The Federal Reserve Board today announced technical details related to reserve requirements for depository institutions, which will remain zero...

Wut Mean?:

- The Federal Reserve Board announced that the reserve requirements for depository institutions will remain at zero.

- However, as legally required, it provided annual adjustments to the reserve requirement exemption amount and the low reserve tranche for 2024, clarifying that these do not represent a change in reserve requirements.

TLDRS:

- The reserve requirements for depository institutions continue to be zero.

- The adjustment and publication of the reserve requirement exemption amount and low reserve tranche are legal requirements and do not imply a change in the actual reserve requirements.

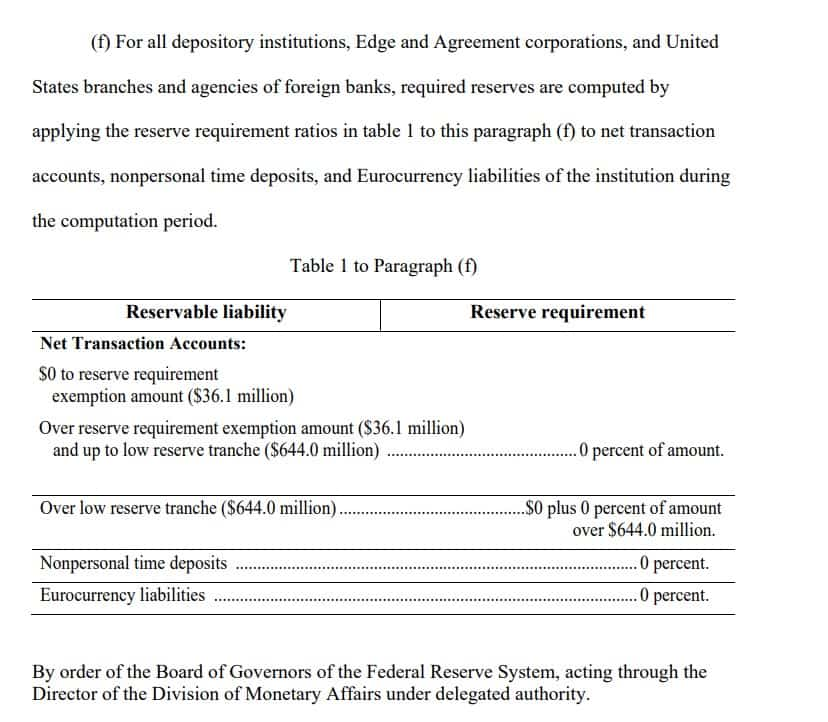

- If reserve requirement ratios were above zero, the reserve requirement exemption amount would define the portion of a depository institution's liabilities exempt from reserve requirements.

- The low reserve tranche would determine the portion of an institution’s net transaction accounts that might be subject to a reserve requirement ratio of up to three percent.

- For 2024, the reserve requirement exemption amount is set at $36.1 million (unchanged from 2023), and the low reserve tranche is set at $644.0 million (decreasing from $691.7 million in 2023).

- These new amounts, derived from formulas in the Federal Reserve Act, will be effective from January 1, 2024.