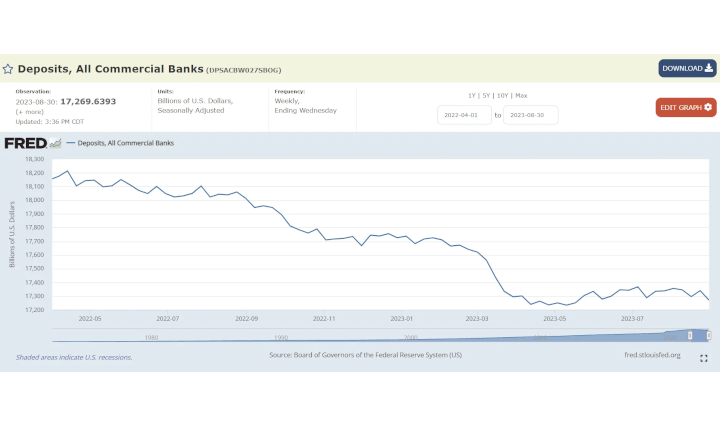

Bank Run Alert! $70 billion withdrawn from commercial banks last week (8/23-8/30). $889 billion in deposits has been pulled since the all time hit 4/13/22. It looks like the bank run is back to picking up speed!

TLDRS:

- Folks have pulled $889 billion in deposits since 4/13/2022

- Folks have pulled $421 billion in deposits since 2/22/2023

- Folks have pulled $70 billion in deposits in the last week.

- Borrowing from the liquidity fairy via BTFP continues to make up for a shrinking M2 and dwindling commercial deposits.

- Bank Term Funding Program over $100B for the 14th week in a row ($107.855B) .

- BTFP offers higher interest rates but longer terms--to need over $100 billion in liquidity at near 5.5% interest must really be all about 'surviving another day'?

- How did all these banks pass those 'Stress tests' the other day needing all this liquidity?!?!...

- "The updated guidance encourages depository institutions to incorporate the discount window as part of their contingency funding plans."

- The liquidity fairy is now ENCOURAGED?

- The FDIC noticed that some banks aren't correctly reporting the amount of deposits they have that aren't covered by federal insurance. Some banks mistakenly think that if a deposit is backed by assets (like collateral), it doesn't need to be reported as uninsured.

- This isn't right! The deposit's status doesn't change just because it has collateral.

- When banks incorrectly report uninsured deposits, it could create a perception in the market that these banks are more stable than they actually are.

- Banks that incorrectly report uninsured deposits might face liquidity challenges in extreme circumstances, where depositors simultaneously demand their funds.

- Reminder, while banks have the liquidity fairy, 'we' get the promise of 2 more rate hikes this year, Atlanta Fed President Raphael Bostic yet again enrichens himself inappropriately from his position.

- To fix one end of their mandate (price stability) from the inflation problem they created, the Fed will continue sacrificing employment (the other end of their mandate) to bolster price stability by continuing to raise interest rates--causing further stress to businesses and households.

- I believe inflation is the match that has been lit that will light the fuse of our rocket.

https://fred.stlouisfed.org/series/DPSACBW027SBOG

https://www.federalreserve.gov/releases/h8/20230825/

A tad over a year ago (4/13/2022) the high was hit at $18,158.3536 billion:

| Date | Deposits, All Commercial Banks (billions) | Down from all time high (billions) |

|---|---|---|

| 4/13/2022 | $18,158 | 0 |

| 2/22/2023 (Run picks up speed) | $17,690 | -$468 billion |

| 3/1/2023 | $17,662 | -$496 billion |

| 3/8/2023 | $17,599 | -$559 billion |

| 3/15/2023 | $17,428 | -$730 billion |

| 3/22/2023 | $17,256 | -$902 billion |

| 3/29/2023 | $17,192 | -$966 billion |

| 4/5/2023 | $17,253 | -$905 billion |

| 4/12/2023 | $17,168 | -$990 billion |

| 4/19/2023 | $17,180 | -$978 billion |

| 4/26/2023 | $17,164 | -$994 billion |

| 5/3/2023 | $17,149 | -$1,009 billion |

| 5/10/2023 | $17,123 | -$1,035 billion |

| 5/17/2023 | $17,152 | -$1006 billion |

| 5/24/2023 | $17,238 | -$920 billion |

| 5/31/2023 | $17,282 | -$876 billion |

| 6/7/2023 | $17,203 | -$955 billion |

| 6/14/2023 | $17,297 | -$861 billion |

| 6/21/2023 | $17,343 | -$815 billion |

| 6/28/2023 | $17,342 | -$816 billion |

| 7/5/2023 | $17,367 | -$791 billion |

| 7/12/2023 | $17,289 | -$869 billion |

| 7/19/2023 | $17,335 | _$820 billion |

| 7/26/2023 | $17,338 | -$820 billion |

| 8/2/2023 | $17,355 | -$803 billion |

| 8/9/2023 | $17,344 | -$814 billion |

| 8/16/2023 | $17,295 | -$863 billion |

| 8/23/2023 | $17,339 | -$819 billion |

| 8/30/2023 | $17,269 | -$889 billion |

All this money pulled from commercial banks as M2 (U.S. money stock--currency and coins held by the non-bank public, checkable deposits, and travelers' checks, plus savings deposits, small time deposits under 100k, and shares in retail money market funds) is decreasing:

The Fed has created an emergency backstop program so that banks won’t have to sell assets into the market if customers pull deposits in search of more attractive yields for their savings....

