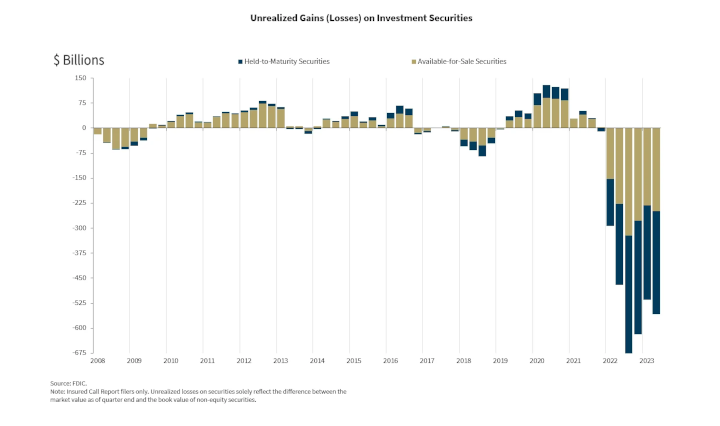

Banks unrealized losses on held-to-maturity securities totaled $309.6 billion in the 2nd quarter, while unrealized losses on available-for-sale securities totaled $248.9 billion.

Source: https://www.fdic.gov/analysis/quarterly-banking-profile/qbp/2023jun/qbp.pdf

Post with more information: https://www.reddit.com/r/Superstonk/comments/16ciko6/unrealized_losses_on_securities_totaled_5584/

TLDRS:

- Unrealized losses on securities totaled $558.4 billion in the 2nd quarter, up $42.9 billion (8.3%) from the prior quarter. Unrealized losses on held-to-maturity securities totaled $309.6 billion in the 2nd quarter, while unrealized losses on available-for-sale securities totaled $248.9 billion.

- Borrowing from the liquidity fairy via BTFP continues to make up for a shrinking M2 and dwindling commercial deposits.

- Bank Term Funding Program over $100B for the 14th week in a row ($107.855B) .

- Notice how use of the Discount Window has PLUMMETED as BTFP has come in to play?

BTFP offers higher interest rates but longer terms--to need over $100 billion in liquidity at near 5.5% interest must really be all about 'surviving another day'?

- How did all these banks pass those 'Stress tests' the other day needing all this liquidity?!?!...

- The liquidity fairy is now ENCOURAGED?

The FDIC noticed that some banks aren't correctly reporting the amount of deposits they have that aren't covered by federal insurance. Some banks mistakenly think that if a deposit is backed by assets (like collateral), it doesn't need to be reported as uninsured.

- This isn't right! The deposit's status doesn't change just because it has collateral.

- When banks incorrectly report uninsured deposits, it could create a perception in the market that these banks are more stable than they actually are.

- Banks that incorrectly report uninsured deposits might face liquidity challenges in extreme circumstances, where depositors simultaneously demand their funds.

- Reminder, while banks have the liquidity fairy, 'we' get the promise of 2 more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

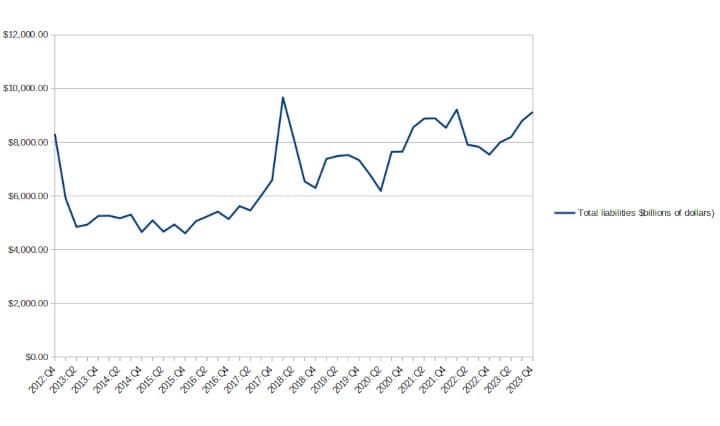

Recalculating the total unrealized losses as of now: $17.5T × 3.9 × 2.7% = $1.84 trillion which is $0.14 trillion more in unrealized losses since March 2023. Oof, there goes that $0.1 trillion to land $0.04 trillion underwater. Which is why banks have upped their BTFP usage to access $107.4 billion worth of cash as of last week (Aug 23) to get an extra $40 billion ($0.04 trillion) from the liquidity fairy to barely survive another day on the bleeding edge of bankruptcy.

Banks would be bankrupt already if it wasn't for BTFP.