CFTC Releases FY 2023 Enforcement Results: 96 enforcement actions charging fraud, manipulation, & other significant violations in diverse markets, including digital assets & swaps markets.

Press Release:

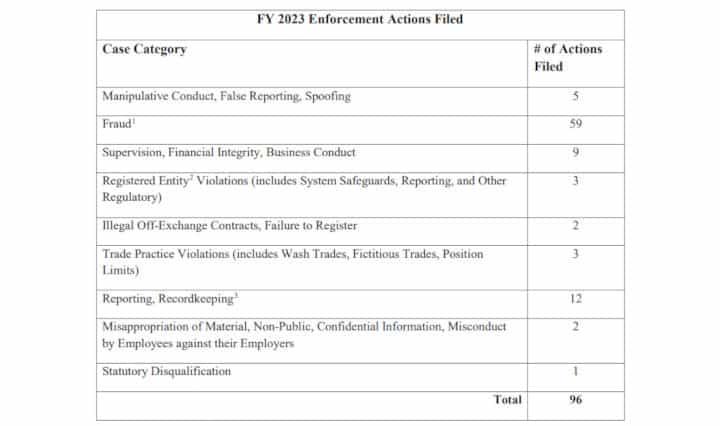

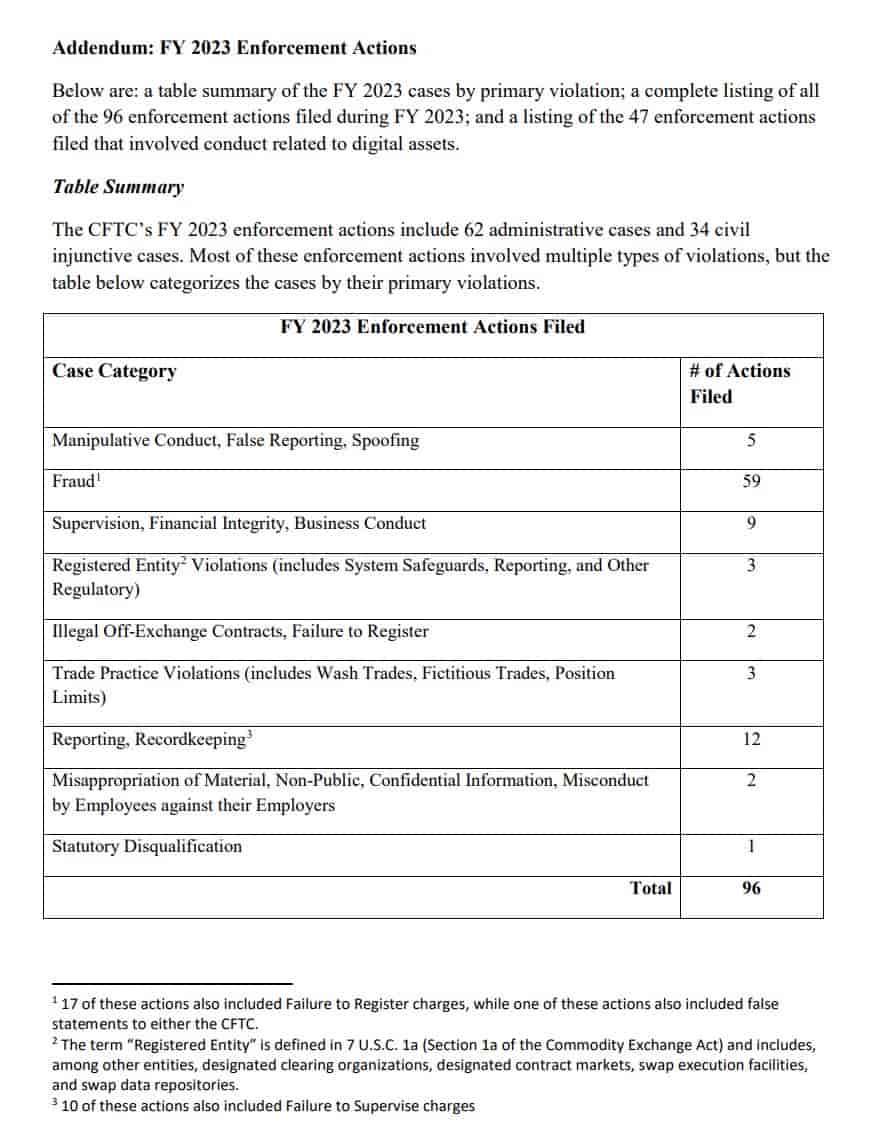

The Commodity Futures Trading Commission today released its enforcement results for Fiscal Year 2023 that include a record setting number of digital asset cases, actions to hold registrants to their regulatory obligations, manipulation and spoofing actions, and precedent-setting court decisions in complex litigations. The 2023 annual enforcement actions demonstrate the CFTC’s unwavering commitment to promote the integrity, resilience, and vibrancy of the United States derivatives markets. In FY 2023, the CFTC’s Division of Enforcement (DOE) filed 96 enforcement actions charging fraud, manipulation, and other significant violations in diverse markets, including digital assets and swaps markets, resulting in over $4.3 billion in penalties, restitution and disgorgement.

“The Commission continues to remain laser-focused on stopping and deterring fraud and manipulation in the U.S. I am proud of the Division of Enforcement’s groundbreaking work in the digital asset space, which resulted in a record number of cases, as well as staff’s dedication to holding registrants and market participants accountable for their conduct in CFTC regulated markets,” said Chairman Rostin Behnam. “At a time of great uncertainty and volatility, healthy U.S. commodity markets are paramount to ensuring a strong economy. The CFTC will continue to take all necessary action to protect customer funds and ensure fair prices for U.S. consumers. I thank the Division staff for their hard work over the last fiscal year.”

“The Division of Enforcement’s FY 2023 results demonstrate the CFTC’s relentless commitment to accountability, deterrence, customer protection, and ensuring market integrity,” said Director of Enforcement Ian McGinley. “I applaud the hardworking and talented staff of the Division, who through their expertise and professionalism brought groundbreaking and impactful cases in emerging markets, such as the digital asset markets, as well as in our traditional markets.”

