Britain is bankrupt, MPs aren't keeping pace with advocacy efforts and we're still battling for shareholder rights! Check out what's got the UK's knickers in a financial twist 🇬🇧

Howdy all, and so begins the new year!

Let's recap with where we left off in 2023 as we look ahead to 2024 together - ever in the quiet confidence that MOASS will one day be tomorrow.

UK shareholders 🇬🇧 🦍 have been reaching out to both the HM Treasury and their MP representatives in recent weeks to safeguard DRS.

It's incredible to see household investors across Britain standing up for their rights and engaging with local politicians to shape & influence how shares will be traded, settled, and managed in the UK as they fight for more involvement, transparency and control over their own assets.

Here's a brief recap of what's going on for all you wonderful folk:

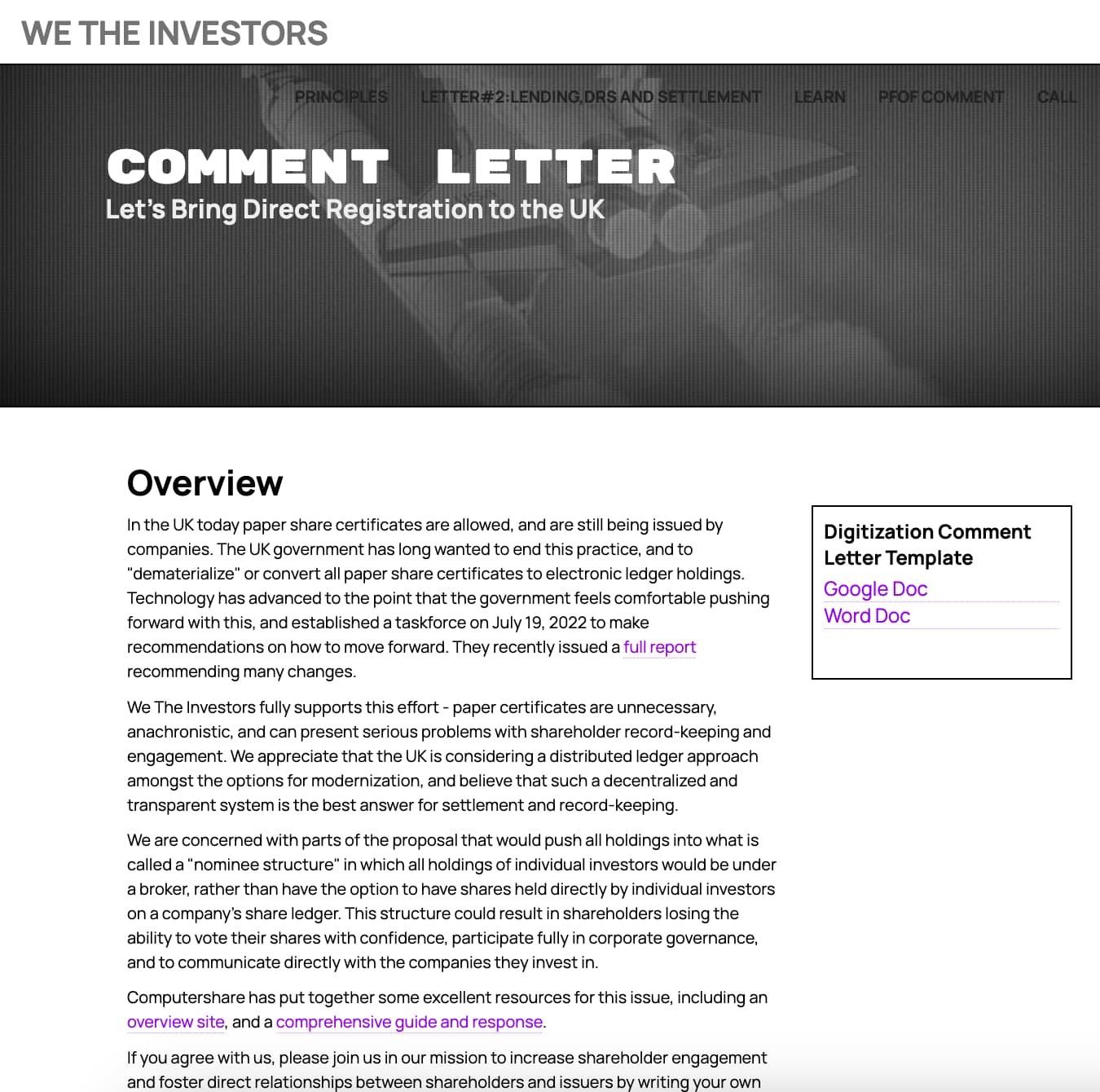

🇬🇧 All UK shares are going fully digital. As they remove paper certificates - they'll be completely revamping how the UK manages share trading, settlement, and record-keeping. The digitisation taskforce are discussing this as we speak. Find out about it more here.

