CFTC Extends No-Action Enforcement on Block & Cap Amendments. A dive into the CFTC's DELAYED regulations aimed at refining swap data reporting, ensuring transparency, & maintaining market integrity.

Wut Mean?:

- The letter addresses a request from swap data repositories Chicago Mercantile Exchange Inc., ICE Trade Vault, LLC, DTCC Data Repository (US) LLC, and KOR Reporting Inc. to extend a no-action position detailed in CFTC Letter No. 22-03.

- The Swap Data Repositories (SDRs) want the Division of Market Oversight of the Commodity Futures Trading Commission (CFTC) to extend the period during which no enforcement action will be taken regarding the "Block and Cap Amendments."

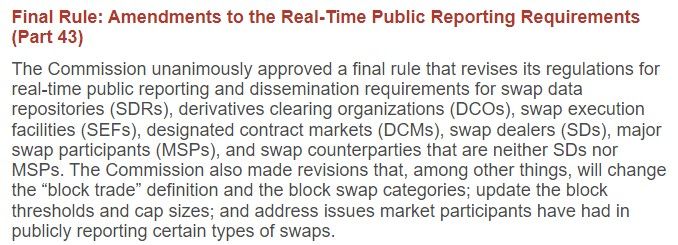

- In 2020, the Commission amended part 43 of its regulations which included the Block and Cap Amendments.

- The compliance date for these amendments was set for May 25, 2023.

- CFTC Letter No. 22-03, dated January 31, 2022, stated that enforcement actions would not be taken until December 4, 2023 if entities complied with certain requirements effective January 1, 2021.

- This no-action position was taken to give market participants enough time to test and prepare for the amended reporting regulations.

- On April 19, 2023, the Commission staff updated post-initial block and cap sizes.

- There have also been steps to implement the unique product identifier (UPI) requirements.

- The Commission expects compliance with UPI requirements by January 29, 2024.

- The SDRs argue that the time gap between the expiration of the no-action position (December 4, 2023) and the UPI compliance date (January 29, 2024) is operationally and technologically challenging.

- Implementing the Block and Cap Amendments between these dates would result in unnecessary costs and inefficiencies.

- Given these challenges, the SDRs request an extension of the no-action position until at least January 29, 2024.

- The Division acknowledges the operational and technological challenges of implementing the Block and Cap Amendments before the UPI and sees the potential for duplicated efforts.

- The Division is extending the no-action position to July 1, 2024.

What are "Block and Cap Amendments"?

The "Block and Cap Amendments" refer to specific changes made to the regulations of the Commodity Futures Trading Commission (CFTC).

Commission regulation 43.4(h), which concerns post-initial cap sizes:

Commission regulation 43.6, which deals with block trades and large notional off-facility swaps:

From the press release:

These amendments were a part of an effort to refine the regulations associated with the Commission's swap data reporting framework.

The primary objective of these amendments is to establish guidelines concerning the sizes of trades (caps) and the reporting of larger trades (blocks) within the swap market and to provide transparency in the swaps market while ensuring market integrity.

This has been delayed until at least July 1, 2024 as the commission staff agreed with the argument made by the Chicago Mercantile Exchange Inc., ICE Trade Vault, LLC, DTCC Data Repository (US) LLC, and KOR Reporting Inc.

Bonus Coverage - Citadel Concerns:

TLDRS:

- The letter addresses a request from swap data repositories Chicago Mercantile Exchange Inc., ICE Trade Vault, LLC, DTCC Data Repository (US) LLC, and KOR Reporting Inc. to extend a no-action position detailed in CFTC Letter No. 22-03.

- The Swap Data Repositories (SDRs) want the Division of Market Oversight of the Commodity Futures Trading Commission (CFTC) to extend the period during which no enforcement action will be taken regarding the "Block and Cap Amendments."

- Commission regulation 43.4(h), concerns post-initial cap sizes

- Commission regulation 43.6, deals with block trades and large notional off-facility swaps:

- The compliance date for these amendments was set for May 25, 2023.

- CFTC Letter No. 22-03, dated January 31, 2022, stated that enforcement actions would not be taken until December 4, 2023 if entities complied with certain requirements effective January 1, 2021.

- The Division acknowledges the operational and technological challenges of implementing the Block and Cap Amendments before the UPI and sees the potential for duplicated efforts.

- The Division is extending the no-action position to July 1, 2024.