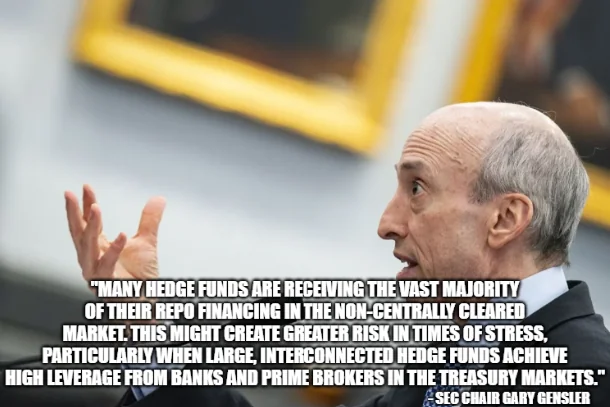

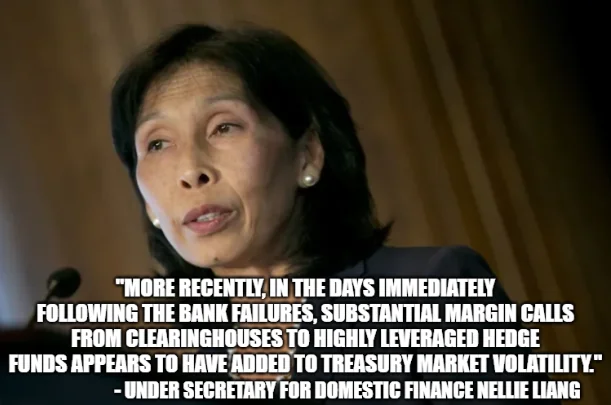

3 times now in the last 5 days hedge funds have been called out for receiving the vast majority of their repo financing in the non-centrally cleared market, where haircuts or initial margin requirements are not necessarily applied

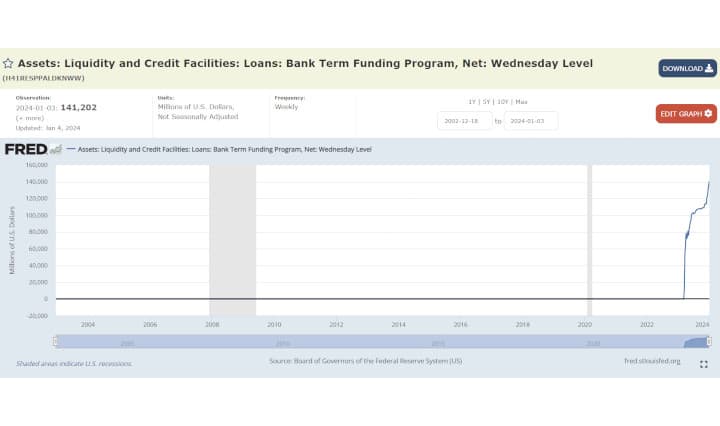

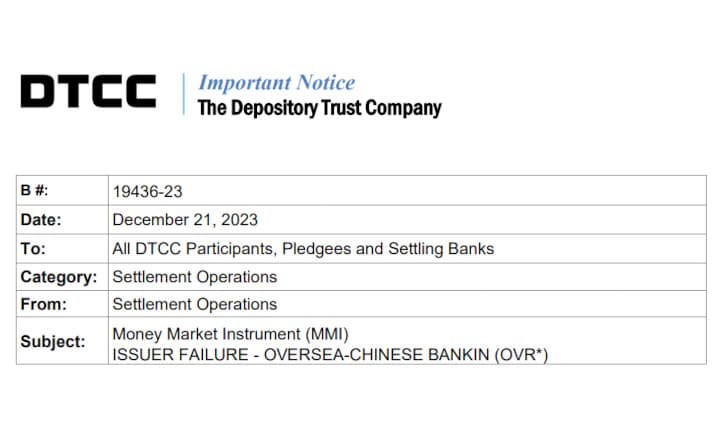

3 times now in the last 5 days hedge funds have been called out for receiving the vast majority of their repo financing in the non-centrally cleared market, where haircuts or initial margin requirements are not necessarily applied and that this might create greater risk in times of stress. Why?