🚨 Out of four proposed models, - the UK HM Treasury are advocating for the mandatory removal of ownership of shares as they are moved into a Central Securities Depository (CSD), as managed by the state.

⚠️ In simpler terms, they want your ownership rights transferred to a government managed intermediary.

💰 They also want to charge you for using your shareholder rights, unlike before.

How do they intend to get away with this❓

They're proposing changing laws to make taking ownership of your assets legal.

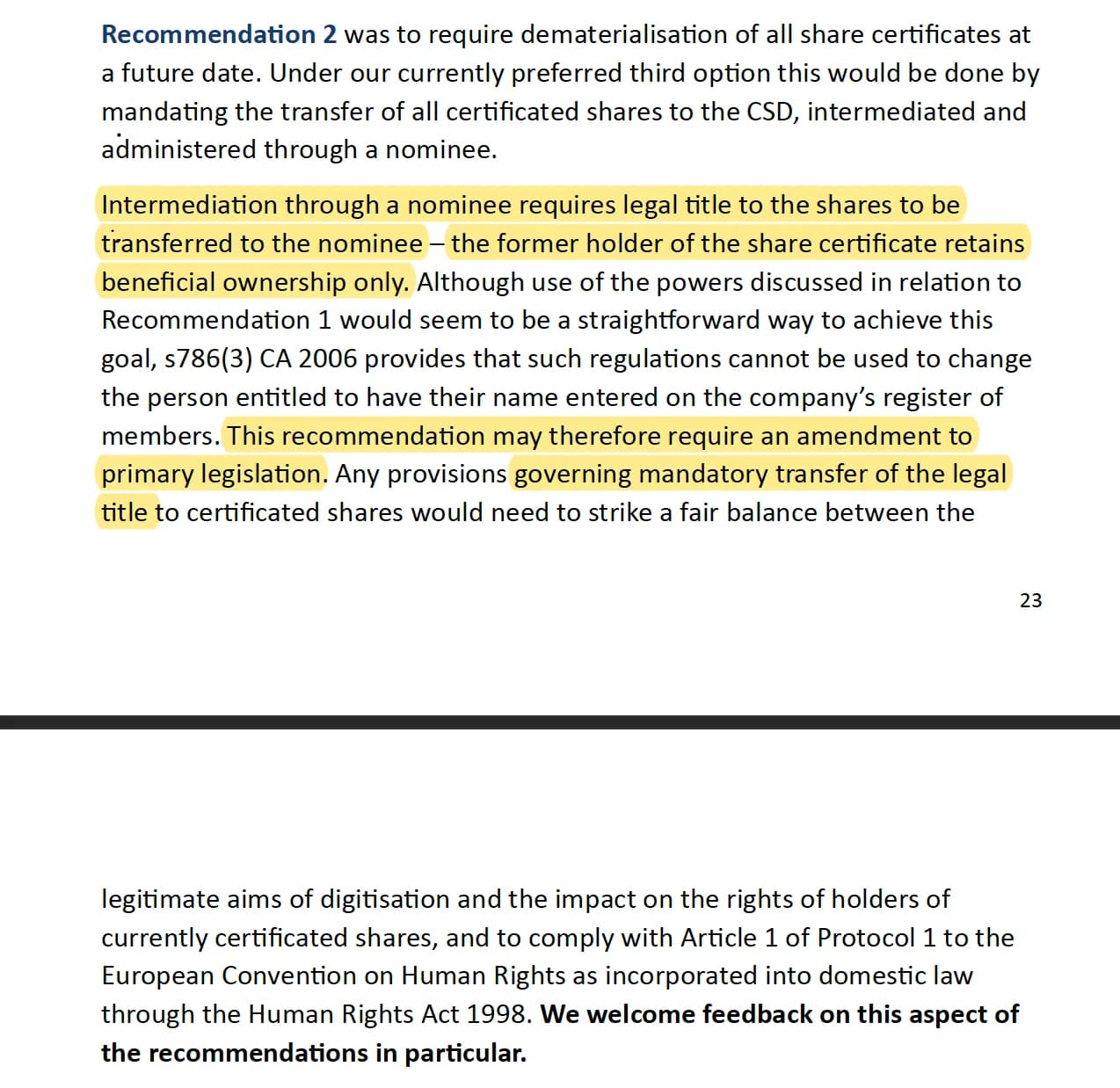

Under "Recommendation 2", Pg. 23 of the proposal - they state that in order to move to a Central Securities Depository (CSD) model of shareholding this "may require an amendment to primary legislation to address legal title transfer" = AKA they want to change the main laws (primary legislation) to allow the legal the transfer of shareholder asset ownership to them.