Below are performance highlights from FY 2023. In addition, the Addendum includes a table summary of the FY 2023 actions, a list of all FY 2023 actions, and a list of FY 2023 actions involving digital asset-related conduct.

Enforcement Performance Highlights

The 96 enforcement actions and FY 2023 litigation victories include the following:

Digital Assets

In FY 2023, the CFTC cemented its reputation as a premier enforcement agency in the digital asset space. It filed high-profile complaints addressing frauds by major exchanges, individual Ponzi-schemers, and others; obtained a first-of-its-kind litigation victory against a decentralized autonomous organization; charged and won another litigation victory against a digital asset futures platform; brought an innovative litigation involving cross-market manipulation in blockchains; and continued its efforts to protect the public in the decentralized finance space. In FY 2023, the CFTC brought 47 actions involving conduct related to digital asset commodities, representing more than 49% of all actions filed during that period. The FY 2023 actions related to digital assets include:

- Charging Samuel Bankman-Fried, FTX, Alameda, FTX Co-Founder Gary Wang, Alameda Co-CEO Caroline Ellison, and, in a separate action, FTX Co-Owner Nishad Singh, for an alleged fraudulent scheme involving digital asset commodities, including misappropriation and the illegal offering of digital asset derivatives to U.S. customers causing the loss of over $8 billion in FTX customer assets. [Press Releases 8638-22, 8644-22, and 8669-23]

- Charging Binance, its founder, and a former chief compliance officer with operating an illegal digital asset derivatives exchange and, for the first time, charging defendants with willfully evading or attempting to evade provisions of the Commodity Exchange Act (CEA) and CFTC regulations. [Press Release 8680-23]

- Charging Celsius and its former CEO Alex Mashinsky with fraud and material misrepresentations in connection with a commodity pool scheme involving digital asset commodities and, for the first time, charging a digital asset lending platform for unlawfully operating as an unregistered commodity pool. [Press Release 8749-23]

