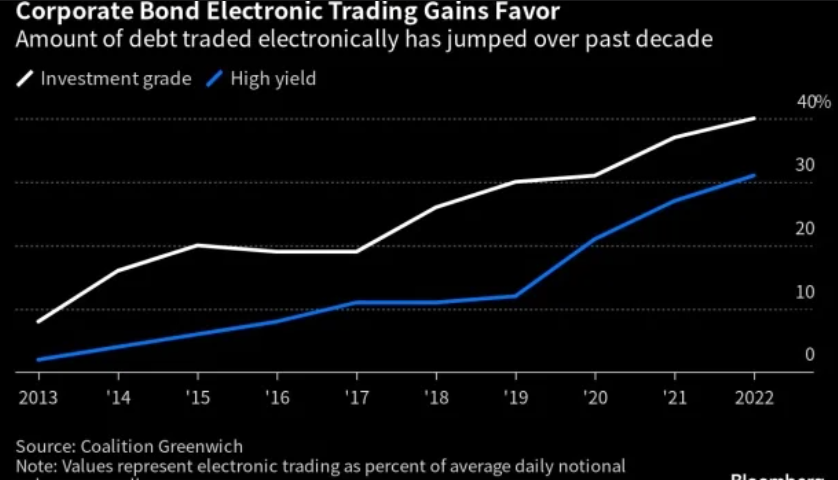

- Historically, corporate bond trading has been more traditional, but that's changing. Now, 40% of investment-grade bond trading is electronic, a significant rise from 8% in 2013. High-yield bond electronic trading also saw growth.

- Other firms, like Jane Street, are also trading corporate bonds, and Bloomberg LP offers related services.

- Citadel has been successfully leveraging tech trends, making it a significant Wall Street entity. It now offers liquidity in 10,000 investment-grade securities and plans to expand further.

TLDRS:

- Citadel Securities is venturing into corporate debt, posing competition to Wall Street banks.

- They've started with investment-grade trading and will soon add high-yield bond trading.

- Citadel aims to deepen its presence in fixed income, facilitated by ETF growth.

- Citadel Securities has entered the U.S. corporate bond market, which is valued at $10 trillion. Citadel acknowledged the market for high-yield credit was “less electronified and more idiosyncratic, so it requires some further refinement in how we’re leveraging our existing franchise”.