Check it out here:

🚩 The proposal language is loose with a great deal of ambiguity. It's not clear which shares are affected, posing a risk to already DRS'd shares and all other UK shareholder assets.

🌎 The UK's Digitisation Proposal doesn't just affect the UK - this is a blueprint for global shareholder rights erosion - it threatens to seize legal ownership of shareholder assets and jeopardises property rights everywhere.

📢 We need to be involved in these ongoing discussions - and the MPs need to advocate for us. The government's purposes, as elected and funded by the UK Taxpayer, is to serve the people. The HM Treasury need to tell the taskforce to open the communication channels - and we're reaching out to our MPs for help to make this happen.

All caught up?

But if you fancy reading up on it more, you can do so here:

- Dave Lauer & We The Investors' full response to the UK Digitisation Task Force [here]. With an accompanying reddit post [here].

- Dr. T's letter to the UK's Digital Taskforce [here] with link to her tweet [here].

- Proposal Break down explanation post [here] and full letter deconstruction [here].

⭐️ ⭐️ ⭐️ ⭐️

We're still awaiting word from the HM Treasury about what they're planning to do with UK shareholder assets.... But we have had a few underwhelming responses from MPs in the recent weeks on this topic.

So we're going to explore two of these responses in this two-part post.

But to contextualize of understanding and the engagements we receive, let's first check out what's happening in the UK right now.

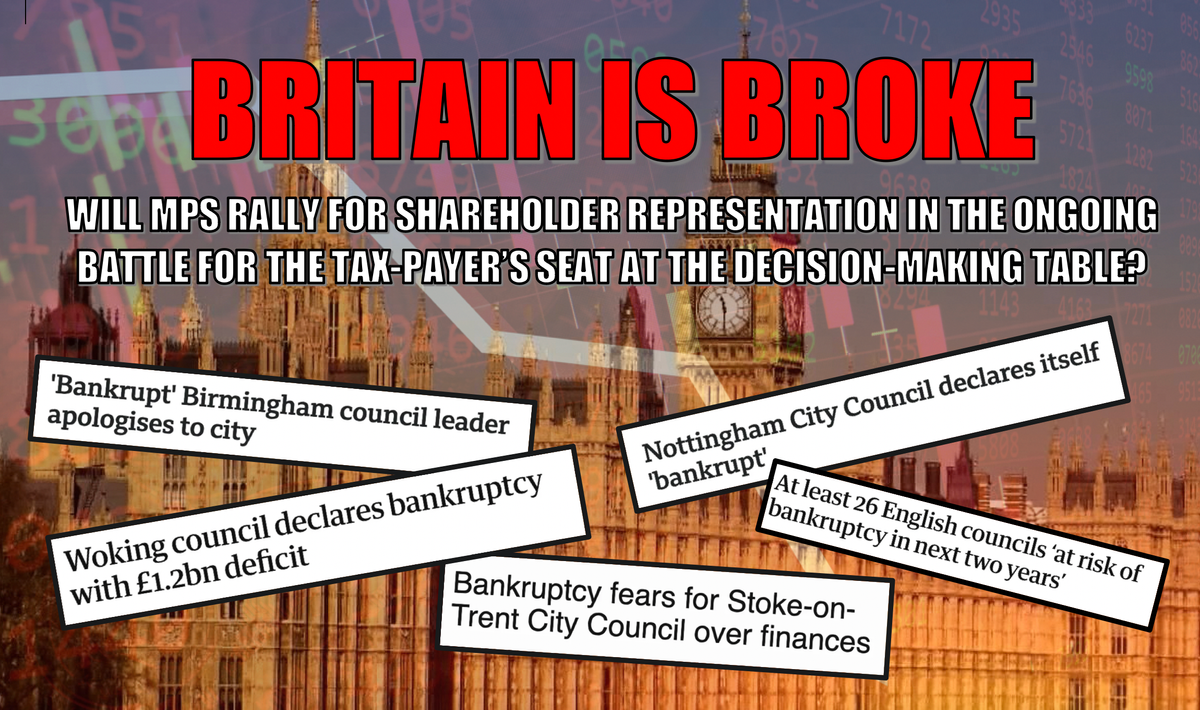

Uh-oh - looks like Britain is in trouble. Just check out some of these recent headlines that have hit across the UK.