- Obtaining orders requiring the defendants in a fraud action to pay $1,733,838,372 in restitution to victims and a $1,733,838,372 civil monetary penalty (CMP), which is the highest CMP ever ordered in any CFTC case. [Press Releases 8696-23 and 8772-23]

- Winning a groundbreaking alternative service motion and a subsequent default judgment order against the Ooki DAO, a decentralized autonomous organization the CFTC charged with operating an illegal trading platform and unlawfully acting as a futures commission merchant (FCM). The court held the Ooki DAO could be sued and served as an unincorporated association and is a “person” under the CEA and thus can be held liable for violations of the law. The court further held the Ooki DAO violated the law as charged. [Press Release 8715-23]

- Obtaining a default judgment against defendant operators of a digital asset trading platform for illegally offering futures transactions on a platform other than a designated contract market and attempting to manipulate the price of the Digitex Futures native token (a commodity in interstate commerce). [Press Release 8748-23]

- Charging Avraham Eisenberg for a fraudulent and manipulative scheme to unlawfully obtain over $110 million in digital assets from Mango Markets, a purported decentralized digital asset exchange, utilizing a complex manipulation strategy. [Press Release 8647-23]

- Simultaneously filing and settling charges against the operators of three digital asset decentralized finance (DeFi) protocols for illegally offering leveraged and margined retail commodity transactions in digital asset commodities and, in the case of two of the operators, failing to register as a swap execution facility or designated contract market, failing to register as an FCM, and failing to adopt a customer identification program as part of a Bank Secrecy Act compliance program, as required of FCMs. [Press Release 8774-23]

- In an enforcement sweep, charging 14 entities that offered a variety of services to their customers in connection with trading foreign exchange (forex) and digital assets with falsely claiming to be CFTC-registered FCMs and retail foreign exchange dealers (RFEDs) and members of the National Futures Association. [Press Release 8693-23]

Manipulative and Deceptive Conduct and Spoofing

The CFTC is focused on detecting, investigating, and prosecuting misconduct—fraud, manipulation, spoofing, or other forms of disruptive trading—that can undermine market integrity. In FY 2023, actions related to manipulative and deceptive conduct and spoofing include:

- Simultaneously filing and settling charges against HSBC Bank USA, N.A. finding it engaged in manipulative and deceptive trading related to swaps with bond issuers, spoofing, and supervision and mobile device recordkeeping failures at various times during approximately an eight-year period, and imposing a $45 million CMP. [Press Release 8702-23]

- Charging two commodity pool operators (CPOs), Glen Point Capital Advisors LP and Glen Point Capital LLP, and their Co-Founder and Co-Chief Investment Officer, Neil Phillips, with deception and manipulation in a $30 million scheme to illegally trigger payouts on two large binary option contracts that were swaps. [Press Release 8640-22]

- Simultaneously filing and settling charges against Goldman Sachs & Co. LLC for failure to maintain adequate supervisory systems and controls to ensure its customers’ trading was not disruptive and for material omissions in a letter to DOE, and imposing a $3 million CMP. [Press Release 8800-23]

- Simultaneously filing and settling charges against a registered CPO and commodity trading advisor (CTA) for spoofing involving CBOT soybean futures, soybean meal futures, and soybean oil futures contracts. [Press Release 8637-22]

- Charging a registered CTA/CPO and its associated person with spoofing, engaging in manipulative and deceptive conduct, failing to supervise, and violating a prior CFTC order in a scheme involving crude oil and natural gas futures contracts—specifically, calendar spread contracts—traded on CME and ICE Futures Europe. [Press Release 8773-23]

Reporting, Risk Management, Adequate Compliance Programs and Business Practices

The CFTC’s enforcement program helps to ensure registrants comply with recordkeeping and reporting requirements; adopt and implement proper risk management processes; maintain adequate compliance programs; and engage in appropriate business practices. In FY 2023, actions related to reporting, risk management, adequate compliance programs and business practices include:

- Simultaneously filing and settling charges against the affiliates of three financial institutions (Goldman Sachs & Co. LLC, $30 million CMP; JPMorgan Chase Bank, N.A., et al., $15 million CMP; and Bank of America, N.A, et al., $8 million CMP) for swap data reporting and other failures relating to their business as swap dealers (SDs), including, in one case, failures related to the disclosure of pre-trade mid-market marks (PTMMMs). [Press Release 8801-23]

- Simultaneously filing and settling charges that a registered derivatives clearing organization violated its Core Principles to establish, implement, maintain and enforce certain policies and procedures reasonably designed to manage its operational risks by identifying the plausible sources of operational risk and mitigating their impact through the use of appropriate systems, policies, procedures, and controls. [Press Release 8661-23]

- Finding a provisionally registered SD failed to satisfy the CFTC’s Business Conduct Standards when soliciting U.S.-based clients to trade certain equity index swaps by failing to disclose all material information, including the PTMMM and failing to communicate in good faith and in a fair and balanced manner. [Press Release 8685-23]

- Simultaneously filing and settling charges against an SD finding it committed recordkeeping violations in connection with its failure to properly record and retain certain audio files and violated the cease-and-desist provision of a prior order, which involved similar recordkeeping violations, and imposing a $5.5 million CMP. [Press Releases 8769-23 and 8086-19]

- Finding liable CFTC registrants, including the SD and FCM affiliates of financial institutions (The Bank of Nova Scotia, et al., $15 million CMP; HSBC Bank USA, N.A., et al., $30 million CMP; BNP Paribas S.A., et al., $75 million CMP; Société Générale SA, et al., $75 million CMP; Wells Fargo Bank NA, et al., $75 million CMP; and Bank of Montreal, $35 million CMP; and Interactive Brokers Corp., et al., $20 million CMP), for recordkeeping and supervision violations finding that for a number of years they failed to stop their employees, including those at senior levels, from communicating both internally and externally using unapproved communication methods. [Press Releases 8699-23, 8701-23, 8762-23 and 8794-23]

Misconduct Involving Confidential Information

Illegal use of confidential information can significantly undermine market integrity and harm customers in the CFTC’s markets. In FY 2023, the actions related to misconduct involving confidential information include:

- Settling charges against a registered introducing broker, its owners, and affiliated companies finding they engaged in fraud by misappropriation of material, nonpublic information by taking the opposite side of thousands of brokerage customer block trade orders without the customers’ prior consent, and imposing a $2.5 million CMP and $496K in disgorgement. [Press Release 8672-23]

- Charging a trader with running a fraudulent scheme where he misused knowledge of his employer’s trading in feeder cattle futures and options to trade for his own benefit in breach of a duty to his employer. [Press Release 8682-23]

Protecting Customers

Since its inception, the CFTC has focused on protecting customers in commodity and derivatives markets from fraud and other abuse. Many of the matters above involved important customer protection elements. In addition, in FY 2023, below are other actions that protected the public, including significant litigation victories:

- After substantial litigation, including two appeals to the Ninth Circuit [Press Release 7984-19], obtaining an order imposing $33 million in restitution and a $5 million CMP against precious metals firm Monex Deposit Company and its affiliated companies and principals for fraud and illegal off-exchange transactions. [Press Release 8643-22]

- Bringing its first case involving a romance scam, commonly known as "Pig Butchering," a type of fraud that is growing in popularity, in which the fraudsters cultivate a friendly or romantic relationship with a potential customer, "fatten" them up with falsehoods, before soliciting the customer to participate in a fraudulent financial opportunity. [Press Release 8726-23]

- Obtaining a preliminary injunction in an enforcement action charging fraud, misappropriation, and registration violations in connection with a $58 million fraudulent forex scheme. [Press Release 8790-23]

- Obtaining an order imposing $112.7 million in restitution and a $33 million CMP against defendants who, acting as a common enterprise, engaged in a fraudulent and deceptive scheme to solicit and misappropriate tens of millions of dollars in funds and silver in connection with a fraudulent silver leasing program. [Press Release 8741-23]

