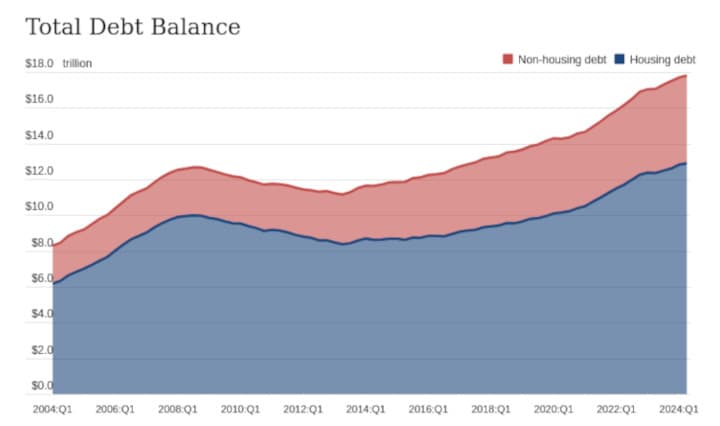

Consumer credit increased at a seasonally adjusted annual rate of 2.4% during Q2. Revolving credit (credit cards) up 1.2%, while nonrevolving credit up 2.9%.

Consumer credit increased at a seasonally adjusted annual rate of 2.4% during the second quarter. Revolving credit (credit cards) increased at an annual rate of 1.2%, while nonrevolving credit increased at an annual rate of 2.9%. In June, consumer credit increased at an annual rate of 2.