These are all articles from the last 6 months.

And it's been rapidly going down hill from as early as summer this year, and the outlook isn't looking too good for our government outfits moving forward either.

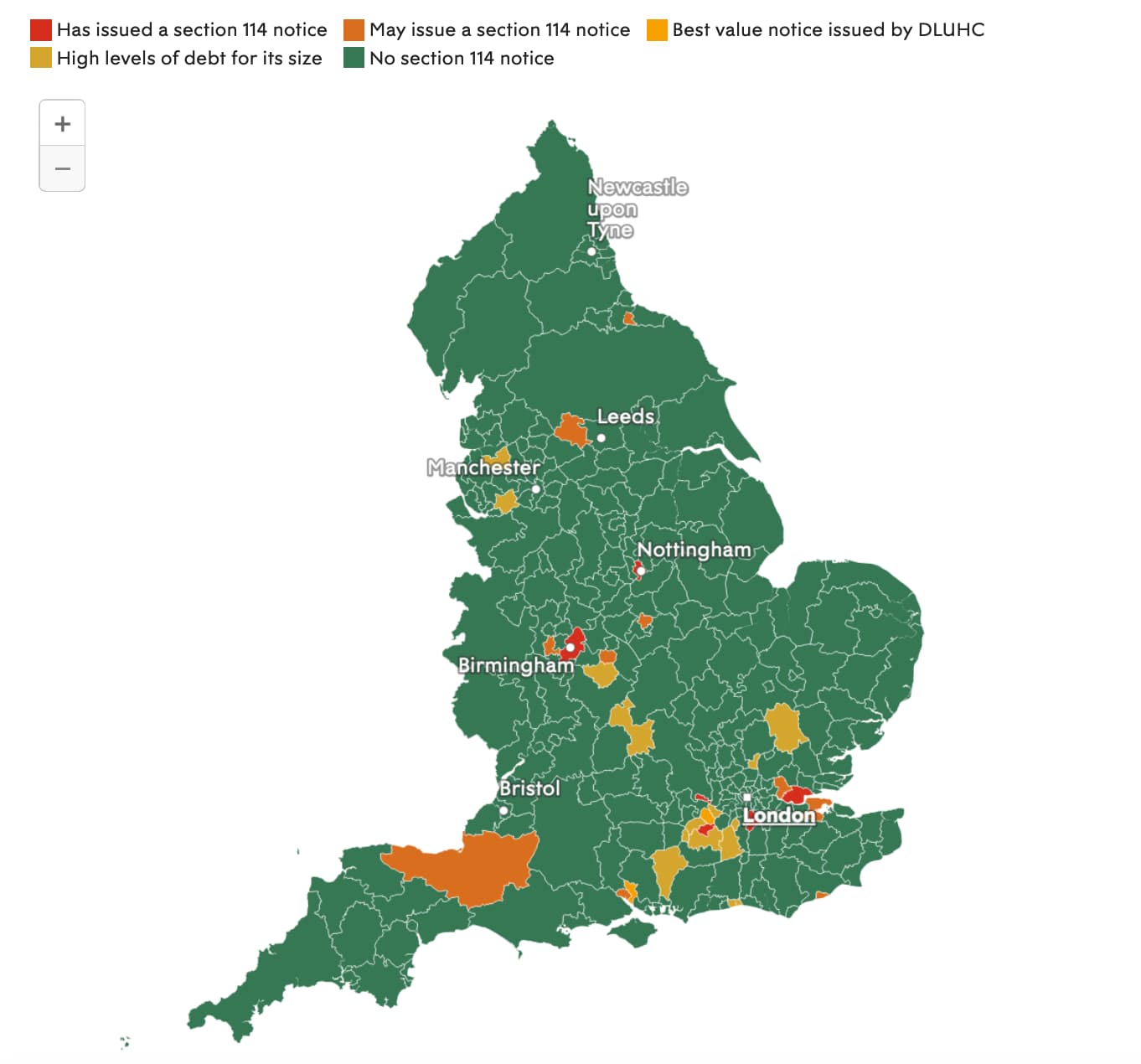

We're seeing UK councils falling like dominoes - and it's picking up momentum....

And now we can keep track: Below is a map tracking which councils in England are going bankrupt.

This screenshot below is as of January 2024.

So given the financial turmoil the UK is facing and the growing lack of confidence in the UK Government's ability to manage financial matters, shareholders are doing their part to ensure that all conversations within the HM Treasury regarding OUR shares and assets include those as related to any proposed regulatory changes.

Our seat needs to be well and truly established at our own democratic table, as we strive to be part of discussions that impact us.

And don't you worry, we're asking for to be represented in these ongoing talks nearly every week.

You can check out our earlier emails to the HM Treasury here: [1] , [2] , [3] , [4] , [5] , [6] , [7] , [8]

But alas, no response as of yet.

But this leads does us beautifully into the purpose of this post.

🥁 🥁 🥁 🥁

Yep. Britain is broke, but that doesn't mean that they get to bail themselves out of debt by stealing our assets and the monetary value of those assets to do so.

UK shareholders are reaching out to their MPs to address this fundamental attack on our ability to directly register shares - held in our name - and to fight for our rights to prevent this from happening.

And with thanks to those who have proactively engaged with their MP representatives, we, the tax-paying constituents, continue to have a say in shaping the future of UK share trading, settlement, and record-keeping, and it's making a difference.

We're making ourselves heard 🗣️

And better yet, those same game-changers have even shared some of their responses from their MP representatives.

Just before we begin I want to ensure that we're are being appreciative to these MPs who did actually bother to write back.

Many apes out there have reported sending their comments/letters to their representatives and have simply been biffed off by a vague impersonal secretary response, or meet with generic automated replies - so at least these people took a moment out to write a response.

So thank you to them, and I hope it's the beginning of many more ongoing, and positive engagements as had between the elected representatives and the people they serve.

That said.

These responses need to do a lot better.

These MPs need to be fighting in our corner, and representing our voice - which is why we're getting them involved - so they can help us, as we help each other.

🇬🇧 🦍🇬🇧 🦍🇬🇧

RESPONSE ONE:

The first response from the MP above demonstrates an unwillingness to be proactive in her advocacy - as they suggest waiting 6 months until after the talks are done in which to assess the outcome, by which point - it will already be too late.

The HM Treasury are discussing the means in our shares are held as we speak - so we need to be in that discussion - now.

Sorry Liz, but being told to "sit on it" was not the response we were looking for here.

These are important ongoing discussions - the Digitisation Taskforce are advocating for changes in primary legislation that will legally transfer the ownership of your shares to the nominee if held in a Central Securities Depository (CSD).

That would give the government full legal control of our assets (and money) - which is pretty convenient now that the UK is financially bankrupt.

Therefore - we need to encourage MPs to put us at the centre of these conversations and it's not for her to tell us to wait until those same conversations have finished. The HM Treasury need to crank open those communication portals and provide us meaningful channels that allow us to dictate how our assets are managed.

After all - the government's role is to serve us.

We don't need permission to get involved, they need to step up and start working collaboratively with us, because we're not leaving.

So here's a response that was created in reply to Liz, to help demonstrate the ways we're looking to get ourselves involved in the ongoing conversation and inspire her assistance:

Here's hoping Liz listens and does her part to help us out.

Go on Liz, do it for Britain 🇬🇧

And there we have it folks!

Let's partake in meaningful dialogue with our elected representatives to nurture real change within our financial markets.

Feeling inspired? Why not get involved!

If you're a British Shareholder 🇬🇧 and want to fight to protect your shares, here's an easy-to-do guide to contact your MP representative with letter template included - check it out here.

If you want to read more about the GOV.UK digitisation proposal and why it is a threat, check it out:

Interim Report - Digitisation Taskforce: here

Overview Explainer Post: here

Example of submitted response to Taskforce: here.

⭐️ ⭐️ ⭐️ ⭐️

Time for a breather now before we head on into Part Two - with a letter from Bim Afolami, the Economic Secretary for the HM Treasury.

TL;DR

- Britain is at breaking point, with councils across the UK on the brink of bankruptcy - the government is running out of cash fast.

- We're asking MP representatives to ensure UK Taxpayers have a seat at the table - as we fight back against plans to take ownership of our assets and safeguard DRS.

- An MP Representative sends us a response - we check it out, and write back our response.

That's all folks.

Be excellent to each other.