- Charging defendants, doing business as “My Forex Funds,” with fraudulently soliciting at least $310 million in fees from more than 135,000 customers to trade leveraged, margined, or financed retail forex, and leveraged retail commodity transactions. [Press Release 8771-23]

- Charging precious metals dealers with fraudulently soliciting more than $7 million from over 100 customers, mainly elderly and retirement-aged, to purchase precious metals in self-directed individual retirement accounts, and misappropriating customer funds and assets. [Press Release 8784-23]

- Charging precious metals dealers and a principal for perpetrating a $30 million precious metals investment fraud targeting hundreds of elderly persons nationwide who invested in gold and silver coins worth far less than the defendants led victims to believe. [Press Release 8694-23]

- Simultaneously filing and settling charges against a Switzerland-based trading platform that illegally offered transactions in leveraged gold and silver and leveraged forex, such as the Euro and Japanese Yen, to prospective retail customers and commodity pools in the U.S. It accepted orders for, and funds to margin these transactions without registering as a FCM; did not conduct the metals transactions on a registered exchange; and failed to supervise diligently its employees’ handling of these customers’ accounts because it did not implement adequate anti-money-laundering procedures. [Press Release 8799-23]

- In a sweep, simultaneously filing and settling charges against eight entities for fraudulently claiming to be CFTC-registered FCMs and RFEDs. These entities offered a variety of services to their customers in connection with trading a variety of products including futures, options, and forex as well as digital assets that are commodities in interstate commerce. [Press Release 8796-23]

Cooperation with Criminal and Regulatory Authorities

The CFTC’s enforcement program focuses on collaborative relationships with self-regulatory organizations, and state, federal, and international authorities, including achieving efficiencies through referrals, to meet its enforcement objectives. The parallel enforcement program is based on the premise that the CFTC can most effectively protect markets when working together with colleagues in the enforcement and regulatory community.

Specifically, the CFTC believes a robust combination of criminal prosecution and regulatory enforcement is critical to deterring violators, punishing misconduct, preserving market integrity, and protecting market participants. An example is a FY 2023 case where the CFTC and state regulators in California and Hawaii filed a joint civil enforcement action against a precious metals dealer, its chief executive officer, and a senior account executive for perpetrating a $61.8 million nationwide fraudulent scheme. [Press Release 8704-23]. The CFTC also filed an action with California authorities against a precious metals dealer charging the defendants with misappropriating more than $21 million in a nationwide fraudulent scheme. [Press Release 8791-23]

Whistleblower Program

The Whistleblower Program continued to demonstrate its importance to the CFTC’s enforcement program as reflected in the leads generated, successful enforcement actions, and whistleblower awards. In FY 2023, the CFTC granted seven applications for whistleblower awards, totaling approximately $16 million, for individuals who voluntarily provided original information that led to successful enforcement actions. Since the inception of the Whistleblower Program through FY 2023, the CFTC has issued 41 orders granting awards totaling almost $350 million. The total sanctions ordered in all whistleblower-related enforcement actions has surpassed the $3 billion milestone.

DOE Task Forces

The DOE utilizes specialized task forces in complex and developing program areas to ensure consistency, identify best practices, and develop new approaches and ideas based on lessons learned. The DOE established two new task forces in FY 2023. The Cybersecurity and Emerging Technologies Task Force addresses cybersecurity issues and other concerns related to emerging technologies (including artificial intelligence). The Environmental Fraud Task Force combats environmental fraud and misconduct in derivatives and relevant spot markets. [Press Release 8736-23] These efforts augment the work of seven additional DOE task forces that focus on the following substantive areas: Spoofing and Manipulative Trading, Digital Assets, Insider Trading and Protection of Confidential Information, Bank Secrecy Act, Swaps, Foreign Corruption, and Romance Scams.

TLDRS:

- CFTC Releases FY 2023 Enforcement Results

- 96 enforcement actions charging fraud, manipulation, & other significant violations in diverse markets, including digital assets & swaps markets.

- Resulting in over $4.3 billion in penalties, restitution and disgorgement.