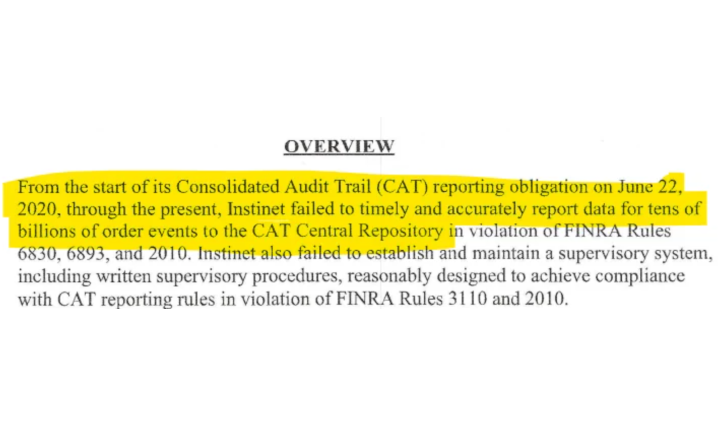

"Unrelated to the data conversion issue, Instinet experienced late reporting issues in connection with at least 26 billion events from 11/2020 through 12/2022, which constituted approximately 8% of the firm's CAT reporting obligation for this period"

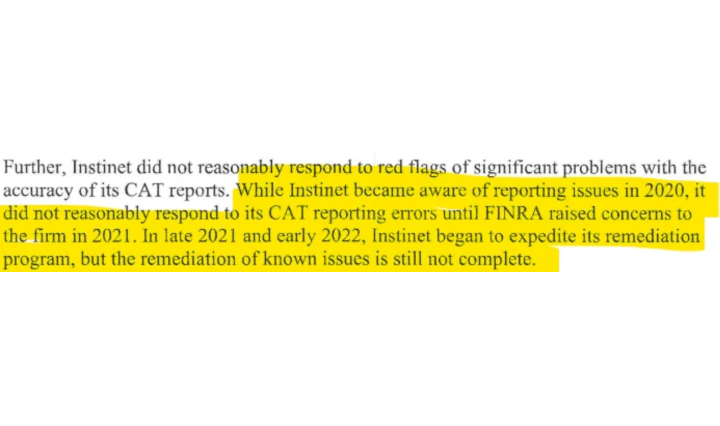

FINRA says they knew & did not care!

https://www.finra.org/sites/default/files/fda_documents/2020067139101%20Instinet%2C%20LLC%2C%20CRD%207897%20AWC%20gg.pdf

Wut Mean?:

* Instinet was mandated to start reporting order data to the CAT Central Repository from June 22, 2020.

* Instinet hired a third-party