Bank Term Funding Program (BTFP):

https://www.federalreserve.gov/releases/h41/20230907/

https://fred.stlouisfed.org/series/H41RESPPALDKNWW

9 straight weeks of gains now!

https://www.reddit.com/r/Superstonk/comments/11prthd/federal_reserve_alert_federal_reserve_board/

- Association, or credit union) or U.S. branch or agency of a foreign bank that is eligible for primary credit (see 12 CFR 201.4(a)) is eligible to borrow under the Program.

- Banks can borrow for up to one year, at a fixed rate for the term, pegged to the one-year overnight index swap rate plus 10 basis points.

- Banks have to post collateral (valued at par!).

- Any collateral has to be “owned by the borrower as of March 12, 2023."

- Eligible collateral includes any collateral eligible for purchase by the Federal Reserve Banks in open market operations.

Richard Ostrander (one of the architects of BTFP) spoke about it the other day:

When the Federal Reserve established the BTFP, the lawyers of the New York Fed played an important role in facilitating its rapid implementation. I was responsible for coordinating among my team of attorneys at the New York Fed and the Board of Governors to ensure that our actions complied with applicable statutes and regulations.Over the weekend of March 11 and 12, the Fed designed the BTFP to support the stability of the broader financial system by providing a source of financing for banks with Treasury, Agency and other eligible holdings whose market value had significantly diminished given interest rate increases.There was not enough time to set up special purpose vehicles as the Fed had done for some of the pandemic programs. The only way to have the program up and running so quickly was to leverage our discount window facilities.As a result, we turned to Section 13(3) of the Federal Reserve Act, which authorizes specialized lending in unusual and exigent circumstances. The BTFP extends the maximum term of lending from the Section 10B limit of four months up to a special limit of one year. Additionally, unlike traditional discount window operations, the BTFP authorizes banks to borrow against eligible holdings up to their par value rather than their market value less a haircut

Over the few weeks prior to the FDIC receivership announcements on March 10 and 12, the banking sector lost another approximately $450 billion. Throughout, the banking sector has offset the reduction in deposit funding with an increase in other forms of borrowing which has increased by $800 billion since the start of the tightening.

The right panel of the chart below summarizes the cumulative change in deposit funding by bank size category since the start of the tightening cycle through early March 2023 and then through the end of March. Until early March 2023, the decline in deposit funding lined up with bank size, consistent with the concentration of deposits in larger banks. Small banks lost no deposit funding prior to the events of late March. In terms of percentage decline, the outflows were roughly equal for regional, super-regional, and large banks at around 4 percent of total deposit funding:

The blue bar in the left panel above shows that the pattern changes following the run on SVB. The additional outflow is entirely concentrated in the segment of super-regional banks. In fact, most other size categories experience deposit inflows.

The right panel illustrates that outflows at super-regionals begin immediately after the failure of SVB and are mirrored by deposit inflows at large banks in the second week of March 2022.

Further, while deposit funding remains at a lower level throughout March for super-regional banks, the initially large inflows mostly reverse by the end of March. Notably, banks with less than $100 billion in assets were relatively unaffected.

However, during the most acute phase of banking stress in mid-March, other borrowings exceeded reductions in deposit balances, suggesting significant and widespread demand for precautionary liquidity. A substantial amount of liquidity was provided by the private markets, likely via the FHLB system, but primary credit and the Bank Term Funding Program (both summarized as Federal Reserve credit) were equally important.

- Large banks increased borrowing the most, which is in line with deposit outflows being strongest for larger banks before March 2023.

- During March 2023, both super-regional and large banks increase their borrowings, with most increases being centered in the super-regional banks that faced the largest deposit outflows.

- Note, however, that not all size categories face deposit outflows but that all except the small banks increase their other borrowings.

- This pattern suggests demand for precautionary liquidity buffers across the banking system, not just among the most affected institutions:

Wut Mean?

- Banks have been replacing deposit outflows with the borrowing we have covered above.

- 'Strong and resilient' indeed....

- It is starting to smell idiosyncratic all up in here:

https://www.marketwatch.com/story/u-s-bank-lending-falls-in-latest-week-fed-says-b633e731

To me, this is looking more and more like over-reliance on Central Bank Funding!

Oh yeah...

Fed & FDIC 🦵🥫 can't hide unrealized losses

Recalculating the total unrealized losses as of now: $17.5T × 3.9 × 2.7% = $1.84 trillion which is $0.14 trillion more in unrealized losses since March 2023. Oof, there goes that $0.1 trillion to land $0.04 trillion underwater. Which is why banks have upped their BTFP usage to access $107.4 billion worth of cash as of last week (Aug 23) to get an extra $40 billion ($0.04 trillion) from the liquidity fairy to barely survive another day on the bleeding edge of bankruptcy.

Banks would be bankrupt already if it wasn't for BTFP.

From the FDIC YESTERDAY: